Summary:

- Microsoft’s stock price has surged by 17% since the publication of a ‘Strong Buy’ thesis, driven by strong earnings and the integration of AI-powered features.

- Azure’s capability to provide third-party AI models to enterprise customers and the acceleration of large Azure deals are key takeaways from Q3 results.

- The adoption of Copilot, an AI companion, has significantly enhanced productivity for IT developers and is expected to have high adoption rates among enterprises.

jewhyte

I published my ‘Strong Buy’ thesis for Microsoft (NASDAQ:MSFT) in my initiation report, published in July 2023. Since then, the stock price has surged by about 17%. I highlighted Microsoft’s capability to integrate AI-powered features into all their software and platforms. They released their Q3 FY24 earnings on April 25th with 17% of constant revenue growth and 23% of operating profit growth, beating the market expectations. I am encouraged by their Copilot and Azure AI, extending Microsoft’s existing technology advantage. I reiterate my ‘Strong Buy’ rating with a one-year target price of $510 per share.

Acceleration of Large Azure Deals and Infrastructure for 3rd Party AI Models

My biggest takeaway from their Q3 result is the acceleration in the number of large Azure deals, and Azure’s capability to provide third-party AI models to enterprise customers. To boost computing powers, Azure teams up with NVIDIA (NVDA) and AMD (AMD) to leverage the massive GPU computing power, and provide 3rd party AI models to enterprise customers.

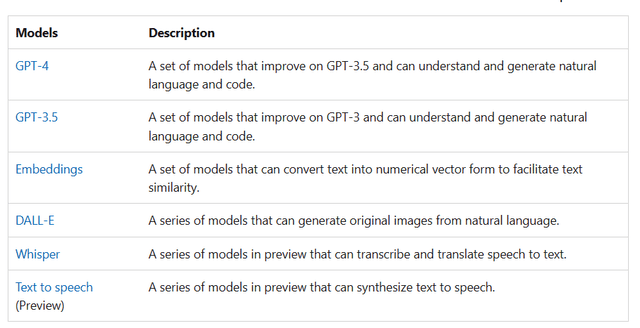

For instance, Azure offers OpenAI Service, granting REST API access to OpenAI’s powerful language models including the GPT-4, GPT-4 Turbo with Vision, GPT-3.5-Turbo, and Embeddings model series, as disclosed in their manual. These models would enable Azure users to conduct large model machine learnings and handle various AI-related workloads.

As communicated over the earnings call, >65% of the Fortune 500 utilize Azure’s OpenAI Services. I expect the industry adoption will accelerate in the near future, as Microsoft extends their services to small and mid-sized enterprises at affordable costs. The primary costs for AI computing are GPUs and energy costs. With more companies entering the attractive GPU market, I forecast the cost of GPUs will decline overtime. The improving cost structure could pave the way for industry adoptions among small and mid-sized customers.

Microsoft anticipates that Azure OpenAI and related APIs atop Azure could become the major growth driver for their cloud infrastructure business. Azure’s AI models could offer developers best tools to perform large language models and implement AI related workloads. As a result, Microsoft has been securing larger and more strategic Azure deals with an increase in the number of $1 billion plus Azure commitments. During the earnings call, Microsoft indicated that they experienced an acceleration in the number of large Azure deals in the quarter. The number of deals surpassing $100 million increased by 80% year-over-year, which is quite remarkable. As such, I am quite optimistic about their Azure AI growth in the upcoming years.

For enterprises conducting AI workloads, they have to move these workloads to cloud first, then utilize existing AI models for LLMs. It would be more convenient for enterprises to use Hyperscalers’ AI related APIs, as enterprises do not need to manage different vendors ((cloud infrastructure and model provider)). More importantly, enterprises can choose and switch different AI models offered by their cloud infrastructure provider. Therefore, Azure has unique advantage for its AI model offerings.

Adoption of Copilot

In September 2023, Microsoft announced their Copilot strategy. As an AI companion, Copilot could incorporate the context and intelligence of the web and work data, improving productivities for users. As disclosed, Copilot will be rolling out across Microsoft’s major applications and platforms. Specifically, the next Windows 11 update brought Copilot and new AI-powered functions to all major apps. Their search engine and browser: Bing and Edge, have been powered by the latest AI models. Additionally, OpenAI’s GPT-4 Turbo is available in Copilot and enterprise customers can leverage OpenAI’s latest model for their AI-related workloads.

As communicated in the earnings call, GitHub Copilot has significantly enhanced productivity for IT developers, being utilized by 1.8 million paid subscribers, representing a 35% year-over-year growth.

Most importantly, Microsoft is making Copilot available to all types and sizes of enterprises. Nearly 60% of the Fortune 500 enterprises are now using Copilot service. I think Copilot will bring Microsoft to a fresh new level, embedding AI into all major applications. Key reasons are:

It costs $30 per user per month for subscription to Copilot for Microsoft 365, which includes everything in Copilot plus AI in Word, Excel, PowerPoint, OneNote, Outlook, Teams, Copilot Studio, and data protection. As indicated in the latest conference, their management stated that Microsoft conducted a survey with 100 CIOs, and 38% of them are expected to adopt Microsoft’s Copilot in the next 12 months. I anticipate Copilot is going to have a high adoption rate, as these AI-powered functions could improve employee’s productivities and save additional costs for enterprise customers. In addition, enterprises might need to adopt the latest AI-powered 365 in order to attract experienced talents.

Microsoft 365 Chat is indeed a core feature of Copilot, enabling it to analyze a wild range of data sources including emails, meetings, chats, documents, and web contents. I argue that only Microsoft possesses the true capability to leverage all sources of data and integrate these data points to provide valuable insights for enterprise customers. With Microsoft’s expansive ecosystem encompassing the operating system, email services, Team meetings, various applications, search engine, office suite, and internet browser, the integration of Copilot with these existing applications holds immense potential, in my view.

Financial Recap and FY25 Outlook

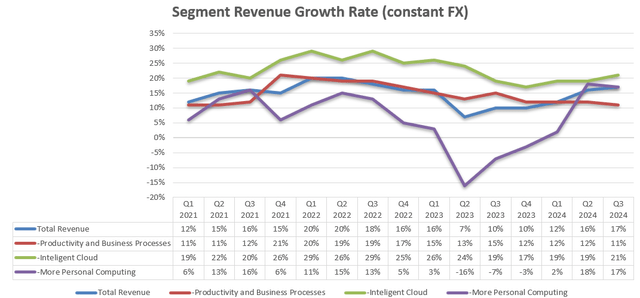

In Q3 FY24, Microsoft delivered 17% constant revenue growth and 20% EPS growth, beating the market expectations. As illustrated in the chart below, Microsoft’s business growth has been accelerating in recent quarters, primarily driven by strong intelligent cloud growth and the market recovery of personal computing.

As Microsoft has already delivered strong topline and earnings growth in the past three quarters, they are more likely to deliver double-digit revenue growth and 20%+ EPS growth for FY24. The market will pay more attention to their FY25’s growth potential, and I am considering the following aspects:

-For Azure Cloud business, I assume they will maintain 20%+ growth over the next few quarters. As communicated by all the major hyperscalers, including Microsoft, Amazon (AMZN) and Alphabet (GOOGL), enterprises began to optimize their cloud consumptions in 2023 in order to reduce the overall IT spending budget. In the most recent quarter, the three cloud players all indicated that the optimization was nearing completion, and they expect cloud spending to normalize in the near future. As such, I anticipate Microsoft’s cloud growth will accelerate in FY25. In addition, Microsoft has expanded their AI capabilities in Azure infrastructure, providing third-party AI APIs for enterprise customers. These AI capabilities would enhance their revenue growth potential in FY25, in my view.

– Microsoft still has huge growth potential in their Office E5 penetration. During the recent conference, Microsoft discloses that Office E5 only has 12% penetration rate among their Office 365 base, as such, they have a huge growth opportunity through E3-E5 upgrades. Office E5 provides enhanced security features including Cloud App Security, Defender, as well as BI Pro application. Cloud security is quite important for enterprise customers and the upgrade from E3 to E5 could bring additional value for enterprise customers, better leveraging Microsoft’s Copilot and related AI functionalities. Consequently, I anticipate the upgrade could contribute to tremendous growth for Office 365.

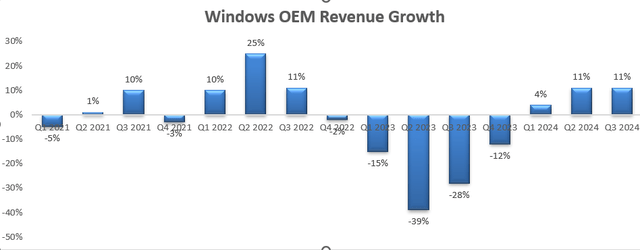

– Lastly, Windows OEM growth is tied to the PC shipment to some extent, which is quite volatile in nature. As depicted in the chart below, Windows OEM grew by 11% in Q3 FY24, rebounding from sluggish growth in FY23.

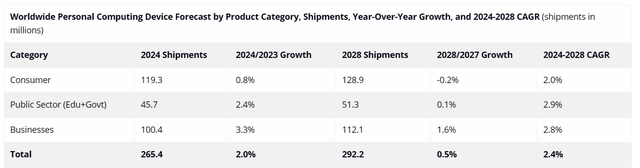

IDC predicts that the global PC shipment will grow at a CAGR of 2.4% from 2024 to 2028, as detailed in the table below. As such, I predict Microsoft will generate around 5% of revenue growth from Windows OEM in FY25, reflecting 2.5% volume growth and 2.5% price growth.

Putting everything together, I calculate that Microsoft will deliver 15% of topline growth in FY25.

Valuation Updates

As discussed, the revenue is expected to grow by 15% year-over-year in FY25, primarily driven by 20%+ Azure cloud growth, E3 to E5 upgrades, and Copilot and Azure AI stack growth. Please note that Microsoft completed the acquisition of Activision Blizzard in Q2 FY24, which will be reported in More Personal Computing segment.

On the cost side, Microsoft has been working on their cost optimization initiatives. The total number of headcounts at the end of December 2023 was 2% lower than one year ago. At the same time, Microsoft has been increasing R&D spending on AI, which could exert some cost pressure on gross profits. I anticipate Microsoft will achieve a 10bps margin expansion from gross margin, and 20bps from sales & marketing expense leverage. The sales & marketing spending as a % of total revenue declined from 15.8% in FY18 to 10.7% in FY23. I anticipate Microsoft could continue to benefit from the operating leverage from their sales & marketing expenses as Microsoft is providing more products related to AI and cross-selling could improve salesforce productivities.

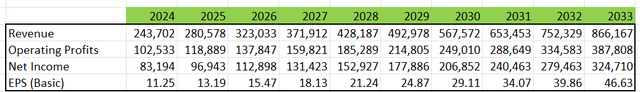

The revenue, operating profits and net income are projected as follows:

Microsoft DCF – Author’s Calculations

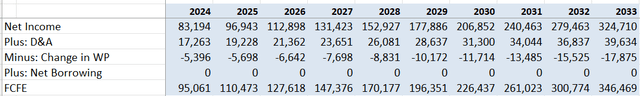

In order to calculate free cash flow to equity, I adjust their net income with depreciation & amortization, working capital changes and net borrowings.

Microsoft FCFE- Author’s Calculations

The cost of equity is estimated to be 12% for Microsoft with these assumptions: risk-free rate 4.22% (US 10-Y Treasury Yield); equity risk premium 7% and beta 1.12 (SA’s DATA). Discounting all the future FCFE, the one-year price target is calculated to be $510 per share. As Copilot and Azure AI stack haven’t generated meaningful growth for Microsoft at present, the market might be underestimating the strong growth potential from these AI related investments.

Key Risks

Microsoft has been allocating more than 13% of total revenue towards capital expenditures, primarily driven by increasing investment on cloud infrastructure, data centers and AI related investments. I don’t anticipate Microsoft will slow down their capital expenditure in the near future. As communicated over the earnings call, Microsoft will increase their CAPEX spending in FY25.

Their cloud business is still growing at 20%+, and the increasing AI demands require them to boost computing power and purchase more GPUs from Nvidia and AMD. Although the increasing CAPEX would impact their free cash margin in the near future, I think Microsoft is making the right investment for their future growth.

As reported by the media, Microsoft will stop packaging its Teams videoconferencing app with its Office software after the practice attracted antitrust scrutiny. Without bundling, Microsoft might encounter some headwinds for their Teams growth. Customers will need to purchase Teams subscription separately, and in that case, customers might opt for other videoconferencing apps like Zoom (ZM).

Conclusion

I believe Microsoft is well positioned to capitalize on AI related investments, with both Copilot and Azure AI holding significant growth potential in the AI era. Microsoft’s comprehensive AI offerings span across operating system, searching, gaming, Office 365, cloud infrastructure, emails, and online collaborations. I am encouraged by their acceleration of large Azure deals in recent quarters, signaling enterprises are ramping up their investment in AI and cloud transition. Consequently, I reiterate my ‘Strong Buy’ rating with a one-year target price of $510 per share.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of MSFT either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.