Summary:

- Microsoft’s stock rose 4% after surpassing earnings expectations in 1Q FY2024, driven by strong growth in cloud revenue, particularly Azure.

- The company achieved significant double-digit revenue and earnings growth and its highest-ever non-GAAP operating margin.

- Microsoft’s AI initiatives, including the M365 Copilot, provide a strong catalyst for future growth, even though the company’s outlook for FY2024 remains conservative.

- I’m bullish on the stock as the current 34x P/E GAAP TTM can be supported by the recent AI developments in my view.

da-kuk

What Happened

Microsoft’s (NASDAQ:MSFT) stock popped 4% in aftermarket, driven by 1Q FY2024 earnings that surpassed expectations. Despite the seemingly modest 4% rally, I want to point out that reactions to companies exceeding estimates have generally been muted in this earnings season. This can be attributed to high earnings estimates and valuations against the backdrop of elevated long-end interest rates over the past months. According to a Bloomberg article, the median level of outperformance of beats in the current earnings season lagged behind the benchmark index by 0.6%.

I believe that MSFT’s post-earnings rally can be attributed to the robust growth in cloud revenue, particularly Azure. In my previous article, I’ve discussed why MSFT’s Azure has been gaining market share from Google Cloud and AWS. I’m impressed by the company’s initiative to increase AI spending while maintaining its operational efficiency. This is why I reiterated my buy rating on the stock, as I’m confident that MSFT’s AI monetization roadmap will continue to unfold in the coming years.

1Q24 Earnings Takeaway

MSFT beat on both top and bottom lines in 1Q FY2024. Revenue demonstrated a significant double-digit growth of 13% YoY, marking the first time since 1Q FY2023. This growth also represents an acceleration from the 10.6% YoY growth in 1Q FY2023.

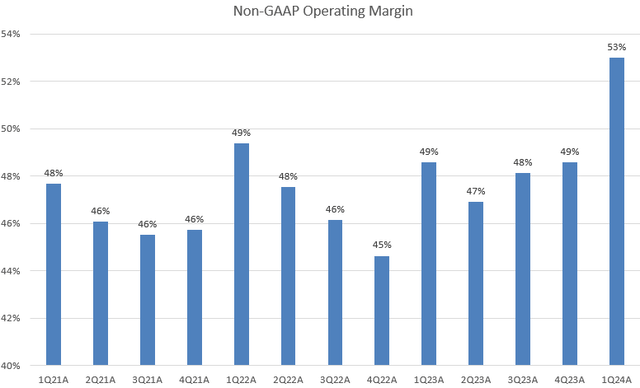

Moreover, its non-GAAP operating margin (excluding SBC and amortization) came in at 53%. As shown in the chart, this is the highest record in the company’s history. The company has demonstrated an impressive operating efficiency despite the company’s record high capex of $11.2 billion in the last quarter.

I think that the margin expansion played a crucial role in driving the company’s GAAP EPS to $2.99 per share, marking an impressive 27.2% YoY increase. This growth exceeded the consensus by 12.8%. It’s worth highlighting that the momentum of GAAP EPS growth continues to accelerate, increasing from 20.6% YoY in 4Q FY2023.

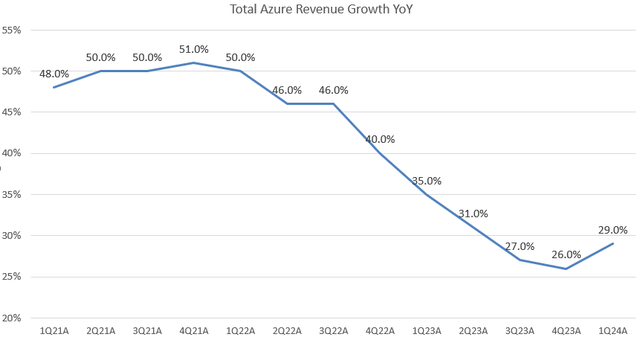

The significant growth was largely powered by MSFT’s Intelligent Cloud segment, with a large contribution from Azure revenue, which grew by an impressive 29% YoY. As we saw in the chart, Azure revenue showed a rebound in growth for the first time since 4Q FY2021. During the earnings call, the management explained that the increased consumption of AI played a significant role in driving Azure’s growth.

Furthermore, CFO Amy Hood added that the company’s cloud gross margin exceeded expectations as well, driven by the performance of Azure and Office 365. This indicates MSFT’s potential to further expand its market share in the cloud vendor market. As Azure remains a growth engine for MSFT, I’m expecting a further acceleration in Azure revenue in the near term.

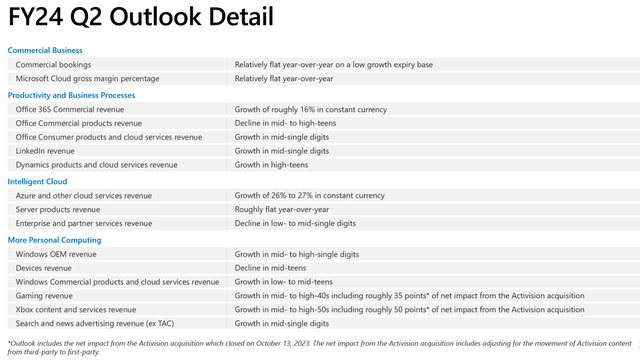

However, MSFT has issued a muted growth outlook for FY2024. Notably, despite the better-than-expected growth in Azure revenue in 1Q FY2024, the company maintains a 26%-27% YoY growth in constant currency for 2Q FY2024. This reflects a slight slowdown when compared to the 28% YoY constant currency growth in the previous quarter, a point also raised by an analyst during the earnings call.

Additionally, while the management mentioned that the acquisition of Activision would impact its operating margins and forecasted flat YoY growth for FY2024, it’s possible that this guidance reflects a conservative approach due to potential economic uncertainties in the coming quarters. Nevertheless, I maintain an optimistic outlook on MSFT’s long-term growth prospects due to their increasing investments in AI and monetization efforts.

M365 Copilot is a Growth Catalyst

One of MSFT’s featured AI products is M365 Copilot, which is integrated into Office 365 applications. M365 Copilot leverages large language models from OpenAI and combines them with business data from Microsoft Graph to generate rich, editable content in response to user text prompts. The CEO Satya Nadella described it as follows:

“Now on to the future of work. Copilot is your everyday AI assistant, helping you be more creative in Word, more analytical in Excel, more expressive in PowerPoint, more productive in Outlook, and more collaborative in Teams. More than 73% of the Fortune 1000 use three or more of our data solutions today. We have over 1 million paid Copilot users and more than 37,000 organizations have subscribed to Copilot for business, up 40% quarter-over-quarter with significant traction outside the United States”.

MSFT has recently introduced the most extensive update to Windows 11, incorporating 150 new features, including new AI-powered experiences within applications. This serves as another catalyst for cloud revenue growth in the near term. I believe that MSFT’s journey into AI monetization is only just beginning.

Valuation

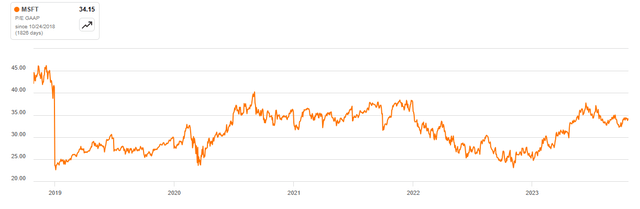

In terms of valuation, MSFT is currently trading at a P/E GAAP TTM of 34x, which is slightly above its 5-year average. However, I believe that the stock’s valuation is not excessively stretched when compared to the 30x P/E of the Nasdaq 100 index.

Furthermore, it’s important to consider that the company’s AI roadmap has the potential to structurally sustain its valuation at a higher level than it was five years ago. This is because these new AI products are expected to drive long-term growth acceleration for the company. As evidenced in 1Q FY2024, MSFT achieved a strong quarter of growth with a record high operating margin, particularly driven by its AI initiatives. Therefore, I hold the view that the stock’s current valuation can remain resilient even in a high-interest-rate environment.

Conclusion

MSFT delivered strong earnings results in 1Q FY2024, driven by remarkable growth in its Intelligent Cloud segment, particularly Azure. The introduction of AI products, like M365 Copilot, creates a significant growth catalyst for the company. However, the company did not raise the outlook for FY2024, possibly impacted by economic uncertainty and the Activision acquisition’s margin impact. Nevertheless, I believe its valuation remains reasonable compared to the broader market. Therefore, I remain bullish on the stock as MSFT’s AI initiatives look promising, and the company’s potential for sustained growth is reflected in its higher valuation.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of MSFT either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.