Summary:

- Microsoft’s investment in AI, especially within Azure, is crucial given the growing demand and significant opportunity in the AI space.

- Despite a smaller-than-expected beat in FY4Q24, Microsoft showed strong overall performance, with notable growth in the More Personal Computing and Productivity segments.

- Management plans to scale AI infrastructure investments in FY2025, but remains flexible to adjust based on demand signals to maintain margins.

- Microsoft’s AI services, including Copilot for Microsoft 365 and GitHub Copilot, are seeing strong demand, justifying continued investment in AI infrastructure.

hapabapa

The investment story for Microsoft (NASDAQ:MSFT) depends on a large extent on Azure, its cloud business.

In turn, Azure’s growth is increasingly seeing growing contribution from AI services.

In this article, I’ll briefly go through my review for the reported FY4Q24 results, but more importantly look into the opportunity and debate about Microsoft’s AI monetization. I will look deeper into the ROI of Microsoft’s AI investments, and whether these capital expenditures are worthwhile.

Firstly, I am of the view that Microsoft has to invest in the AI opportunity given the growth in demand in the space and the huge opportunity.

Secondly, I am also of the view that Microsoft has the ability to adjust capital expenditures when necessarily should demand change.

I have written extensively about Microsoft on Seeking Alpha, which can be found here.

4Q24

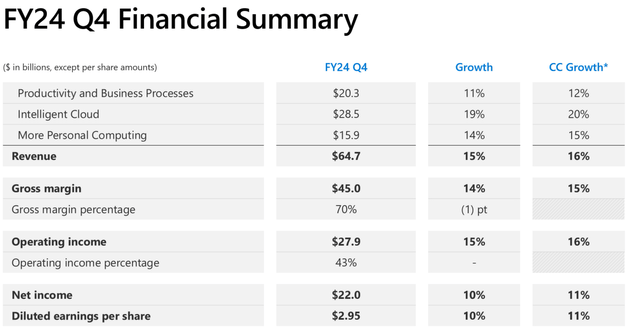

Microsoft’s FY4Q24 quarter saw a smaller beat than what the market was expecting, but overall, still a very healthy quarter.

Revenues for the quarter came in at $64.7 billion, growing 16% on a constant currency basis and coming in 1% ahead of consensus.

That said, the intelligent cloud segment revenue came in at $28.5 billion, 1% below consensus, weaker than what the market had expected (More on that below).

The beat came from the more personal computing segment, where revenues came in at $15.9 billion, beating consensus by almost 3%, due to Search and news advertising revenues grew 19% from the prior year and strong Windows commercial revenues which were up 12% from the prior year.

There was also a beat in the Productivity and Business Processes segment, which grew 12% on a constant currency basis and beat consensus by about 1%, driven by better-than-expected results across all business units.

The beat in revenues flowed to gross profit, which came in at $45 billion, growing 14% from the prior year and coming in 1% ahead of consensus.

In particular, Microsoft Cloud gross margin fell about 2 percentage points to 69%, which was largely driven by the scaling of its AI infrastructure.

Operating income came in at $27.9 billion, or 43.1% operating margin, 1% ahead of consensus and growing 16% from the prior year.

Operating margin came in at 43%, and excluding the impact of account changes, it actually increased slightly due to continued cost discipline that led to improved operating leverage.

EPS came in at $2.95, 1% ahead of consensus.

Now, on to the balance sheet.

Capital expenditure for FY4Q24 was $19 billion, but the cash paid for PP&E came in at $13.9 billion, largely due to the nature at which finance leases are accounted for.

Microsoft generated free cash flow of $23.3 billion, growing 18% from the prior year.

The company returned $8.4 billion to shareholders through dividends and share repurchases in FY4Q24 and for the full 2024 fiscal year, returned more than $34 billion to investors.

Outlook

Microsoft’s language around capital expenditures for the next 2025 fiscal year was different compared to what we have seen in the past.

As the company expects double-digit percentage growth in revenue and operating income, to meet what they see as growing demand signal for their AI and cloud products, the plan remains to scale infrastructure investments in FY2025, which is expected to be higher than that of FY2024.

That said, management was quick to reiterate that these capital expenditures are dependent on the demand signals that they are seeing and the adoption of their services through FY2025.

At the same time because the scaling of AI infrastructure will drive growth in the COGS line, management reiterates their discipline on management operating expenses.

The commitment here is to grow operating expenses for FY2025 at single digits, slower than the double-digit percentage growth in revenue expected.

As such, despite the scaling of AI infrastructure driving up COGS, management only expects operating margin for FY2025 to be down only about one percentage point from the prior year. Microsoft Cloud gross margin is expected to be about 70%, down from the prior year due to scaling its AI infrastructure.

Management expects Intelligent Cloud to grow between 18% and 20% in constant currency to between $28.6 billion and $28.9 billion for FY2025, driven by Azure.

Azure is expected to see revenue growth of between 28% to 29% in constant currency for FY1Q25, driven by AI growth, and management expects consumption trends from FY4Q24 to continue into the first half of FY2025.

I think this basically implies that for the first half of FY2025 will continue to see limited growth due to the non-AI growth trends in Europe and capacity constraints impacting AI demand.

For the other segments, the More Personal Computing segment is expected to see revenue growth between 9% and 12% in constant currency and the Productivity and Business Processes segment is expected to see revenue growth of between 10% and 11% in constant currency.

Azure

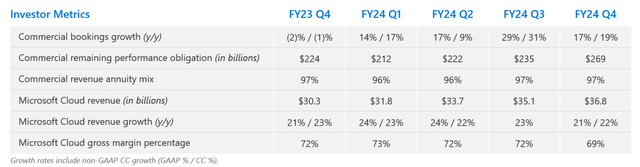

Azure remains the most important business for Microsoft and the table below shows how commercial bookings, revenue and gross margins have trended in the last four quarters.

Azure growth moderated to 30% growth from the prior year on a constant currency basis. Within Azure, AI services contributed to 8 percentage points of growth, up from 7 percentage points of growth from the prior quarter.

Quarterly commercial highlights (Microsoft)

I think there is one positive in that there continues to be capacity constraints within the AI services space, which means that as Microsoft continues to invest to grow capacity in this space, the contribution from AI services could continue to go up.

When it comes to Azure’s AI services, management reiterated what they said last quarter that “demand remained higher than their available capacity”.

This strength in AI services for the quarter also meant that non-AI or core Azure services decelerated 2 percentage points.

This core Azure deceleration was impacted by some macro softness in Europe.

Despite some macro weakness in Europe, there was still strength in large, long-term Azure contracts, with the number of $10 million and more and $100 million and more contracts increasing.

This helped to bring commercial bookings growth of 19% growth on a constant currency basis.

In general, for the non-AI, core Azure part of the business, it does seem that the quarter looked similar to the prior quarter, implying consistent macro environment and IT spending environment.

ROI on AI investment

Microsoft was very intentional about communicating to investors its ability to adjust cloud and AI related spend based on demand and that it is able to maintain margins despite accelerating investments into AI infrastructure.

Mix of capital expenditures

Capital expenditures for the quarter came in at $19 billion, which was in-line with expectations.

Specifically, nearly all of that capital expenditure was spent on cloud and AI related spend.

If we break that down further, 50% of that spend is for infrastructure needs. This will include the land, the building and leasing of data centers, and this portion of capital expenditures is expected to support monetization over more than 15 years from today.

The good thing about the long-term build is that they are highly flexible and have a consistent architecture. What this means is that the long-term build can be used for commercial cloud or Azure AI, depending on the demand, or it could be used for Microsoft internally or third parties. They all use the same infrastructure and architecture.

The other 50% of the capital expenditure spent relates to servers, which includes both CPUs and GPUs. This spend will be based on customer demand signals and can be adjusted accordingly.

The full year capital expenditure mix is similar to that as what we saw for 4Q24.

Ability to taper capital expenditures

While capital expenditures have been increasing, Microsoft sees a path where it could taper down capital expenditures and still see consistent growth numbers.

In particular, what could happen is that with half of the capital expenditures going to long-term builds and the other half into CPUs and GPUs, if there are changes to the demand signal that suggests Microsoft could reduce investments, the company could reduce spend either on the CPUs or GPUs side of the equation or even both.

In fact, this is what Microsoft has done since increasing the investment into GPUs, as it has reduced the investment on the CPU side to ensure that the capital expenditure figure is managed accordingly.

Yield on AI investment

One of the biggest questions that the market has right now for hyperscalers investing large amounts on AI is the monetization or yield of those investments.

For Microsoft, the way they think about the yield or monetization on their investment into AI is to determine whether there are demand signals that indicate that they should be investing. Given that the AI opportunity is both capital and knowledge intensive, Microsoft needs to see some sort of value coming from customers and something that will drive growth rates going forward.

What Microsoft has seen from the demand perspective so far has been encouraging, hence the investment into AI.

For example, the demand signals from Copilot for Microsoft 365 have been strong, with a doubling of the number of daily users of Copilot for Microsoft 365 in the quarter relative to the prior quarter, 60% sequential increase in Copilot for Microsoft 365 users, and the number of customers with more than 10,000 seats more than doubling sequentially. The last point is important because customers that are trying out Copilot for Microsoft 365 are assured of the value it brings and are buying in bulk.

Microsoft now has more than 60k Azure AI customers, up 60% from the prior year and the average spend of these customers continues to grow.

Another example is for GitHub. GitHub Copilot is now the most widely adopted AI-powered developer tool, and just two years since being generally available, more than 77k organizations use GitHub Copilot, up 180% from the prior year. GitHub Copilot made up 40% of this year’s revenue growth and GitHub Copilot is already a larger business than GitHub when Microsoft acquired it.

As a result of these strong demand signals that Microsoft is seeing, they are investing in the necessary capital expenditure to cater to that growth.

All in all, my thoughts are that the ongoing debate about AI infrastructure monetization and yield is a healthy one that helps ensure that we consider all aspects of the investment case. That said, I am in the camp where these investments into AI infrastructure that Microsoft is doing is absolutely necessary given, we are in the early stages of the AI transition. The key will be how it manages that investment, and management has shown its ability to not only manage margins and profitability while scaling AI investments, but also the ability for it to manage capital expenditures based on demand signals.

Valuation

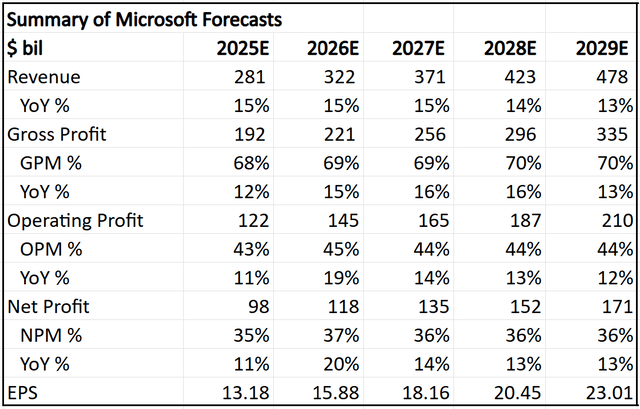

I have updated the Microsoft forecast to include FY2029 since FY2024 is now over.

Specifically, I assume FY2025 EPS and profitability headwinds to persist given the elevated levels of AI spend, and from FY2026, the investments in AI infrastructure should drive higher operating leverage in the system, and as Microsoft tapers down on capital expenditures.

Summary of 5-year forecasts for Microsoft (Author generated)

My intrinsic value for Microsoft goes up to $429 after this revision, assuming 30x terminal multiple and 10% cost of equity.

My 1-year and 3-year price targets are $461 and $613 respectively implying 35x FY2025 P/E and 30x FY2027 P/E.

As can be seen by the price action after the earnings results, Microsoft has now moved closer to its intrinsic value, and while not cheap, is trading fairly.

Conclusion

Make no mistake, Microsoft’s business remains solid.

I think what is happening right now is the phase where the company is investing heavily into future growth opportunities, and the results of that investment are not yet very visible, hence the market is somewhat uncertain about what that might look like.

Until then, management has done a good job explaining the strong demand that they are seeing, talking about why they need to invest, and sharing about the levers they have to pull if demand were to slow down.

Microsoft, especially on the Azure front, continues to benefit from increasingly contribution from AI services, and on its internal front, has been rolling out Copilots that are gaining traction amongst developers and knowledge workers.

Again, my view is that these investments into AI infrastructure that Microsoft is doing are absolutely necessary given, we are in the early stages of the AI transition. The key will be how it manages that investment, and management has shown its ability to not only manage margins and profitability while scaling AI investments, but also the ability for it to manage capital expenditures based on demand signals.

Microsoft continues to be on the right track and a great business to own.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Outperforming the Market

Outperforming the Market is focused on helping you outperform the market while having downside protection during volatile markets by providing you with comprehensive deep dive analysis articles, the AI deep dive report, and access to The Barbell Portfolio.

The Barbell Portfolio outperformed the S&P 500 by 50% in the past year through owning high conviction growth and contrarian stocks.

Apart from providing bottom-up fundamental research, we also provide you with intrinsic value, 1-year and 3-year price targets in The Price Target report.

Join Outperforming the Market before the 20% price hike next month.