Summary:

- Microsoft’s Q4 fiscal results slightly exceeded estimates with a revenue of $56.2 billion, but guidance missed expectations, causing concern among investors.

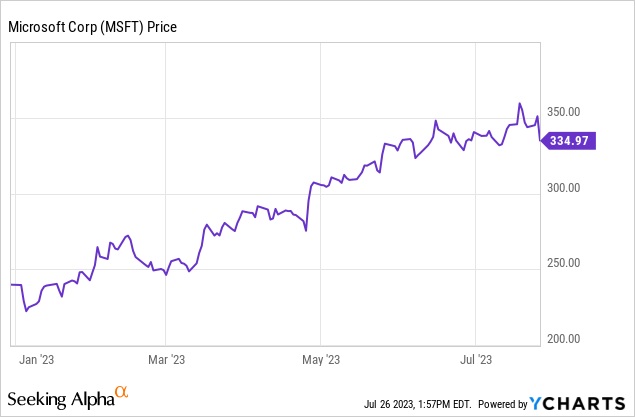

- Despite a 10% growth in revenue, the company’s stock experienced a 5% decline after the earnings release, possibly due to high expectations surrounding its AI initiatives.

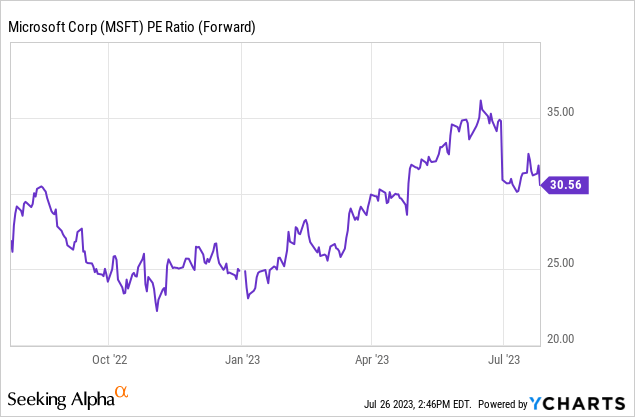

- The company’s current high P/E multiples may not be sustainable, suggesting investors should approach with caution.

stockcam/iStock Unreleased via Getty Images

In a market characterized by high expectations on AI and surging prices, Microsoft Corporation (NASDAQ:MSFT) recently reported its quarterly results, slightly surpassing the estimates for the fiscal Q4 with a revenue of $56.2 billion compared to the expected $55.5 billion.

Microsoft demonstrated an impressive 10% growth in constant currency during the last quarter, showcasing its ability to navigate challenging economic conditions. Additionally, the EPS figure of $2.69, surpassing the projected $2.55, shows the company’s earnings power and shareholder value generation.

However, it is worth noting that Microsoft missed the expectations about revenue guidance, a crucial metric for evaluating a company’s strategic planning and growth projections. In the context of MSFT, a firm with high stakes and heightened expectations surrounding its AI initiatives, this deviation from guidance may have been a cause for concern among investors.

Despite the good performance, the market’s response was not without reservation. Following the earnings release, the stock experienced a modest decline of around 5%. This comes after a prolonged period of significant growth throughout the year. This decline could be seen as a natural corrective phase after a robust uptrend, with some investors taking profits or reassessing their positions.

MSFT is currently priced at a Forward P/E ratio exceeding 30 for the upcoming fiscal year. This might have raised concerns among investors, as future estimates may face downward revisions following the latest guidance provided by the company.

The Challenge in the Cloud Sector

While the Cloud sector is thriving, market expectations were exceptionally high for Microsoft’s Azure service, particularly due to the buzz around generative AI and the company’s reputed position. That might have been one of the main issues in MSFT’s earnings: meeting the estimates at a growth of 27% in constant currency proved insufficient to satisfy the market, evident from the negative reaction upon results publication. When a stock trade at such a multiple, it might not be enough to meet estimates, because so much growth is priced in.

AI Enthusiasm

The release of the outlook for the first quarter of next fiscal year further worsened Microsoft’s position as excessive enthusiasm surrounding unrealistic AI expectations disappointed investors. Analysts’ estimates of revenue guidance were unmet. And probably the multiples reflected even higher market expectations.

MSFT has an enviable balance sheet, sustained growth, and healthy cash flow, but these attributes are now considered the bare minimum for companies at such high P/E multiples. The guidance, however, had a negative impact on the market, as overly high expectations often lead to disappointments. Conversely, the case of Alphabet (GOOG, GOOGL) demonstrates how more realistic expectations contributed to healthier price growth throughout the year, without reaching excessively high valuation multiples.

Shareholder remuneration has been modest compared to the market cap of the company, amounting to around $10 billion through share buybacks and dividends. Nevertheless, if we annualize and compare the number to market capitalization, a 1.5% yield might not be enough to sustain the stock price in case of future negative news.

A Comparison Between Microsoft and Google Stocks

A parallelism between MSFT and GOOG might be interesting. In a recent article, we wrote about Alphabet’s earnings. Taken alone, the earnings are not more impressive than Microsoft’s numbers. However the issue is about other important figures: multiples and market expectations. As we said, guidance provided by Microsoft has disappointed the market, reinforcing the recurring issue of overinflated expectations. Investing in such a scenario requires caution.

While Microsoft holds a leadership position in the development of AI tools, this necessitates substantial future investments as was mentioned in the call:

So you’re seeing the CapEx spend accelerate in Q4 and then again in Q1, and we’ve talked about what it should look like the rest of the year.

The same management speaks about how difficult it might be to sustain high growth for an already giant business:

But at the same time, we are a $111 billion commercial cloud that has grown in 20s, and so therefore, we do hit law of large numbers.

Being an already colossal company, Microsoft may struggle to sustain growth rates that justify the current multiples.

Current multiples appear to be too high for MSFT, at 30x P/E Forward, especially when compared to Google’s more moderate valuations at just over 22 times estimated earnings for the next four quarters.

Conclusion

Microsoft remains a formidable company, and its market position should not be underestimated. However, investors should carefully consider current prices and the frequently overly high expectations that often lead to disillusionment. For those interested in tech investments, Alphabet might be a more attractive option. While for general market exposure, despite its high cost, the purchase of the S&P 500 (SP500) could be a more reasonable choice. Although Microsoft could continue to be a prominent player, the current elevated prices suggest the need for a prudent evaluation.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of GOOG either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

The information in the article is provided for informational purposes only. It should not be construed as investment advice or advice on buying, selling, or other types of transactions relating to an investment in products or services, much less an invitation, an offer or a solicitation to invest. The information in the article is provided solely by virtue of the fact that everyone will independently make their own investment decisions: the report does not take into account investment objectives, nor specific needs or financial situation. In addition, nothing in the article represents or is intended to express financial, legal, accounting or tax advice.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.