Summary:

- Powered by an acceleration in Azure to 30% y/y growth, Microsoft delivered a solid double beat for Q2 FY2024.

- However, the stock failed to move higher in light of this report, with Microsoft priced for perfection and more at ~38x forward P/E.

- According to TQI’s Valuation Model, Microsoft is running well ahead of its fair value estimate. MSFT’s 5-year expected CAGR of ~4% is comparable to risk-free treasuries.

- Should you buy MSFT stock in light of its solid Q2 FY2024 earnings report? Read on to find out.

David Becker

Brief Review of Microsoft’s Q2 FY2024 Report

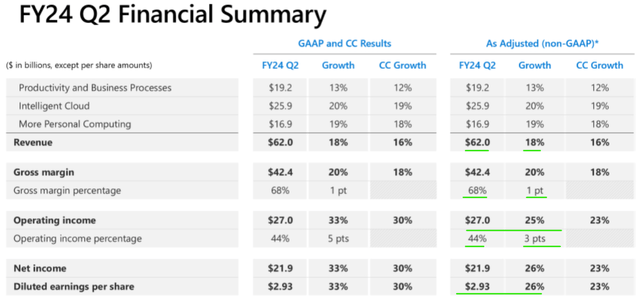

In Q2 FY2024, Microsoft Corporation (NASDAQ:MSFT) reported total revenues of $62B (+18% y/y, vs. est. $60.97B) and diluted EPS of $2.93 (+26% y/y, vs. est. $2.61) to sail past consensus estimates. However, this strong double beat from Microsoft failed to inspire an upward move in MSFT stock during the after-hours session, which can be construed a sign of tapped out valuations with Microsoft trading at an elevated ~38x forward P/E multiple.

Microsoft Q4 2023 Earnings Presentation Microsoft Q4 2023 Earnings Presentation

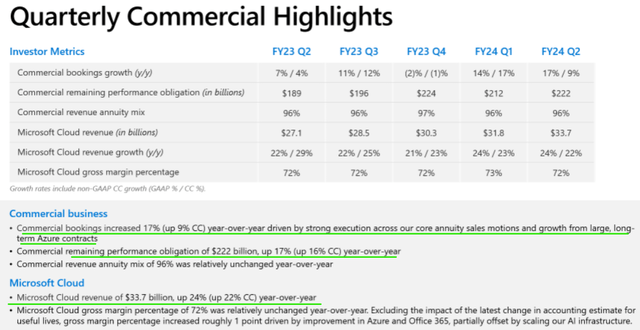

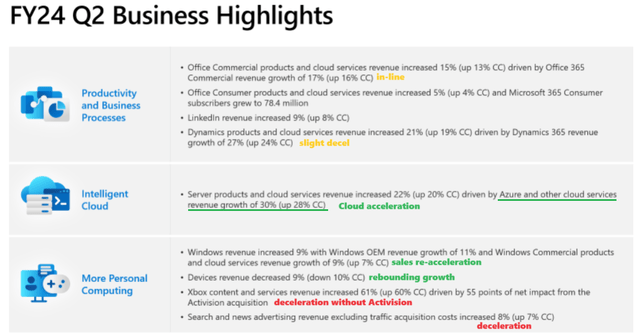

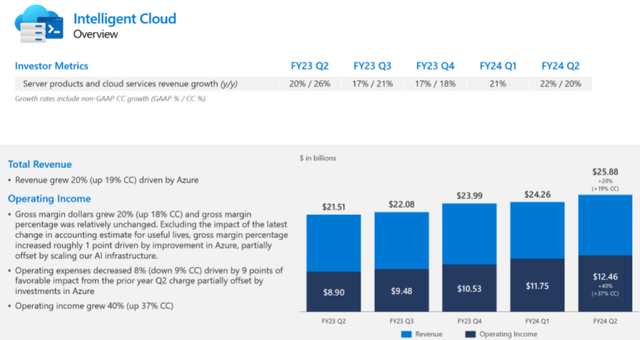

While all three segments at Microsoft reported solid double-digit growth rates and beat management’s guidance for Q2 FY2024, the outperformance in the “Intelligent Cloud” segment [Azure in particular] single-handedly drove the overall top-line beat at Microsoft.

| Q2 FY2024 Guidance | Q3 FY2023 Actual Revenue | Result | |

| Productivity & Business Processes | $18.8B to $19.1B | $19.2B | Beat |

| Intelligent Cloud | $25.1B to $25.4B | $25.9B | Beat |

| More Personal Computing | $16.5B to $16.9B | $16.9B | Met |

Author, Microsoft Q4 2023 Earnings Presentation

Once again, the highlight of Microsoft’s quarter was its Azure Cloud business, which accelerated to ~30% y/y growth in Q2 FY2024. Along with a promising re-acceleration in growth, Microsoft Azure is taking market share, according to Satya Nadella’s comments from the Q2 earnings conference call.

In addition to Azure, Microsoft’s AI Copilot has the potential to become an important growth driver for MSFT for years to come:

TYLER RADKE, Citi: Thanks for taking the question. Satya, your enthusiasm about GitHub Copilot was noticeable on the conference call and at the AI Summit in New York last week. I’m wondering how you’re thinking about pricing. Obviously, this is driving pretty incredible breakthroughs in productivity for developers, but how do you think about your ability to drive RPU on the GitHub Copilot over time? And just talk us through how you’re thinking about the next phase of new releases there.

SATYA NADELLA: Yeah. I mean, I always go back to sort of my own conviction that this generation of AI is going to be different. It started with the move from 2.5 to 3 of GPT, and then it’s used inside of developer scenario with GitHub Copilot. And so, yes, I think this is the place where it’s most evolved in terms of its economic benefits or productivity benefits.

And you see it. We see it inside of Microsoft. We see it in all the case studies we put out of customers. Everybody I’ve talked to, it is the one place where it’s becoming standard issue for any developer. It’s like if you take away spellcheck from Word, I’ll be unemployable. And similarly, it’ll be like I think GitHub Copilot becomes core to anybody who is doing software development.

The thing that you brought up is a little bit of a continuation to how Amy talked about it, right? You are going to start seeing people think of these tools as productivity enhancers, right? I mean, if I look at it, our RPUs have been great, but they’re pretty low. Quite frankly, even though we’ve had a lot of success, it’s not like we are a high-priced RPU company.

I think what you’re going to start finding is, whether it’s Sales Copilot or Service Copilot or GitHub Copilot or Security Copilot, they’re going to fundamentally capture some of the value they drive in terms of the productivity of the OpEx, right? It’s like 2 points, 3 points of OpEx leverage would go to some software spend. I think that’s a pretty straightforward value equation.

And so, that’s the first time, I mean, this is not something we’ve been able to make the case for before. Whereas now I think we have that case.

Then even the horizontal Copilot is what Amy was talking about, which is that the Office 365 or a Microsoft 365 level. Even there, you can make the same argument. Whatever RPU we made, we’ll have with E5. Now you can say incrementally, as a percentage of the OpEx, how much would you pay for a Copilot to give you more time savings, for example?

And so, yes, I think, all up, I do see this as a new vector for us in what I’ll call the next phase of knowledge work and frontline work, even, and their productivity, and how we participate. And I think GitHub Copilot – I’d never thought of the tools business as fundamentally participating in the operating expenses of a company’s spend on, let’s say, development activity. And now you’re seeing that transition. It’s just not tools, it’s about productivity of your dev team.

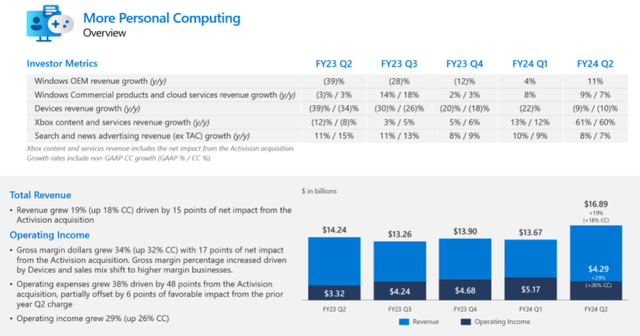

With green shoots of recovery in the PC markets, Microsoft’s “More Personal Computing” segment fared better-than-feared in Q2 as Windows OEM, Windows commercial products, and devices revenue experienced a re-acceleration. In Q2 FY2024, MSFT’s Search & News advertising revenues grew by just 8% y/y (decelerating from ~10% y/y growth in Q1 FY 2024). As you may know, Microsoft made a huge push to increase market share in “Search” advertising via a new AI-powered Bing. However, these efforts haven’t worked out so far.

Microsoft Q4 2023 Earnings Presentation

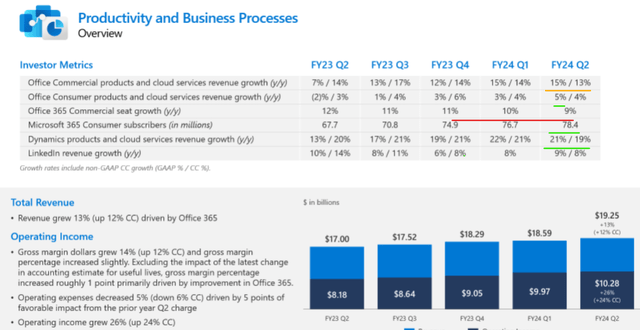

Furthermore, Productivity & Business Processes and Intelligent Cloud segment performance for Q2 was also robust from both sales and operating income perspective, which is a clear sign of Microsoft’s business resilience.

Microsoft Q4 2023 Earnings Presentation Microsoft Q4 2023 Earnings Presentation

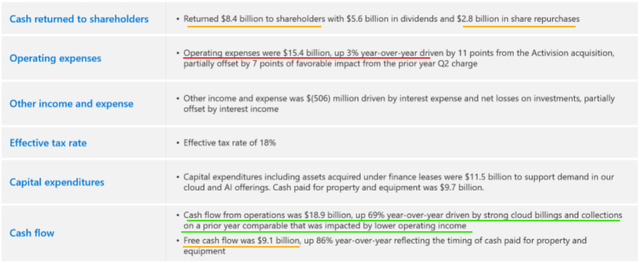

During Q2 FY24, Microsoft’s operating expenses grew by just +3% y/y while revenue growth rate accelerated to +18% y/y. Consequently, Microsoft generated $18.9B in cash flow from operations and $9.1B in quarterly free cash flow in Q2. From these free cash flows, Microsoft returned $8.4B to its shareholders in the form of share repurchases ($2.8B) and dividends ($5.6B).

Microsoft Q4 2023 Earnings Presentation

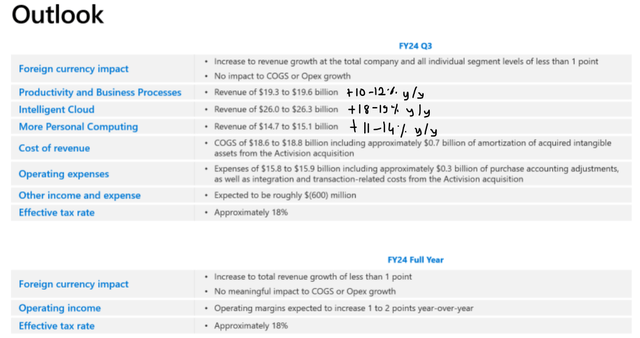

For Q3 FY2024, Microsoft’s management provided softish guidance that calls for modest growth deceleration across all three of their revenue segments. Furthermore, management warned about accelerated CAPEX spending in upcoming quarters despite guiding for operating margin improvement of 1-2 points for the full-year 2024.

Microsoft Q4 2023 Earnings Presentation

In a nutshell, Microsoft’s Q2 FY2024 report was yet another solid print from the most valuable company in the world! However, does that render Microsoft a buy at a $3T+ market cap? Let’s find out.

Is Microsoft a Buy, Sell, or Hold After Q2 FY2024 Earnings?

Back in January 2023, I downgraded Microsoft’s stock to a “Sell” rating, terming it “overloved” and “overvalued” through the following reports:

- Microsoft Stock: You Have Been Warned By Satya Nadella

- Microsoft Q2 Review: You Were Warned

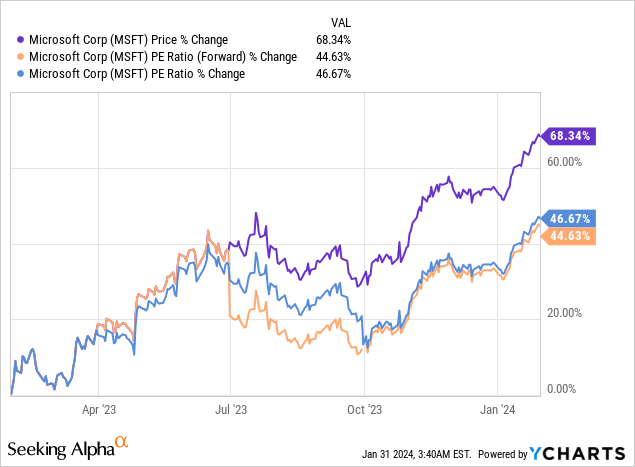

Since then, MSFT stock price has shot up from $240 to $408 (after-hours price on 31st January 2024), a gain of ~70% in the space of a year or so. While I have missed out on these juicy gains, I do not regret my decision to sell MSFT at ~$240 per share since a big chunk of these gains have resulted from an expansion in trading multiples.

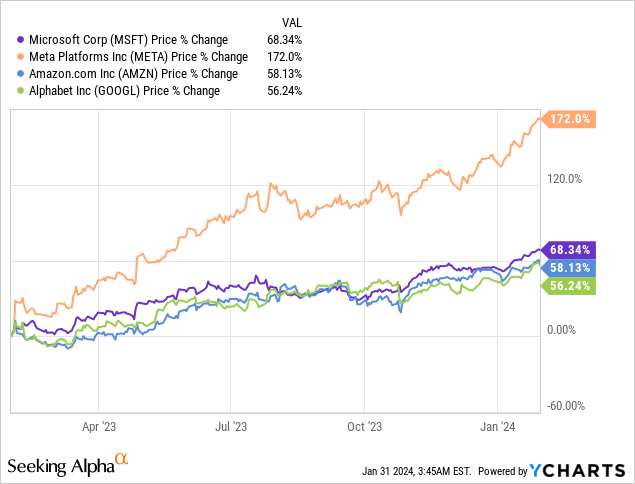

Furthermore, large gains in my big tech investments – Meta (META), Amazon (AMZN), and Alphabet (GOOG)(GOOGL) – have cushioned the blow of missing out on a stellar run in MSFT.

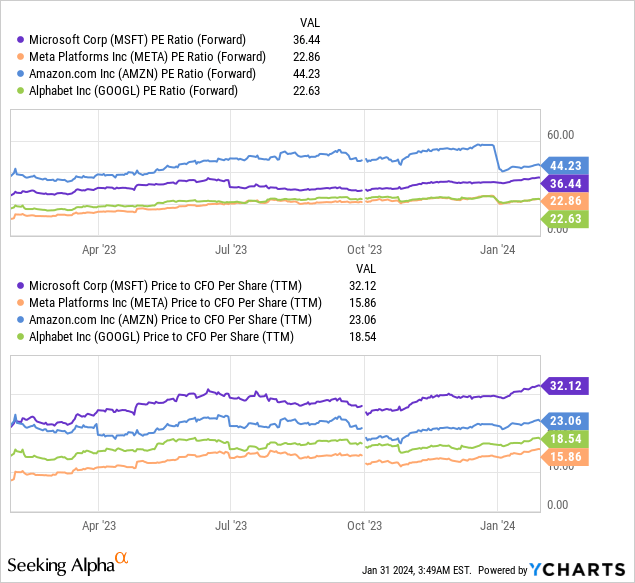

While Mr. Market is seemingly excited about Microsoft’s future prospects with tons of hype around AI, ascribing a ~38x forward P/E multiple to a mature business like Microsoft is absolutely wild in my view. As you can see on the chart below, on a relative basis (P/CFO), Microsoft is far more expensive than any of TQI’s core big tech holdings.

Even in a zero-interest rate environment, such a high trading P/E multiple for MSFT would be exorbitant. And while bulls may disagree, we no longer operate in such an environment, with risk-free (debatable) US Treasury bonds yielding nearly ~4-5%.

Despite Microsoft showing real AI substance in recent quarterly reports, it remains a mature (fundamentally sound) business that is unlikely to experience explosive hypergrowth like what we have seen with the likes of Nvidia (NVDA) and Super Micro Computer (SMCI).

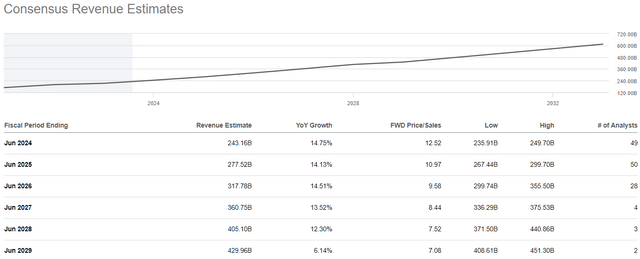

As per consensus estimates, Microsoft is projected to grow top-line numbers at low-double-digit rates for the next five years:

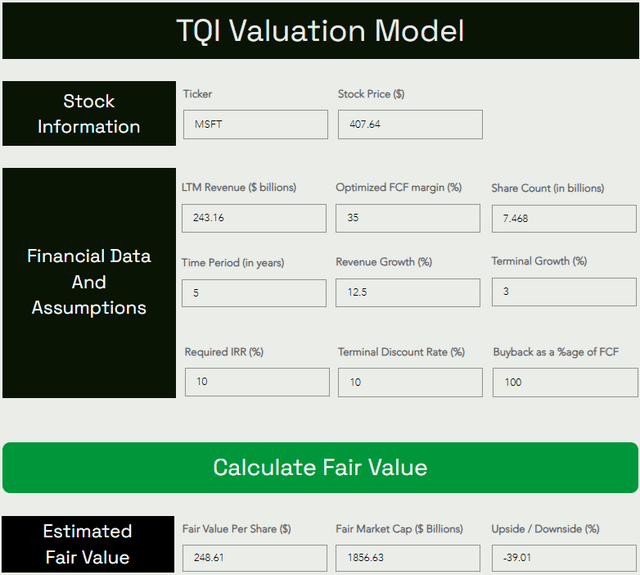

While soft landing is the consensus view in the investing world, a FED-induced economic downturn cannot be ruled out just yet. For the purpose of this valuation exercise, we will ignore the possibility of a hard landing, and utilize a generous 12.5% CAGR sales growth rate for the next five years. Furthermore, I am baking in a good bit of margin expansion by assuming optimized FCF margin of 35%. Despite using 6-month forward revenue estimates and aggressive assumptions for long-term growth and steady-state margins, Microsoft continues to look significantly overvalued:

TQI Valuation Model (Free to use at TQIG.org)

According to TQI’s Valuation Model, Microsoft’s fair value is ~$249 per share (or $1.85T). With the stock trading at ~$408 per share, I now see a downside of -40% to fair value in MSFT.

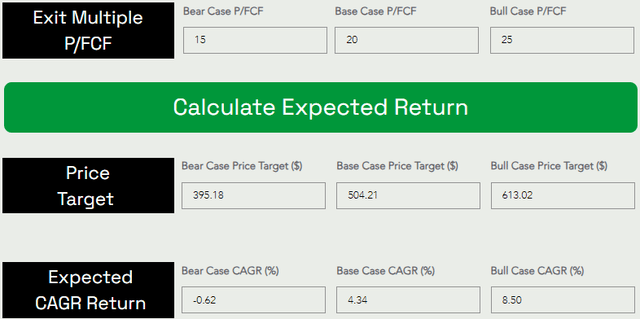

Predicting where a stock would trade in the short term is impossible; however, over the long run, a stock would track its business fundamentals and obey the immutable laws of money. If the interest rates were to stay depressed, higher equity multiples would be justifiable. However, I work with the assumption that interest rates will eventually track the long-term average of ~5%. Inverting this number, we get a trading multiple of ~20x [P/FCF].

TQI Valuation Model (Free to use at TQIG.org)

Assuming a base case exit multiple of 20x P/FCF, I see Microsoft stock rising from ~$408 to ~$504 per share in the next five years at a CAGR of 4.34%. While MSFT’s expected return falls well short of my investment hurdle rate of 15% and the S&P 500’s (SPY) long-term average return of ~8-10%, I think Microsoft’s stock is extremely frothy given its expected return is similar to that of risk-free government treasuries.

In the event of a hard landing, I could see Microsoft retracing to its fair value (and who knows, it could probably overshoot to the downside like in previous economic downturns). On the back of a 30%+ rally in MSFT stock since my last update, the long-term risk/reward for Microsoft has worsened quite a bit and I can now see downside risk of 40%+ in MSFT stock.

As you may know, I do not short individual equities. However, if I owned MSFT shares, I would make a tactical sale here and look for a better entry point through a price and/or time correction. From a fundamental perspective, Microsoft is performing well, but its stock has run up too far, too fast.

Key Takeaway: I rate Microsoft a “Sell” at $408 per share.

Thank you for reading, and happy investing! If you have any questions, thoughts, and/or concerns, please feel free to share them in the comments section below.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of META, GOOGL, AMZN either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

We’re currently running a special New Year’s sale at our investing group:

Get 50% Off On The Quantamental Investor

Sale ends today. Sign up now!