Summary:

- Microsoft’s Q1 2025 earnings exceeded expectations, driven by strong growth in its Intelligent Cloud unit.

- More importantly, the earnings report demonstrates to me MSFT’s remarkable ability to consistently balance growth and profitability despite its mega-size.

- Measured by the Rule of 40, Microsoft consistently scores well above the 40% threshold even with the most stringent profitability metric.

Andranik Hakobyan/iStock via Getty Images

MSFT stock and Q1 recap

My last work on Microsoft (NASDAQ:MSFT) was published a month ago. That article was entitled “Microsoft: Back To Basics” and argued for a buy thesis on the stock. The article’s arguments were centered around the potential of AI infusion and the scalability of the business model. Quote:

This article details the top two positives on my mind. The first one is the potential for accelerated AI infusion, judging by the recent developments surrounding OpenAI. The second one is the fundamental scalability of its business, as revealed by its marginal return on capital employed (MROCE).

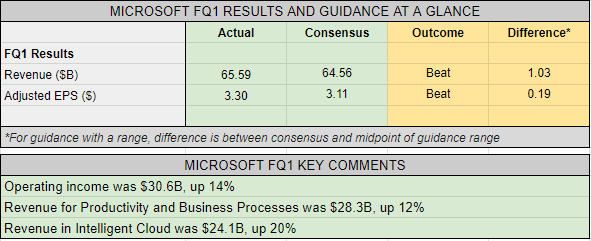

Since then, the company has reported, 2025 FY Q1 earnings. The ER provided several material updates for MSFT’s business operations, which are key catalysts for investors to take a new look at the stock. Overall, the company delivered another terrific quarter and beat analyst expectations for both revenue and EPS. More specifically, as you can see from the next chart below, revenue for the fiscal quarter came in at $65.59 billion, surpassing the consensus estimate of $64.56 billion by $1.03 billion. To echo the argument in my previous article regarding accelerated AI infusion, a key driver for the growth is its Intelligent Cloud unit, whose revenue totaled $24.1 billion, translating into a 20% year-over-year growth rate. Adjusted EPS reached $3.30, also exceeding the consensus estimate of $3.11 by a good margin of $0.19.

Looking ahead, I expect Microsoft’s strong performance to continue, especially with its cloud computing business, driven by Azure and other cloud-based offerings. Additionally, I also expect the company’s productivity and business processes segment (which includes Office 365) to see both solid growth and strong profitably as AI infusion continues.

And this brings me to the core thesis of this article – the balance of its growth and profitability. In the remainder of this article, I will examine this balance by the so-called rule of 40 (and I will simply refer to it as “the rule” from here on). This examination shows me that MSFT is a rare case of a mega cap that can manage to consistently meet the requirements of rules, thus leading to a reiteration of my Buy rating.

Seeking Alpha

MSFT stock Q1 measured by Rule of 40

In case you’re unfamiliar with the rule, the following quotes from Wall Street Prep (slightly edited by me) should provide the background necessary for the rest of the discussion:

The management teams of high-growth SaaS startups are often required to choose between rapid growth and expansion, or improving profitability – for which, the Rule of 40 has become a practical framework to balance the two concepts. The Rule of 40 – popularized by Brad Feld – states that a SaaS company’s revenue growth rate plus profit margin should be equal to or exceed 40%. Thus, the Rule of 40 measures the balance between a SaaS company’s growth rate and profitability. Profitability is typically measured by EBITDA margin, EBIT, net income margin, or levered free cash flow margin.

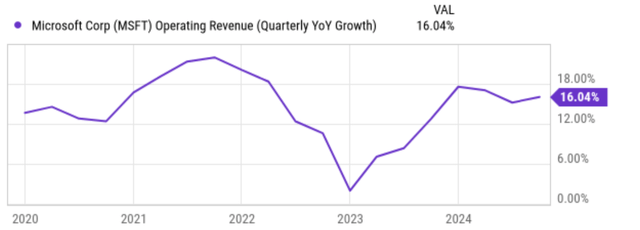

As seen, the rule is quite simple and involves only two variables – revenue growth rate and profit margin. Let’s start with the revenue growth rate. The next chart illustrates Microsoft’s quarterly YOY operating revenue growth in the past five years from 2020 to 2024. As seen, despite some fluctuations, the company maintained double-digit growth rates during most of the quarters except for some slight dips during/after the COVID-19 pandemic. For its latest FY Q1 2025 quarter, the YOY growth rate came in at 16.04%.

Seeking Alpha

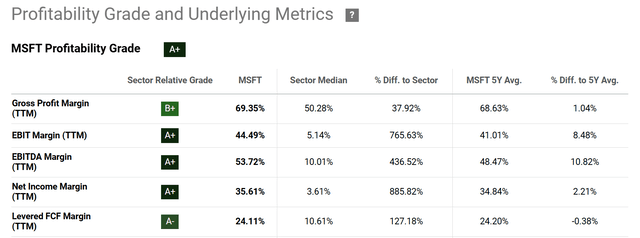

Now let’s move on to profit margins. The company maintains an impressive profitability profile, as seen from the chart below. It outperforms the sector median drastically across a variety of profitability metrics. For example, in terms of gross profit margin, MSFT boasts a gross profit margin of 69.35%, significantly higher than the sector median of 50.28%. As aforementioned, in the rule, profitability is typically measured by EBITDA margin, EBIT, EBIT, net income margin, or levered free cash flow margin. The further we move down this list, the more difficult it is to meet the rules.

MSFT beats the rule when profitability is measured in EBITDA or EBIT margins. As seen, in the trailing twelve months of its Q1 earnings, MSFT’s EBITDA margin of 53.72% and EBIT margin of 44.49% are already sufficient to beat the rule by themselves without the addition of growth rate.

In terms of net income margin, MSFT’s net income margin is 35.61% as of TTM. With the 16.04% YOY operation revenue growth as aforementioned, MSFT’s score of the rule is over 51%, again exceeding the requirement of the rule by a sizable gap. Now, in terms of levered FCF margin, the most stringent profitably measure, MSFT’s levered free cash flow margin dialed in at 24.11% as TTM. Once we add the 16.04% YOY operation revenue growth, MSFT’s score worked out to be 40.2%, also exceeding the minimum thresh hold of rule.

Next, I will better contextualize the above scorecard.

Seeking Alpha

MSFT stock and rule of 40: Historical perspective

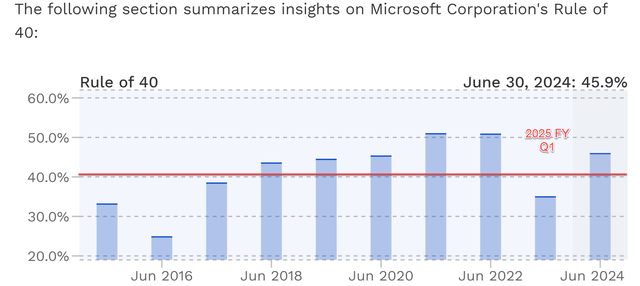

To provide a better context, let me start with a historical perspective. The next chart illustrates Microsoft’s Rule of 40 scores over time (and this chart used the FCF margin). As seen, Microsoft’s score has steadily increased since 2015. In June 2016, the score was around 25%, the lowest point in this period. By 2018, it had risen to 42% and surpassed the threshold. The score continued to improve, reaching 45% in 2020 and 50%-plus in both 2021 and 2022. As of the previous quarter, the score stood around 45.9%. The only time the score dipped below 40% since 2015 was 2023, in the aftermath of the COVID. The point I’m trying to make is that Microsoft has effectively and also consistently balanced its growth and profitability in the past, and the remarkable balance continues, as reflected in its FY Q1 earnings.

FinBox

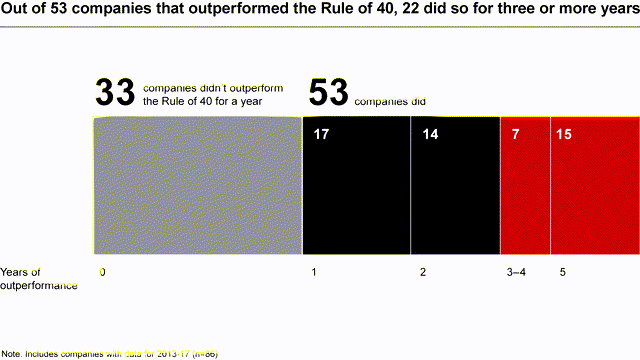

A horizontal comparison can better illustrate how remarkable the track record is. As you can see from the following results compared by Bain,

Even beating the rule in a year is not that easy. Out of the 86 companies the research studied by Bain, 33 of them did not manage to beat the rule for any single year. Beating the rule for multiple years is an even greater challenge and only 15 of them managed to beat the rule continuously for five years.

Bain report

Other risks and final thoughts

As a bellwether stock, MSFT faces the same set of downside risks common to its tech peers, such as increasing competition, sensitivity to economic downturns, antitrust scrutiny, regulatory challenges, etc. In particular, in order to pursue the AI opportunities mentioned earlier, I anticipate continued heavy capex from MSFT in the years to come (with a recent example quoted below). These investments could create near-term headwinds for its profitability.

SA news: Microsoft (MSFT) could spend almost $10B between 2023 and 2030 renting servers from artificial intelligence startup CoreWeave. That amount is larger than previously known and represents more than half of the $17B total signed contracts CoreWeave has with customers, the news outlet added, citing comments the company made to investors.

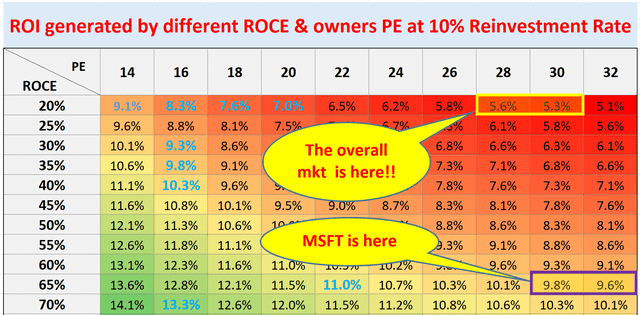

The second key downside risk on my mind is valuation. At the price of this writing, MSFT stock is trading at a FWD P/E of 31.3x, a very elevated multiple in both relative and absolute terms. As a reference point, the overall market represented by the S&P 500 index now trades around 29.2x P/E, which is already among its highest P/E ratios since the dot.com bubble. However, investors need to bear in mind that MSFT boasts an average ROCE (return on capital employed) far higher than the overall economy (about 65% vs. about 20% as shown in the next chart below). Thus, assuming the same reinvestment rate (taken to be 10%, which is the average level for the overall market), MSFT still offers a higher potential return despite its P/E premium (and the details of this return projection model is provided our earlier article).

To conclude, the goal of this article is to examine MSFT’s FY Q1 2025 earnings report from the perspective of the rule of 40. My analysis demonstrates MSFT’s remarkable ability to balance growth and profitability despite its mega size. There are some risks as just mentioned. But my overall conclusion is that the stock still offers a far superior return/risk profile than the overall market, and thus I maintain my Buy rating.

Author

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

As you can tell, our core style is to provide actionable and unambiguous ideas from our independent research. If your share this investment style, check out Envision Early Retirement. It provides at least 1x in-depth articles per week on such ideas.

We have helped our members not only to beat S&P 500 but also avoid heavy drawdowns despite the extreme volatilities in BOTH the equity AND bond market.

Join for a 100% Risk-Free trial and see if our proven method can help you too.