Summary:

- Microsoft stock is trading at a premium to the IT sector. And it is highly unlikely that OPEX discipline will close the valuation gap.

- A workforce reduction of 10,000 people does not instill confidence that Microsoft is still a high growth company.

- I lower my EPS outlook for MSFT due to continued weakness in enterprise cloud, PC/ hardware sales, gaming and advertising.

- I reiterate a ‘Hold’ recommendation and advise caution going into Microsoft’s upcoming quarterly earnings reporting on 24th January.

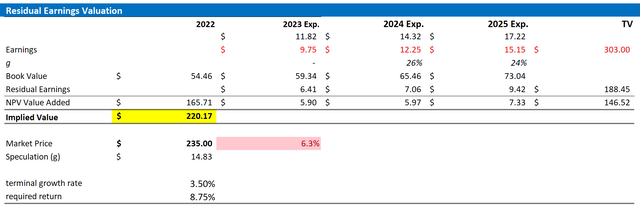

- I lower my base case target price for MSFT to $220.17/share.

Jean-Luc Ichard

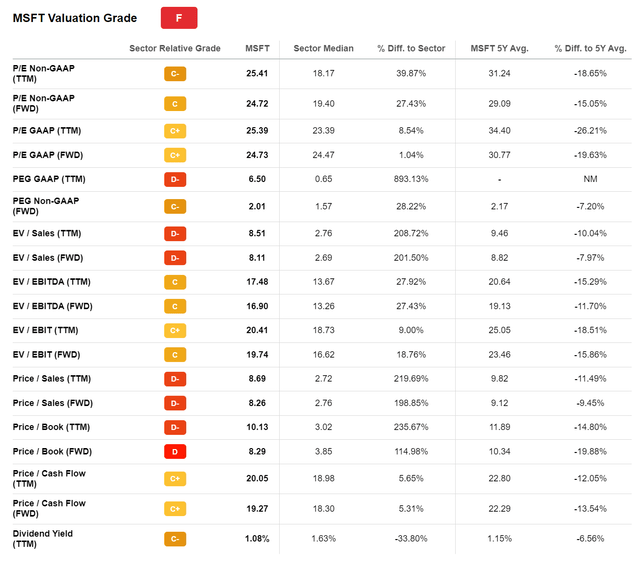

Thesis

I have downgraded Microsoft (NASDAQ:MSFT) to ‘Hold’ in late October 2022. And although I see a few notable developments, including job cuts and a partnership with ChatGPT, I cannot convince myself to buy the stock, yet. At an EV/EBIT multiple of greater than x20 and an EV/Sales of approximately x10, MSFT stock is simply valued too expensive to allow for a margin of safety — which would most definitely be needed given the multifaceted macroeconomic challenges.

Although I acknowledge a slight margin expansion through 2025, given more OPEX discipline, I lower my EPS outlook for MSFT due to continued weakness in enterprise cloud, PC/ hardware sales, gaming and advertising. In addition, I raise my cost of equity for MSFT to 8.75%. The net-effect of this adjustment is that I lower my base case target price for MSFT to $220.17/share.

I reiterate a ‘Hold’ recommendation and advise caution going into Microsoft’s upcoming quarterly earnings reporting on 24th January.

Job Cuts Are Likely Value Accretive…

Microsoft is reportedly planning to lay-off 10,000 workers by end of March, which would represent a relative reduction of approximately 5% of the firm’s headcount.

Assuming that the affected workforce is skewed towards HR, internal consulting, and other support/ staff functions, an analyst may reasonably estimate that Microsoft may save an average annual salary between $115,000 and $135,000 per employee. Accordingly, if this assumption is correct, the company will likely capture annual cost-savings of $1.15 billion – $1.35 billion.

In addition, Microsoft has also announced that the company will push to reduce its real estate and hardware portfolio footprint, which could likely reduce operating expenses by an incremental 150 – 225 basis points as a percentage of total OPEX, or, in financial terms, between $425 million – 650 million.

According to my estimates, Microsoft may realize total OPEX savings between $1.7 billion and $2 billion. However, although this number seems large, it is only slightly value accretive in relation to Microsoft’s $1.7 trillion dollar market capitalization. In fact, assuming a P/E multiple of x25, which is a proud multiple to begin with, Microsoft’s operating discipline may ‘only’ add about $42.5 to $50 billion of equity value (roughly 2.5% of market capitalization).

… But Is Microsoft Still A Growth Stock?

Microsoft stock is trading at a premium to the IT sector. And it is highly unlikely that OPEX discipline will close the valuation gap. Business growth, in theory, could. Investors should consider, however, that a workforce reduction of 10,000 people does not instill confidence that Microsoft is still a high growth company.

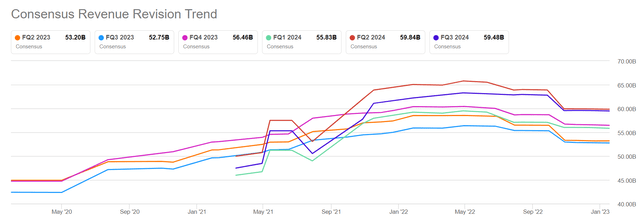

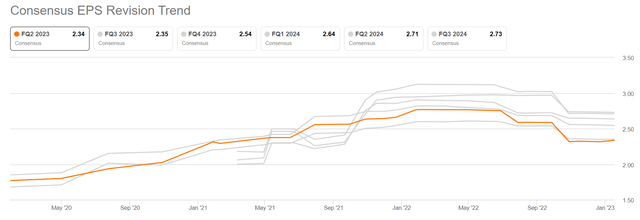

With that frame of reference, it is important to point out that analyst consensus growth estimates for Microsoft have started to come down already. Notably for the upcoming December quarter, 45 analysts have submitted their revenue estimates for MSFT and the average expects only 2.84% year over year sales growth. Needless to say, this is lower than inflation.

And EPS growth is even less convincing. For the December quarter 2022, analysts believe that Microsoft’s earnings per share are likely to fall to $2.34, which would be a year over year contraction of 5.8%!

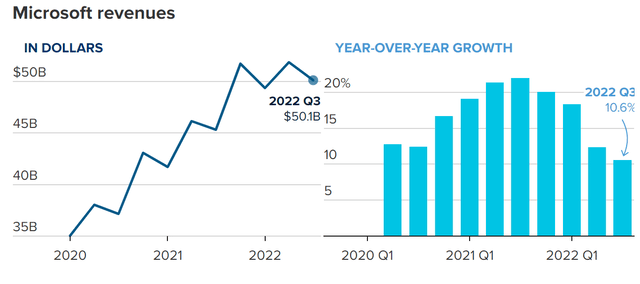

Analysts are not unreasonable here. In fact, there are indeed good reasons why Microsoft’s business will likely stagnate for a few quarters. First, Microsoft is fighting against a sharply slowing demand in personal computing products/services — with PC shipments having fallen 19.5% in the September quarter 2022 versus the same period one year prior. Secondly, with exposure to LinkedIn and Bing Search/ News, Microsoft is also challenged by a weakening advertising market. And third, even Microsoft’s high-growth vertical Azure has started to falter: With Q3 reporting, Amy Hood commented that the growth of Microsoft’s cloud business will likely slow by 5% in the 2022 December vs September quarter, closing the year with 37% year over year growth.

Share Price Under Pressure, But Valuation Still Rich

In line with deteriorating fundamentals, Microsoft’s share price has been under pressure during recent months. And MSFT stock is now a relative underperformer versus the S&P 500 (SPY). For reference, MSFT stock is down approximately 21.5% for the trailing twelve months, as compared to a loss of ‘only’ 13.2% for the S&P 500.

However, Microsoft is still valued at rich multiples: According to data compiled by Seeking Alpha, MSFT is trading at a one year forward EV/EBIT of approximately 20, which is a relative sector premium of 19%. Microsoft’s EV/Sales is priced at about x8, a 200% premium respectively.

Valuation Update: Lower TP To $220.17/share

On the backdrop of a continued weakness in Microsoft’s largest exposure verticals, including enterprise cloud, PC/ hardware sales, gaming and advertising, I lower my EPS expectations for MSFT in 2023. I estimate that Microsoft’s EPS in 2023 will likely fall to somewhere between $9.5 and $10.25. Moreover, I also lower my EPS expectations for 2024 and 2025, to $12.25 and $15.15, respectively.

I continue to anchor on a 3.5% terminal growth rate (one percentage point higher than estimated nominal global GDP growth) but I raise my cost of equity for MSFT to 8.75% (given higher risk premia for growth/ tech assets)

Given the EPS upgrades as highlighted below, I now calculate a fair implied share price for MSFT of $220.17.

Author’s estimates and calculation

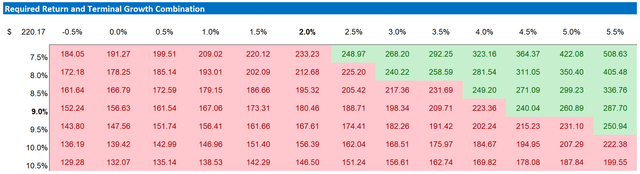

Below is also the updated sensitivity table.

Author’s estimates and calculation

Conclusion

Although Microsoft’s cost saving initiatives could likely add about $42.5 to $50 billion of equity value, it is unlikely that OPEX discipline will push up investors’ confidence to buy/ hold MSFT stock at x20 EV/EBIT.

Reflecting on continued pressure on Microsoft’s largest exposure verticals, including enterprise cloud, PC/ hardware sales, gaming and advertising, I lower my EPS outlook for MSFT through 2025 and now calculate a fair implied share price of $220.17. I maintain a ‘Hold’ recommendation and advise being cautious before Microsoft’s upcoming quarterly earnings report on January 24th.

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: Not financial advice.