Summary:

- Microsoft is in a prime position to be the future leader in cloud services provision, which is an essential and fast-growing market that could be worth $3 trillion.

- Despite the AI hype, Microsoft’s real value lies in these cloud services, including its SaaS, IaaS, and PaaS solutions.

- The current valuation is high but we believe justified by Azure’s potential, though there are regulatory risks.

- We expect 7-12% annual returns, which are based on what, we believe, are conservative estimates.

- We see Microsoft as a buy, but hope a price dip offers a better margin of safety.

da-kuk

Moats and Monopolies

Here at Moats and Monopolies, we do things a little differently. Rather than writing about companies that we do not know intimately, we write exclusively about companies that we own in our portfolio, which has comfortably beaten the S&P 500 since we began to share it here on Seeking Alpha in April 2023.

We are quality only investors, owning what we believe to be some of the best compounders from around the world. Our philosophy is pretty simple – look for companies with defensible competitive advantages and unique assets, pay a reasonable price and hold for long enough periods for them to grow into their valuations.

Microsoft (NASDAQ:MSFT) is our biggest holding (around 7.3% of the Moats and Monopolies portfolio at time of writing), and needs no introduction – you are probably using at least one of its products in your home and in your workplace. One thing that strikes us as an interesting narrative change in recent months is how the company is being increasingly connected to the big ‘theme du jour’ – AI.

Scrolling through the Microsoft analysis section, it seems that half of all articles on Seeking Alpha are being written about AI: whether about Microsoft’s own products or their indirect exposure to the theme through their investments in other companies as well as the wider investing opportunity from this potentially paradigm-shifting macrotrend. However, as an investing community, we cannot ascertain whether the company is in pole position or dead money:

Microsoft: Anticipating Strong Q1 As AI ROI Becomes Clearer

Microsoft: The Market Is Not Pricing In Enough AI Growth

Over 80% Of AI Projects Fail – Microsoft Is Vulnerable

Microsoft Q1 Preview: Copilot Struggles, Customers Not Satisfied (Rating Downgrade)

The thesis of this article is rather simple: Microsoft is not ‘an AI play’, it’s a cloud one. We will discuss Azure, what it does, what the current state of the market looks like as well as the future growth opportunity, and we will do our upmost not to mention the ‘A Word’.

Microsoft in Exactly 100 Words

Microsoft is a technology company that has been in the top 10 by market cap since 1998, a feat unmatched by any other business. It is highly diversified with: PC operating systems and hardware, productivity software, social media, hardware sales, digital advertising, console gaming and cloud services in addition to many others. The majority of its business model is high margin, recurring and subscription based, which explains why it is the number one most held position by the so called ‘super investors’. It is now part of the ‘AI’ race and has partnered closely with ChatGPT parent company Open AI.

Azure: The Jewel in the Crown

Let’s start with what, I believe, is the single most important reason to either hold Amazon (AMZN) or Microsoft in your portfolio, should you be a stock picker and not use ETFs or other funds. The cloud. We believe there is still a misconception of both what it is and what the opportunity is moving forward. So, let’s do a shallow dive together.

The cloud is a metaphorical term that relates to a huge network of servers that host and deliver content and services, such as: streaming music, video games and video content; office productivity software and files; social media content and photos, etc, which can then be accessed somewhere using a web-enabled device – your smartphone, laptop, smart TV, games console, smart speaker, iPad… You get the idea.

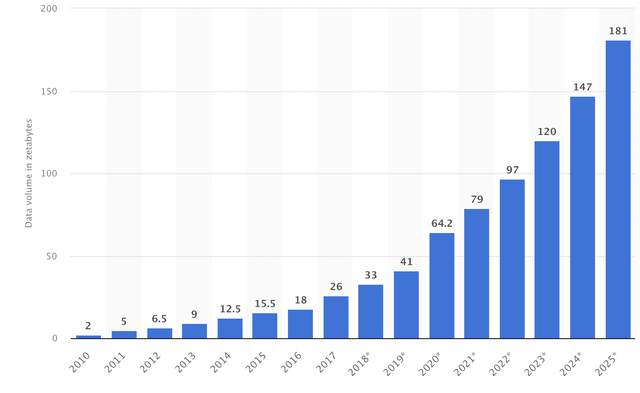

These services create a huge amount of data and require astrophysics-like mental gymnastics to get one’s head around the scale of the storage required to hold these files. Each attempt to get an answer from Google brought us different answers, but using Statista as a frame of reference, there is around 180 zettabytes of information created, copied or consumed worldwide, online each year. That is 180,000,000,000,000,000,000,000 bytes or, if it’s easier, 180 trillion Gigabytes.

Created, copied, consumed data worldwide (Statista)

It should be a surprise to absolutely no one that this number is increasing, and quickly. Consider that the numbers of users on the internet is increasing. Companies moving their operations from their own managed data centres to the cloud is increasing. Streaming services are providing more content to more people with ever-increasing resolutions (8K TV anyone?). Where does all of this data get stored? Probably on the public cloud, i.e. through the portal of your subscription service, you can access the same data as someone else using the same service.

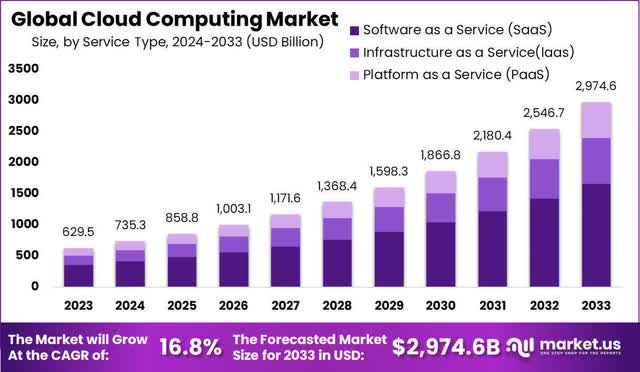

market.us

Zooming out, let’s look at what the Global Cloud market is predicted to do over the next decade or so. Again, take all forecasts with a pinch of salt (including this article) as no one can actually tell the future, but the market is undeniably going to increase. The graphic suggests a tripling from here of the market and parses the opportunity into 3 parts: Software as a Service (SaaS), Infrastructure as a Service (IaaS), and Platform as a Service (PaaS).

Microsoft is across all of them. You probably guessed that didn’t you? As a SaaS company, Microsoft’s big hitters include Office 365 (think all of the industry productivity standards, such as Word, Excel, PowerPoint, etc) and Xbox Game Pass, the company’s ‘Netflix of video games’, which includes some key games from its 2022 acquisition of Activision Blizzard, such as the new Call of Duty. As an IaaS company, it offers data storage, protection and security to its customers by moving their operations to Microsoft’s own physical servers in huge data centers (the building up of which is the main reason for Nvidia’s (NVDA) recent meteoric rise), complete with firewall and security protection. Finally, as a PaaS company, Microsoft offers the same infrastructure but with all of the tools and storage space for their customers to develop their own applications, including additional services such as databasing and business analytics. These latter two (infrastructure and platform) are what Microsoft’s jewel in the crown – Azure – caters for.

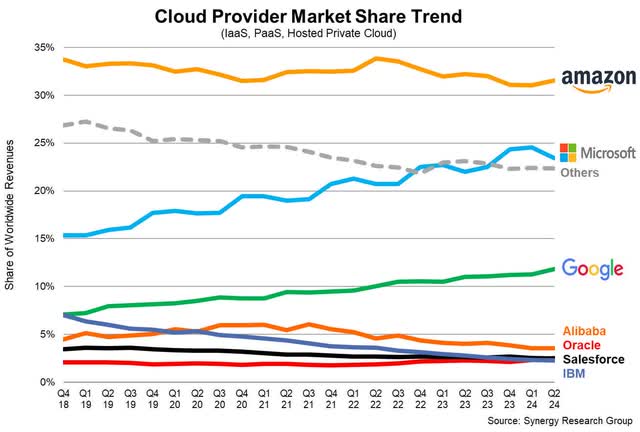

Synergy Research Group

In the above chart, we can see that Microsoft’s complete package, and history in providing industry standard enterprise solutions has seen it slowly take some of Amazon/AWS’ market share as well grow faster than the total market. It currently has around a quarter of the total cloud market. Those with good memories will remember the first infographic shown in this article, which posits a 3 trillion dollar total opportunity in 2033. Azure will thus be in a market, which is around half of that opportunity (i.e. the non-software part).

Now, I want you to imagine for the purpose of valuation and opportunity that Azure is a separate company, spun out or forcibly divested if you will. Should it hold or even grow its 25% market share, that’s an annual revenue of around $375 billion. Let’s be conservative and keep their 45% current operating margin and we get $170ish billion of operating income per year, or around $135 billion assuming a 20% tax rate. Considering the high margin and recurring nature of this business, and put a PE of 20 on those earnings. We have a 2033 valuation for Azure of $2.7 trillion, which isn’t far away from the current market cap of the complete Microsoft. And remember, we’ve been very conservative with these numbers. If this fictional, separate, future Azure traded around Microsoft’s 20 year average PE (just under 30) it’s valuation looks more like $3.9 trillion!

Risks

If the above numbers play out, the price we pay today is basically worth what Azure will be worth out a decade, making the current price much more understandable for those long term mindset, buy and hold investors out there. However, all investments carry risks, including this one.

Cloud infrastructure is fast becoming for many businesses an essential utility like energy and water. With that comes potential regulation, and with the numbers we have been discussing here, it feels more a case of when than if. The current approach that regulators and regulating bodies use, typically puts these services under the umbrella of online platforms, but that fails to take into account the complex and unique features of these aforementioned models (i.e. IaaS and PaaS). For example, we could see regulators needing to consider interoperability between providers as well as the ability to switch them. Considering the head start that Microsoft, Amazon and to a much lesser extent Google (GOOG) have, it is difficult to believe that there are many other potential providers who have the scale and resources to compete, and with each of these three companies already in the sights of regulators, there may be increased incentives to push more extreme ideas, such as break ups.

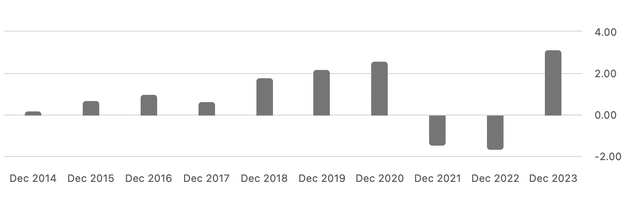

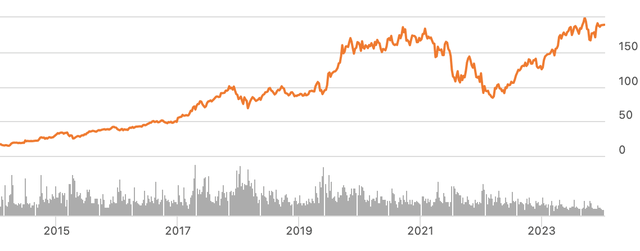

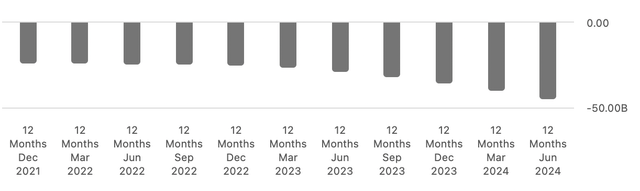

After regulation, we feel that the biggest risk is capital expenditures outweighing potential future earnings, but we are not too concerned about this. For those who remember the huge buildup of Amazon’s fulfilment centres and logistics offerings during and post pandemic, they will remember just how severely free cash flow was impacted by these costs and how the share price consequently suffered. We can see this exact impact in these two charts below. Notice how the free cash flow per share dips as capital expenditures increase, and below the exact impact on the share price.

Amazon’s FCF per share chart (Seeking Alpha)

Amazon’s share price (Seeking Alpha)

It is entirely possible that Amazon overspent during that time; however, they have grown into their additional capacity. We believe that the current ramp up in spending that Microsoft is undertaking will play out in the same way. Even if they are currently buying too many Nvidia chips and building too much data centre capacity for today, they will inevitably grow into that potential sometime in the future. After all, if it isn’t AI, then it is automated driving, cybersecurity, the metaverse, virtual reality, individualised medicines, biotechnologies and preventative medication, humanoid robots, smart roads/cities or indeed any future technology that you could envision that requires data to be stored in a public cloud that can be accessed by connected devices. Further, Microsoft’s 20 year ROIC is over 30%, which is very high and very consistent, demonstrating that over both Ballmer and Nadella’s tenures, the company has always found ways to put its capital to work in order to grow.

Microsoft Capital Expenditure Growth by TTM (Seeking Alpha)

A final threat is that the nature of Azure’s service offerings means that they need to a) keep their physical data centres online constantly and b) keep their customer’s services and data safe from hackers/digital terrorists etc. The former puts pressure on where they build out their giant data centres – they need to have access to reliable and reasonably priced power, particularly for cooling, one of the reasons that we are increasingly seeing Big Technology companies pursuing nuclear energy solutions. Unreliable power = unreliable IaaS/PaaS provision = loss of customer trust. Further, should Microsoft’s security measures not protect their customers from data hacks that either put end users at direct risk or leave them without service, then that could be potentially reputation damaging or even fuel litigious responses.

Current Valuation and Chances of Beating the Market

As we move along to the most important aspect of the article – whether the company can achieve Alpha – let’s look at some of our assumptions.

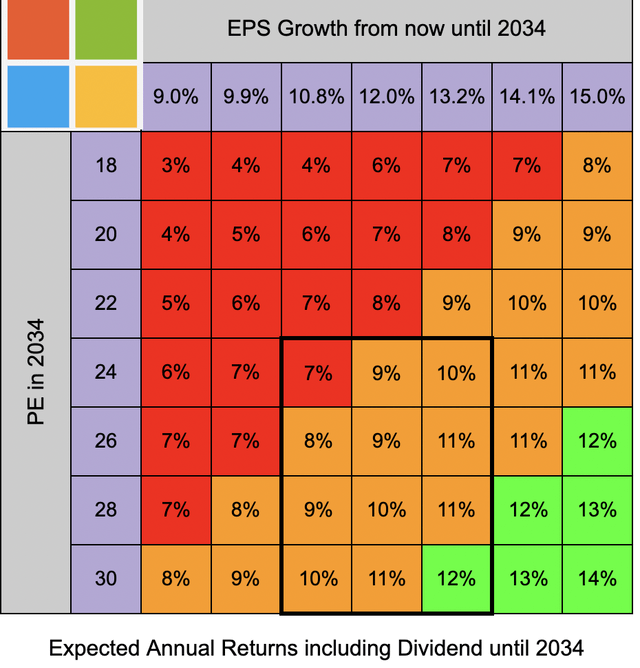

Microsoft has been growing its EPS by 16% per year over the last 10 years, which has actually been accelerating recently. With analysts looking at a growth of around 13-14% in the next few years before tapering off, we will forecast assuming 12% EPS growth over the next decade, which could be conservative considering the nature of the opportunity ahead.

The 20 year average price multiple on those earnings, the PE ratio, has been just shy of 30, and that has increased in the past few years with the excitement over Microsoft’s role in future technologies, including cloud computing as posited in this article. We do not believe that the current PE of around 36 is sustainable and could see the stock trade flat or see a re-rating over the short term. We are assuming that the qualities and competitive advantages of Microsoft as well as its high margin, recurring business model and (once the Activision Blizzard acquisition debt is paid off) incredible balance sheet, will see it always trade with a premium to the market, and could see a PE of anywhere between 24 and 30 out a decade.

We also expect that the company will continue to grow its rather paltry 0.7% dividend over the next decade by the same 10% it has done over the past one. This is included in the returns matrix below.

Just to help with the colour coding: red means that there is an expected annual return less than 8%, orange around a historical market return, i.e. between 8-12%, and green is above that. Note that where 2 numbers are identical and have different colours, it is because the decimals are not shown for sake of readability and thus numbers may have been rounded up or down.

As you can see, we expect a total annual return to be between 7%-12% compounded over the next 10 years. This will probably see it grow in line with or slightly above the market.

Microsoft potential total returns over the next 10 years (Author’s own work)

Final Words

Why a ‘buy rating’ when forecasting Microsoft to return 7-12%? Well, we believe that it is entirely possible that the company can grow its earnings above the 12% used above. We would not be surprised to see Azure gain a larger than 25% market share and be the top provider for cloud services in 2033, further, it may well end up being even more profitable that assumed here. Microsoft’s high quality, wide moat business model is always worth paying a premium for and even at its current valuation, we would be happy to add more. Having said that, we are also rather hoping for a margin of safety from a dip in the price and are crossing our fingers that there will be a disappointing quarter coming in the next few reports that sees this wonderful company re-rated. Should that happen, we’ll fill our boots.

As always, we look forward to constructive comments below the line.

MaM.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of MSFT, GOOG, AMZN either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.