Summary:

- Microsoft is significantly overvalued relative to the S&P 500, with an expected long-term annual return ranging from 7.92% to 11.82%.

- The P/S ratio is a better valuation metric than earnings, and comparative valuation shows Microsoft usually carries a premium.

- Despite potential growth from AI and other technologies, Microsoft’s shares are overvalued, making it a poor long-term investment choice.

jejim

MSFT is not Trading at a Fair Price

The litigation involving Microsoft’s (NASDAQ:MSFT) desired acquisition of Activision Blizzard has provided us with new information that helps us better understand Microsoft’s intrinsic value and potential long term growth rate. Charlie Munger said, “A great business at a fair price is superior to a fair business at a great price.” I define a “fair price” as 95% of the expected return for the stock’s benchmark, in this case the S&P 500. The expected 10-year return for the S&P 500 is 12.5% so a fair price for MSFT would result in an expected return of 11.88%.

Based on the new information brought to light, and the most reliable valuation methods, I believe Microsoft is a great company at an unfair price.

Earnings are a Poor Measure of Valuation

The current litigation involving Microsoft’s attempted acquisition of Activision Blizzard (ATVI) has brought to light that MSFT hopes to increase total annual revenue to $500 billion per year by FY 2030.

Professor Aswath Damodaran is considered an authority on valuation and states that the correlation between earnings and stock prices is weak. He also states that sales have a much higher correlation with share prices than earnings. For this reason, I use the P/S ratio to approximate a fair value for MSFT.

Over the past 3 years Microsoft’s P/S ratio has ranged from as high as 13.68 to as low as 8.57. According to Seeking Alpha the 5 year average is 9.47.

When looking at the entire history of Microsoft it does not have a long history of keeping its P/S ratio above 10. Many market participants believe this time is different because Microsoft, like other mega cap stocks, has established such massive moats that they deserve a massive premium over the rest of the market.

If we accept the “new normal” argument then with a 9.45 p/s ratio and $500 billion in sales MSFT should have a market cap of ~$4.75 trillion. At current prices this would translate to annual gains of 7.95%. At a higher P/S ratio of 11.25 the annual return increases to 10.30%. For perspective the current 10 yr average for the S&P 500 is ~12.5%. This leads me to believe MSFT is overvalued.

The AI Revolution – Internet Adoption as a Guide

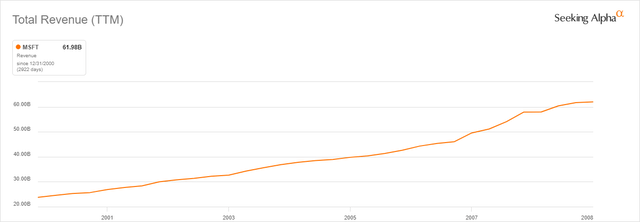

If we use the internet’s adoption as a guide for what MSFT’s future revenues can be we would arrive at a revenue growth rate of 12.72%. The chart below shows from 2001 to 2008 MSFT revenue grew from $23.78 billion to $61.96 billion.

Let’s assume MSFT benefits from AI adoption like it benefited from the internet adoption. We assume the following; Revenue of ~$214 billion for FY 23 with a 12.72% CAGR over 8 years, MSFT revenue in 2030 would be $557.73 billion. For shareholders, this translates to a 2030 share price of $843.85, with a P/S ratio of 11.25. This equates to an annualized rate of return for present buyers of 11.82%, which is below the expected market return of 12.5%

The future of AI is likely not priced in, but still does not make MSFT fairly valued.

Comparative Valuation is Bad News for MSFT

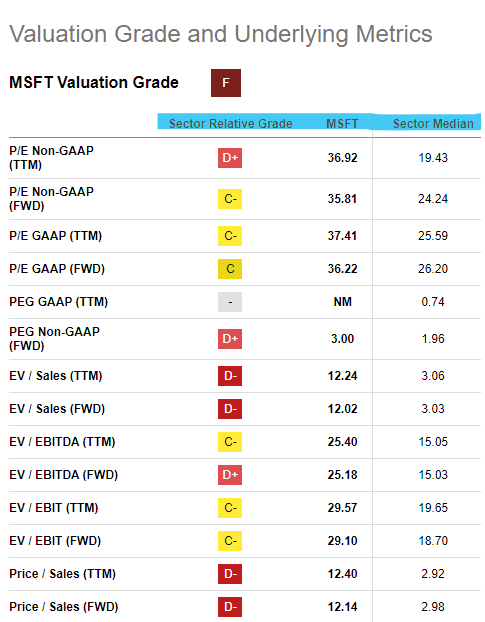

Comparative valuation is when you compare one company’s valuation to the average of a group of companies. The “fatal flaw” with this method of valuation noted by professor Damodaran, is you assume that the company is the “average” of the selected group. This is usually a mistake because people compare valuations based on the sector average or industry average. This is something seeking alpha takes into consideration on their valuation ratings, as seen below.

Valuation Grade (Seeking Alpha)

As you can see, MSFT is being valued as the “average” company in the information technology sector. I don’t think anyone reading this will argue that MSFT is an average company. The broad consensus, including my opinion, is MSFT is one of the best companies and should command a premium in terms of valuation relative to its sector.

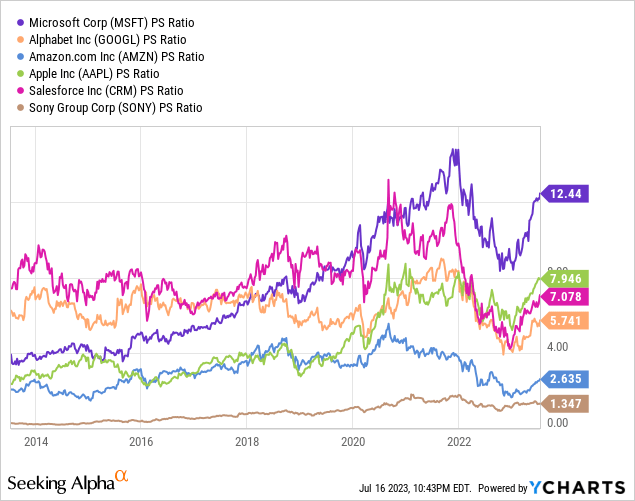

Now a better comparative valuation is to compare MSFT to its peers such as Apple (AAPL), where it competes on windows products vs iOS products. Amazon (AMZN), who Microsoft competes against in cloud computing. Salesforce (CRM), who competes with Microsoft in the CRM space. Sony (SONY), who competes with them in the video game space, and Alphabet (GOOGL), where they compete on search engines. These companies rival Microsoft and should have similar valuations..

Below is a comparative P/S valuation for the last 10 years.

Over the last 10 years Apple and Amazon have never had a higher P/S ratio than MSFT. Alphabet and Salesforce consistently had a greater valuation prior to 2018 and 2019 respectively. Since then MSFT has consistently had the highest valuation of the group.

The P/S ratio for MSFT did not dip below 8.0 during the 2020 or 2022 crash, suggesting the fair range for MSFT is above 8.0 and below 12.0..

Based on the comparative valuation method, I believe a fair value for MSFT is a P/S of 10.0

With a P/S of 10.0 and an estimated $557 billion in sales in 2030, that would equate to a return of 10.19% at current prices. With a market average rate of return of ~12.5%, I consider this overvalued price. The share price would have to decline to ~$305.50 to offer a long term return of 11.88% which is 95% of benchmark’s expected return.

Risks

Microsoft’s long history shows it is very rare for the company to have a P/S of 10 or higher. A quick look shows that Microsoft’s P/S ratio is well above their rivals. It is possible Microsoft returns to its historic P/S range of 3 to 7. This is a long-term forecast, and it is possible that advances in AI and other technologies allow Microsoft to grow sales far beyond the current $500 billion target. Investors will have to keep a close eye on MSFT and competitors.

I will take this opportunity to note I have intentionally refused to mention stock buybacks. There are 2 reasons for this decision; #1 the new excise tax of 1% on share buybacks will probably change the size of share buybacks in the future. This creates uncertainty that is difficult to forecast. #2 Excluding all share buybacks in the future skews my valuation towards the conservative side of things. This makes it easier for companies to outperform my valuation.

Conclusion

Based on all known factors and the most reliable methods of valuation, the expected long-term annual return on an investment in MSFT ranges from 7.92% to 11.82%. As the quote at the top of the article says, a great business at a fair price is a good buy and MSFT at current prices is not fairly priced. I rate the stock a sell, because I believe this is a great opportunity to sell shares in order to realize gains and rebalance your portfolio. I do have a long position in MSFT because of an ETF I own.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of MSFT either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.