Summary:

- Despite being up 22% YTD, Microsoft’s stock still has a few things going in its favor.

- AI enthusiasm is likely to help further in the short term, although long-term impact is to be assessed.

- This covered call trade adds a nice 2.30% cushion on top of the 10% higher strike price.

jewhyte

Microsoft Corporation (NASDAQ:MSFT) is up nearly 22% YTD and unless the market crashes here on, it is hard to see the stock finishing in red for the 2nd consecutive year, just like I had predicted in this article. Given the recent buzz with Artificial Intelligence (“AI”) and Microsoft’s involvement in this area, I expect the stock to hold its ground fairly well. But stranger things have happened, so never say never. But what about the stock right here, right now?

Investing is a funny game. When your picks do well, you tend to think “How far can they go? Do I need to sell before I lose my gains?”. When your picks go against you, you think “That’s alright, let me average down”. Microsoft stock is firmly in the former category for me and I’d say almost anyone who bought it any time before 2022. But given the company’s footprint in the daily lives of Billions around the world (and part jealousy), I am not satisfied to sell the stock here (or anytime for that matter.) But that does not mean we need to sit around waiting for things to happen. This article suggests a covered call trade at a strike price that is 10% higher than the current market price. Before we get into the trade’s details, let’s go over a couple of reasons why I believe Microsoft’s stock is poised for at least a bit more upside here despite its strong performance YTD already.

Improving Macro And Company Conditions

Macroeconomic conditions are certainly improving with the Job market cooling down and Fed expected to at least slow down the rates if not pause or slash yet. With Macro conditions not as concerning as before, at least on the surface, stronger companies like Microsoft have come back roaring in 2023 with more focus on each company’s fundamentals and execution. For example, while Microsoft’s strong position in being the preferred operating system is almost unchallenged, the company is challenging Alphabet Inc.’s (GOOG) position as the preferred search engine in Apple Inc.’s (AAPL) ecosystem due to its AI infusion. In the long run, AI’s impact remains to be seen and evaluated but it is still causing enough buzz for Microsoft’s stock to benefit in the short-term.

Technically, More Room To Run

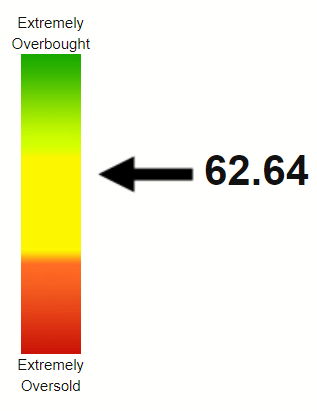

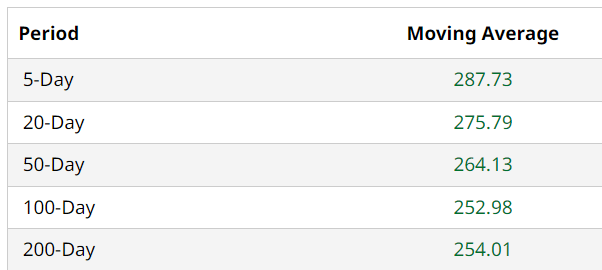

Surprisingly, the stock is not technically overbought here despite an unquestionably strong run. This suggests that the stock still has more room to the upside given the strength shown in the moving averages.

MSFT RSI (Stockrsi.com)

MSFT Moving Avgs (Barchart.com)

What’s The Trade?

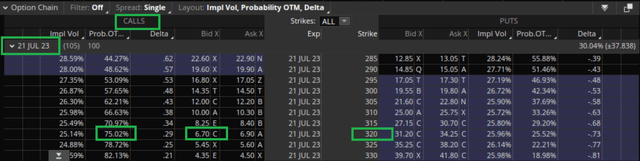

- If you hold at least 100 shares of Microsoft, I suggest selling Covered Calls to enhance your returns. The options chain I am considering is shown and described below.

- The strike price is $320 and the premium paid is $6.70 per share, which means $670 for each contract of 100 shares. The options chain expires July 21st, 2023, which is my sweet spot as it is not too short-term like weekly and monthly and not too long-dated like Leaps.

- If Microsoft stock goes to $320 or above, the covered call seller will be forced to sell their shares at $320, which is 10% higher from the current market price. Add the $670 in premium and you get an overall return of 12.30% if your shares get called away (that is, $320 + $6.70 – $291 = $35.70, divided by $291 = 12.30%. Overall, if the covered call seller does indeed get called away here, it would be at a higher price (very close to all time high of $339) along with a premium for doing so.

- Mr. Market assigns a 75% probability that Microsoft’s stock will be below $320 by the time this chain expires. If that holds true, you won’t be called away but you just enhanced your returns by a solid 2.30%. This is my preferred scenario.

Please note that things tend to get volatile around earnings. Microsoft is definitely going to have at least one earnings report within this time period (April 27th) and may potentially have one more in July (although it is likely to be a little after this chain expires). Also, Covered Calls tend to work better with dividend paying stocks, which Microsoft fits into. But given the dividend of 68 cents, this won’t be a significant factor here.

MSFT Options Chain (Think or Swim)

Conclusion

Given the forward multiple of 31 and an expected earnings growth of 12%/yr for the next five years, Microsoft stock has a Price-Earnings/Growth (“PEG”) multiple in excess of 2.50. That’s too pricey for my taste. If you see Microsoft as a core long-term holding, I rate the stock a “Hold” here and recommend using Covered Calls to enhance your gains. If Microsoft is not a long-term cornerstone in your portfolio, it is not a bad idea to at least trim here. But I recommend having some exposure to this bellwether of a company.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of MSFT, AAPL, GOOG either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.