Summary:

- Microsoft beat bottom and topline expectations for Q1’25 due to a strong performance in the Intelligent Cloud segment.

- All core business grew revenues at double-digits in the first fiscal quarter, and Microsoft continued to generate a ton of free cash flow for shareholders.

- Intelligent Cloud grew its operating income at 18% Y/Y, the fastest rate of all the company’s segments.

- In my opinion, MSFT is likely fairly valued here and has a limited upside potential. Meta Platforms and Google offer much deeper value than Microsoft.

HJBC

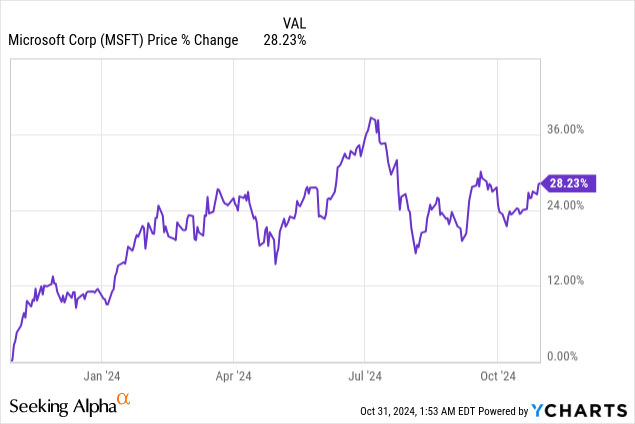

Microsoft (NASDAQ:MSFT) submitted its earnings sheet for the September quarter on Wednesday and the tech company beat both on revenues and earnings, chiefly because of strong execution in the Cloud segment. All core segments generated a double digit top line growth with Intelligent Cloud seeing 20% year-over-year growth rate. AI-driven tailwinds helped especially Intelligent Cloud and the company generated once again a ton of free cash flow, much of which could be returned to shareholders going forward via stock buybacks. As much as I like Microsoft, I believe the AI tailwinds here are fully priced into Microsoft’s shares and don’t see an especially appealing risk profile following Q3’24 earnings.

Previous rating

I rated shares of Microsoft a hold in my last article in July 2024 because I thought that the hardware and software company was fully valued. Microsoft benefited from a strong recovery in the Personal Computing segment after the 2023 sector down-turn in the device market while performance in the Intelligent Cloud business effectively lifted the entire company’s growth rate. Microsoft continued to see strong AI tailwinds in the first fiscal quarter, but shares remain expensive and may have little upside.

Microsoft beats earnings, sees solid AI-related growth

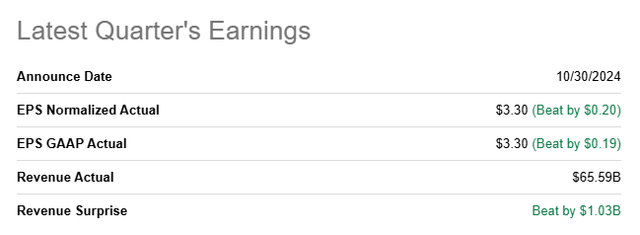

Microsoft reported better than expected earnings for both the top and the bottom line for Q1’25: the software company had adjusted earnings of $3.30 per-share, which beat the average prediction by $0.19 per-share. The top line came in better than expected as well at $65.6B and beat the consensus expectation by $1.03B.

Seeking Alpha

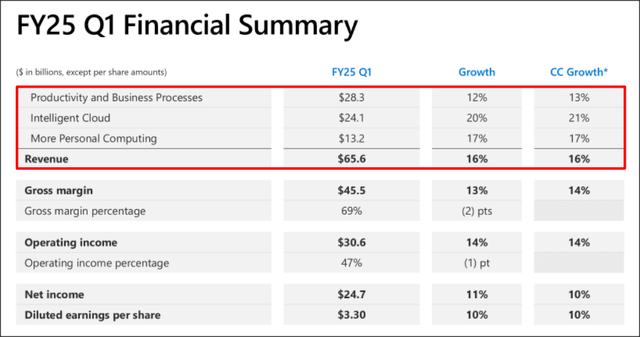

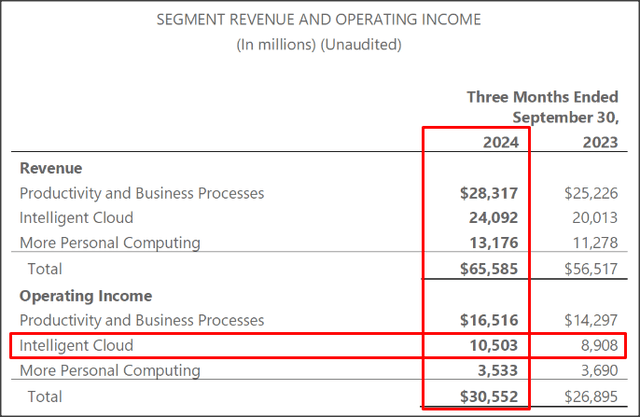

As I said above, Microsoft has seen double-digit top line growth in all of its core segments including Productivity and Business Processes, Intelligent Cloud and Personal Computing. Microsoft’s consolidated revenue growth rate in the first fiscal quarter was 16% Y/Y which marked a 1 PP acceleration compared to the previous quarter.

Microsoft

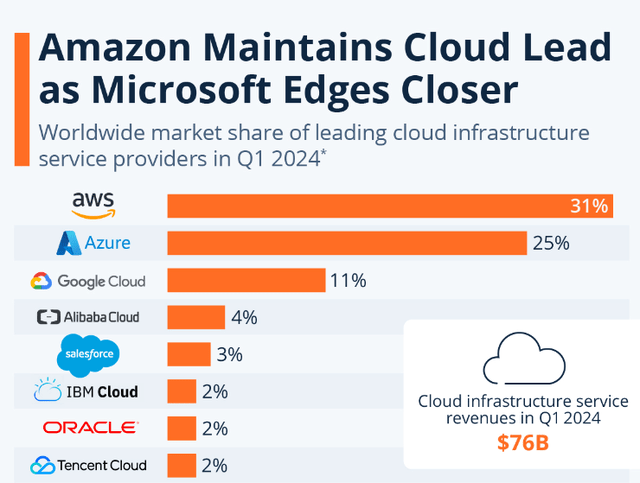

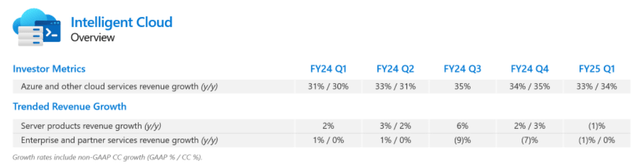

Microsoft is doing especially well in terms of Intelligent Cloud, where the company is seeing the biggest momentum. Key to this momentum is Azure, which is Microsoft’s large cloud infrastructure platform which has a market share of 25% (as of Q1’24).

Statista

Azure is doing great with more companies moving their AI workloads to Microsoft’s Cloud platform. Not surprisingly, Azure is by far the fastest-growing cog in the Microsoft machine, growing 33%% year-over-year.

Microsoft

Microsoft’s Intelligent Cloud was the second most profitable segment for the company and its investors: it contributed $10.5B in operating income in Q1’25 to a total of $30.6B (34%), but it is growing its income at the fastest pace. In the third-quarter, Intelligent Cloud grew its operating income 18% year-over-year, due to AI tailwinds, compared to 16% Y/Y for Productivity And Business Processes.

Microsoft

Free cash flow

Microsoft generated $19.3B in free cash flow in the September quarter, which reflected a 7% year-over-year decline. However, Microsoft is still one of the most free cash flow-profitable big tech companies in the U.S. stock market and earns impressive free cash flows overall. It is this kind of free cash flow that allowed Microsoft, as an example, to invest $10B in ChatGPT operator OpenAI. The enormous amount of free cash flow Microsoft generates could be either used to invest in, or acquire, AI start-ups, and thereby accelerate the company’s exposure to the AI theme, or return more cash to shareholders via stock buybacks.

|

$billions |

FQ1’24 |

FQ2’24 |

FQ3’24 |

FQ4’24 |

FQ1’25 |

Y/Y Growth |

|

Revenues |

$56,517 |

$62,020 |

$61,858 |

$64,727 |

$65,585 |

16% |

|

Cash Flow From Operating Activities |

$30,583 |

$18,853 |

$31,917 |

$37,195 |

$34,180 |

12% |

|

Capital Expenditures |

($9,917) |

($9,735) |

($10,952) |

($13,873) |

($14,923) |

50% |

|

Free Cash Flow |

$20,666 |

$9,118 |

$20,965 |

$23,322 |

$19,257 |

-7% |

|

Free Cash Flow Margin |

36.6% |

14.7% |

33.9% |

36.0% |

29.4% |

-20% |

(Source: Author)

Microsoft’s valuation

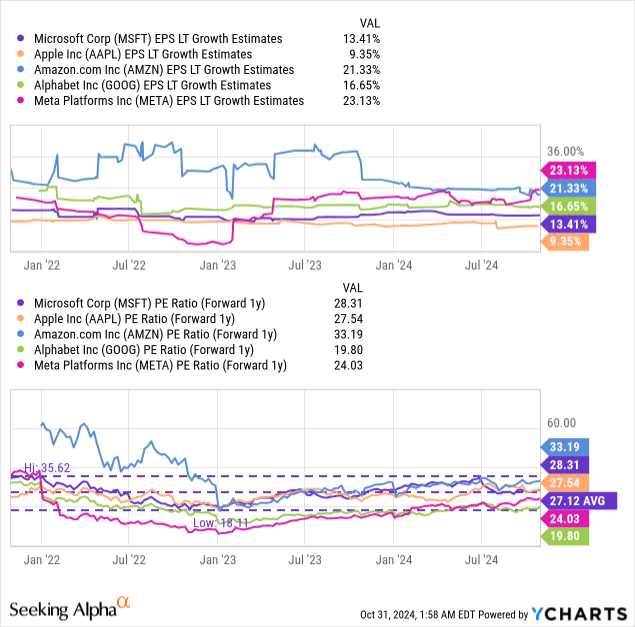

Shares of Microsoft are expensive and have been so for a while, chiefly because of investors’ high expectations for the company’s Intelligent Cloud business, which includes Azure. Microsoft is currently valued at a price-to-earnings ratio of 28.3X, which makes it the second most expensive big tech company after Amazon (AMZN).

The industry average group P/E ratio for big tech companies of 26.6X, and the longer term, 3-year average price-to-earnings ratio for Microsoft is 27.1X. This means that Microsoft is currently more expensive than its historical standard in the last three years, and more expensive than the average big tech company.

In my opinion, the best values in the big tech group are represented by Google (GOOG) and Meta Platforms (META) which both trade well below the industry group average P/E ratio. Google offers the deepest value for tech investors, so I stated in my last article on the tech company. Meta’s valuation also makes no sense to me, considering how quickly the social media company is growing.

In my last article on Microsoft I calculated a fair value for shares of Microsoft of ~$400 based off of the company’s historical valuation average and I see no reason to materially change this fair value estimate for the time being. Analysts currently expect Microsoft to earn $15.26 per-share. Applying a fair value P/E of ~27X (which is both the average P/E and the industry group P/E) calculates to a fair value of $412 per-share (+$12 per-share compared to my earlier fair value estimate). This is, as always, a dynamic value, that could rise and fall with Microsoft’s overall growth and its execution in its Intelligent Cloud segment especially.

Risks with Microsoft

The biggest risk for Microsoft, as I see it, relates to its execution in the Intelligent Cloud business because this segment is especially important for the software company to turbocharge its top line growth. Slowing growth here would likely weigh on investors’ perception as a growth play. What would change my opinion on the tech company is if its growth rate in Cloud decelerated or if the company were to see a significant decline in its free cash flows.

Closing thoughts

All things considered, Microsoft’s first fiscal quarter saw a strong earnings release, with top line growth slightly accelerated (+1 PP Q/Q) compared to the previous quarter. The most important take-away was that Microsoft continues to see healthy momentum in Azure which is the company’s cloud infrastructure platform. This segment also saw by far the biggest increase in its operating income contribution in Q1’25. Microsoft once again generated a ton of free cash flow from its core businesses, which is what ultimately underscores the investment proposition for the company. While Microsoft did well and clearly benefits from AI tailwinds in its business, I don’t like the valuation very much, and I see an overall unattractive risk profile because of it.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of AAPL, META, GOOG, AMZN either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.