Summary:

- It’s 10 years ago Satya Nadella took over from Steve Ballmer at the helm of Microsoft Corporation.

- He guided the company through a remarkable turnaround to the biggest company on earth, giving investors a 10x return on their stock.

- We analyze the Microsoft Corporation results that were announced on Tuesday.

- Generative AI, Azure, and GitHub are driving growth and improving productivity, with potential for further expansion.

- I show several 2-step reverse valuation models that seem to indicate Microsoft is overvalued, although it also depends on what you want as a return rate.

David Becker

Introduction

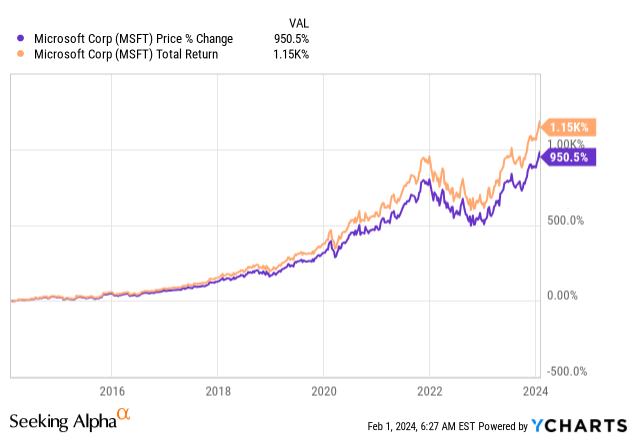

Exactly 10 years ago, Satya Nadella took over at the helm of Microsoft Corporation (NASDAQ:MSFT) from Steve Ballmer, and the company completely changed from a tech laggard on its way to becoming the new IBM (IBM) to one leading all-important trends of today, like cloud computing and generative AI. And that fueled the stock’s great returns, 950% over the last decade and 1,150% if you include the dividend.

Along the way, it became the biggest company in the world, surpassing Apple (AAPL) recently.

But is it also a great stock to buy now?

To examine that, let’s first look at the company’s fiscal Q2 results.

Microsoft’s Earnings

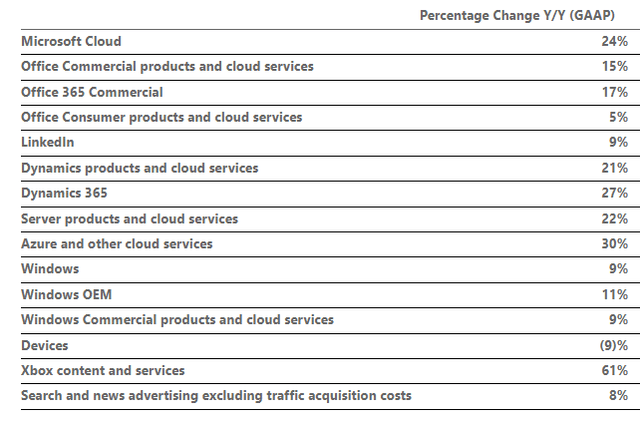

The company’s revenue in fiscal Q2 was up 17.6% year-over-year to $62 billion. That’s amazing at that size. Microsoft and the rest of the Mag 7 (more or less) have defied the law of large numbers for years. That law (in investing) says that the bigger you get, the tougher it is to grow on a percentage base. That’s very natural, but many of the mega caps continue to postpone the inevitability of this law.

This revenue growth also beat the estimates by 1.8%.

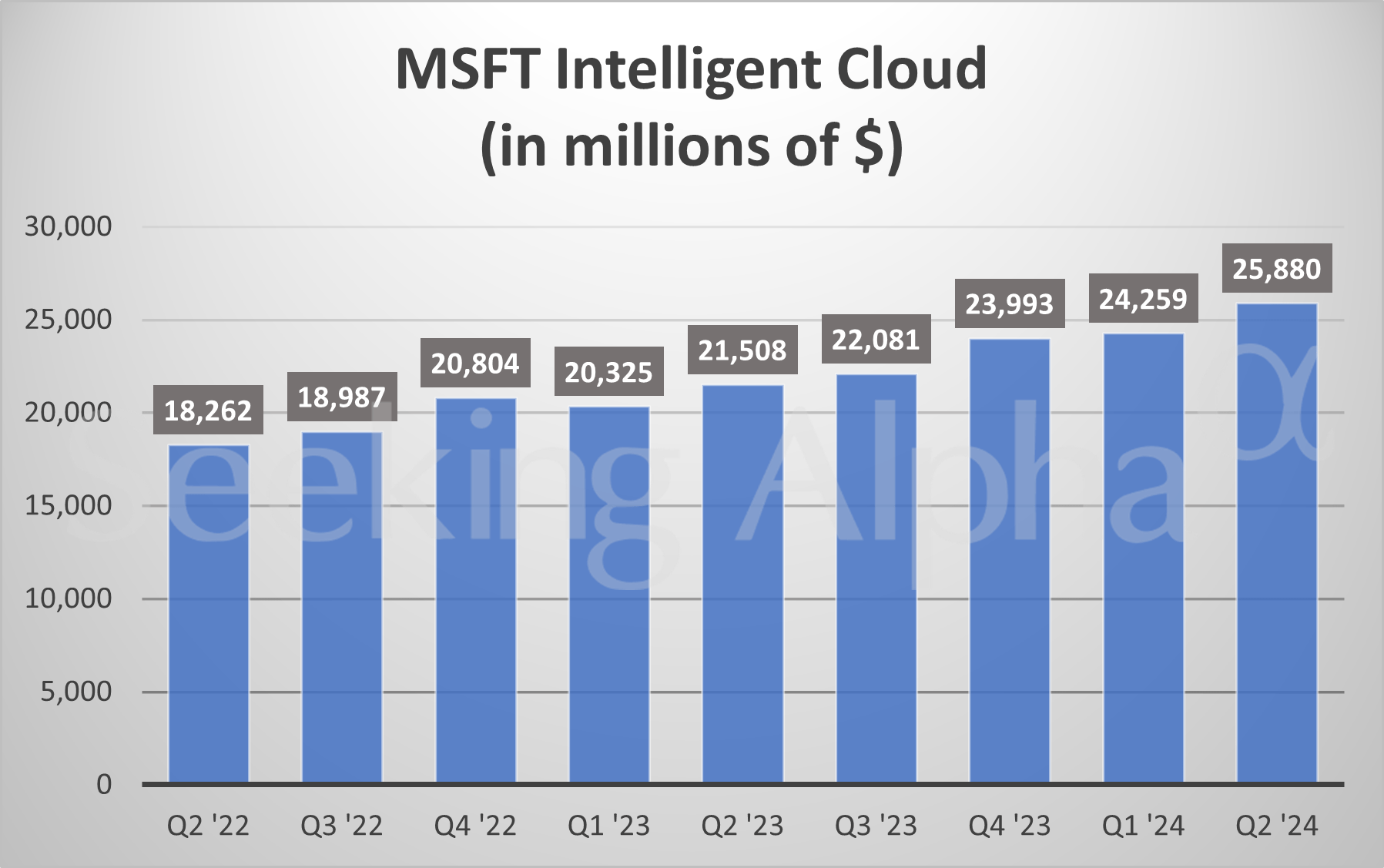

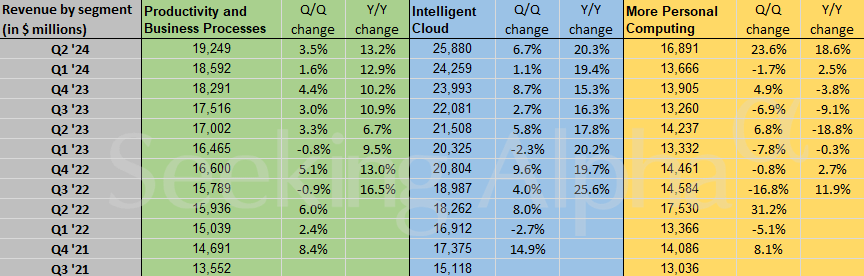

Intelligent Cloud has not only been the fastest grower in the last years, but it has also become the largest part of Microsoft, mainly because of Azure. This quarter, the division grew by 20.3% year-over-year to $25.88 billion, spurred by 30% revenue growth for Azure. Intelligence Cloud now makes up 41.7% of revenue.

Seeking Alpha

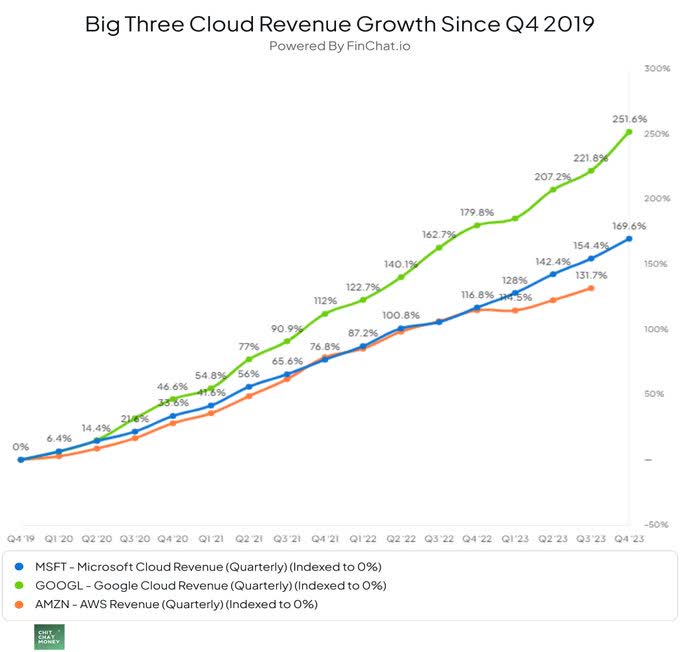

The revenue growth is phenomenal if you look at the other two of the Big Three in cloud computing – Alphabet (GOOG) (GOOGL) and Amazon.com (AMZN).

Chit Chat Money on X

Of course, we have to take into account that Amazon Web Services, or AWS, was by far the biggest in Q4 2019 and Google the smallest, so their positions in terms of growth are normal. This is more about how these giants can grow such big revenue so profoundly.

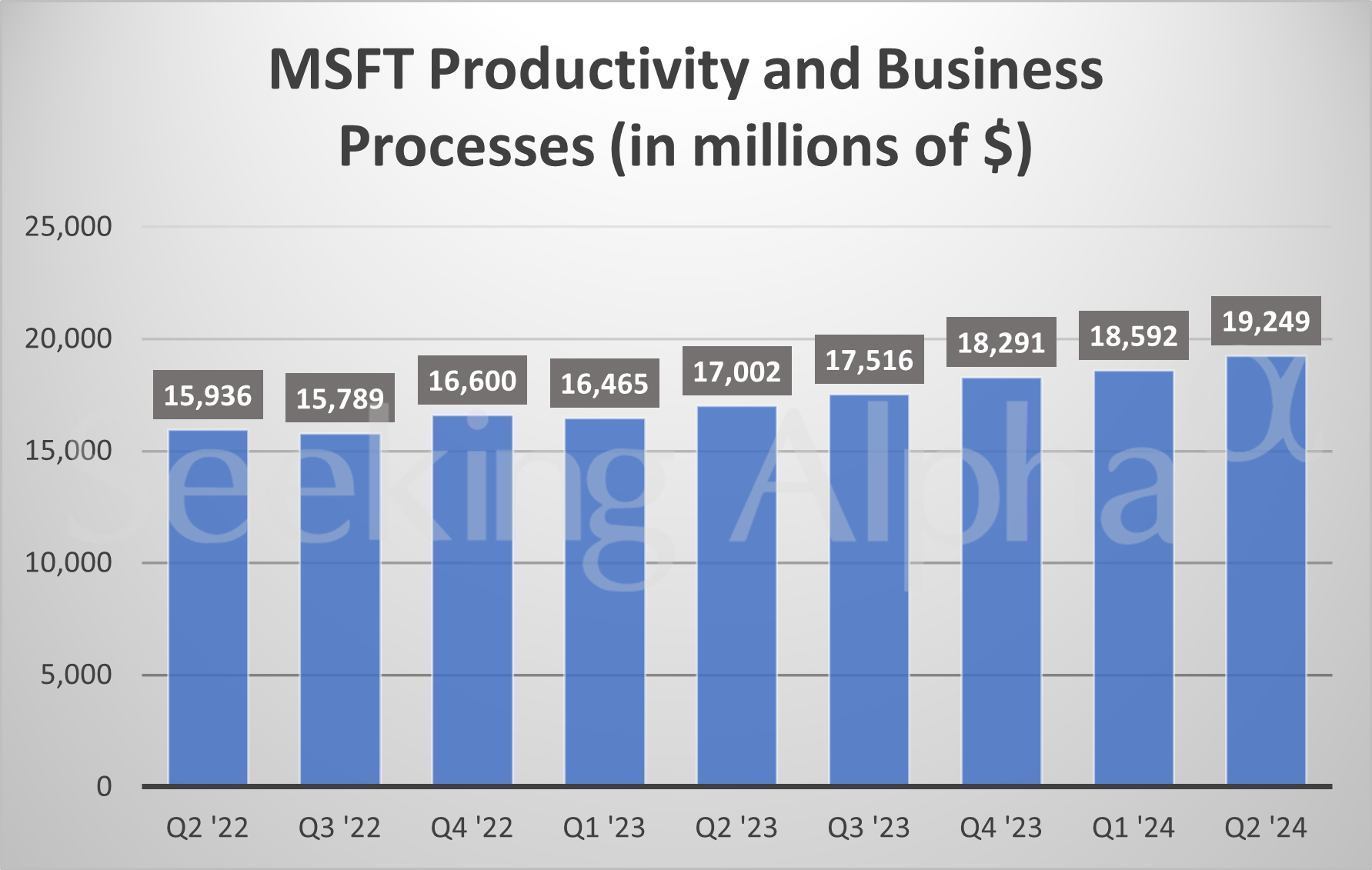

Microsoft’s second-largest business line, Productivity and Business Processes, includes Office products, OneDrive and LinkedIn. Its revenue grew 13.2% year-over-year to $19.25 billion, or 31% of the total business.

Seeking Alpha

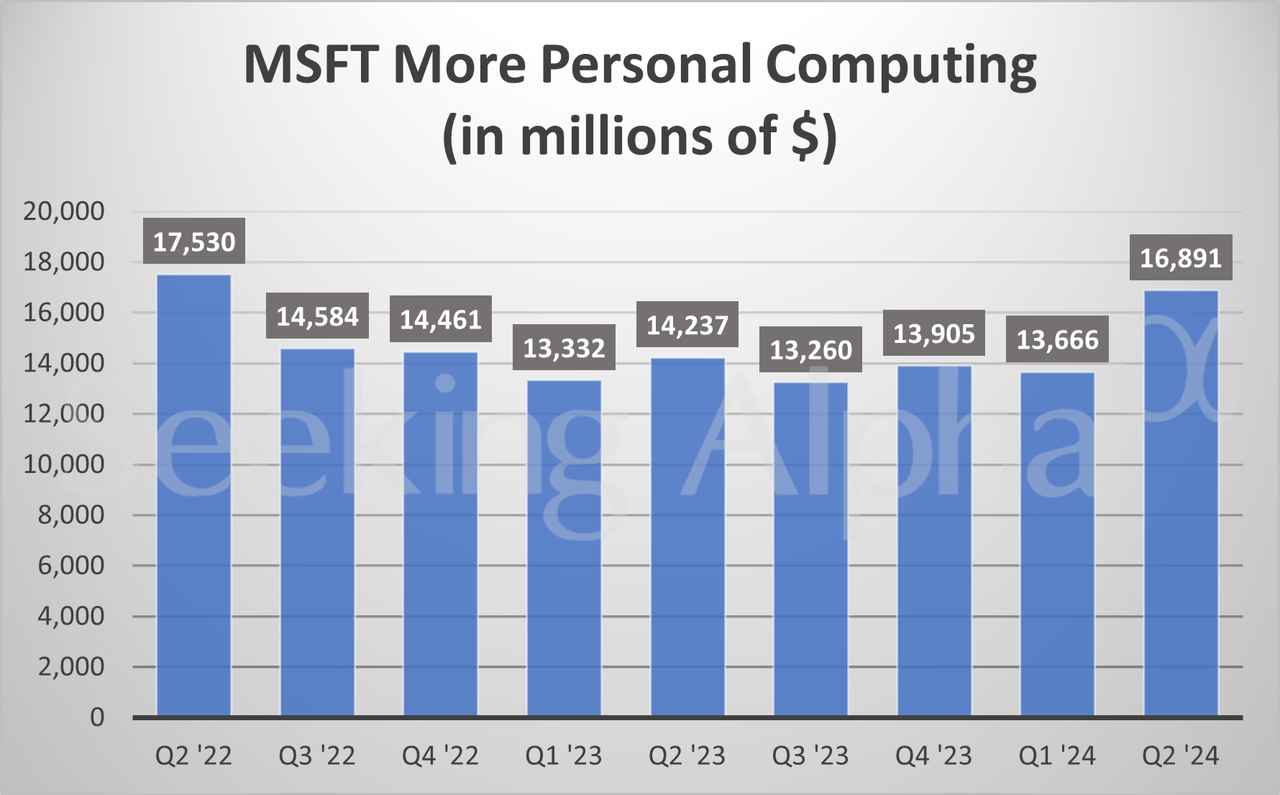

The third arm, Personal Computer and more, consists of Windows, hardware (like the Surface and Xbox), gaming, and Search & Advertising. That was up 18.6% year-over-year to $16.9 billion, or 27.3% of the revenue. The big growth here was also because of the acquisition of Activision Blizzard, of course.

Seeking Alpha

This graph gives you an overview of the segments and their history of growth.

Microsoft earnings presentation

On a purely organic basis – so without Activision Blizzard – Microsoft would have grown 13.8% year-over-year.

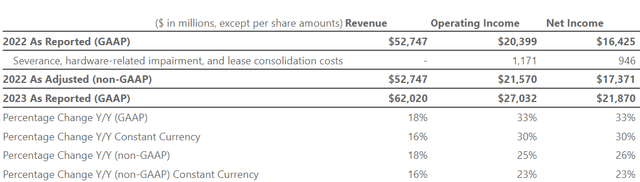

If we look at profitability, the numbers are very impressive.

While revenue was up 18%, operating income was up 25% and net income was up 26%. This clearly shows that the company has operating leverage. But we have to be careful. A big severance charge was taken in the same quarter last year, of $800 million. That automatically inflates growth as well this year.

This is a detailed overview of the trends per major product.

In terms of returning money to shareholders, the company bought back $4 billion of shares, which was mostly to offset stock-based compensation, or SBC. The share count didn’t really move a lot.

On the balance sheet, we see $72 billion in debt and $81 billion in cash and equivalents. In other words, there’s a net cash position of $9 billion.

The company guided for $60.5 billion in revenue in the next quarter, 0.8% below the consensus, but the $25.95 billion EBIT guide was 5.3% higher than the estimates. Azure is expected to grow at 28% again in the current quarter, which is higher than previously thought.

The RPO, or current Remaining Performance Obligation, grew by 17%, which indicates that the next year could see continued growth in the high teens. RPO is money that is already billed or under contract, but that can’t be recognized yet because the company still has to deliver its services for it. The current RPO is the money that will be recognized in the next 12 months, so this provides a reliable window into the next 12 months.

Generative AI, Azure, & GitHub

Of course, AI was a focal point. CEO Satya Nadella during the Q2 conference call:

We’ve moved from talking about AI to applying AI at scale. By infusing AI across every layer of our tech stack, we’re winning new customers and helping drive new benefits and productivity gains across every sector.

Of course, Nadella is referring to Co-Pilot. It was first introduced in GitHub but was later rolled out in other products as well. But Satya Nadella says this is still very early and while adoption was strong, there is much room for ARPU (average revenue per user) expansion. Nadella again on the conference call:

So you are going to start seeing people think of these tools as productivity enhancers, right. I mean, if I look at it, our ARPUs have been great, but they’re pretty low.. You know even though we’ve had a lot of success, it’s not like we had a high-priced ARPU company. I think what you’re going to start finding is, whether it’s sales copilot or service copilot or GitHub Copilot of security copilot.

Right now, generative AI, in general, already added 6 points to Microsoft’s Azure revenue, proving for all the non-believers that GenAI is NOT a hype but a full-blown paradigm shift. Azure AI has attracted 53,000 new customers, up a whopping 50% year-over-year. 50% of the Fortune 500 already use Azure AI. That’s crazy! GitHub’s revenue accelerated by over 40% year-over-year, propelled by the platform growth and adoption of GitHub Copilot.

And generative AI has a profound influence on productivity. Nadella:

A growing body of evidence makes clear the role AI will play in transforming work. Our own research as well as external studies show as much as 70% improvement in productivity, using generative AI for specific work tasks. And overall early Copilot for Microsoft 365 users was 29% faster in a series of tasks like searching, writing, and summarizing.

With increasingly specialized versions of Copilot and even broader adoption, both ARPU and the total market have a lot of room left for growth.

Very important was that Satya Nadella said this (my bold):

We’re going to continue to have these cycles where people will build new workloads, they will optimize the workloads and then they’ll start new workloads. So I think that that’s what we continue to see. But that period of massive, I’ll call it, optimization only and no new workloads start, that I think has ended at this point.

This is extremely important for all players who work in cloud data. Think of Snowflake (SNOW), Cloudflare (NET), and Datadog (DDOG), for example. The CEOs of both Cloudflare and Datadog already said on their Q3 earnings calls that they thought the optimization had seen the bottom. This is a confirmation from Nadella.

Some quick, interesting facts

A few quick facts about the other divisions:

- Microsoft 365 has achieved over 400 million paid Office 365 seats.

- AI will become integral to every Windows PC by 2024, unlocking new AI experiences for tasks like searching, summarizing, and optimizing performance.

- Over 75 million Windows 10 and Windows 11 PCs already have Copilot, and a new Copilot key has been introduced for easy access.

- LinkedIn has reached over 1 billion members, assisting in learning, selling, and hiring, with strong global membership growth.

- CFO Amy Hood talked about “accelerated capital expense to continue to be able to add capacity in the coming quarters, given what we see in terms of pipeline.” This is another green flag for Nvidia (NVDA).

Valuation

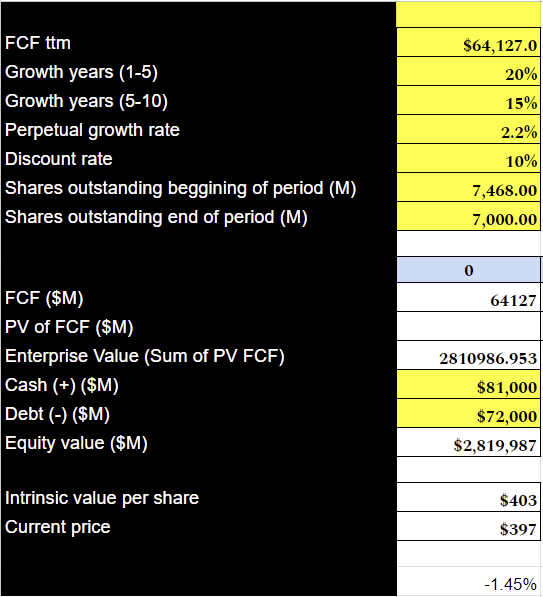

I made a quick 2-step reverse discounted cash flow, or DCF, to see what is priced in at the current price of $397.

As you see, for a 10% yearly return (+dividend), Microsoft would have to grow its cash flow by 20% in the first five years and 15% in the next five. And that is assuming a buyback of about 6.7% of the share. If you know that Microsoft grew its free cash flow, or FCF, by a CAGR of 10.8% over the last ten years and 8% in the last three years, there would have to be a quick acceleration in the next few years to make buying Microsoft at this price attractive.

If I were a shareholder, it would not be a reason to sell, though. I focus on the long term, and the best companies often surprise to the upside. But this looks like quite a high bar to jump over to me.

Made by the author

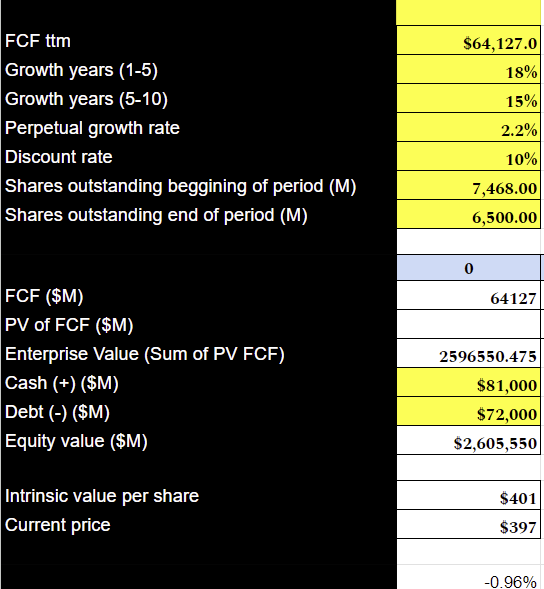

If we assume that Microsoft buys back about 15% of the outstanding shares, the FCF growth decreases only a bit in the first 5 years.

Made by the author

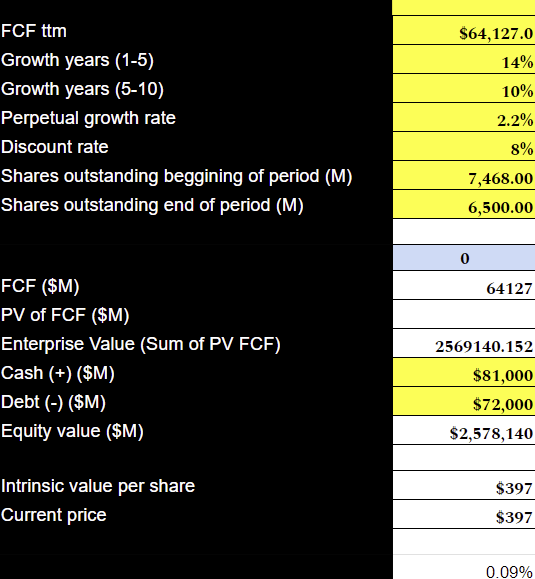

Of course, if you are happy with a return of 8% (+ the dividend!), more or less in line with the market, and you believe the company will buy back about 15% of its outstanding shares, the FCF growth expectations are lower too.

Made by the author

For me, for Microsoft to get more attractive to consider buying it, it would have to go to $300 or slightly below, so about 35% lower from here. I doubt that will happen, but I’m OK not owning this one.

Conclusion

Fiscal Q2 was another very solid quarter for Microsoft Corporation. The company keeps delivering, and AI is the new fuel for the engine that will keep pushing the biggest company in the world up for many more years.

In my opinion, a lot of that growth is already baked into the current stock price. But it also depends on your expected returns, of course.

In the meantime, keep growing!

Analyst’s Disclosure: I/we have a beneficial long position in the shares of AMZN, GOOGL, NET, DDOG either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Potential Multibaggers focuses on stocks that have the potential to go up 10x or more over the next decade.

Potential Multibaggers is for long-term investors who want to fill their portfolio with potentially life-changing returns and have the patience and equanimity to hold through volatility.

We focus on long-term fundamentals, not short-term noise.

Go from market noise to clarity and start the free trial now!