Summary:

- Microsoft’s recent pullback is attributed to multi-faceted reasons, partly the CRWD snafu and the supposedly slower AI monetization.

- Combined with the massive capex reported in FY2024 and the guidance of higher spending in FY2025, it is unsurprising that the market reacted as it had.

- Even so, we maintain our optimism surrounding its long-term prospects, attributed to its still robust cloud market share and growing backlog despite the capacity constraints.

- With MSFT still reporting rich Free Cash Flow generation and a healthy balance sheet, we believe the market overreacted.

Edin

We previously covered Microsoft Corporation (NASDAQ:MSFT) (NEOE:MSFT:CA) in May 2024, discussing its robust FQ3’24 earnings call results, with the growing partnership with OpenAI and expansion of in-house AI capabilities delivering excellent Azure cloud results.

Combined with the tailwinds from the new PC refresh cycle, we had continued to rate the stock as a Buy for those looking to dollar cost average at every dip.

Since then, MSFT has rallied by another +11.4% to new heights of $460s, before drastically pulling back as the market rotated from high-growth stocks and the labor market was impacted, triggering intensifying recession fears.

This is worsened by the management’s softer forward guidance and the potential implication from the previous CrowdStrike outage.

Even so, we shall discuss why we are maintaining our Buy rating, with the recent selloff triggering an improved risk/ reward ratio and an attractive entry point, with the article focusing on MSFT’s Cloud business opportunities.

The Mag 7 Pullback Is Likely Here

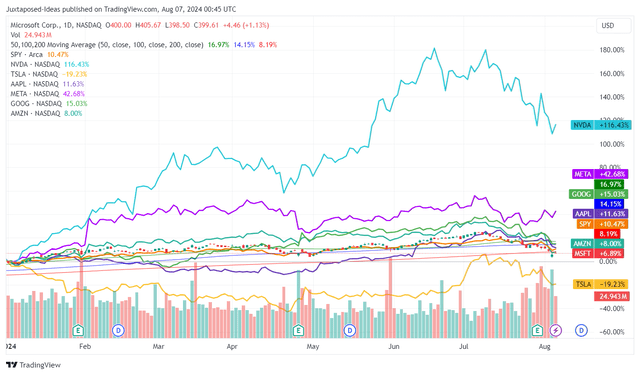

MSFT YTD Stock Performance

We believe it is no secret that a correction is here, with it moderating much of MSFT’s YTD gains along with the other Mag 7 stocks, worsened by the perceived slower AI payoff (an erroneous notion, in our honest opinion).

The former’s optics have also been further worsened by the CrowdStrike (CRWD) outage, with 8.5M Windows machines affected by the software update being just a small “subset of devices actually affected.”

Given that the update operates at the kernel level – effectively taking the whole computer system down, we believe that the impact may be worse than the reported sum of 8.5M, potentially in the tens of millions – impacting global operations across hospitals, banks, airlines, TV broadcasters, supermarkets, and many others.

While the management is currently looking at “reducing the need for kernel drivers to access important security data,” it remains to be seen how their future remediation may be implemented indeed.

Otherwise, MSFT has reported double beat FQ4’24 earnings call with revenues of $64.7B (+4.5% QoQ/ +15.1% YoY) and adj EPS of $2.95 (in line QoQ/ +9.6% YoY), with most of the tailwinds naturally attributed to Intelligent Cloud revenues at $28.5B (+6.7% QoQ/ +18.7% YoY) and Azure at +30% YoY growth.

With the management already reporting over 60K Azure AI customer (+60% YoY), along with higher cross-selling within its vertically integrated data, developer, Copilot for Microsoft 365, Customer Relationship Management [CRM], and Enterprise Resource Planning [ERP] platforms, among others, we believe that its AI adoption and monetization has been robust indeed.

This development plays into the market’s expectations as well, naturally justifying MSFT’s hefty FY2024 capex of $44.47B (+58.2% YoY) and the management’s guidance of “FY2025 capital expenditures expected to be higher than FY2024.”

MSFT remains more than well capitalized to continue investing in its growth driver as well, based on the still healthy balance sheet at a net cash position $23.93B despite the expensive Activision acquisition and the rich Free Cash Flow generation of $74B in FY2024 (+24.5% YoY).

Unfortunately, while these numbers appear to be excellent, it is undeniable that its cloud delivery may fall somewhat short of the market’s lofty expectations in the near-term.

For one, MSFT has offered a lower FQ1’25 Azure growth guidance of +28.5% YoY, with it naturally disappointing analysts attributed to their expectations at over +30% YoY.

This is despite the management’s commentary that the lower guidance is attributed to “capacity constraints and non-AI growth trends,” with things to accelerate by H2 of FY2025, “as our capital investments create an increase in available AI capacity to serve more of the growing demand.”

Unfortunately, with Blackwell delivery delayed due to production issues and MSFT’s AI capacity expansion likely to be temporarily impacted, we believe that the stock couldn’t have avoided the recent correction indeed.

This is especially attributed to the tougher YoY comparison to Azure’s growth at +27% YoY in FQ4’23 and +27% in FY2023.

Secondly, the same underwhelming cloud development is also observed, when comparing MSFT Intelligent Cloud’s lower unearned revenues of $23.11B (+7.1% YoY), compared to the AWS backlog at $156.6B (+18.5% YoY) and Google Cloud at $78.8B (+30% YoY).

Combined with Intelligent Cloud’s lower market share at 23% (-2 points QoQ/ +1 YoY), compared to AWS at 32% (+1 points QoQ/ in line YoY) and Google Cloud at 13% (+2 points QoQ/ YoY), likely attributed to the same capacity headwinds, it is unsurprising that the stock was sold off after the recent earnings call.

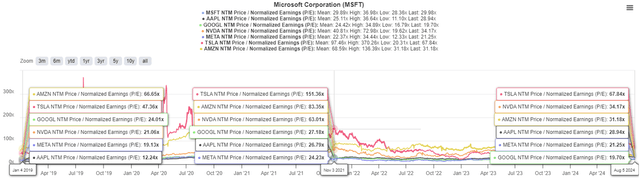

MSFT Valuations

Lastly, these teething issues may have also contributed to MSFT’s relatively slower projected bottom-line expansion at a CAGR of +15% through FY2027 (CY2026), compared to AMZN at 36.8% and GOOG at 19.7%.

While MSFT has gotten increasingly larger and well-diversified in capabilities over the past few years, especially due to the recently completed Activision acquisition, it is apparent that the stock has been overly expensive at the recent peak of 36.9x pre-correction.

This is compared to the previous article at 34.8x, the 5Y mean of 31.3x, 10Y mean of 25.7x, and post-correction levels of 29.9x.

Anyone concerned about MSFT’s recent dip must also note that the same moderation has been observed in its hyperscaler peers, Amazon (AMZN) at 31.1x and Google (GOOG) at 19.7x by the time of writing, compared to their 5Y means of 79.6x/ 25.8x and 10Y means of 93x/ 23.72x, respectively.

Nonetheless, when combined with MSFT’s underwhelming forward guidance and impacted cloud market share, it is undeniable that this is a classic case of where elevated P/E valuations come with great expectations, with any earning misses and/ or underwhelming forward guidance likely to bring forth potential corrections, despite the highly strategic partnership with OpenAI.

As a result of the near-term uncertain market conditions, we will be revising our fair value estimate and long-term price target (in the next section) using MSFT’s more moderate 5Y P/E mean of 31.3x for an improved margin of safety.

So, Is MSFT Stock A Buy, Sell, or Hold?

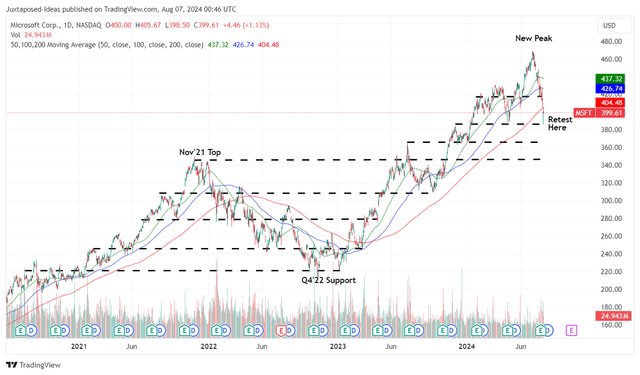

MSFT 4Y Stock Price

For now, MSFT has already pulled back drastically by -14.6% from the recent peak of $460s, while appearing to be well-supported at the previous support levels of $390s and nearing our previous recommended buy ranges of between the $385s and $400s.

For context, we had offered a fair value estimate of $402.90 in our last article, based on the LTM adj EPS of $11.55 ending FQ3’24 and the FWD P/E valuations of 34.8x. This is on top of the long-term price target of $545.60, based on the consensus FY2026 adj EPS estimates of $15.64.

Based on MSFT’s LTM adj EPS of $11.80 ending FQ4’24 and the more moderate 5Y P/E mean of 31.3x, it is apparent that the stock is still trading at a notable premium to our updated fair value estimates of $369.30.

Even so, despite the lowered consensus FY2026 adj EPS estimates of $15.33 (-1.9%) and the same P/E, there remains an excellent upside potential of +20% to our updated long-term price target of $479.80, thanks to the pullback.

As a result of the still attractive risk/ reward ratio, we are reiterating our Buy rating for the MSFT stock, with a few caveats.

Risk Warning

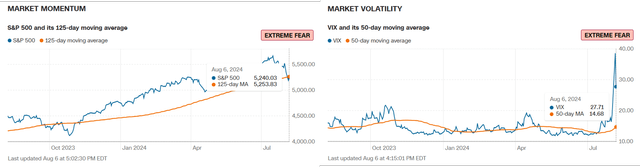

Market Momentum Turning Pessimistic

It is no secret that we have temporarily entered pessimistic market conditions over the past few weeks, with the CBOE Volatility Index hitting heights unseen before and the SPY breaching the prior 125 trading days rolling average, similar to October 2023 pessimism levels.

We believe that the next few weeks may bring forth more volatility until the Fed pivots as projected by the September 2024 FOMC meeting.

At the same time, after four quarters of robust top/ bottom-line growth, we believe that FY2025 may bring forth a tougher YoY comparison as observed in the market’s over reaction to MSFT’s softer FQ1’25 Azure guidance, with sentiments likely to remain impacted in the intermediate term.

As a result of the potential volatility, we are lowering our recommended buy range to its next support levels in the $365s, with those levels also nearer to our fair value estimate while offering interested investors with an improved margin of safety.

This dip is unlikely over yet.

It pays to be prudent for now.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

The analysis is provided exclusively for informational purposes and should not be considered professional investment advice. Before investing, please conduct personal in-depth research and utmost due diligence, as there are many risks associated with the trade, including capital loss.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.