Summary:

- Microsoft Corporation’s Intelligent Cloud has recorded expanding top/ bottom lines and backlog, attributed to the robust demand for OpenAI-enabled SaaS offerings across legacy and startup companies.

- With the upcoming quarter likely to bring forth expanded cloud migration, we can understand why Mr. Market has increasingly awarded the stock with its premium valuations.

- The legal overhang over ATVI has also been cleared, with the deal completed by October 2023, potentially producing increased synergy for MSFT’s existing game offerings.

- As a result of these promising developments, we believe that Microsoft may be trading slightly above its fair value of $323.21, offering interested investors a reduced margin of safety.

- Investors may want to wait for a moderate retracement, preferably to its previous support level of $305s for an improved upside potential. Do not chase this rally.

Klaus Vedfelt

We previously covered Microsoft Corporation (NASDAQ:MSFT) in July 2023, discussing its excellent Fiscal Q4 2023 performance as its raised prices and cost optimizations boosted its top and bottom lines then. Combined with the generative AI boom, its Cloud segment had recorded accelerating growth/ backlog and expanding margins.

In this article, we will be discussing MSFT’s excellent growth in the cloud segment, naturally contributing to a top and bottom line beat in its FQ1 2024 (ended September 30th) quarter. It is unsurprising then, that Mr. Market has rewarded the stock with a great recovery from the September 2023 bottom, further aided by the completion of the Activision Blizzard (“ATVI”) acquisition.

However, with ATVI unlikely to meaningfully contribute to MSFT’s profitability while draining its liquidity in the near term, we believe that there is a minimal margin of safety here, with the latter also trading well above its fair value.

MSFT Continues To Generate Profitable Growth, With The Forward Guidance Instilling Confidence

MSFT reported exemplary FQ1’24 results indeed, most notably in the Intelligent Cloud segment, with it recording growth in revenues to $24.25B (+1% QoQ/+19.3% YoY) and backlog to $19.47B (-9.6% QoQ/+12.6% YoY).

This is on top of the segment’s expanding operating incomes to $11.75B (+9.9% QoQ/ +30.9% YoY) and margins to 48.4% (+5.4 points QoQ/ +4.3 points YoY), implying its ability to command higher ASPs thanks to the robust Generative AI demand and increased operating efficiency from the aggressive layoffs.

On the one hand, investors may want to note that MSFT’s backlog growth has paled in comparison to its direct cloud peers, such as Google’s (GOOG) to $64.9B (+7% QoQ/+23.8% YoY) and Amazon’s (AMZN) to $133B (+0.6% QoQ/+27.5% YoY) in the latest quarter.

Interested investors may read up more in our recent GOOG article here.

On the other hand, we believe things may accelerate from the next quarter, thanks to the management’s timely release of Microsoft 365 Copilot for its Enterprise clients, with 40% of the Fortune 100 already enrolled in its “early access program.”

These may trigger increased migration to MSFT’s Cloud services, especially made attractive by the availability of its well diversified OpenAI-enabled SaaS across legacy and startup companies.

It also appears that Intelligent Cloud has achieved an improved economy of scale as it commands a larger portion of the company’s overall profitability at 43.6% (+0.9 points QoQ/ +1.9 YoY).

For now, MSFT cloud’s outperformance has well balanced the underwhelming sequential results reported in the Productivity and Business Processes at $18.59B (+1.6% QoQ/ +12.9% YoY) and More Personal Computing at $13.66B (-1.7% QoQ/ +2.4% YoY) by the latest quarter.

However, we believe that things may lift from henceforth, since multiple sources, including Taiwan Semiconductor Manufacturing Company Limited (TSM) and Intel (INTC), have highlighted the near bottoming trend of the PC demand destruction.

While MSFT’s gaming segment remain soft, we may see increased consumer engagement as the management merges its existing Xbox and ATVI offerings over the next few quarters, with new title releases during the upcoming holiday season potentially revitalizing consumer interest.

In addition, investors must note that the next replacement cycle for games consoles is only expected to occur by 2024, based on the typical life cycle of every five years.

This also coincides with Advanced Micro Devices’ (AMD) commentary in the recent earnings call, with the Xbox and Sony game consoles currently “in the fourth year.”

MSFT Forward Guidance

For now, MSFT has guided FQ2’24 revenues of $60.9B at the midpoint, with a QoQ and YoY comparison being non-comparable, given ATVI’s top-line contribution from the upcoming quarter.

However, based on our estimates below, it appears that the SaaS company may generate a robust organic top-line growth of +3.6% QoQ and +11.1% YoY to approximately $58.6B (excluding ATVI).

This is after deducting ATVI’s revenue contribution of approximately $2.3B in MSFT’s next quarter More Personal Computing guidance, taking account of the gaming company’s stable revenues of approximately $2.3B over the past three quarters.

On a segmented basis, we believe that the company may still generate an excellent growth across its offerings as well.

This is based on the MSFT management’s FQ2’24 revenue guidance of $18.95B for Productivity & Business Processes (+1.9% QoQ/ +11.4% YoY) and $25.25B for Intelligent Cloud (+4.1% QoQ/ +17.4% YoY) at the midpoint, with our estimated More Personal Computing top-line of approximately $14.4B (+5.4% QoQ/ +1.1% YoY).

In addition, it is evident that MSFT’s cost optimizations have paid off extremely well, thanks to the reduced headcount by -7% on a YoY basis, well balancing ATVI’s inclusion from the upcoming quarter.

This is based its FQ2’24 operating income profitability guidance at approximately $25.85B for the upcoming quarter (non comparable QoQ/ YoY), with an excellent operating margins of 42.4% (-5.2 points QoQ/ +2.2 YoY). This also builds upon the sustained expansion in its margins from FY2020 levels of 37% (+2.9 points YoY) and FY2019 levels of 34.1% (+2.3 points YoY).

As a result of these promising developments, we believe that MSFT may be able to sustain its highly profitable growth trend moving forward, despite ATVI’s hefty price tag.

With the deal already completed by mid-October 2023, it appears that we may see a few more quarters of restructuring, with ATVI unlikely to have a significant impact on MSFT’s adj EPS in the near term.

This is based on ATVI’s minimal net income generation of $2.16B over the LTM (+15.5% sequentially), compared to MSFT’s $77.09B at the same time (+10.4% sequentially).

In addition, the $69B all-cash deal is likely to drain MSFT’s robust FQ1’24 balance sheet with a net cash position of $76.2B (+10% QoQ/ +23.1% YoY), on top of the unexpected “short-term debt of $25.8B with a weighted average interest rate of 5.4% and maturities ranging from 7 days to 190 days.”

As a result of the growing debt level and expensive short-term debt, we may also see the company’s annualized interest income of $4.66B (+28.8% QoQ/ +81.9% YoY) temporarily negated. This is attributed to the elevated interest rate environment and increased annualized interest expenses of $2.15B (+9.3% QoQ/ +7.6% YoY) by the latest quarter.

With an impacted balance sheet, MSFT investors may want to temper their near-term expectations. Despite its robust Free Cash Flow generation of $63.22B over the LTM (inline sequentially), we believe that these headwinds may trigger the stock’s sideways movement for some time, as observed since April 2023.

So, Is MSFT Stock A Buy, Sell, Or Hold?

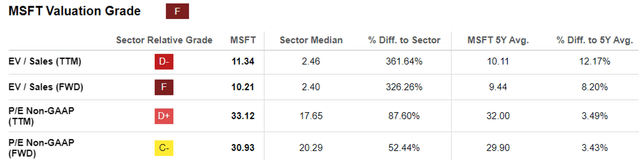

MSFT Valuations

For now, MSFT trades an elevated FWD P/E valuation of 30.93x, compared to its 3Y pre-pandemic mean of 24.41x and sector median of 20.29x. This premium is probably attributed to the baked-in optimism surrounding its Generative AI prospects and completed ATVI deal.

This premium remains reasonable compared to its global cloud provider peers, such as Google at 22.21x/ Amazon at 51.67x, and its cybersecurity/ AI peers, such as CrowdStrike (CRWD) at 63x/ Palantir (PLTR) at 65.63x.

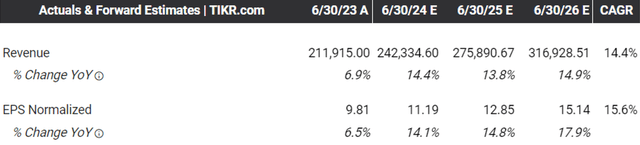

The Consensus Forward Estimates

Part of the premium is probably attributed to the promising consensus forward estimates as well, with MSFT expected to generate a robust top and bottom line growth at a CAGR of +14.4% and +15.6% through FY2026. This is compared to the historical CAGR of +14% and +19.9% between FY2017 and FY2023, respectively.

In addition, based on the consensus FY2026 adj EPS estimates of $15.14 and its FWD P/E valuation of 30.93x, there appears to be an excellent upside potential of +34.4% to our long-term price target of $468.28.

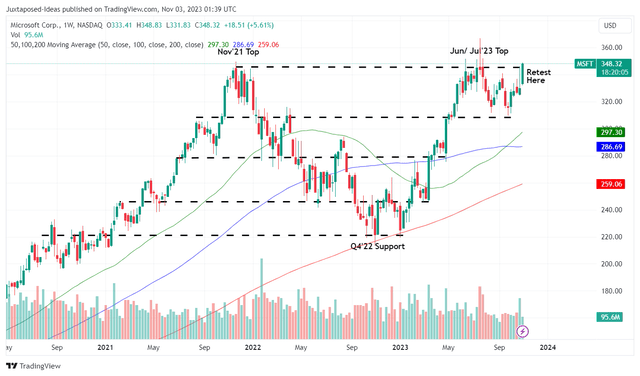

MSFT 3Y Stock Price

Then again, MSFT has also popped by +6.6% since the recent earnings call, with the stock currently retesting its November 2021 and June/ July 2023 peak.

While we remain optimistic about MSFT’s prospects, thanks to its long-term partnership with OpenAI, we believe that the stock is trading slightly above its fair value of $323.21. This is based on its LTM EPS of $10.45 (+12.6% sequentially) and its FWD P/E valuation of 30.93x.

We do not recommend anyone to chase this rally here, especially since it remains to be seen if the stock is able to sustain the current momentum to break out from its critical resistance level of $345s. This is due to the uncertain macroeconomic outlook and the increasing fear index in the stock market.

While we may rate Microsoft Corporation stock as a Buy thanks to the attractive upside potential, investors may want to wait for a moderate retracement, preferably to its previous support level of $305s for an improved margin of safety.

There may be more attractive chances in the intermediate term.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of MSFT, AMD, INTC, AMZN, CRWD, GOOG, PLTR either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

The analysis is provided exclusively for informational purposes and should not be considered professional investment advice. Before investing, please conduct personal in-depth research and utmost due diligence, as there are many risks associated with the trade, including capital loss.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.