Summary:

- Microsoft is also participating a bit in the AI hype as the company is backing OpenAI and embedded ChatGPT in Bing.

- Microsoft is still reporting solid growth rates in the third quarter, and not only the cloud business will continue to grow in the years to come.

- It also seems like the acquisition of Activision Blizzard will come to an end after Microsoft won in court against the FTC.

- Despite being optimistic about AI growth potential, Microsoft seems overvalued.

Jeenah Moon

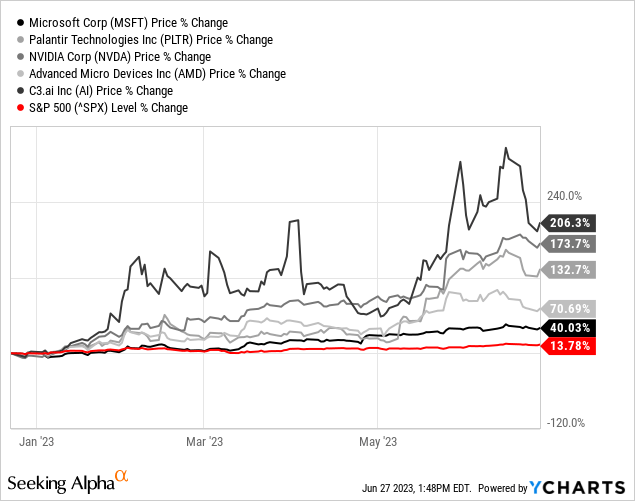

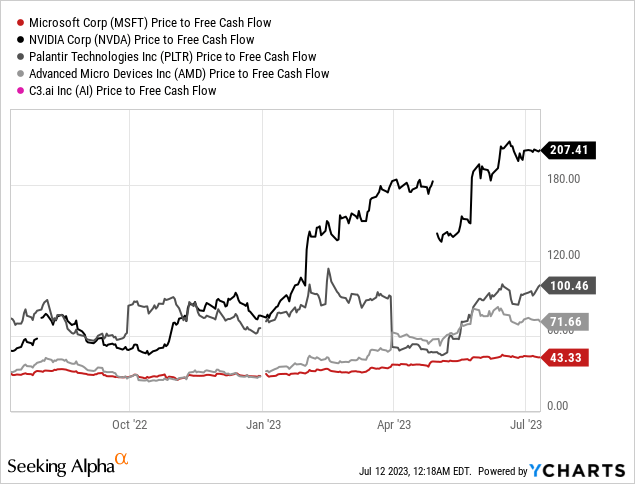

One of the major news stories in the last few months and one of the major buzz words right now is “artificial intelligence” and every company that can somehow be associated with the trend seems to outperform every other asset right now. Prominent examples are NVIDIA Corporation (NVDA) or Palantir Technologies Inc. (PLTR).

And Microsoft Corporation (NASDAQ:MSFT) can also be seen as an AI-driven stock. Especially due to the company’s investment in OpenAI, it seems like Microsoft is closely associated with the buzz words “ChatGPT” and “AI”. In my last article titled “A buying opportunity in the making” I assumed that Microsoft was still a bit overvalued and not a great investment. At this point, Microsoft was trading for $235 and has since then increased more than 40% in value and is trading for $335 right now.

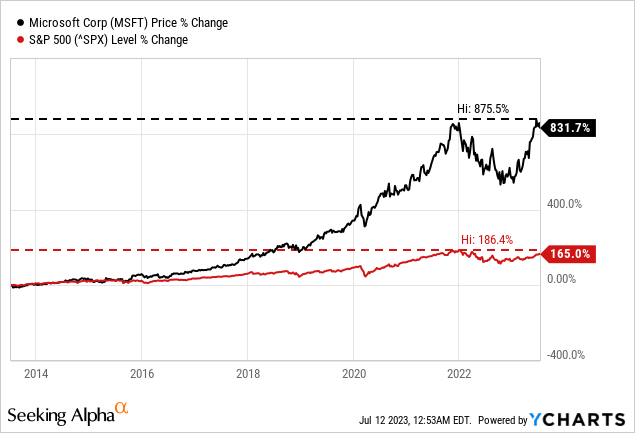

Microsoft clearly outperformed the S&P 500 (SPY) and broader market in the last few months, but when comparing it to stocks like Palantir, NVIDIA, Advanced Micro Devices, Inc. (AMD) or C3.ai, Inc (AI). we hardly can make the argument that Microsoft is hyped. But it also does not seem accurate to call Microsoft a bargain. Let’s take a closer look at Microsoft again and answer the question if Microsoft is a good investment to participate in the potential megatrend “artificial intelligence”.

Bing Not Gaining Market Shares

Year-to-date, Microsoft gained about 40% and while many other stocks – as well as the major indices – gained in value since October 2022, it was shown that AI boom stocks (and companies that profited from the hype around AI) were driving the gains of the S&P 500 in the last few months.

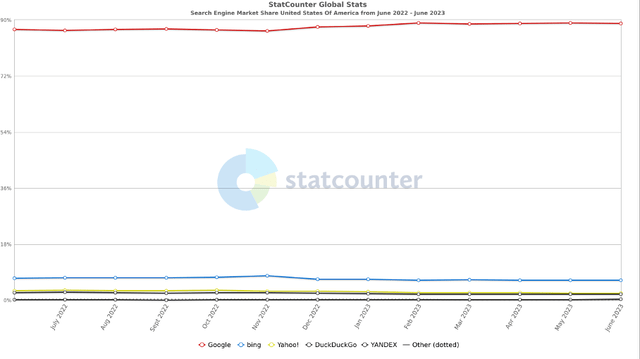

And in case of Microsoft, the hype was especially driven by Bing embedding ChatGPT. In a previous article about Google (GOOG) I already wrote about this as the question if ChatGPT might be able to challenge Google’s moat and if it is a threat to the business was asked a lot. In the article published in February 2023, I wrote:

It seems right now as if the AI war is heating up and competition is increasing. Baidu for example announced it will launch its ChatGPT-like bot called “Ernie” in the coming weeks. And while Alphabet doesn’t have to worry much about Baidu (as the company is only operating in China, a market to which Alphabet has no access to), Microsoft partnering with OpenAI could be the bigger challenge for Alphabet. So far, Google had a market share of 88% in the United States with competitor Bing being only around 7%, but analysts estimate that Microsoft could gain market shares by the move to include ChatGPT in its Bing search. And first numbers are already indicating Bing is gaining traction. On February 9, 2023, the number of App downloads for Bing spiked and the number of daily active users increased from about 370k on February 2, 2023, to 570k on February 9, 2023.

And at the Bank of America Global Technology Conference, management commented on the progress of Bing and ChatGPT:

So — yeah, since the — and it’s only been about four and a half months. But since the launch, we have had a bunch of great progress and milestones on that. First off and just from in terms of usage, Bing has now surpassed 100 million daily active users, which, by all accounts of any kind of product on the Internet is a super impressive number.

In the world of the Internet search. It’s not that much. We are still single-digit — a single-digit player, which means we have a lot of upside. But 100 million daily actives is pretty impressive. We have seen our mobile traffic increase 4x and we have seen a lot of pickup now and usage of it.

And while this statement sounds rather positive, it does not seem like Bing could gain market shares in the United States so far (also not in the mobile market). The market share of Bing remains around 7% in the United States.

Not Just Bing

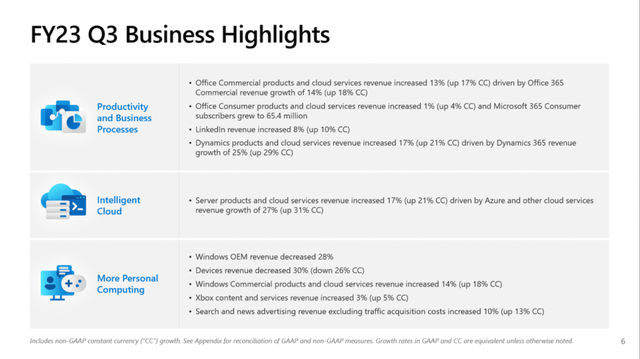

But of course, when talking about artificial intelligence and Microsoft we are not just talking about ChatGPT being embedded in Bing (see here for an “AI overview” of Microsoft). And during the last earnings call, management pointed out that more and more applications become AI-powered:

Now I’ll highlight examples of our progress, starting with infrastructure. Azure took share as customers continue to choose our ubiquitous computing fabric from cloud to edge, especially as every application becomes AI-powered. We have the most powerful AI infrastructure and it’s being used by our partner, OpenAI, as well as NVIDIA and leading AI start-ups like Adept and Inflection to train large models.

Our Azure OpenAI Service brings together advanced models, including ChatGPT and GPT-4 with the enterprise capabilities of Azure. From Coursera and Grammarly to Mercedes-Benz and Shell, we now have more than 2,500 Azure OpenAI Service customers, up 10x quarter-over-quarter. Just last week, Epic Systems shared that it was using Azure OpenAI Service to integrate the next generation of AI with its industry-leading EHR software.

Not Just AI

But it would also be a mistake just to focus on artificial intelligence or assume the financial success of Microsoft is just depending on AI. Microsoft’s core businesses existed before the current AI hype began and Microsoft will make money not only by focusing on AI. For starters, this can be shown by looking at the third quarter results.

Third Quarter Results

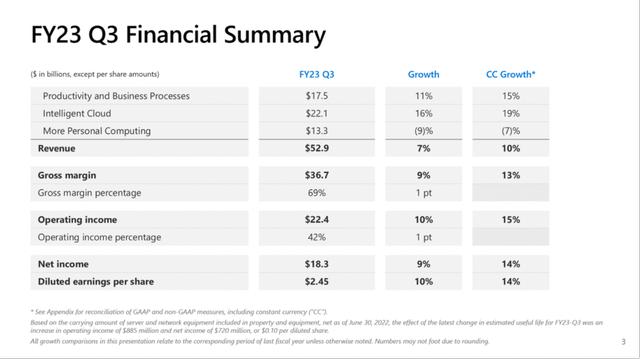

Microsoft is continuing to report great quarterly results. While other companies are already struggling, total revenue for Microsoft increased from $49,360 million in Q3/22 to $52,857 million in Q3/23 – resulting in 7.1% year-over-year growth. In constant currency, revenue increased 10% and although we saw higher growth rates in the last few quarters these are still solid numbers.

Microsoft Q3/23 Investor Presentation

Operating income increased 9.8% year-over-year from $20,364 million in the same quarter last year to $22,352 million this quarter. And diluted earnings per share increased from $2.22 in Q3/22 to $2.45 in Q3/23 – resulting in 10.4% YoY growth. Only free cash flow declined 11.0% from $20,046 million in the same quarter last year to $17,834 million this quarter. This is the result of lower net cash from operations and higher capital expenditures.

When looking at the results in more detail, product sales declined 10.2% year-over-year to $15,588 million while “Service and other” increased 16.5% YoY to $37,269 million. And when looking at the three business segments, “More Personal Computing” reported declining revenues (9.1% YoY decline) while Intelligent Cloud (16.3% YoY growth) as well as Productivity and Business Processes (10.9% YoY growth) reported increasing revenues.

Microsoft Q3/23 Investor Presentation

Future Growth

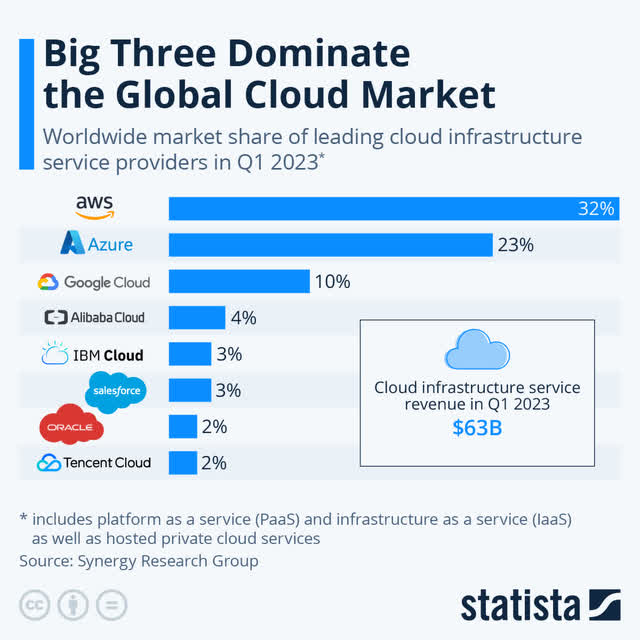

And Microsoft has the potential to keep growing in the coming years – for example by focusing on its cloud business, which was one of the drivers of growth and will most likely continue to do so. Behind competitor Amazon (and AWS), Microsoft Azure is the second biggest player in the global cloud market.

It seems like we are moving into a direction where more and more data is generated by individuals as well as corporations and governments and the data needs to be stored, which is a tailwind for companies like Microsoft as it will fuel the demand for cloud solutions. And according to many different studies and analysis, the cloud market worldwide will grow at a high pace (see here, here, here or here).

But it is not just the cloud business, which will contribute to growth in the years to come. During the Bank of America Global Technology Conference management also mentioned that over 1.4 billion people use Windows monthly (with a huge majority using it daily) and usage is at an all-time high. Aside from more and more people using Windows, LinkedIn is also reporting record numbers. Member growth accelerated for the seventh consecutive quarter and LinkedIn saw a record engagement as more than 930 million members are active on the network. And finally, Teams is also expanding the total addressable market and nearly 60% of enterprise Teams customers buy Teams Phone, Rooms or Premium.

Overall, we can be rather optimistic about Microsoft continuing to perform well in the coming quarters and years in its core business and not being dependent on artificial intelligence to report solid growth rates.

Activision Blizzard

When talking about Microsoft, we also must look at the acquisition of Activision Blizzard (ATVI) as it seems like this saga could finally come to an end. On Tuesday, a federal court ruled in favor of Microsoft in its legal battle with the FTC and is bringing Microsoft one step closer to its $69 billion acquisition of Activision Blizzard. This is not the final “Go” sign for Microsoft, but the court argued that the FTC did not explain sufficiently why the acquisition would be bad for competition. And Microsoft winning against the FTC was followed by signs of a peaceful regulatory resolution in the United Kingdom. And the time is also ticking as both parties can walk away from the deal or renegotiate the $95/share purchase price in a few days from now.

As a result, the Activision Blizzard stock jumped to $91 and is now close to the takeover offer. And it seems like Microsoft will try to close the deal quickly after the intent to acquire Activision Blizzard was made public about 1.5 years ago – in January 2022.

Intrinsic Value Calculation

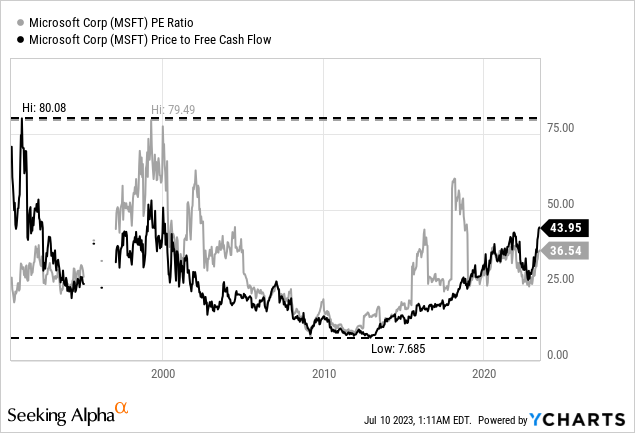

When asking the question if Microsoft is overvalued or hyped, we must look at the intrinsic value or valuation multiples. In theory, we can look at Microsoft from different perspectives. When comparing Microsoft to companies like NVIDIA, Palantir or AMD, the valuation multiples of Microsoft seem reasonable. For example, NVIDIA is trading for 207 times free cash flow and Palantir is trading for 100 times free cash flow, while Microsoft is trading only for 43 times free cash flow.

However, just looking at extremely overvalued stocks and therefore assuming Microsoft is a great investment is not enough and an investment approach that is a bit dangerous. We can also look at the long-term picture of Microsoft and the valuation multiples over time. And especially when looking at the price-free-cash-flow ratio, we see Microsoft trading for the highest P/FCF ratio since the Dotcom bubble about 20 years ago. One can always make the argument that this time it is different and artificial intelligence will lead to unprecedented growth rates and the opportunity of a lifetime. Or we can remember that the same arguments were made during the Dotcom bubble and the result was Microsoft taking more than a decade before reaching its peak stock prices of the Dotcom bubble again.

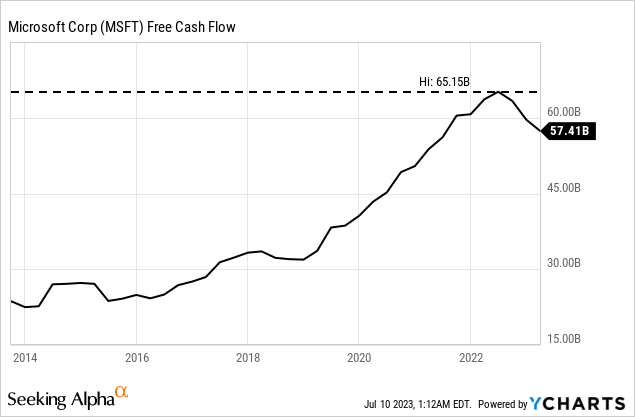

So, let’s take a neutral look at Microsoft to calculate an intrinsic value by using a discount cash flow analysis and determine if the stock is a good investment. As basis for our calculation, we can take the free cash flow of the last four quarters (which was $57,406 million). This number is already lower than in previous quarters. As always, we assume a discount rate of 10% and calculate with 7,464 million diluted outstanding shares.

To be fairly valued, Microsoft has to grow 14% in the next ten years followed by 6% growth till perpetuity. And Microsoft can clearly grow with a high rate but assuming 14% growth for the next 10 years is quite optimistic. Right now, everybody seems to be bullish and is expecting extremely high growth rates due to AI, but we should be cautious and not be overly optimistic.

In the last ten years, Microsoft could grow earnings per share with a CAGR of 17% and from that point of view, 14% growth seems possible. However, we should not ignore that growth rates were extremely high in the last few years, and we don’t know if Microsoft can grow at similar rates in the next ten years.

Selling Shovels

In this article I compared Microsoft and NVIDIA several times. And while both companies can somehow be associated with AI, there are some huge differences. First, the hype surrounding chip makers like NVIDIA is much more extreme – and this is leading to much higher valuation multiples (as I have already written above). And while a first impulse is to see NVIDIA much more overvalued than Microsoft, NVIDIA might also profit more from the hype. There is an old saying that during a gold rush, one should sell shovels. And NVIDIA is selling the shovels so to speak. We don’t know if applications like ChatGPT will be used in a few years from now and we don’t know if Zuckerberg’s vision of the Metaverse will become reality and we don’t know what jobs could be automated by using artificial intelligence – but we know that companies will have to buy the necessary hardware to move into that direction. And NVIDIA is selling the hardware.

But in some ways, Microsoft is also selling shovels as it is providing the server capacity to store huge amounts of data. Analysts are also optimistic that Microsoft is a company in the pole position in the generative AI race and several analysts are optimistic Microsoft can reach a $3 trillion valuation in the coming quarters. Another argument often made is that the cloud business will continue to grow and contribute to Microsoft’s success.

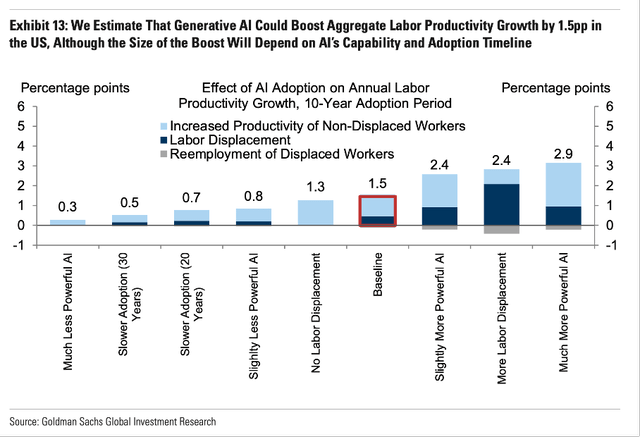

And Goldman Sachs for example is cautiously optimistic that AI will contribute to GDP growth and increase productivity in the years to come.

Conclusion

Despite all optimism about artificial intelligence, that might be justified, Microsoft is overvalued in my opinion and not a good investment at this point (neither is NVIDIA by the way). But I certainly would not short the stock as Microsoft is a high-quality business and it is dangerous shorting such companies. If you are a shareholder, you could consider trimming the position a little bit – but at this point I would hold.

And when looking at the performance in the last ten years, Microsoft clearly outperformed the S&P 500. Part of that outperformance is due to the strong growth of the fundamental business, but a huge part is also stemming from the expansion of valuation multiples and goes hand-in-hand with the risk of a contraction of valuation multiples that poses a huge downside risk for the stock.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.