Summary:

- Microsoft’s 4% pullback in post-4Q FY2023 earnings is due to slower growth in the Azure and cloud segment, but the company is well-positioned to capitalize on demand for generative AI.

- Its current P/E of around 35x is close to the Nasdaq index, and in terms of AI exposure among the “Magnificent Seven,” I believe MSFT is considered the most undervalued.

- MSFT’s recent monetization initiative with Microsoft 365 Copilot is expected to contribute top-line growth in the next following quarters.

- The company is actively targeting an increase in its CAPEX, which is fueled by the rapid expansion of AI within the industry’s TAM.

Laurence Dutton

Investment Thesis

Despite Microsoft (NASDAQ:MSFT)’s 4% pullback due to a lackluster growth in its cloud segment in 4Q FY2023, the management signaled a further growth decline in 1Q FY2024. While MSFT is well positioned to capitalize on the significant demand for generative AI in the coming decade, with a P/E TTM of around 35x, the multiple is slightly higher than the Nasdaq Index’s P/E of 33x. However, in terms of AI exposure among the “Magnificent Seven“, I believe MSFT is actually the most undervalued.

MSFT’s recent monetization initiative with Microsoft 365 Copilot is expected to drive some top-line growth in the near future. As a major market leader in the software and cloud industry, the company is able to maintain its dominant position in the increasingly competitive market. Its robust cash flow provides substantial support for a higher capex trend.

Moreover, the price action has been well-coordinated with upward earnings revisions, making its valuation more appealing compared to other peers. Therefore, considering the previous overbought signal, I maintain the buy rating for the stock, as this post-earnings selloff presents a favorable buying opportunity for long-term investors.

4Q23 Takeaway

In 4Q FY2023, MSFT exceeded expectations on both revenue and GAAP EPS consensus. However, investors were disappointed by a sequential growth slowdown in the ‘Azure and Other Cloud’ segment. Given the recent AI-fueled rally, it seems that MSFT’s recent price action had already factored in high expectations for the cloud segment. This could possibly explain the 4% selloff during the 4Q earnings call, as the management provided a lackluster cloud outlook for 1Q FY2024.

During the earnings call, an analyst asked about the Azure’s growth outlook in the upcoming quarters. However, instead of directly addressing the short-term growth, CEO Satya Nadella focused on discussing the long-term growth outlook for Azure,

“Then Azure, the way I think about it is we still are, whatever, you’re inning 2 or inning 3 of even the cloud migration, especially if you view it, right, whether by industry moves to the cloud, segment move to the cloud as well as country adoption of the cloud, right? So there’s still early innings of the cloud migration itself. So there’s a lot there still.”

Therefore, I believe the market initially priced in an upbeat outlook on Azure but did not receive a clear answer from the management during the earnings call. I think MSFT may face some near-term headwinds due to the continued deceleration in its cloud segment.

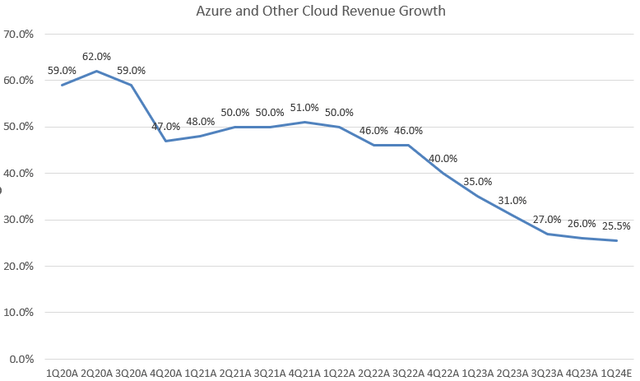

Looking at the chart, we can observe that the growth in the cloud segment has been decelerating since 4Q FY2021. Despite the company’s primary focus on AI platform shift this year, the market is eagerly seeking any signs of growth acceleration to confirm the success of their AI monetization efforts.

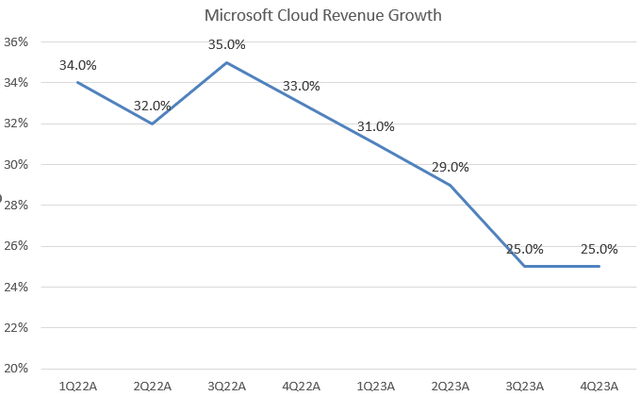

Now, let’s look at MSFT’s Microsoft Cloud Revenue. The 4Q23 Press Release reported a 25% YoY constant currency growth, which maintains the same YoY growth as in 3Q FY2023. This indicates that MSFT did not accelerate the growth in the Microsoft Cloud segment either. Therefore, we can conclude that MSFT’s AI monetization has not seen significant progress, which may have disappointed some investors. However, I believe the recent pullback could be an attractive buying opportunity for long-term investors.

Monetization on AI Products is Key

During MSFT’s partners conference, the company surprised investors by announcing the pricing for M365 Copilot at $30 per user per month, which I believe greatly exceeded market expectations, leading to a positive 4% stock gain. However, the company has not disclosed the general availability date yet. The better-than-expected pricing has given MSFT a first-mover advantage and may signal increased pricing and monetization trends in the software industry, serving as a significant catalyst for other AI-centered software companies.

Nevertheless, some investors have expressed concerns that the high price could potentially limit demand, particularly given the current limited availability of GPUs, which might impact broader adoption in the early stages. However, considering MSFT’s favorable branding and leading role in the market, I believe there won’t be a structural demand weakness despite the premium price tag for its AI product. On the contrary, software companies should consider implementing monetization strategies to boost their top-line growth, given the increasing importance of Generative AI (GAI) in the global economy.

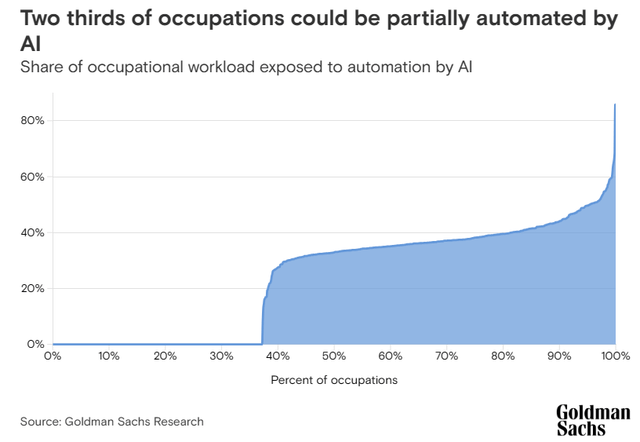

GAI Could Significantly Boost Global GDP

According to the Goldman Sachs research, over a 10-year horizon, GAI has the potential to significantly boost global GDP by 7% and increase productivity growth by 1.5%. Under this backdrop, I believe that MSFT is actively aiming to increase its capex in FY2024, driven by the rapid expansion of AI within the industry’s total addressable market (TAM). MSFT’s well-established branding and robust cash flow profile provide a clear comparative advantage compared to non-profitable peers.

I also believe that the increased capex is expected to create a positive cycle of investment, reshaping industries, and unlocking new opportunities for innovation and efficiency. As GAI continues to evolve and integrate into various sectors, MSFT’s prominent position in the software industry positions them favorably to capitalize on the transformative potential of future AI developments. By leveraging their leadership in this domain, MSFT is well-positioned to harness the opportunities that arise from the ongoing evolution of GAI and drive substantial growth and impact across multiple sectors.

In addition, the CEO Nadella in the partner conference addressed the massive opportunity in AI industry. According to his outlook, AI currently represents approximately 10% of GDP. To illustrate this, in an economy with a total value of $100 trillion, AI has the potential to contribute an additional $7 to $10 trillion to the GDP. Furthermore, Nadella pointed out that for MSFT and its partner ecosystem, AI adoption could lead to a significant increase of 50% in their TAM.

AI Drives Azure Growth Potential

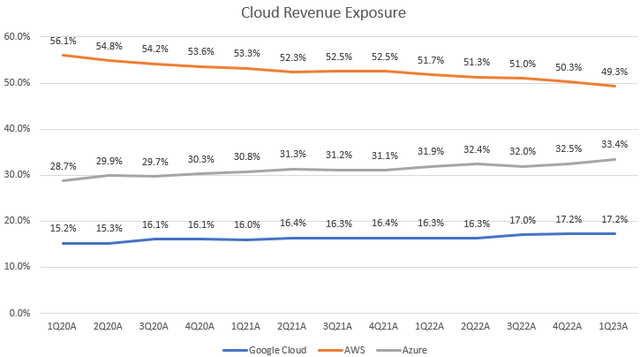

I want to clarify that the chart above displays the percentage exposure of each vendor’s cloud revenue in relation to the total cloud revenue of all three vendors in each calendar quarter (not fiscal quarter).

The increasing demand for AI-related products has emerged as a significant catalyst for MSFT’s Azure platform. Many businesses from different industries are realizing the potential of AI and relying on cloud platforms that can handle complicated AI workloads. Azure offers a wide range of AI services, like Azure Machine Learning, Cognitive Services, and Bot Services, making it a top choice for AI development and deployment.

Based on the previous analysis, I believe that Azure has the potential to narrow the gap with Amazon’s AWS in the near term and potentially become the leading cloud vendor in the industry. As the demand for AI solutions continues to surge, Azure’s specialized offerings and capabilities position it favorably to attract more customers and solidify its position as a dominant player in the cloud computing market.

Valuation

This year, the technology sector has been the top performer, significantly outpacing the S&P 500 index, mainly fueled by the relentless AI-driven rally. Specifically, the software sector ETF (IGV) has seen an impressive 40% YTD. Currently, the software sector is trading at a P/E of 45x for FY2023.

Despite Microsoft’s strong 44% YTD rally, its valuation remains relatively attractive at 36x Non-GAAP P/E FY2023, which is lower than the software sector’s average. Taking into account MSFT’s adjusted earnings consensus for FY2024, the stock is presently trading at 33x P/E, indicating that its recent price action is not excessively inflated compared to other AI beneficiaries like NVDA (59x) and TSLA (63x).

Looking at the chart, we observe that MSFT’s P/E GAAP TTM has expanded from a low of 23x last year to the current 37x, which is roughly 10% higher than its 5-year average. Therefore, considering the significant increase in valuation among AI-related stocks this year, I believe MSFT still remains very attractive now.

Downside Risk

In addition to potential upside factors, investors should also consider some downside risks. From a macro perspective, there is a concern that headline inflation could remain sticky or reaccelerate, leading to a more hawkish stance from the Federal Reserve, resulting in higher interest rates and a possible hard landing. Although the risk of a recession may have been pushed out to 2024 due to the lagging effect of monetary tightening, the current inverted yield curve implies a potential economic downturn in the near term that could still impact MSFT’s growth outlook and stock price.

On a company-specific level, it’s important to consider that any potential delays in AI monetization could also impact MSFT’s top-line growth. The recent rally in the stock has largely been driven by the market’s expectation of significant growth reacceleration, mainly due to AI and machine learning integrations. Therefore, any unforeseen setbacks in the realization of these growth prospects could influence investor sentiment and potentially affect the stock’s performance.

Conclusion

Regarding MSFT’s 4Q FY2023 earnings, the market had initially priced in high expectations for Azure’s performance, but the lack of a clear outlook during the earnings call resulted in a 4% selloff. The deceleration in the cloud segment’s growth and the perceived delay in AI monetization may have disappointed some investors. However, for long-term investors, the recent pullback presents a potential buying opportunity, considering MSFT’s dominant position in the software and AI space and its potential for future growth and innovation. Therefore, I remain buy rating on the stock as the current valuation is still reasonable, and investors can consider adding to their positions during any future pullbacks.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of MSFT either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.