Summary:

- Microsoft is competing with other tech giants to provide the best AI services, and recent stock gains show the market’s interest in AI.

- Microsoft’s Azure cloud computing platform is a major revenue generator, and they are rolling out AI-as-a-service features on it.

- Microsoft is making strategic investments and acquisitions in AI, including acquiring a part of OpenAI and investing in AI companies globally.

- They are also investing abroad, looking to secure AI customers from across developed and emerging markets in Asia and elsewhere.

lcva2

Introduction

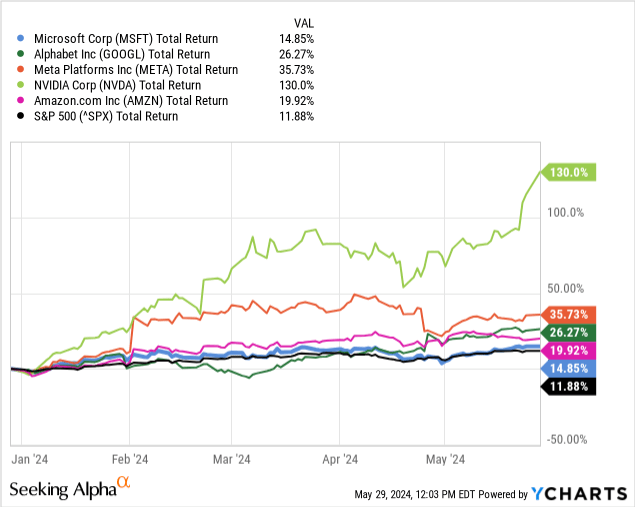

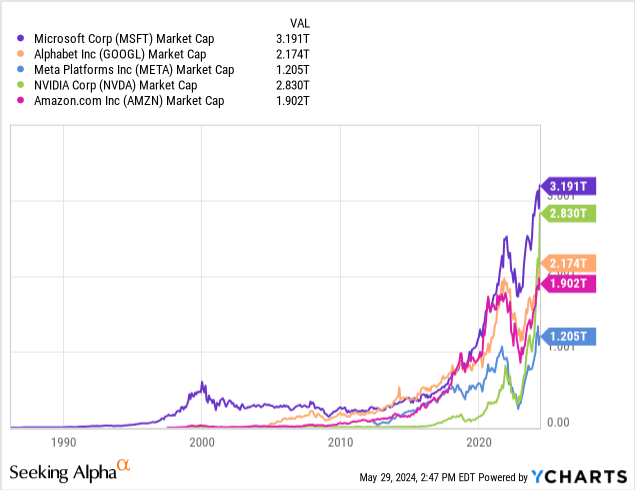

Microsoft Corp (NASDAQ:MSFT) is engaged in a bitter war with its mega-cap tech rivals Alphabet Inc (GOOG/GOOGL), Meta Platforms Inc. (META), NVIDIA Corp (NVDA) and Amazon.com Inc (AMZN) among others to win out on providing the best AI services.

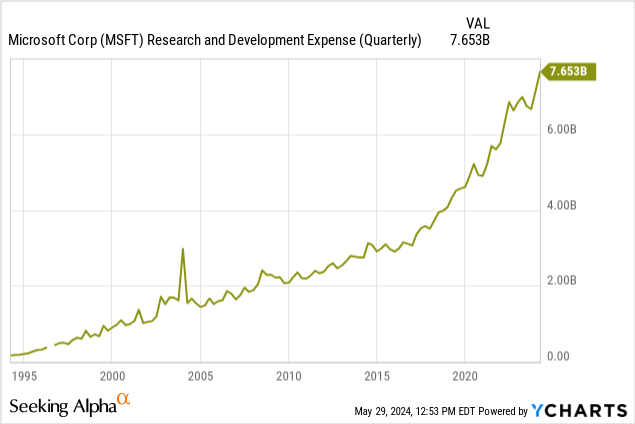

Recent stock gains in all of these names have shown the market’s appetite for these firms’ spending on research and development and acquisitions in the AI space.

To this end, MSFT has done quite a bit of maneuvering to position itself ahead of the others including massive R&D spending, large acquisitions, and strategic partnerships with outside firms. These moves have given MSFT an edge over the others mentioned above, and one that I believe will allow Microsoft to outshine its competitors and roll out its AI services to end-users faster and with greater amounts of success.

Financial Review

I won’t go too deep into this section since my primary thesis is about MSFT’s AI efforts, but some overview is necessary to understand MSFT’s business.

There are several aspects I want to highlight:

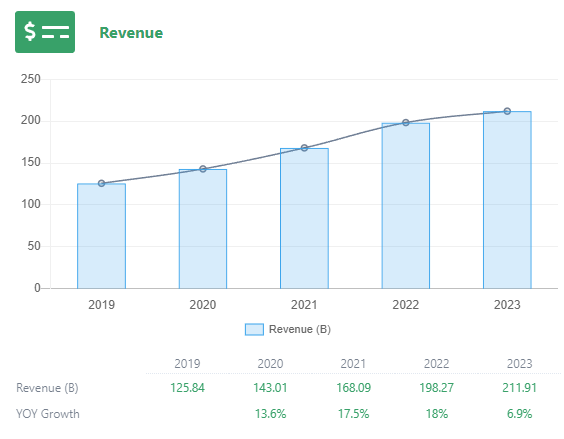

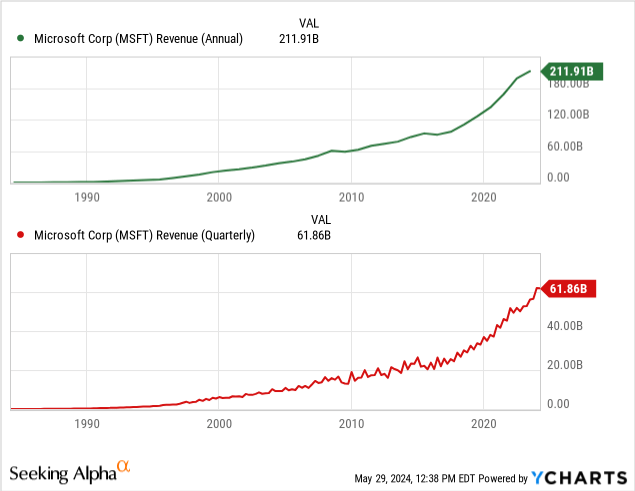

Rising Revenue

Figure A (Grasshopper Stocks)

This is important for MSFT’s future success, especially as training new AI models and improving Azure (its primary delivery method for AI) becomes more and most costly and eats into profits without further revenue growth. YoY growth in the mid-teens in 2020, ’21, and ’22 really showed how much MSFT has been growing in the last few years, outpacing previous expectations.

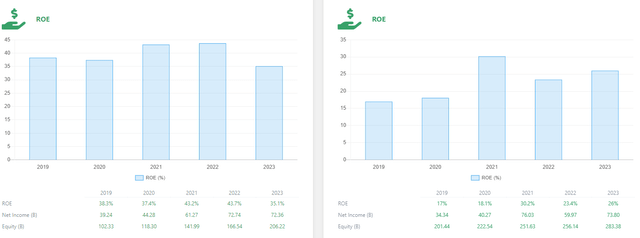

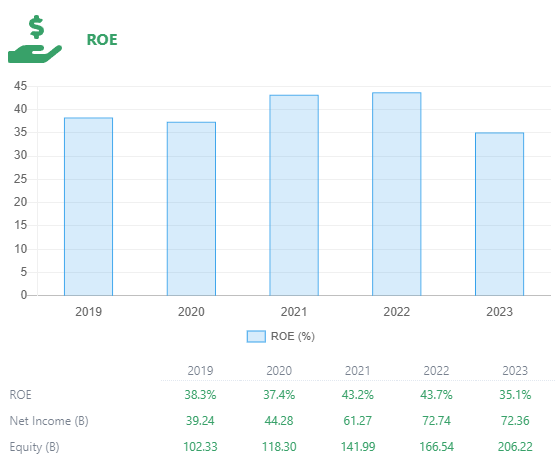

Consistently Positive RoE

Figure B (Grasshopper Stocks)

Return-on-equity is an important factor to consider because it tells us how much shareholders are actually gaining in value each year from the company’s net assets. MSFT carries a positive RoE on average. In 2023, there was a hiccup where income didn’t grow, but assets did. This left investors with a lower RoE than the last few years, but staying above 35% is still very impressive.

Compare Microsoft (on the left) to Google (on the right) in this next graphic, where we can see consistently half the same ROE as MSFT.

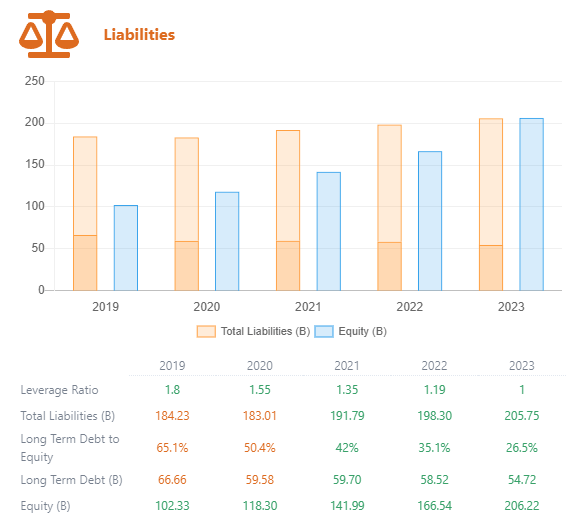

Liability Ratio

Figure D (Grasshopper Stocks)

While we can see a growth in total liabilities over the past five years, there has been a recent trend of reducing long term debt and raising equity, bringing the LT-debt-to-equity ratio down from 65% in 2019 to 27% in 2023. This is a very positive sign for MSFT as it shows that they have their debt under control and are reducing it while rates are high so it will impact their bottom lines less.

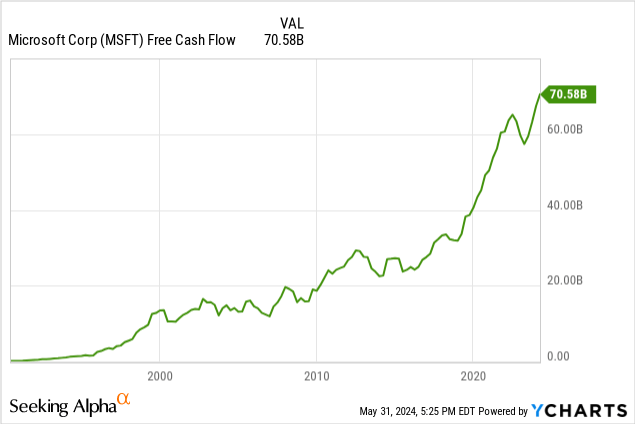

Beyond these big figures, I also want to highlight MSFT’s free cash flow, which is one of its stronger points financially. MSFT is cash-rich, which has been a boon for the acquisition and talent hiring spree they’ve been on in the past few years.

While we saw a reduction last year, this year MSFT is on track to outperform and increase their FCF. This means that they will have more dry powder for future acquisitions, which may be needed to further develop their new AI department (more on that later as well).

Azure Cloud Computing

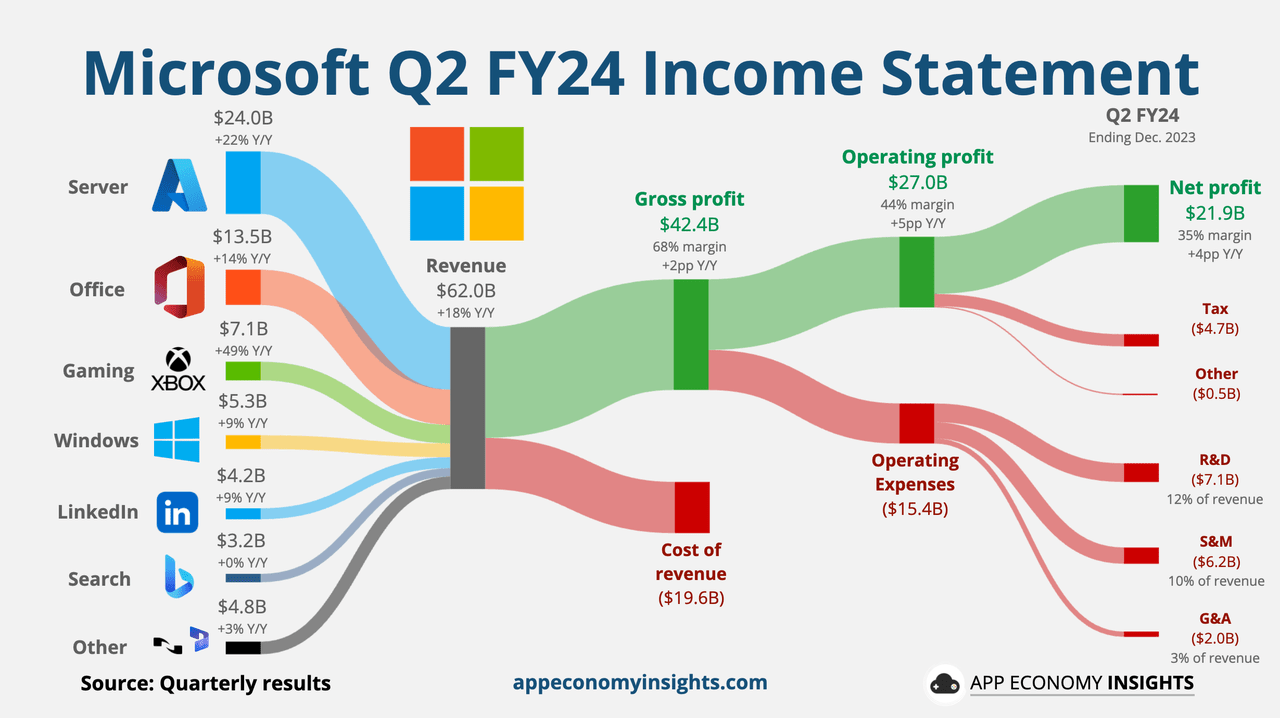

MSFT is already rolling out their AI-as-a-service features on their Azure cloud computing platform, which already stands as one of Microsoft’s largest revenue-generators, dwarfing the next largest generator, Office software.

Figure 1 (App Economy Insights)

The introduction of data and cloud services via Azure, which launched in 2010, changed MSFT’s revenue trend. See how the pre-2010 trend is far flatter than the post-2010 trend, both in the quarterly and annual revenue figures.

This jump is no coincidence. It was fueled by Azure and MSFT continues to make money hand-over-fist with its cloud computing services.

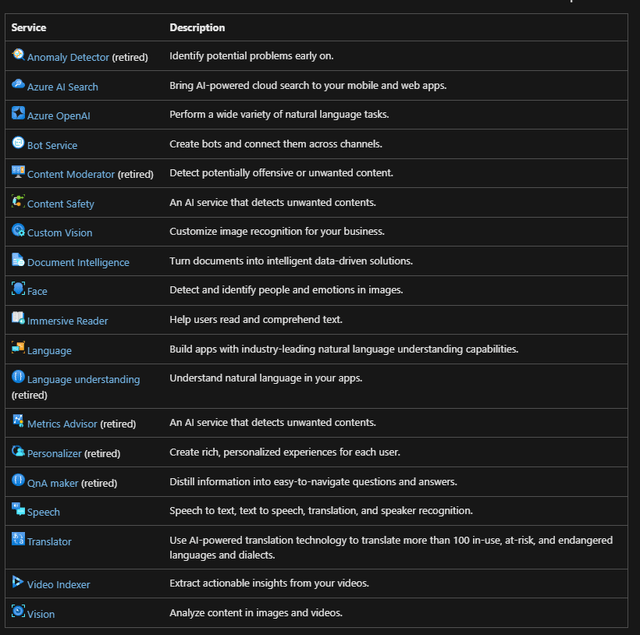

MSFT’s AI offerings are primarily concentrated in its cloud offerings. They have provided several AI services that are now defunct, which are marked in the list below as “retired.” These services are aimed at bringing in new customers who see these tools as useful for their business or workflow, and enticing Amazon Web Services (“AWS”) and Google Cloud Platform (“GCP”) customers to switch over.

Because Azure makes up so much of MSFT’s revenue, it’s vital for them to continue bringing in customers to fuel the growth that’s expected of them from the market.

I believe that MSFT will have no problem bringing in these new customers. They are already making strategic investments across the globe to create new customers for their products.

Strategic Investments

Microsoft made big news when they acquired a large part of OpenAI back in 2019, starting at $1bn. Since then, its investment has grown to over $13B. OpenAI produces the prolific ChatGPT and Dall-E AI, which are the most popular generative AI platforms on the market currently.

Hoping to bridge out to developing and emerging markets with Azure, to capture the wave of companies from Asia and the Middle East moving to Web 2.0 as their economies evolve and digitize, MSFT has made several very large investments in cloud computing and AI in the last few months.

Geographic Investments Around the World

All of these news releases from MSFT themselves are from the last two months.

- $2.9B in Japan to open a research center in Tokyo and train 3M+ people

- $1.5B in the UAE for a stake in AI company G42 and infrastructure

- $1.7B in Indonesia for infrastructure and to train 800,000+ people

- $2.2B in Malaysia for infrastructure and to train 200,000+ people

- $3.3B in Wisconsin, USA to build a manufacturing-focused AI research lab on the University of Wisconsin-Milwaukee campus, build infrastructure, and training 100,000+ people

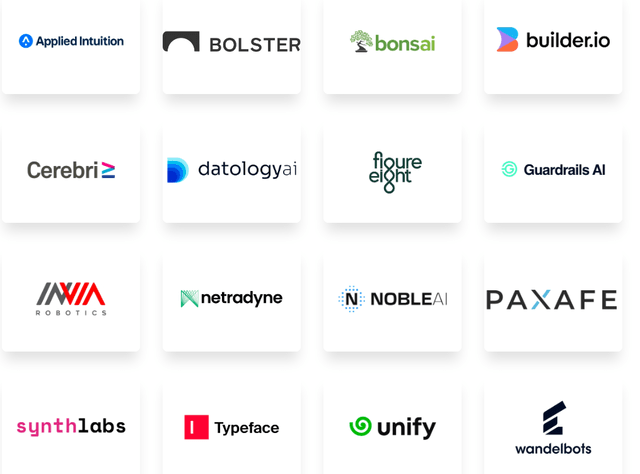

MSFT’s Venture Capital Fund, M12

In addition to these investments, Microsoft is taking positions in several private AI companies via its venture capital fund, M12.

Here is a list of large stakes they’ve acquired in AI-focused companies, via their website. There you can also find their cloud infrastructure and other investment focus areas on that site. The list is extensive and I encourage you to take a look for familiar names.

In total, M12 currently has 292 total investments with it taking the lead on 86 of them. Of those, 16 are AI-focused investments, and that is only counting funding rounds that M12 has participated in. MSFT proper also has its own acquisitions and investments in the space.

The Poaching of Mustafa Suleyman

There are a few names in the AI world that are widely-known. Sam Altman of OpenAI is likely the only AI developer more well-known than Mustafa Suleyman, who was one of the co-founders of DeepMind Technologies. DeepMind was acquired by Google in 2014, four years after its launch, and became the backbone of Google’s AI division.

Suleyman left Google in 2022 and started his own company with Linked-In co-founder Reid Hoffman, Inflection AI.

Microsoft didn’t acquire Inflection AI, likely to avoid more regulatory scrutiny, but instead poached Suleyman and a significant portion of Inflection AI’s staff. Suleyman is now Microsoft’s Chief of AI, and leads their AI division entirely. They also purchased a $650M stake in Inflection AI through its venture capital wing.

This hiring of Suleyman and the formation of a new division in Microsoft for him and his team, along with the departments that ran search and browser software, shows how important this acquisition is to Microsoft and how much of a boon they see it for themselves.

AI at Scale

One of the things that struck me the most from Microsoft’s last earnings call was when the CEO, Satya Nadella, said this from his prepared remarks:

We’ve moved from talking about AI to applying AI at scale.

Microsoft is seeing themselves as a leader in the space, and this remark is evidence of that. Satya rarely promises what he can’t deliver and has called for reigning in AI for safety.

Scale is also one of the most important aspects for Microsoft to get right with its AI roll-out. We know that training new models and running them can cost hundreds of millions of dollars, so getting something wrong can be a very costly mistake.

Google’s costly mistake is plaguing them currently, with its search overview AI offering up hallucinated results and misinformation, and output information that was dangerous. This has caused a stir publicly and given Google a bad look.

Fair Value

How will AI affect Microsoft’s value? Currently, MSFT is the most valuable company in the world, sitting at nearly $3.2T. This is a massive achievement, but I see more in MSFT’s future.

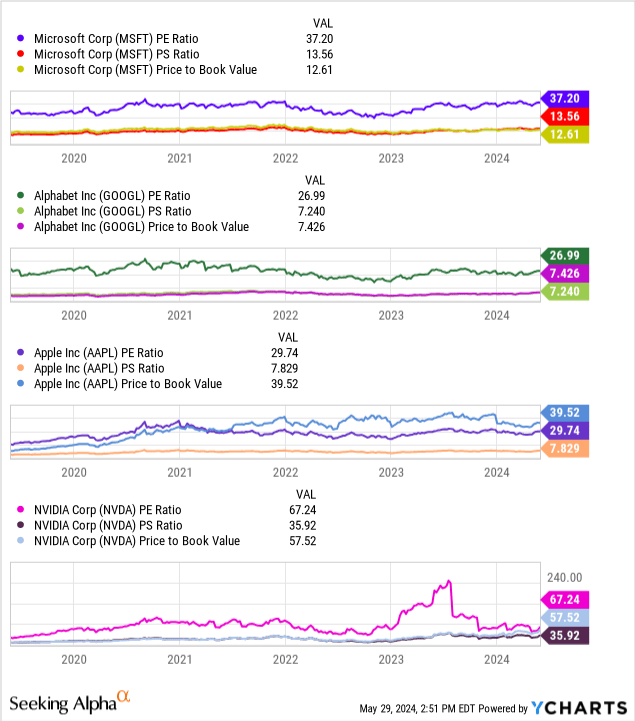

It trades around 37 P/E, 14 P/S, and 13 P/B, which is higher than Google and Apple (bar Apple’s P/B), but less than NVIDIA. Its fundamental ratios are more highly valued than the S&P 500 average, but this is due to Microsoft’s growth trajectory getting steeper. I believe that MSFT’s AI integration and new tools will deliver on those growth goals.

How high MSFT can go is unclear, as we are now in newly charted territory for valuations. US valuations have never been higher than where they are today, and MSFT already has the highest valuation of any company in the world, but that doesn’t mean we are at a ceiling.

Based on the metrics reviewed in the financials section, I believe that we are not at the end yet. There is still room for MSFT to add new and build on existing revenue streams in emerging and developing markets, by taking market share from AWS and GCP, and with new tech breakthroughs in AI with their new AI division.

Risks

There are a few major risks to this thesis, primarily:

- The MSFT AI division could fall short, despite all of its major acquisitions and talent poaching. Good people and companies doesn’t guarantee that they will innovate or accelerate their revenue with these services.

- Google, Apple, Meta, NVDA, or another big firm investing in AI may be able to outspend MSFT, which is not the leading R&D spender among mega-caps (actually, Amazon is).

- Generative AI may have peaked, something I wrote about recently.

- Breakthroughs in AI research, fueled by the spending and acquisitions, could result in very little gains that do not produce enough ROI to make further investment worthwhile.

- Breakthroughs in tech could be squandered by bad products, e.g. the Windows Phone.

- A large market correction could harm MSFT more than some other mega-cap tech, because its valuation is richer than that of some of its peers like Apple and Google and has further to fall before it is in “value” territory.

Conclusion

Microsoft is set to win the AI war, with its deployment being generally well received compared to Google’s recent search AI mishaps. MSFT’s increased growth is thanks not only to its poaching of key staff like its new Chief of AI, Mustafa Suleyman, but also to its strategic partnerships abroad, and its acquisition of and investment in numerous AI firms around the globe.

Winning the AI war (i.e. having the best AI systems) will set up Microsoft to have the dominant tech stack attached to their cloud computing service, Azure. MSFT gleans a significant portion of its revenue from Azure and an increase in customers for the platform directly translates into revenue and profit for Microsoft.

I am issuing a “buy” rating for Microsoft and am considering it for a position in my equity portfolio as a stand-alone stock, but will limit my exposure to no more than 5% of my single-stock portfolio.

Thanks for reading.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, but may initiate a beneficial Long position through a purchase of the stock, or the purchase of call options or similar derivatives in MSFT over the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

I have a long stock position in shares of GOOGL.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.