Summary:

- Microsoft continues to post resilient fundamental results in spite of the tough macro.

- I argue that these strong results are not strong enough given the current valuation.

- Investors may have been caught off guard by how little generative AI is boosting current results.

- I explain in simple terms why a “lost decade” may be in store for the stock.

Loren Elliott

High expectations may not always be a good thing for stocks. That proved to be the case with Microsoft (NASDAQ:MSFT) as the company reported what otherwise would be considered solid results but were arguably insufficient given the stock price valuation. MSFT is widely regarded as being optimally positioned for the growth of generative AI, but it is becoming clear that stock prices may have preemptively priced in much of the gains as management appears to be downplaying how quickly investors should see results. MSFT is not terribly overvalued at current levels but I question the premium valuation relative to mega-cap tech peers. Investors must discern between strong fundamentals and attractive valuations as it is not immediately clear if MSFT will outperform the broader market index over the long term, at least from current levels.

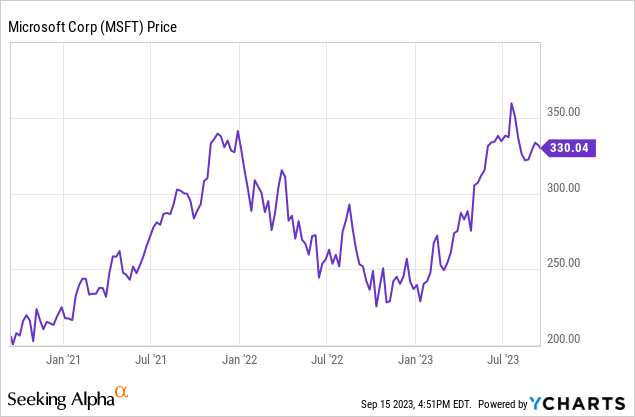

MSFT Stock Price

MSFT is a large, mature tech company but that has not stopped it from furious returns as of late.

I last covered MSFT in June where I explained why I was downgrading the stock from a buy to a hold. Valuation remains an utmost concern, though the stock is not so egregiously overvalued to warrant a sell rating.

MSFT Stock Key Metrics

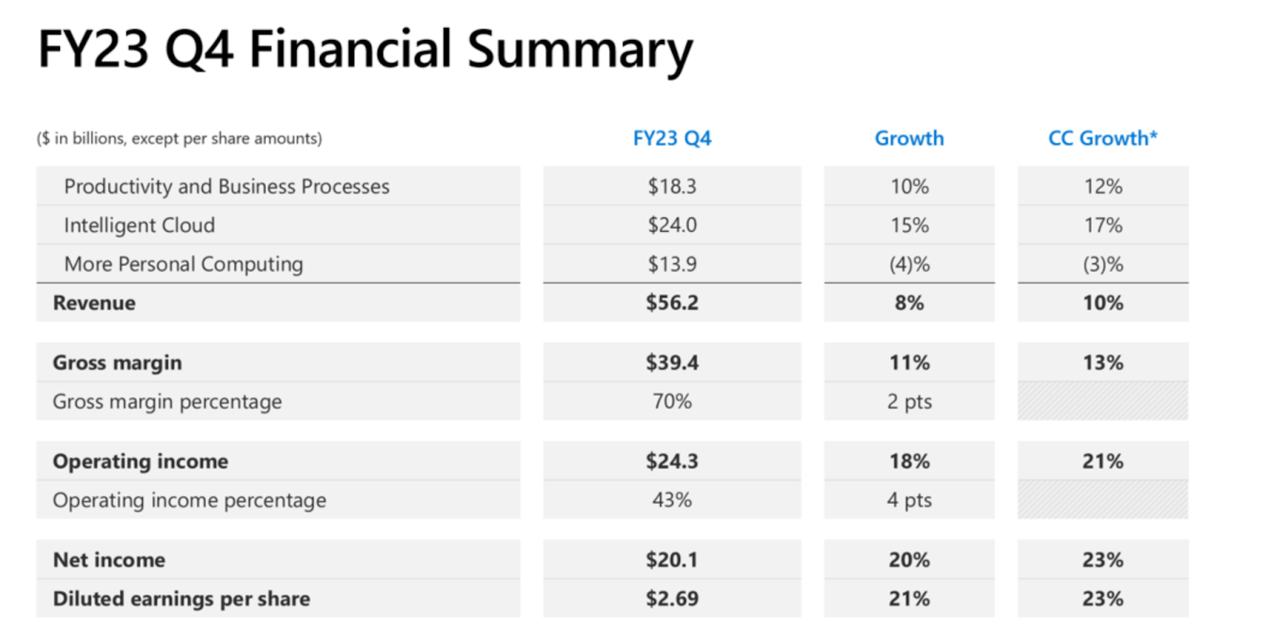

In its most recent quarter, MSFT delivered solid results which showed double-digit growth that beat consensus estimates.

It is incredible for a company of this size to show such resilient growth amidst this tough macro environment, but the stock’s valuation guaranteed high expectations heading into the print.

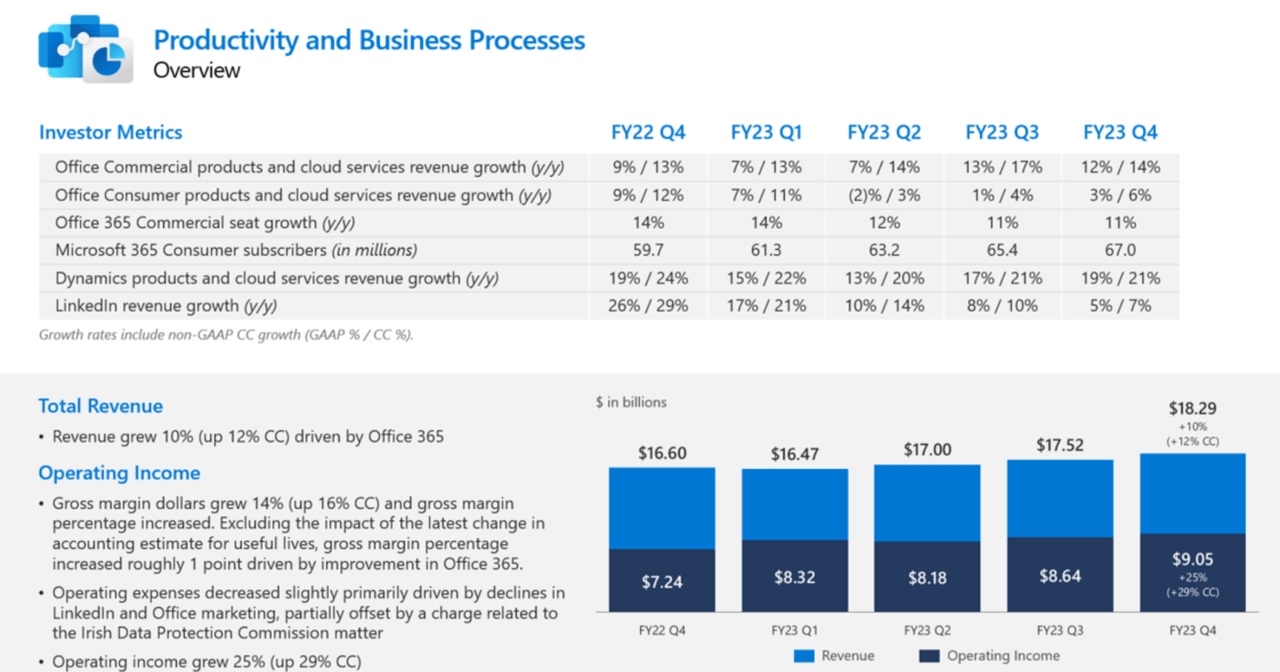

Investors may have been hoping for generative AI to help boost growth rates across the board. That did not quite happen. MSFT delivered resilient growth rates in its core Office and Dynamics products, which I again stress would be an incredible result ignoring the valuation.

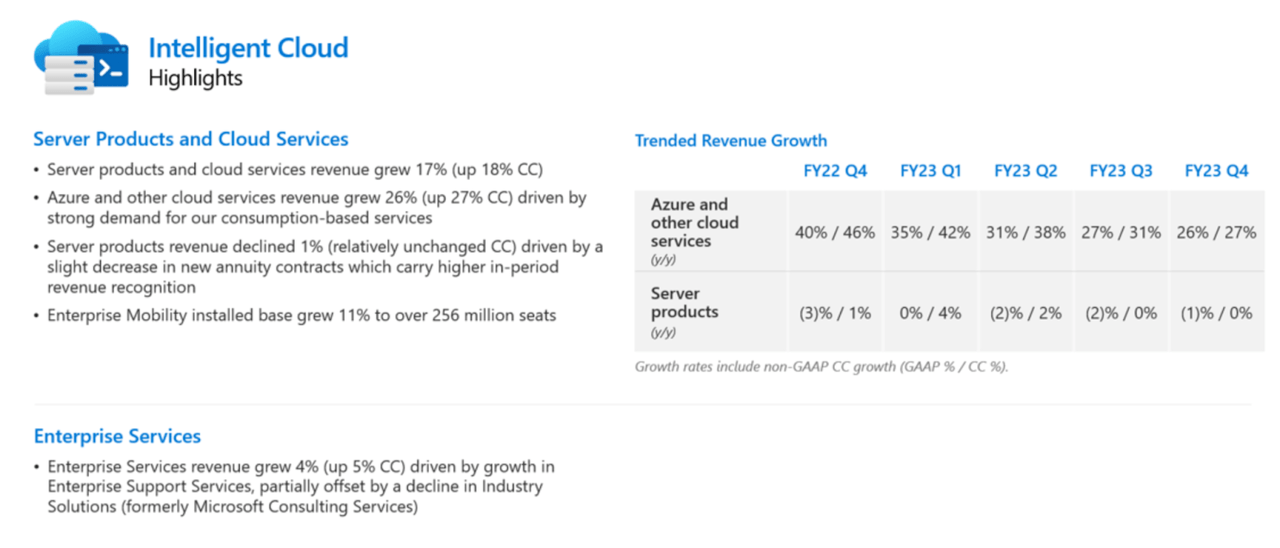

MSFT delivered 26% YOY growth in Azure (27% constant currency), in-line with guidance for up to 27% growth. Given the size of Azure (finally disclosed on the conference call to be around $15 billion in quarterly revenues), that is an incredible growth rate, but investors may be left scratching their heads as to why the segment showed sequential deceleration in spite of perceived generative AI benefits.

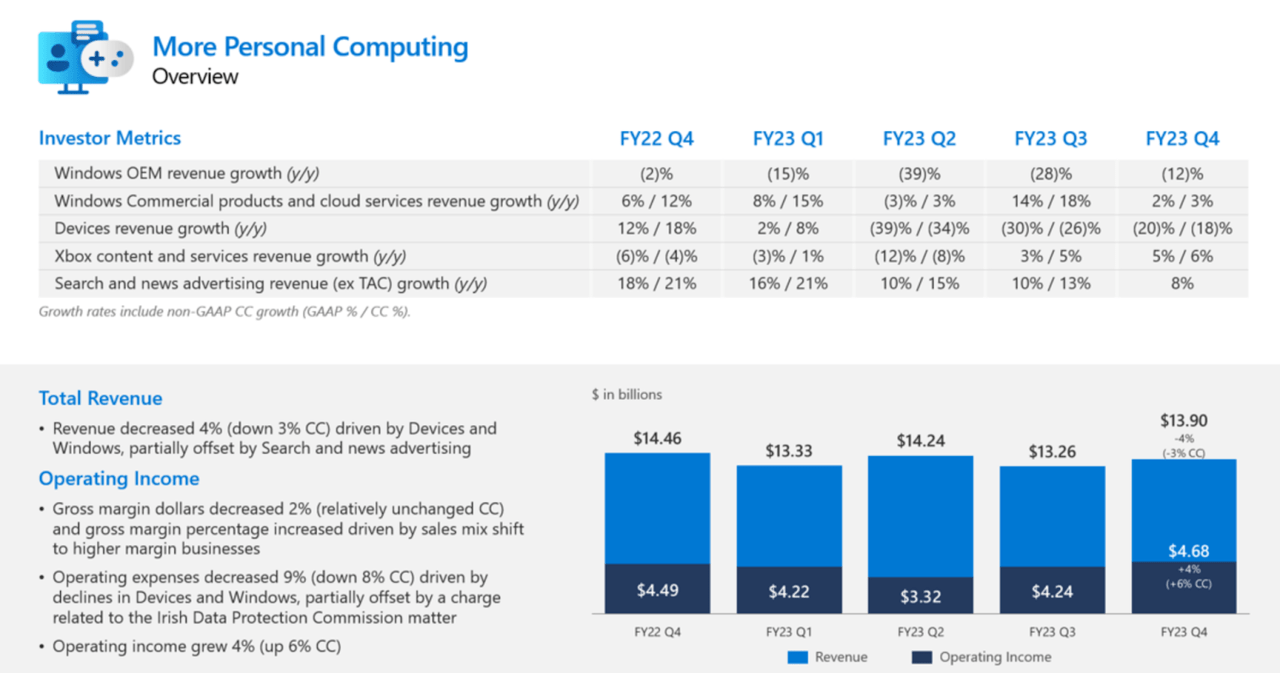

In my opinion, the brightest spot came from the personal computing segment which ironically is historically the weakest business line. MSFT delivered solid growth in earnings as it finally began lapping easy comparables.

MSFT ended the quarter with $111.3 billion of cash (this does not include the over $10 billion of investment in OpenAI) versus $47.2 billion of debt. As usual, MSFT was a shareholder yield machine, returning $9.7 billion to shareholders through $5.1 billion in dividends and $4.6 billion in share repurchases. The steep valuation of MSFT makes those share repurchases somewhat questionable, but one could make the argument that share repurchases help to support the lofty valuation and the company is so big that M&A is not so easy to accomplish.

On the conference call, management attempted to temper expectations for generative AI, stating that they expect growth from AI services to be “gradual” with the largest impact being seen in the second half of this upcoming fiscal year. This commentary makes sense given that a generative AI bubble seems to be forming – MSFT understandably does not want to be dragged down once that bubble bursts. Like other mega-cap tech titans, management guided CapEx to increase every quarter moving forward in order to meet the generative AI demand. I am doubtful that many investors are unhappy with such a forecast given that generative AI is expected to lead to stronger tail-end growth over time.

Looking forward, management has guided for its Office and Dynamics business segments to see 9% YOY revenue growth (11% constant currency) – again reflecting resilient growth. Some investors may have been hoping for the integration of generative AI in these products to lead to accelerating growth rates, but again, investors might need to wait another 2 quarters before such efforts bear fruit. Management guided for Azure to see growth decelerate further to 25% – these results indicate that analysts may have gotten ahead of themselves in expecting the tech titan to see immediate benefits from generative AI.

Unlike last quarter, in which management appeared very optimistic for the future of generative AI, this quarter saw increased commentary explaining why the “cloud optimization” continues to persist. Again, this switch in commentary is likely driven by the generative AI bubble in stock prices. Management noted that the pandemic may have seen an acceleration in new project starts and a postponement in optimization, meaning that we are now seeing some sort of “catch-up optimization” taking place. Management continues to expect these optimization headwinds to eventually subside over time.

Is MSFT Stock A Buy, Sell, or Hold?

At recent prices, MSFT traded hands at around 31x forward earnings. That isn’t a crazy valuation relative to historical levels, but one mustn’t ignore the higher interest rate environment and slower growth than in the past.

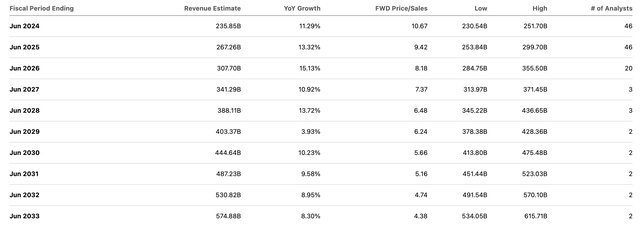

The rich valuation is best illustrated by examining the price to sales multiple, which stood at 10.7x versus modest double-digit growth moving forward. Even after the big rally in tech stocks, most names trade with P/S multiples roughly half of their growth rates, or lower, making MSFT’s valuation an incredible sight to behold.

To be clear, I am not calling MSFT a bubble per se – the company’s solid resilient fundamentals across the business cycles has earned the premium valuation (and on top of that there is the generative AI positioning). But assuming that we are aiming to beat the market, such analysis is insufficient to support buying the stock. I am doubtful that MSFT can sustain a 30x earnings multiple in a decade when top-line growth inevitably slows down. Sure, consensus estimates call for high-single-digit growth even in 2032 but that is implying essentially no deceleration in growth rates from today’s levels. Even if we were to assume 9% revenue growth in 2032, 45% long term net margins (ahead of the Street), and a 1.5x price to earnings growth ratio (‘PEG ratio’), then we’d arrive at a 6.075x sales multiple in 2032, implying a stock price of $457 per share or 3.6% potential annual upside over the next 9 years. Throw in the 0.8% dividend yield and total returns might be around 4.4%. If we instead use the earnings yield then total returns might be more around 6% to 7%. I am of the view that the broader market still can deliver 8% to 10% annual returns from here, meaning that MSFT may not be able to keep up over the next decade. In order for MSFT to outperform the market, it would need to retain a premium multiple even as top-line growth slows. Assuming that MSFT instead trades at a 10x sales multiple in 2032, in line with today, then MSFT might trade at $753 per share, implying around 9.6% total annual return potential over the next 9 years (perhaps 12% to 13% inclusive of the earnings yield). It is not impossible for MSFT to beat the market but the likelihood looks slim and the potential outperformance is arguably not worth it.

What are the key risks to my neutral thesis (what might make me regret not owning the stock)? It is possible that generative AI enables MSFT to further differentiate its products from competition, helping to accelerate revenue growth meaningfully. My neutral thesis incorporates the assumption that generative AI merely allows MSFT to sustain current growth rates, helping to fend off deceleration in growth, but perhaps I am not optimistic enough. Similar to Amazon’s (AMZN) domination in e-commerce, MSFT is widely viewed to be a dominant force in the enterprise tech space, with many investors believing that the company will eventually dominate all of the sectors it operates in. I am doubtful that MSFT’s large size gives it the competitive advantage for investment that is implied in such a statement, but it is possible that the company develops a name brand that eventually supersedes objective performance. It is possible that MSFT is perennially viewed as a sort of consumer staples allocation in the tech sector – perhaps investors with lower total return hurdles might be attracted to MSFT’s reliable revenue stream, growing dividends, and ongoing share repurchase program. This is the most likely possibility in my view among the risks laid out here, but I note that if this were to take place, then cheaper tech peers would likely offer superior return potential.

While MSFT continues to post solid fundamental results amidst difficult macro conditions, I reiterate my neutral rating as the math does not support outperformance over the long term.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of AMZN either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

I am long all positions in the Best of Breed Growth Stocks Portfolio.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Sign Up For My Premium Service “Best of Breed Growth Stocks”

After a historic valuation reset, the growth investing landscape has changed. Get my best research at your fingertips today.

Get access to Best of Breed Growth Stocks:

- My portfolio of the highest quality growth stocks.

- My best deep-dive investment reports.

- My investing strategy for the current market.

- and much more

Subscribe to Best of Breed Growth Stocks Today!