Summary:

- Microsoft’s Q2 FY24 revenue surged 18% to $62 billion, driven by growth in all major segments.

- The company’s cloud business, including Azure services, is steadily closing the gap on market leader Amazon’s AWS.

- MSFT’s current valuation seems stretched compared to some AI-fueled peers, limiting potential upside for investors.

- I recommend investors look elsewhere for better risk-reward opportunities with either lower valuation or higher EPS growth.

David Becker

It’s been four months since I wrote an article about whether Microsoft Corporation (NASDAQ:MSFT) was the “best AI stock, at the right price?” While the stock jumped 23% since then, beating the market but trailing some AI darlings, I still believe it remains a top choice in the AI arena.

Price Development (Seeking Alpha)

Microsoft CEO Satya Nadella’s recent statement further strengthens this perspective. He boldly claimed AI could add a whopping 10% to global GDP, translating to a potential $7-10 trillion boost. This immense potential underscores the significance of AI.

However, what truly sets Microsoft apart is its unparalleled reach. Its Microsoft 365 suite boasts a staggering 345 million users, nearly 5% of the world. This opens a game-changing opportunity: seamlessly infusing AI into these existing applications for businesses. This wouldn’t simply attract new users; it would propel companies into an era of higher productivity, revolutionizing workflows in ways never before possible.

While Microsoft’s business performance has been stellar, and it’s viewed as a top AI play by many, the question remains: is the stock still a buy at today’s price, or has the valuation gotten ahead of itself?

Let’s take a look.

Business Update

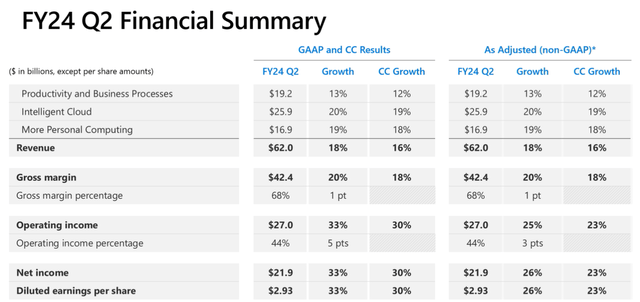

Microsoft kicked off 2024 with a strong Q2 FY24, exceeding expectations with revenue surging 18% to $62.0 billion. This growth was fueled by impressive performance across all major segments:

- Productivity and Business Processes: Revenue climbed 13% to $19.2 billion, driven by a 17% increase in Office 365 subscriptions and continued momentum from LinkedIn, up 9%.

- Intelligent Cloud: Revenue soared 20% to $25.9 billion, largely thanks to a 30% jump in Azure and other cloud services.

- More Personal Computing: Revenue grew 19% to $16.9 billion, with Windows revenue increasing 9%. While device sales dipped 9%, Xbox content and services surged a remarkable 61%.

Additionally, Microsoft’s recent acquisition of Activision Blizzard is expected to contribute significantly to the More Personal Computing segment in the future, unlocking potential for further growth and efficiency gains.

These stellar results translated into a 33% YoY increase in operating income of $27.0 billion and net income of $21.9 billion, leading to EPS of $2.93.

Q2 Financial Summary (MSFT IR)

Microsoft shareholders had plenty to celebrate in Q2 FY24, with the company returning a hefty $8.4 billion through share repurchases and dividends.

But the real star of the show was the Microsoft Cloud, which soared past $33 billion in revenue, fueled by an impressive 24% growth rate. Microsoft has moved beyond simply talking about AI and is now making significant strides in applying it at scale, seamlessly integrating it across its entire technology stack. This approach is not only attracting new customers but also driving significant productivity gains across various industries.

The company’s commitment to AI is further evidenced by its explosive growth in Azure AI customers. They now boast 53,000 users, with over a third joining in the past year alone.

Additionally, Microsoft is making it easier for developers to leverage the power of AI by offering access to cutting-edge Large Language Models (LLMs) from companies like Cohere and Meta (META), eliminating the need for them to manage complex infrastructure.

Further solidifying their leadership in the AI space, Microsoft has bolstered their partnership with OpenAI. Support for the latest OpenAI models, including GPT-4 Turbo and DALL-E 3, has been warmly received by both AI-first startups like Moveworks and Perplexity and established giants like Ally Financial (ALLY) and Coca-Cola (KO). In fact, over half of the Fortune 500 companies now rely on Azure OpenAI solutions.

The future looks bright for Microsoft, with larger and more strategic Azure deals becoming the norm. Vodafone’s (VOD) recent $1.5 billion commitment over 10 years serves as a prime example of the transformative power of Microsoft’s cloud and AI offerings.

At Ignite Conference, back in November, Microsoft showcased fresh AI tools for businesses and unveiled Azure Maia, their custom AI chip. This strategic move aims to lessen reliance on Nvidia (NVDA) while carving its own path in the competitive AI landscape.

Microsoft’s cloud ambitions are heating up as they close the gap on market leader Amazon’s AWS (AMZN).

In Q4 CY23, AWS held 31% of the market share, but Microsoft surged to 25%, narrowing the lead significantly. Google Cloud (GOOGL) remains a distant third at 10%.

This growth coincides with a booming cloud infrastructure market, which surged 16% YoY to $73.5 billion, highlighting the massive potential in this space.

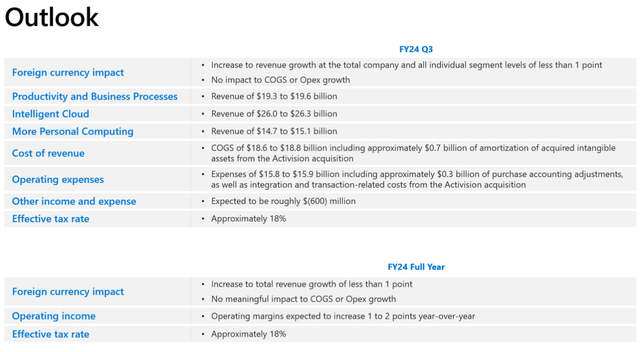

Microsoft is now expecting, for Q3 FY24, revenue of $61 billion at the upper end of their guidance. This translates to a healthy 15% growth compared to the same quarter last year, showcasing the company’s strong momentum.

Operating margins are expected to increase by 1-2%, demonstrating continued efficiency improvements.

The quarter also sees EPS expected to reach $2.82, representing a 15% YoY increase.

Valuation Is The Risk

The primary risk I see for Microsoft today is its valuation, which has become stretched amid the AI frenzy.

While the company boasts superior earnings quality and stability compared to many other mega-cap stocks, its expected EPS growth doesn’t fully justify the current valuation, unlike some other companies riding the AI wave:

- Nvidia: Blended P/E of 58.67x, FY25 EPS growth of 67%

- Meta: Blended P/E of 30.53x, FY24 EPS growth of 34%

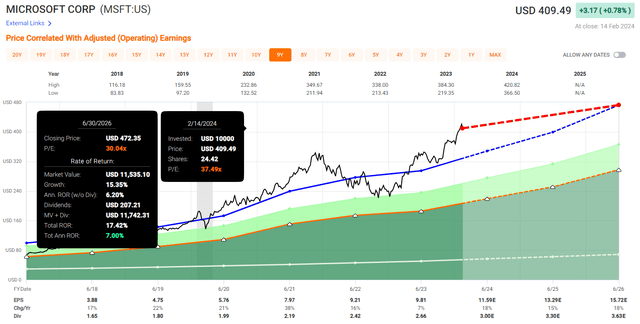

Microsoft’s stock trades at a blended P/E of 37.49x. While I acknowledge the quality and stability of its earnings, the forward growth needs to justify the premium valuation, something it falls short of in my view:

- FY24 EPS: $11.59E, YoY growth: 18%

- FY25 EPS: $13.29E, YoY growth: 15%

- FY26 EPS: $15.72E, YoY growth: 18%

This translates to a PEG ratio of 2.08 for FY24, which is significantly higher than the sub-1.00 PEG ratios of the mentioned AI-fueled companies.

Looking at forward valuations, the picture remains similar:

- FY24 Forward P/E: 35.33x

- FY25 Forward P/E: 30.81x

- FY26 Forward P/E: 26.04x

Historically, Microsoft traded at an average P/E of 21.01x since 2003, with an average annual EPS growth of 12.5%. While the current growth acceleration and industry tailwinds are positive, the valuation seems detached from this historical context.

Therefore, I don’t foresee a significant mid-term upside.

Considering the projected 16.5% EPS growth over the next three years, a more reasonable valuation would be around 30x earnings.

If the stock would trade at this more reasonable valuation by the end of FY26, this would imply a potential total return of roughly 7%. Given the risk, lack of margin of safety, and better opportunities in the market, the return doesn’t justify accumulating shares at the current price.

Takeaway

Microsoft kicked off 2024 with a strong Q2 FY24, exceeding expectations with revenue surging 18% to $62 billion.

All major segments contributed to the growth, with Productivity and Business Processes fueled by Office 365 growth and LinkedIn momentum, Intelligent Cloud showcasing a 30% jump in Azure services, and More Personal Computing driven by strong Xbox content and services performance. The recent Activision Blizzard acquisition promises further potential in the future.

This stellar performance translated into a 33% YoY increase in operating income and net income, ultimately leading to impressive EPS of $2.93. Meanwhile, Microsoft continues to be a major player in the cloud wars, steadily closing the gap on market leader Amazon’s AWS.

While Microsoft boasts superior earnings quality and stability, its current valuation seems stretched compared to some AI-fueled peers like Nvidia and Meta, which offer higher projected EPS growth.

Considering the valuation and limited potential upside compared to other opportunities in the market, accumulating shares at the current price might not be the most attractive option for investors seeking better risk-reward profiles.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of MSFT either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.