Summary:

- Microsoft beats FY 2024 Q4 expectations with 15% YoY revenue growth and $27.9 billion operating income.

- AI workloads contribute significantly to Azure’s 30% YoY growth, with AI services and GitHub Copilot showing strong performance.

- Microsoft’s long-term outlook remains promising; however, competitive challenges and CAPEX intensity may weigh on investor sentiment.

- Shares are also valued richly: Based on my residual earnings valuation framework, I see MSFT fairly valued at $312.

lcva2

In Q4 2024, Microsoft (NASDAQ:MSFT, NEOE:MSFT:CA) reported solid FY 2024 Q4 results: The company’s overall revenue was strong (+15% YoY), with AI workloads contributing significantly to topline expansion. Operating income for the period was $27.9 billion, a 6.4% increase YoY. Overall, I see FY 2024 Q4 as a proof-point that Microsoft continues to lead in AI monetization, with significant adoption of AI capabilities across its portfolio, including M365 Copilot and GitHub Copilot.

Looking forward, Microsoft’s long-term outlook remains supportive of the equity story; but competitive challenges and CAPEX intensity must be managed prudently. For context, in the past quarter capital expenditures reached a record $19 billion, mostly directed towards cloud and AI infrastructure. Valuation may be another headwind for MSFT shares over the next 12-24 months, with shares trading at a P/E of >30x. Based on my residual earnings valuation framework, I see MSFT fairly valued at $312 (base case).

Microsoft (MSFT) stock has been a relative underperformer in 2024 so far, with shares gaining approximately 9%, compared to a gain of about 12% for the S&P 500 (SP500).

Microsoft Beats FY 2024 Q4 Expectations

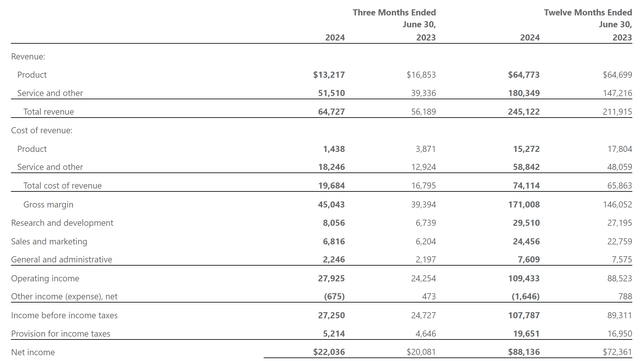

Microsoft reported results for the June-quarter on July 31st and delivered an overall strong set of results, beating consensus estimates on both revenue and earnings: Between April and June 2024, Microsoft generated total group revenues of approximately $64.7 billion. This represents a 15.2% increase YoY from the same period in the previous year ($56.2 billion). On that note, the revenue was slightly above the consensus analyst expectations by around $0.3 billion, with analysts estimating $64.4 billion according to Refinitiv.

Operating income for the period was $27.9 billion, a 6.4% increase YoY from $26.2 billion in the same period in 2023. Net income stood at $22.0 billion ($2.95 per share), reflecting a 9.7% increase YoY, and slightly above consensus estimates, as analysts had projected earnings of about $2.94 per share, as per Refinitiv data.

On a segment basis for Q4 2024, revenues from the “Productivity and Business Processes” segment were $20.3 billion, showing a 9% YoY growth, driven by continued growth in “Office Commercial products and cloud services” and a significant rise in LinkedIn sales. The “More Personal Computing” segment generated $15.9 billion, a 2.5% increase compared to Q4 2023, influenced by a recovery in Windows OEM revenue and a modest rise in Xbox content and services revenue. Lastly, the “Intelligent Cloud” segment reported revenues of approximately $28.5 billion, a 16% YoY growth.

Azure growth was a key highlight, with revenues increasing by 30% YoY. Notably, AI workloads contributed 8 percentage points to Azure’s growth, reflecting the growing demand for AI capabilities. Indeed, AI Services continued to gain traction, now representing a $5 billion run-rate business. GitHub also performed well, reaching a $2 billion run rate, with over 40% of growth attributed to Copilot. The adoption of AI capabilities across Power Platform and M365 Copilot was quite impressive, in my view, with daily users doubling QoQ and customers increasing by 60%. Azure commercial bookings grew by 19% YoY, driven by significant increases in large deals. The company highlighted growth in $10 million and $100 million+ deals for Azure and Microsoft 365, signaling strong customer commitments to long-term contracts. In fact, despite some supply constraints, the company expects acceleration in Azure growth in the second half of FY25 as additional capacity comes online.

The AI Narrative Is Key For The Equity Story

Looking ahead, Microsoft provided guidance for double-digit revenue and operating income growth for FY25. While the first quarter is expected to show slight softness, particularly in the More Personal Computing and Azure segments, the company anticipates stronger performance in the latter half of the fiscal year as investments in AI and cloud infrastructure start to pay off.

On a structural perspective, I highlight that Microsoft’s Azure platform remains a cornerstone of the company’s equity story. In that context, I point out that Azure’s YoY growth of 30% was at the lower end of expectations, likely contributing to some temporary share price pressure until further proof-points on a re-acceleration of growth are evident. However, most of the negative investor sentiment relating to Microsoft’s Azure momentum may be misplaced, in my view, as Azure’s growth rate still signifies robust expansion, particularly driven by AI workloads. On a high level, investors should consider that Microsoft is still in the early innings of leveraging AI integration across its product suite. As adoption of AI capabilities in products like GitHub Copilot and M365 Copilot gain traction, monetization should follow swiftly. Moreover, some of the growth headwinds may be due to current supply constraints, as highlighted by Microsoft management. As capacity expands, Microsoft should be able to capture solid growth upside that is reflected in the company’s financial numbers.

As potential headwinds to Microsoft’s growth upside, I highlight that Microsoft faces competition in both the cloud and AI sectors, primarily from other tech giants like Amazon (AMZN) and Google (GOOG). While Azure currently gains market share, maintaining this momentum requires ongoing innovation and investment, particularly as competitors also enhance their AI and cloud offerings. So, Microsoft’s growth upside from the AI tailwind won’t be without challenges. In addition, the significant amounts capital expenditures required for cloud and AI infrastructure are another source of challenge, as investors raise questions about the timing of returns and the efficiency of capital deployment. Investors are keen to see how quickly these expenditures translate into tangible revenue and profitability gains. For context, Microsoft’s capital expenditures rose significantly to $19 billion in the quarter, exceeding Street estimates.

Valuation Update: Target Price At $312

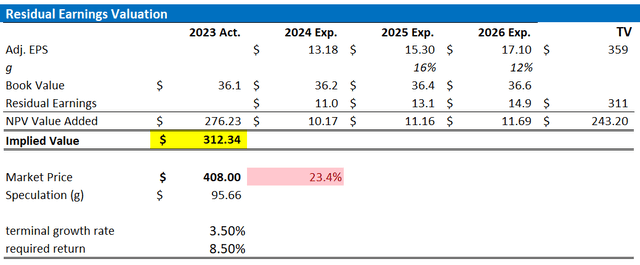

Following Microsoft’s earnings report for FY 2024 Q4, which has been slightly better than expected, I am updating my projections for Microsoft’s earnings outlook through 2026. For CY 2024, 2025, and 2026, I now expect EPS to be approximately $11.3, $12.9, and $13.4, respectively. At the same time, while I maintain a 3.5% terminal growth rate post-2026, I lower my cost of equity assumption by about 25 bps., to 8.5%, reflecting latest expectations of a more aggressive rate cut path. Based on these updated EPS projections, I calculate a fair implied share price for Microsoft to be $312. This suggests that Microsoft stock may be overvalued according to my base-case expectation; but investors must also consider that the valuation is sensitive to cost of equity and terminal growth rate projections (see below).

For context, the value “Speculation” is just the difference to fair implied value. A positive value implies a premium; or in other words, markets are speculating to price a more fundamental upside compared to my estimates.

Refinitiv; Company Financials; Cavenagh Research’s EPS Estimates and Calculation

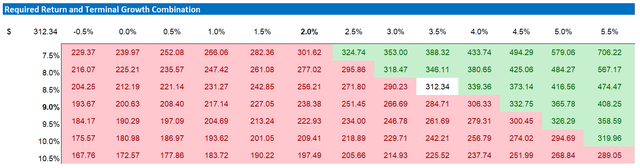

Here also the updated sensitivity table.

Refinitiv; Company Financials; Cavenagh Research’s EPS Estimates and Calculation

Investor Takeaway

In Q4 2024, Microsoft delivered solid financial results for FY 2024 Q4, with overall revenue up by 15% YoY and operating income up 6% YoY. Looking ahead, Microsoft’s long-term prospects remain promising: In my view, Microsoft’s strategic positioning in AI and cloud computing, combined with its robust commercial engagements, provides a solid foundation for future growth. As potential headwinds to sentiment, I highlight that Microsoft must navigate competitive challenges and manage capital expenditure intensity carefully. In the past quarter, capital expenditures hit a record $19 billion, primarily allocated to cloud and AI infrastructure. Additionally, valuation concerns may pose a challenge for MSFT shares over the next 12-24 months, with the stock trading at a price-to-earnings (P/E) ratio above 30x. Based on my residual earnings valuation framework, I estimate MSFT’s fair value to be $312 (base case). I reiterate a “Hold” rating.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Not financial advice

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.