Summary:

- While Microsoft’s FY1Q25 revenue beat may sound positive, most of that beat came from the More Personal Computing segment, with Azure only coming in in-line with expectations.

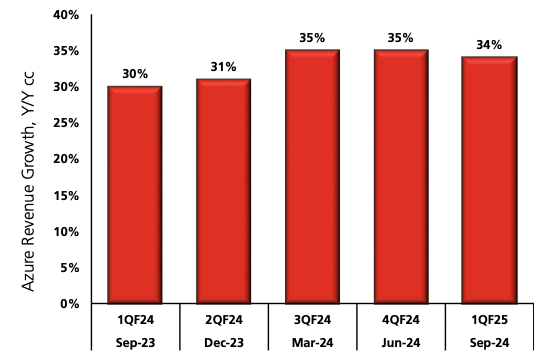

- Azure’s 34% growth in FY1Q25 is in-line with expectations, but management guided to Azure growth of 31% to 32% next quarter, missing expectations by 1 percentage point.

- The key reason for the miss was due to third-party infrastructure providers that are delaying the bringing online of data center capacity.

- In turn, because the AI services portion of Azure is largely supply constrained, I expect that in the second half of FY2025, with easing of supply constraints, Microsoft should see an reacceleration in growth due to Azure.

Morsa Images

Microsoft (NASDAQ:MSFT) posted a rare disappointing quarter, which resulted in share price weakness post earnings.

While revenue in the current FY1Q25 quarter was above guidance, most of the beat came from the less strategic More Personal Computing segment, while Azure’s 34% growth was largely in-line with expectations this quarter.

That said, the guidance for Azure of between 31% to 32% fell short of expectations by 1 percentage point.

This was largely due to the pushout of data center capacity from third-party providers, which I will explain in greater detail later, while the consumption trends for Azure was stable.

A stable Azure consumption trend may not be what investors were looking for as well, as the market was expecting an uplift in IT spending in the second half of the calendar year.

As such, it is clear to me that Azure remains supply constrained, and that if these capacity ramps expected in the third and fourth quarters of FY2025 comes in, growth in Azure will accelerate alongside this.

Another positive from the quarter was the strength in the margin control as operating margins beat the high end of its guidance by 130 basis points despite pressures on gross margin due to the scaling of AI infrastructure

In my opinion, this will be key to restoring investor confidence as investors are growing increasingly cautious about Microsoft’s guidance outlook given multiple mentions of supply pushouts, which I will explain more below.

All in all, I think this creates a rare buying opportunity for a very high quality big tech company, as I will elaborate in greater detail in the article. I have written about Microsoft on Seeking Alpha, and in my previous article, where I made the case that Microsoft was investing into the AI opportunity and whether this investment is yielding a sufficient enough return on investment. In this article, I argue that the fact that we are seeing such a strong demand from Microsoft Azure AI services such that supply is unable to catch up does suggest that there are increasingly more evidences that the investments into scaling up AI infrastructure is one that will determine the future growth rates of Azure, and thus, Microsoft, going forward.

FY1Q25 analysis overview

Against the high end of guidance of $64.8 billion, Microsoft’s revenue came in with a solid $800 million beat at $65.6 billion in this September, FY1Q25 quarter.

This meant that on a constant currency basis, revenues grew 16%, which is impressive, in my view, given Microsoft’s scale.

However, this is why I think the stock is not performing well after this considerable feat.

The quality of the revenue beat matters here, and what I found is that out of the solid $800 million beat in revenues this quarter, about $530 million of that beat came from the More Personal Computing segment, which is the PC or hardware focused segment for Microsoft, as both Gaming and Search beat the initial guide they had set out.

Of course, investors these days are focused on Azure given it is a key growth driver for the company.

So, how did Azure perform?

On the surface, Azure revenue growth came in at 34% on a constant currency basis, which was a 1 percentage point beat compared to its guide of 33%.

More importantly, I think, is the sequential revenue dollar growth Azure posted, which was $1.21 billion.

This is the largest ever sequential revenue dollar growth performance that Azure posted.

The good news here is that Azure did not see any material change in the broader macro spending backdrop, which means that things were no worse, but no better either.

This actually brings me to the bad news because it does disappoint investors who have been anticipating something of a second half improvement in IT spending.

However, the bad news does not stop there, as guidance for the second quarter in December came in 1 percentage point lighter than expected, with the guidance for Azure constant currency revenue growth to be between 31% to 32%.

One of the main positives from the quarter was margin control because despite the pressure on gross margins from AI infrastructure scaling, operating margins came in at 46.6%, which was well ahead of the top end of its operating margin guidance for the first quarter of 45.3%.

For the first quarter, capital expenditures came in at $20 billion, up from the $19 billion in capital expenditures for the fourth quarter and Microsoft expects this figure to grow from the first quarter to the second quarter.

As you would expect, most of the capital expenditures are spent on investments in its cloud and AI business.

Azure concerns

As highlighted above, Azure revenue growth in the first quarter was 34% on a constant currency basis, which was a 1 percentage point ahead of guidance and on a sequential revenue dollar growth basis, Azure grew $1.21 billion.

I would also note that Google Cloud also brought in a sequential revenue dollar growth of $1.0 billion, which is a record for the company as well.

Both Google Cloud and Azure’s record sequential revenue dollar growth does indicate that the cloud service providers are seeing very strong demand trends, which is an encouraging sign in my view.

Azure revenue growth (Author generated)

However, I would like to focus more on the guidance and outlook for Azure.

While a 1 percentage point miss for Azure constant currency revenue growth is not that significant, I think investors are more triggered by the reasons for the miss.

So, what were the reasons for the miss in guidance?

The company attributed the miss to the “supply pushouts“, which was highlighted multiple times during its earnings call.

This means that Microsoft expects that in the second quarter ending December and third quarter ending March, there will be a delay in the data center capacity from third-party infrastructure providers like Oracle and CoreWeave.

I think why this is disappointing to investors is because Microsoft actually should have already accounted for some delays in its guidance in the prior quarter, but with this, it does imply to me that there is further slippage of the going live of the data center capacity from these third-party infrastructure providers.

As such, I think what is safe to assume is that the third-party infrastructure providers like Oracle and CoreWeave likely experienced delays. The problem will then be whether these delays will be prolonged or not, given that it is not within the control of Microsoft.

This is the reason I think Microsoft sold off after the first quarter results, as investors have been hearing of the supply pushouts for a few quarters now and the guidance that management gives seems to be at risk.

For now, Microsoft reaffirmed its guidance for an acceleration in Azure in the third and fourth quarters ending March and June respectively, with the assumption that capacity does come in during the third and fourth quarters.

The key here is the conviction in the outlook and capacity addition as it does affect Azure growth for FY2025.

Just three months ago, Microsoft sort of implied that the second quarter Azure revenue should end up close to the 34% growth in the first quarter, which then implies the first half revenue growth of Azure should be 34%.

However, today, with Azure revenue growth landing at 34% in the first quarter and if Microsoft achieves the high end of its Azure guidance of 32%, the implied first half revenue growth of Azure is now just 33%, one point lower.

In my view, I was modelling around 36% revenue growth for Azure in the third and fourth quarters, which indicates a modest acceleration.

If the capacity does come online in the third and fourth quarters as management expects, I think this revenue growth of Azure I was modelling could still be achieved.

Azure AI constrained while non-AI stable

Microsoft stated that AI services brought about a 12-point contribution to Azure growth in the first quarter, and that this was stable relative to the fourth quarter. Management expects that in the second quarter, AI services will contribute a “similar” amount to Azure growth, which also implies a 12-point contribution from AI services.

I think more importantly, management stated in its earnings call that “demand continues to be higher than its available capacity” within AI services, which does imply that it remains supply constrained on this front.

Microsoft’s AI revenues on an annualized basis are expected to reach $10 billion by the next quarter.

This means that the combined M365 Copilot and Azure AI revenues are expected to not only be one of the biggest AI businesses out there today, but it is also one of the fastest growing businesses within Microsoft in its operating history.

Based on the numbers provided above on AI services contribution and that Azure growth came in at 34% this quarter, non-AI Azure growth is implied to be 22%. This was just a 1 percentage point deceleration from the prior quarter, which does imply to me that there is no improvement in spending trends this quarter, nor was there any worsening of the trends, which does imply consumption patterns remained stable.

Given that Azure’s consumption patterns were stable, this once again does imply that the deceleration in Azure from 35% in the fourth quarter of the last fiscal year to 34% in the first quarter and then to between 31% and 32% in the second quarter to all be a result of this timing of data center capacity being ready for deployment.

Productivity and Business Processes

The Productivity and Business Processes segment grew 13% from the prior year, stable relative to the prior quarter.

M365 Commercial Cloud growth came in at 16% on a constant currency in the first quarter, but as I will explain more below, M365 Commercial Cloud revenues are expected to decelerate by 2 percentage points.

The seat growth in the first quarter came in at 8%, with Microsoft guiding seat growth to moderate, which explains the 2-percentage points deceleration in M365 Cloud growth.

I suspected that M365 Copilot should be helped provide incremental M365 Commercial cloud growth by lifting ARPU, and this was further reinforced by management during its earnings call. There were also multiple examples management gave about large enterprises buying more seats for M365 Copilot, with UBS and Vodafone being highlighted.

Valuation

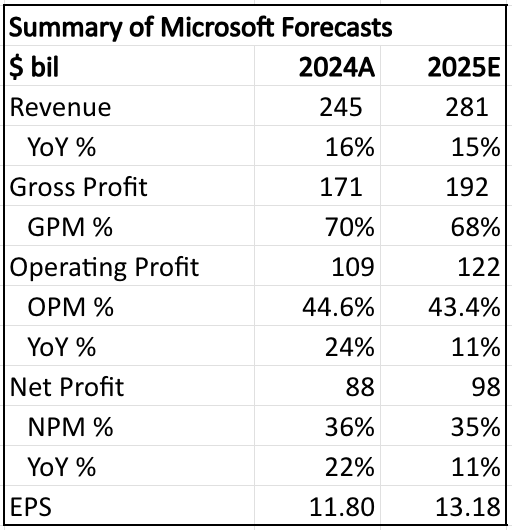

I’ll just briefly share the assumptions in my financial forecasts before sharing more about the valuation of the company.

I assume FY2025 revenue growth of 15%, with the assumption that after the first quarter revenue growth of 34% in Azure, that we will see that growth come down to 32% in the second quarter, and with the second half Azure growth being 36% on average.

This acceleration depends on and assumes that the capacity constraints that the company is facing today are resolved, and this continues to be what Microsoft has been reiterating as well, which again signals its confidence on the matter.

On operating margins, I assume a 100-basis point decline to 43.4% in FY2025, which is in-line with management’s expectations, given continued gross margin pressures from AI infrastructure scaling, which is offset by disciplined control on operating expenses.

That leads to an EPS of $13.18 per share for 2025.

Summary of my forecasts for Microsoft (Author generated)

My 1-year price target for Microsoft is $461.

This is based on applying a 35x FY2025 P/E multiple to the EPS for 2025 mentioned above.

Microsoft trades at a 5-year average P/E of 35x.

In addition, Microsoft trades at a premium P/E multiple to its peer group, which includes the likes of ServiceNow (NOW), Oracle (ORCL), Alphabet (GOOG), Salesforce (CRM), amongst others, which trades at a 31x P/E multiple.

This premium is more than justified in my view, largely due to Microsoft’s larger and faster growing AI opportunity relative to these peers, alongside its strong execution across its diversified business segments, which provide a more resilient business model relative to peers.

Conclusion

There are two camps with differing points of view today. The first believes that the capacity constraints are likely at its worst, with an acceleration coming in the third and fourth quarters of FY2025, while the second camp is more doubtful about whether we will see a re-acceleration in the second half of FY2025.

I would be a buyer of Microsoft on weakness as I belong in the camp that believes that the capacity constraints should alleviate in the coming quarters, with the third and fourth quarters of FY2025 being the key period of acceleration for the company.

Furthermore, despite the consumption trends and the macro spending backdrop seems stable, Azure saw its largest ever sequential revenue dollar growth, alongside Google Cloud, which really highlights the very strong and healthy demand trends these cloud service providers have in today’s environment.

All in all, I think this all creates a rare buying opportunity for Microsoft.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Outperforming the Market

Outperforming the Market is focused on helping you outperform the market while having downside protection during volatile markets by providing you with comprehensive deep dive analysis articles, the AI deep dive report, and access to The Barbell Portfolio.

The Barbell Portfolio outperformed the S&P 500 by 50% in the past year through owning high conviction growth and contrarian stocks.

Apart from providing bottom-up fundamental research, we also provide you with intrinsic value, 1-year and 3-year price targets in The Price Target report.

Join Outperforming the Market before the 20% price hike next month.