Summary:

- More than two-thirds of all personal computers in the world use Microsoft’s software solutions.

- Strong financials, including impressive revenue growth, increasing profit margins, and robust cash flow, are a testament to the company’s resilience and adaptability in an ever-changing market.

- However, current headwinds in the macroenvironment are severe and weaker upcoming earnings or trimmed nearest quarters’ outlook seem highly likely for me.

- My valuation suggests the stock is slightly overvalued at the moment.

FinkAvenue

Investment thesis

Microsoft (NASDAQ:MSFT) has dominated the operating systems market for personal computers [PC] over the last decade. In recent years the company successfully unlocked new solid sources to fuel further growth with its office productivity and cloud solutions, which are rapidly growing. According to prosperspark.com, 95% of Fortune 500 companies use Microsoft Azure, and over 70% of Fortune 500 companies have Microsoft 365 license. The company’s strong track record of stellar financial performance makes me highly convinced that MSFT will continue benefiting from secular market trends toward more digitalization and increased demand for cloud-based solutions. Valuation suggests that the stock is currently slightly overvalued, meaning that adding the stock to long-term portfolios is a good idea, especially in temporary drawdowns. I expect the nearest drawdown in MSFT stock price to happen after the upcoming earnings release.

Company information

Microsoft is a global technology company and the world’s largest independent software developer. The company’s origins date back to the MS Windows operating system and MS Office business applications suite for PCs, which are widely used today. Over the years, Microsoft has expanded its offerings to include enterprise software such as Windows Server, SQL Server, Dynamics CRM, SharePoint, Azure, and Lync. The company also produces hardware, including the popular Xbox gaming/media platform and the Surface tablet.

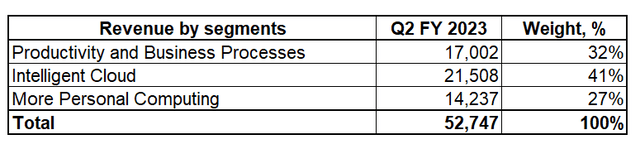

Microsoft’s revenue is divided into three segments, each representing a significant portion of the company’s overall revenue in Q2 FY 2023.

During the last reporting quarter, Productivity and Business Processes, generated $17,002 million in revenue, accounting for 32% of the company’s total revenue. This segment includes a portfolio of products and services that help businesses increase their productivity, such as Office 365, Exchange, SharePoint, and Dynamics business solutions. The second segment, Intelligent Cloud, generated $21,508 million in revenue, making up 41% of Microsoft’s total revenue. This segment primarily comprises Microsoft’s public, private, and hybrid server products and cloud services, including Azure, SQL Server, and Enterprise Services. The third segment, More Personal Computing, generated $14,237 million in revenue, representing 27% of Microsoft’s total revenue. This segment includes Windows, Surface devices, gaming (Xbox), and search and news advertising.

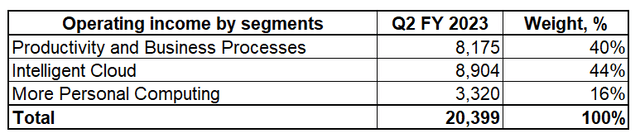

Microsoft’s operating income is also divided into three segments, with the same three segments as its revenue breakdown. The Productivity and Business Processes segment generated $8,175 million in operating income, representing 40% of the company’s total operating income. The Intelligent Cloud segment generated $8,904 million in operating revenue, accounting for 44% of Microsoft’s total operating income. Finally, the More Personal Computing segment generated $3,320 million in operating income, making up 16% of Microsoft’s total operating income.

Overall, Microsoft’s operating margin by segments in Q2 FY 2023 were Productivity and Business Processes at 48%, Intelligent Cloud at 41%, and More Personal Computing at 23%.

Financials

Looking at a company’s financials over the long term is essential because it provides a more comprehensive view of the company’s performance and financial health. Examining a company’s financials over a decade allows for assessing its long-term trends and patterns and its ability to endure economic cycles and maintain stability.

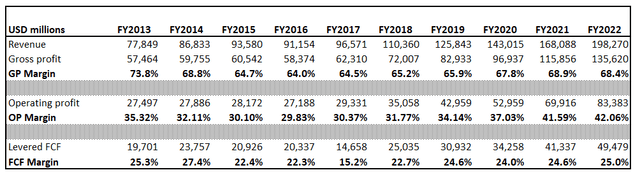

Microsoft’s financials over the past decade show that the company has experienced steady revenue growth, increasing from $77.8 billion in FY2013 to $198.3 billion in FY2022.

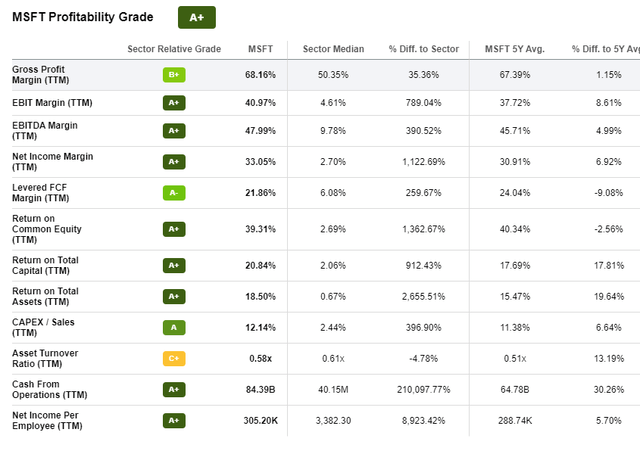

From a profitability perspective, the company’s gross profit has also steadily increased over the past decade, reaching $135.6 billion in FY2022. However, gross profit margins have fluctuated, ranging from 64.0% in FY2016 to 68.9% in FY2021. Operating profit margins have also generally increased, ranging from 29.8% in FY2016 to 42.1% in FY2022. Finally, Microsoft’s levered free cash flow [FCF] has steadily increased over the past decade, from $19.7 billion in FY2013 to $49.5 billion in FY2022. FCF margin has generally remained stable, ranging from 15.2% in FY2017 to 27.4% in FY2014. Based on this profitability dynamics over the past decade, I am not surprised that MSFT has the highest possible Seeking Alpha Quant profitability grade of “A+”.

Microsoft’s balance sheet is truly a fortress, with a total cash balance of $99.50 billion and a net debt of -$21.51 billion. The company has more cash than debt, indicating a healthy financial position. The company’s total debt-to-equity ratio is only 42.58%, which suggests that the company is not over-leveraged and has a strong equity position. Moreover, Microsoft’s current and quick ratios of 1.93 and 1.66 indicate that the company has ample liquidity to meet its short-term obligations.

Overall, Microsoft’s financials from the long-term perspective and the latest available financial position demonstrate the company’s ability to manage debt obligations and make strategic investments for growth.

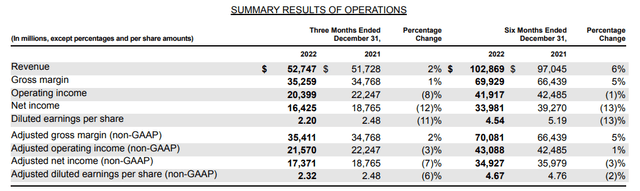

Let me now narrow down to Microsoft’s most recent earnings announcement for the second quarter of the fiscal year 2023. The information was released on January 24th, 2023, and revealed an EPS Normalized Actual of $2.32, which exceeded market expectations by $0.01. However, the EPS GAAP Actual of $2.20 missed by $0.07. The actual revenue for the quarter was $52.75B, falling short of analyst estimates by $404.99M.

The company’s financial performance over Q2 FY2023 demonstrated a revenue increase of $1.0 billion or 2% compared to last year. The change was driven by growth in Intelligent Cloud and Productivity & Business Processes. However, there was a decline in More Personal Computing revenue, which contributed to a decrease in operating income of $1.8 billion or 8%. I will not dig down in deeper details about the company’s latest available quarterly earnings because tomorrow, April 25, post-market, the company will release its financials for the quarter that ended March 31, 2023. Please below read my earnings preview for it.

Upcoming earnings preview

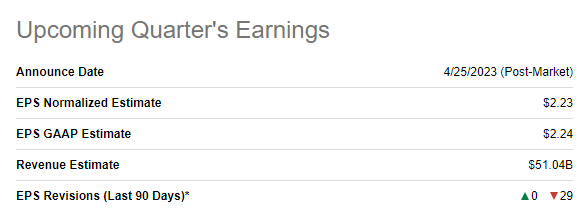

What strikes my attention first when we speak about upcoming earnings is the fact that in last 90 days there were 29 downside revisions for the upcoming financials.

Seeking Alpha

I believe the reasons for such many downward revisions are on the surface. Two weeks ago, International Monetary Fund [IMF] shared its global economic outlook, indicating that the economy is entering the weakest growth period since 1990. IMF also slightly trimmed expectations on short-term global economic growth, projecting a 2.8% growth this year, which I believe is somewhat optimistic because the risk of a hard landing is growing, according to the IMF:

A hard landing — particularly for advanced economies — has become a much larger risk. Policymakers may face difficult trade-offs to bring sticky inflation down and maintain growth while also preserving financial stability.

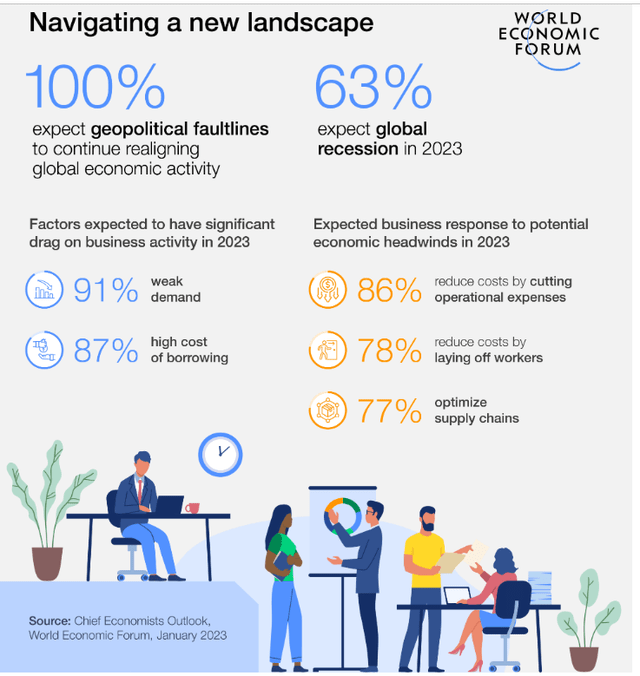

Moreover, according to the World Economic Forum [WEF], businesses will face multiple severe headwinds in the short term, with geopolitical tensions, softening demand and credit crunch dominating in realigning global economic activity.

All these macro headwinds can affect Windows in both bad and good ways. The difference is that good news is related to profits with long duration. Therefore bad news might outweigh good ones in the short term.

For instance, it is obvious that global demand for durables, especially PCs decreased significantly. This will highly likely hit PC segment’s revenue of Microsoft, which has been the company’s cash cow for decades.

On the other hand, we see mass layoffs and other cost-cutting measures from all businesses, whether it is a giant like Google (GOOGL) or a small business. Continuing secular trends of increased digitalization might benefit and even accelerate faster than expected from macroeconomic headwinds and possible recession – according to BBC, AI could replace the equivalent of a staggering 300 million jobs. Last recent months reminded us that laying off employees is the first measure in companies’ cost optimization plans. But the job of laid-off employees has to be done, and here is the likely case for accelerated adoption of AI and other digitalization features businesses. And MSFT is leading the AI race, according to Dan Ives from Wedbush. But I believe the year-to-date MSFT stock rally of almost 20% is already priced in the company’s vast AI potential. There is no reliable measuring of future cash flows incremental growth from AI. And in current circumstances of expensive money, investors are highly likely to prefer more certainty and predictability.

Therefore, I believe that the upcoming earnings announcement will highly likely trigger a mild selloff which will provide better buying opportunities for long-term investors.

To be more precise, I have a couple of thoughts on the upcoming figures based on recent developments. Consensus estimates project a $51.04 billion revenue which means a 3.4% growth on a YoY basis. I believe that revenue numbers might be a little bit overestimated. The decline in PC shipping YoY almost by one third is a well-known fact. Optimists might argue that cloud business is growing double-digit and will offset the probable slip in PC segment. But we have a recent letter to shareholders of Andy Jassy, the CEO of Amazon (AMZN), where he states that AWS, Amazon’s cloud business, is experiencing short-term headwinds as companies are being more cautious in spending given the challenging macroeconomic conditions. The second reason I am cautious about the fact that the company will deliver YoY growth in revenue is a piece of information shared by Barron’s, where recent surveys on large companies’ IT spending from Citi (C) and Goldman Sachs (GS) are discussed. According to this article from Barron’s IT budgets of companies for 2023 are under pressure and it is also a big concern in my opinion.

Next, the EPS, which is expected to be flat YoY by consensus. I am also not so optimistic here, in spite of the fact that in the beginning of 2023 Microsoft announced a 10,000 jobs cut. First of all, laying off employees means severance costs, and Satya Nadella, the CEO, announced a generous “above-the-market’ severance package:

U.S.-benefit-eligible employees will receive a variety of benefits, including above-market severance pay, continuing healthcare coverage for six months, continued vesting of stock awards for six months, career transition services, and 60 days’ notice prior to termination, regardless of whether such notice is legally required.

All these severance costs are highly likely to be recorded in calendar Q1 2023 financials, which were not in place in the comparative quarter. Also, 60 days notice prior to termination means that Microsoft investors will start feeling the favorable effect on costs starting Q2 and beyond. The inflationary pressure on the company’s expenses is also still in place, so for the upcoming earnings I see the minimal possibility that cost-cutting measures will favorably affect upcoming earnings.

With revenues being either flat or declining and several unfavorable factors for the costs side, I see little chance for the EPS not to decline YoY as well.

Valuation

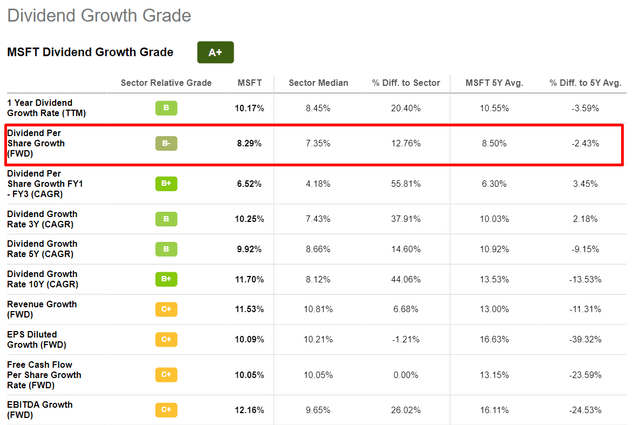

Microsoft consensus estimates expect the company’s revenue to grow at an impressive 8% CAGR over the next decade with EPS consistently expanding. At the same time, the company has had exceptional dividend consistency with dividend payouts and growth for almost two decades in a row.

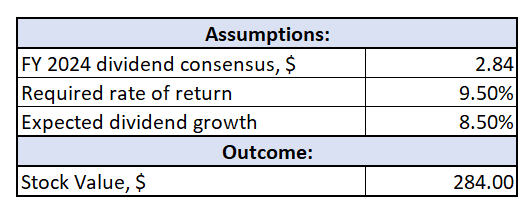

Therefore, for valuation, I will implement both the dividend discount model [DDM] together with discounted cash flow [DCF] approaches. For both models, I need a discount rate, so I use WACC estimated by Gurufocus, which is currently at 9.46%. To be conservative, I round it up to 9.5%.

First, to start with DDM, I need to determine the current dividend and dividend growth rate. For current dividend, I use FY2024 dividend consensus estimates of $2.84 per share, and for the dividend growth rate, I use FWD Dividend Per Share Growth of 8.5%.

Incorporating all assumptions together give me fair price at $284 per share, which is very close to the last close price.

Author’s calculations

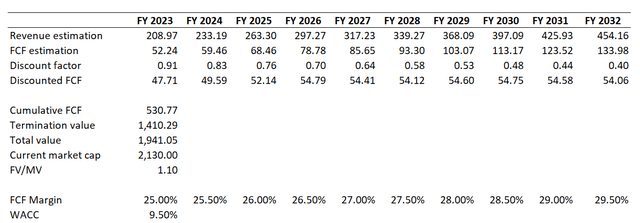

Second, for DCF I need more sophisticated assumptions, which include consensus revenue estimates until FY 2032 multiplied by the levered free cash flow [FCF] margin. For FCF margin, I take the latest full-year metric of 25% and assume that as the company’s revenues and EPS grow over the next decade MSFT will be able to expand the metric by 50 basis points each year.

DCF also suggests that the current market capitalization of the company is very close to the fair value of MSFT business indicating the stock is 10% overvalued.

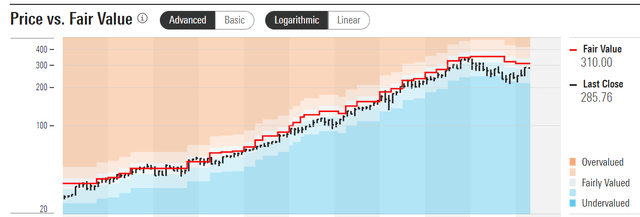

Morningstar Premium sees MSFT stock fair price a little bit higher at $310 per share indicating that the stock is currently trading with an 8% discount. On the below chart you can see how MSFT’s stock price followed Morningstar’s fair value estimations over time.

Overall, the stock is within a range which can be considered as fairly valued given rather conservative assumptions. So, any good news from an assumptions perspective would be a massive buy signal in the short-run.

Risks for the thesis

Although MSFT investment opportunity looks promising, there are some risks that investors should consider before investing in MSFT stock.

One of the main risks to MSFT in an economic downturn is a decline in demand for its products and services. During a recession, consumers and businesses may have less disposable income, which could lead to lower spending on non-essential goods and services such as technology products. However, MSFT has strong pricing power due to its dominant market position. Therefore, the company can maintain its prices even during an economic downturn because customers are willing to pay a premium for its products and services. In addition, MSFT has several businesses that could be less affected by a recession, such as the cloud services segment, which could provide a buffer against a downturn in other areas of the business.

The rapid pace of technological development poses several risks for Microsoft. First, the company operates in a highly competitive industry where new technologies and innovations are emerging rapidly. If the company does not keep up with the latest trends and developments, it may lose market share to more agile and innovative competitors. Second, rapid technological advances can quickly render existing products and technologies obsolete, requiring Microsoft to invest in research and development to remain continuously relevant.

Last but not least relates to my short-term expectations of better buying opportunities ahead, since I believe that weakening earnings will lead to a mild drawdown in stock. There is a risk that Microsoft might come up with a jaw-dropping new product or new integrations with ChatGPT, which will deliver massive value to customers. This year we all saw that the AI hot topic might lead to massive rallies ignoring decelerated growth. This is the risk for the ones who will try to time the market and seek for the post possible buying moment.

Bottom line

In conclusion, Microsoft is an excellent investment opportunity for investors looking for a company with a track record of stellar financial performance, market dominance, and excellent position to capture the shift toward cloud-based solutions and artificial intelligence. At a fair valuation, Microsoft allows investors to benefit from the company’s continued success and long-term growth potential. In my opinion, the stock is a strong buy for long-term investors, but be careful with upcoming earnings since they may lead to stock drawdown. My analysis of upcoming earnings suggests that it is more likely that the market will not like this report in the short-term.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of MSFT either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.