Summary:

- I’ve downgraded Microsoft stock to a “hold” rating due to weak post-earnings performances, high forward valuation metrics, and potential head and shoulders pattern on daily charts.

- Despite beating earnings and revenue estimates, Azure’s performance concerns investors, causing the stock to fall to near-term lows.

- Comparative valuation metrics show other MAG-7 stocks like Alphabet and Meta Platforms as more attractive investment options currently.

- Future outlook hinges on favorable market response to earnings and breaking key resistance levels; otherwise, a further downgrade to “sell” is possible.

Jean-Luc Ichard

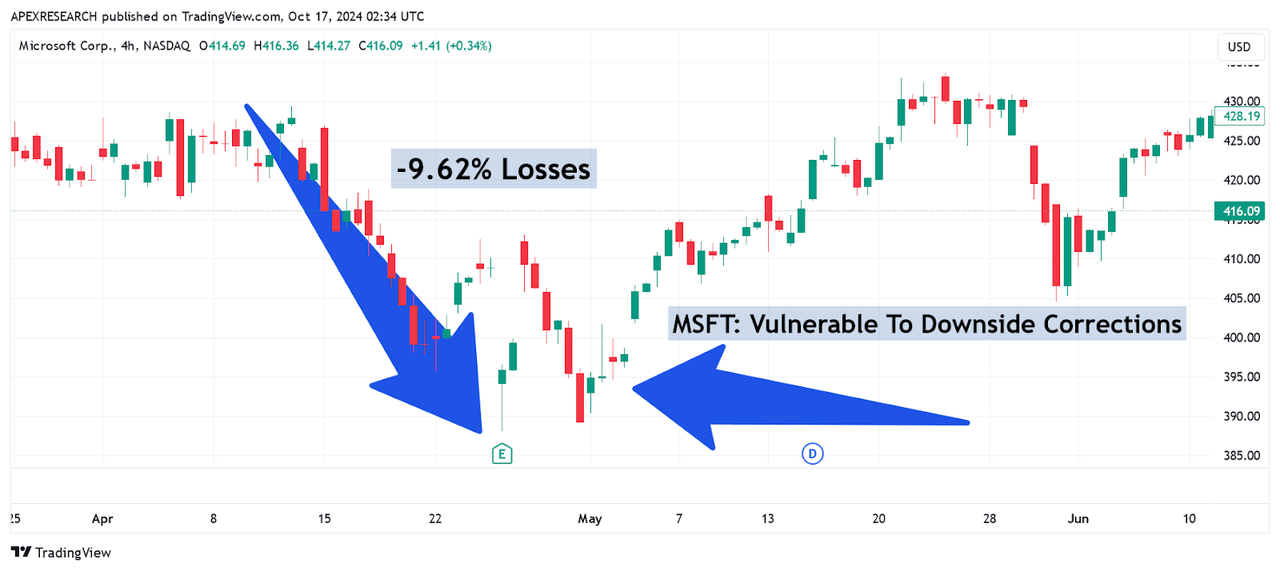

When I last covered Microsoft (NASDAQ:MSFT) with a “buy” rating on April 29th 2024 in “Microsoft: Vulnerable to Downside Corrections”, the stock was in the process of falling from the April 11th highs of $429.37 (in a move that resulted in losses of -9.26%). Overall, the thesis of my bullish article was that these were the types of declines that tend to produce in the best buying opportunities for this stock and that those bearish moves represented a new opportunity to add to long positions:

MSFT: Bearish Declines Precede Prior Stock Rating (Income Generator via Trading View)

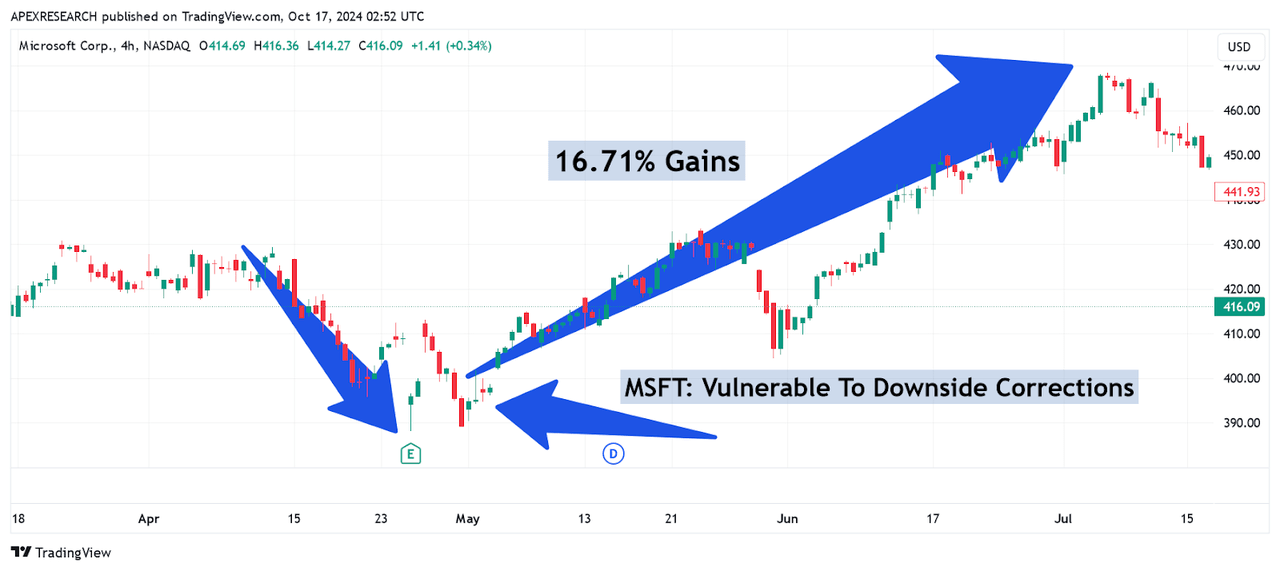

Following my publication, MSFT share prices quickly reversed higher and generated gains of 16.71% over the next nine weeks, showing that well-structured dip buying strategies can be an excellent approach to maximizing gains:

MSFT: Sharp Rallies Follow Buy Recommendation (Income Generator via Trading View)

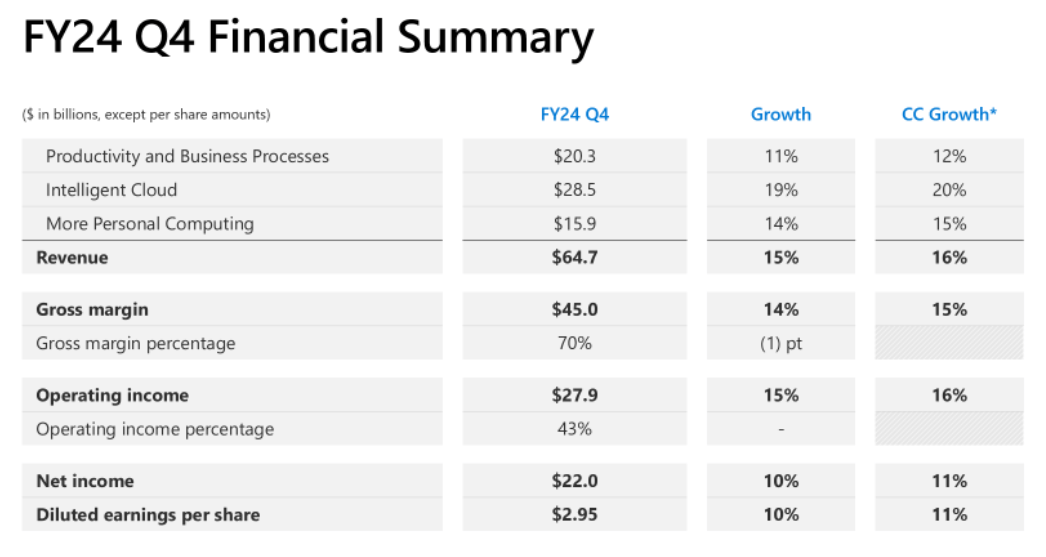

Since then, Microsoft has released quarterly results for the fiscal fourth-quarter period that surpassed consensus estimates for both earnings and revenue. However, weaknesses within the Azure cloud segment were enough to worry investors, and the stock quickly gave back all of its prior gains while falling to near-term lows of $385.60 on August 5th. Specifically, EPS figures came in at $2.95 (slightly beating estimates calling for $2.93 per share) and revenues came in at $64.73 billion (surpassing estimates calling for $64.39 billion). Additionally, the quarter’s net income figure of $22 billion indicates annualized growth rates of 10% while gross margin figures posted annualized gains of 14%:

Microsoft: FY24 Q4 Financial Summary (Microsoft: FY24 Q4 Earnings Presentation)

Overall, revenue growth came in at 15% and Microsoft’s guidance figures suggest current quarter revenues are likely to post within a $63.8-64.8 billion range. At the midpoint, this would imply revenue growth of just under 14% for the period. However, given the market’s most recent negative reaction to earnings, it seems these results (if realized) might not be enough to generate significant share price rallies near-term.

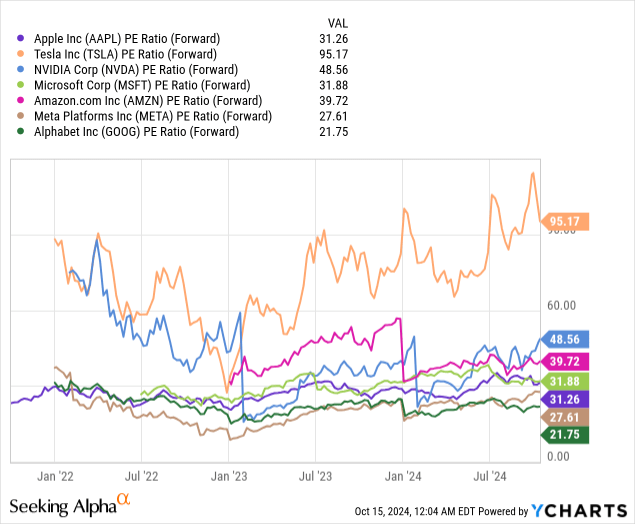

Comparative Forward Price to Earnings Ratios (YCharts)

In my view, part of the reason for this lies in the fact that Microsoft’s forward price-earnings valuation (at 31.88x) suggests that there might be better options right now within the MAG-7 complex. To be fair, Tesla, Inc. (TSLA) is currently trading with an extremely high forward price-earnings valuation of 95.17x while Nvidia Corp. (NVDA) is also relatively elevated levels of 48.56x. Apple, Inc. (AAPL) is a bit more in-line with Microsoft’s current valuation (at 31.26x). Two stock choices that are looking much more well-positioned at the moment can be found with Meta Platforms (META) at 27.61x and Alphabet, Inc. (GOOG) at just 21.75x.

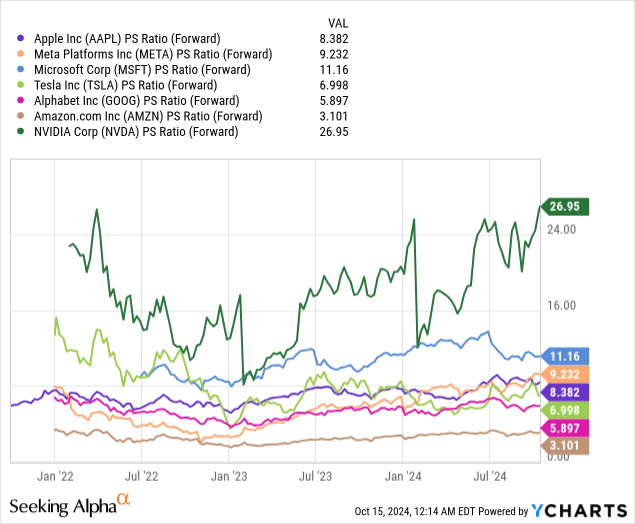

Comparative Forward Price to Sales Ratios (YCharts)

An even worse picture starts to emerge if we look at these same companies through the lens of the forward price-sales metric, where only Nvidia (at 26.95x) is trading with a higher ratio relative to Microsoft (at 11.16x). Of course, this means that five of these seven stocks are currently trading at lower valuations – and some of these selections are significantly cheaper. META (at 9.23x) and AAPL (at 8.38x) are somewhat close using this specific valuation metric. However, TSLA (at 6.99x), GOOG (at 5.89x) and AMZN (at just 3.1x) are looking much more attractive right now.

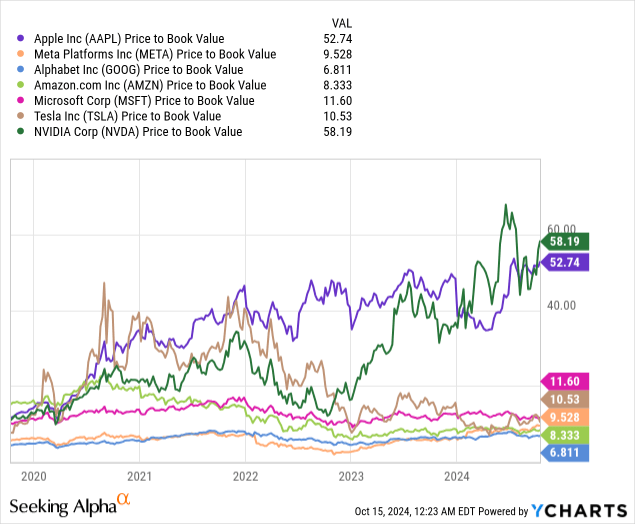

Comparative Forward Price to Book Ratios (YCharts)

Last, I’d like to look at the relative price-book ratio that is seen throughout this mega-cap cohort. Once again, Microsoft is trading within the upper half of this group (at 11.6x) while Nvidia (at 58.19x) and Apple (at 52.74x) are obviously much more expensive. However, once again, we are seeing several MAG-7 options that are trading at much lower valuations at the moment. Specifically, we can point to Tesla (at 10.53x), Amazon (at 8.33x), Meta Platforms (at 9.52x) and Alphabet (at just 6.81x) as potentially preferable options. When we are looking at these comparative valuation ratios, one attractive MAG-7 stock that stands out to me in particular is Alphabet – and this is why I recently upgraded my GOOG rating to a “strong buy” in my article “Google: Buy Before Earnings” on October 14th.

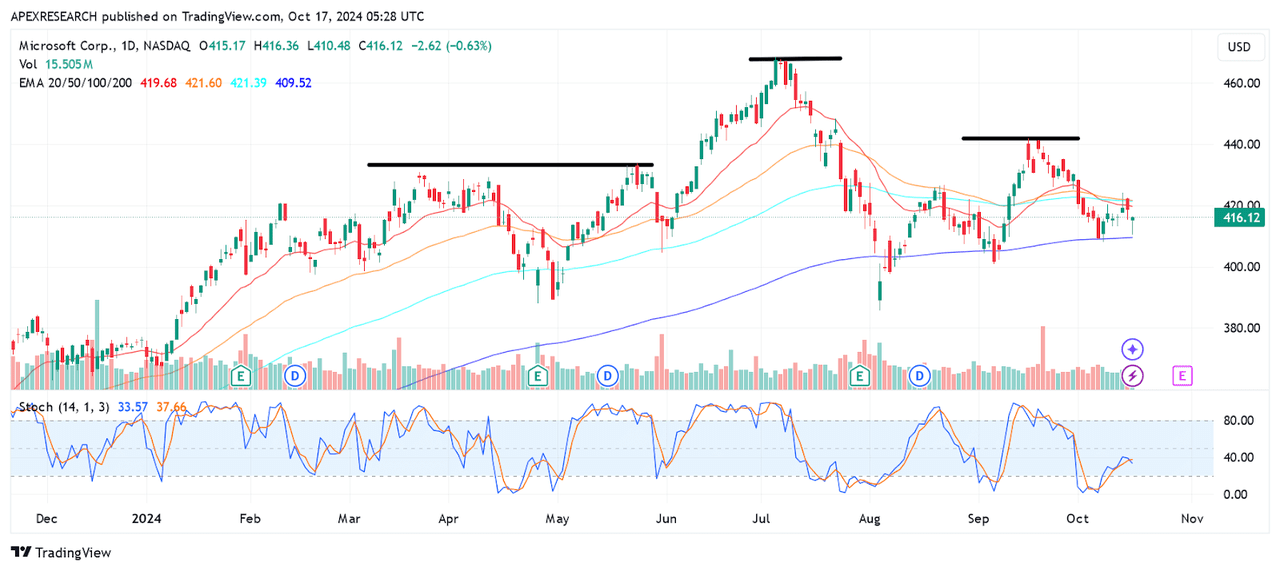

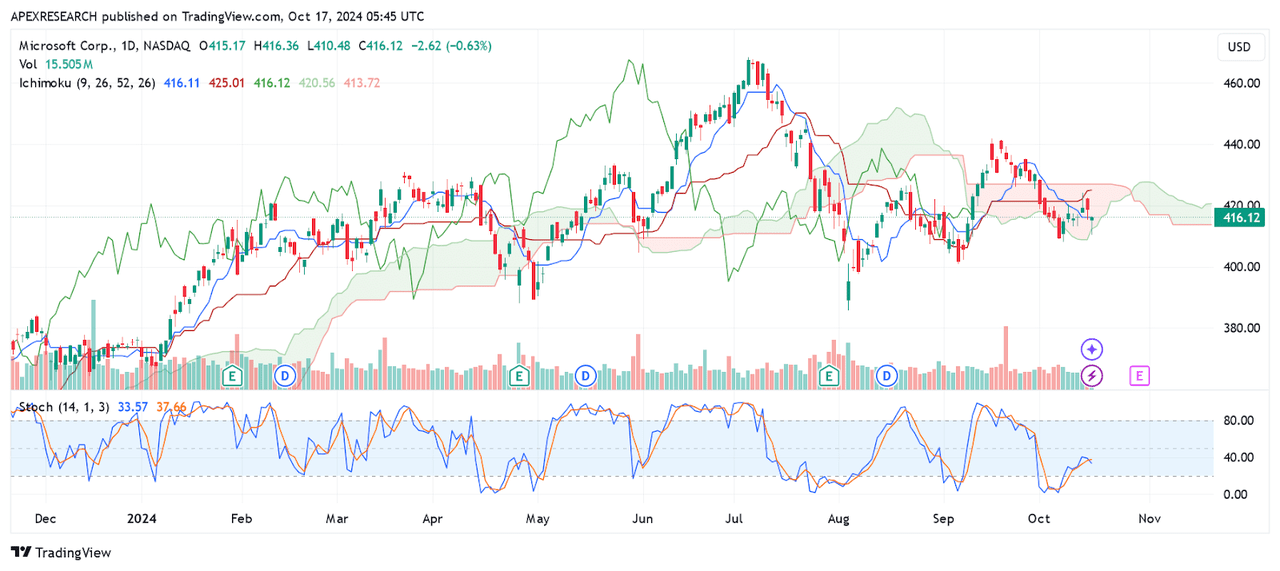

MSFT: Potential Head and Shoulders Pattern Forming (Income Generator via Trading View)

Given the general weakness that we have seen in Microsoft’s most recent post-earnings share price performances, I am a bit reluctant to recommend adding to long positions at current levels. Additionally, we are starting to see the formation of what might actually be a head and shoulders pattern on the daily time frames. If this type of price pattern became apparent on a shorter-term time frame, the overall significant of the formation might be reduced dramatically. However, the daily chart is arguably the most commonly watched time frame in the entire market, so it stands to reason that many other investors might be seeing this bearish pattern as well. Thus, if we combine this price activity with recent market tendencies to sell shares of MSFT following earnings and the underwhelming forward valuation metrics that characterize Microsoft in relation to its MAG-7 peer group, it becomes easier to see why I am currently downgrading my outlook for this stock to a “hold” rating.

MSFT: Key Support and Resistance Levels (Income Generator via Trading View)

In order for me to change this viewpoint, I would need to see markets respond favorably to Microsoft’s next earnings release and engage in enough buying activity to send share prices through important resistance levels that are now found at the September 19th, 2024 highs (of $441.50). If this occurs, my next upside price target for this stock would rest at the stock’s all-time highs of $468.35 (which was recorded during the July 5th, 2024 trading session). Unfortunately, guidance figures for the fiscal first quarter look a bit unimpressive at the moment, with the possible exception of the company’s expected figures for the Azure Cloud segment (with annualized growth estimates currently found between 28-29% for the period). However, growth rates for this segment were previously seen at similar levels and this failed to elicit a bullish response from the market (and the stock ultimately declined in the periods that followed).

For these reasons, I think that we will need to see upside surprises within this segment that are above 30% in order to see MSFT share prices break the aforementioned resistance levels. Conversely, another post-earnings selloff would actually cause me to further reduce my rating outlook for this stock (to a “sell” rating) in the event that share prices breach key support zones currently found at $385.58 (which is the historical low from August 5th, 2024). In this case, we would be seeing a downside break in the “neckline” of the head and shoulders pattern that I outlined previously, and this is the type of event that could cause share price momentum to accelerate in the bearish direction. Of course, this would be the most bearish extent of my current expectations for this stock, but this is the type of outcome that I would need to see before considering selling my MSFT position. Overall, I am a bit disheartened by the fact that other stocks within the MAG-7 cohort are trading with more attractive forward valuations right now, and this is the sentiment that really forms the basis for my decision to downgrade Microsoft to my current “hold” rating.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of MSFT either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.