Summary:

- Microsoft ended FY23 on a strong note, with a 13.4% increase in revenues and an EPS of $2.69 both significantly exceeding expectations.

- The company reported another quarter with significant share gains in cloud and search, outperforming its most notable rivals in Amazon and Alphabet.

- The Activision Blizzard acquisition is nearing completion, with potential cost savings and cross-selling opportunities expected to boost Microsoft’s gaming operations.

- The avalanche of positive announcements continues, as nobody seems to keep up with Microsoft’s unparalleled execution, the company has laid the groundwork for an extraordinary FY24.

- I reiterate a Buy rating on MSFT and upgrade my price target to $389 per share.

Stephen Brashear/Getty Images News

Microsoft (NASDAQ:MSFT) ended FY23 on a strong note, announcing results that demolished expectations. Revenues in the fourth quarter increases by 8.3%, and EPS came in at 2.69$ a $0.14 beat. After another quarter of market share gains in cloud and search, unparalleled execution in AI, and an avalanche of positive announcements in Copilot and gaming, the foundations for an extraordinary FY24 are all set.

I anticipate that Microsoft will maintain its market outperformance in the foreseeable future, and I confidently reiterate my Buy rating with an upgraded price target of $389 per share.

Introduction

In my earlier article on Microsoft in May, I advised investors to look beyond the stock’s sharp incline and instead concentrate on its strong fundamentals, which justified a Buy rating even at that higher level. Since then, Microsoft has continued to surpass the market and even outperform its prominent AI rival, Alphabet (GOOG) (GOOGL).

I encourage you to read the comprehensive article titled ‘Microsoft: Good Luck Trying To Beat Its Bundling Power‘, where I delved into the company’s operating segments, bundling strategy, management quality, and growth pillars. In this follow-up article, we will focus on the recently announced results and provide an outlook for an extraordinary FY24.

Microsoft FY23 Financial Overview

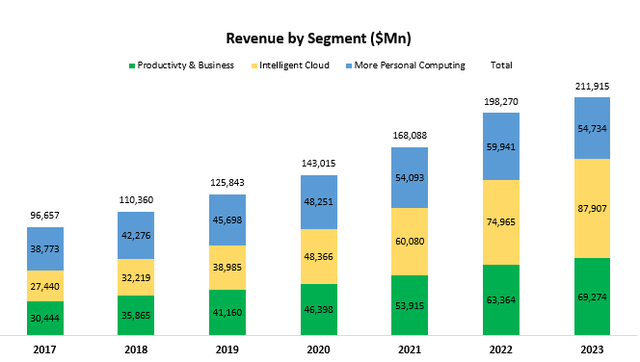

Created by the author using data from Microsoft’s financial reports (10-K)

In FY23, Intelligent Cloud grew by 17.3%, led by market-leading growth in Azure. Productivity & Business grew by 9.3%, as the company’s irreplaceable offering for productivity solutions continued to show strength despite the tougher environment. Lastly, More Personal Computing declined by 8.7%, experiencing headwinds in devices, gaming, and OEM, as previously discussed macroeconomic pressures and pulled-forward demand caused by the pandemic continued to weigh down on the segment.

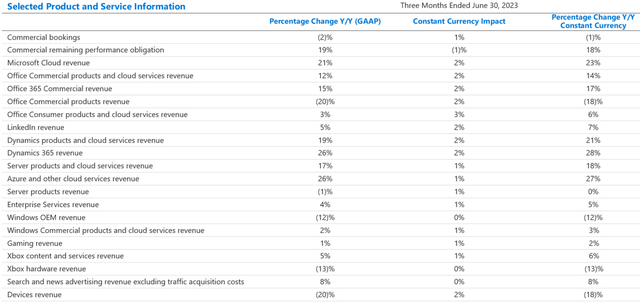

Microsoft FY23 Earnings Slides

Looking at fourth quarter performance broken into individual products and services, we can see that devices, Windows OEM, and on-premise items are the only ones that are experiencing declines, while most of the other products and services grew by double digits. Notably, Azure had another quarter of 27% growth on a constant currency basis, and office products grew at the mid-teens.

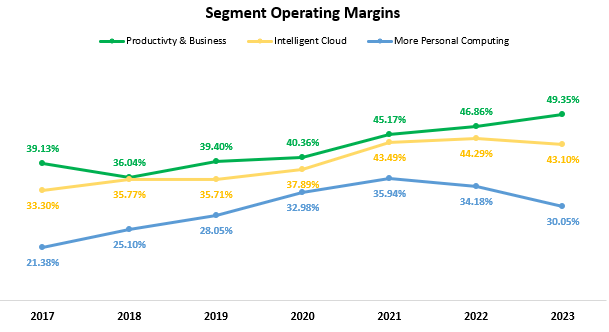

Created by the author using data from Microsoft’s financial reports (10-K)

As we can see, margins contracted in Intelligent Cloud and More Personal Computing, although for different reasons. Cloud is seeing increased investments in developing the company’s AI offerings, as well as short-term pressures from customers’ optimization projects. In Personal Computing, the problem is mainly in the top line, as demand slows.

And looking at Productivity & Business, it seems pretty much unbreakable at this point, with margins expanding an additional 2.5 points in a year that was supposed to be tough. I guess that’s the benefit of providing essential software services that are for enterprises and individuals all over the world.

Microsoft FY23 Earnings Slides

For the first quarter of its fiscal 2024, Microsoft expects double-digit growth in its core software segments. Specifically, looking at the mid-point of the range, Productivity & Business revenues should grow by 10.2%, and Intelligent Cloud is expected to grow by 15.3%, again led by Azure which is projected to grow by 27%. In More Personal Computing, management expects a 4.7% decline, as headwinds begin to ease, but are yet to fully recover. Margin-wise, management is targeting an operating margin of 42.8%, in line with the prior year period.

Cloud – Continued Market Share Gains

The three main players in cloud infrastructure are Microsoft with Azure, Amazon (AMZN) with AWS, and Google with Google Cloud. As of the end of June 2023, Amazon should still remain the largest in terms of sales, with $23.7B, according to its guidance. Google Cloud remained the smallest, with $8.0B, and Azure is estimated to be at around $18.4B.

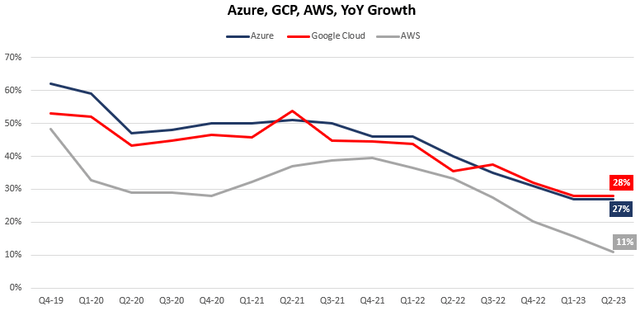

Created and calculated by the author using data from the companies’ financial reports; Microsoft’s fiscal quarter is two periods ahead of the calendar year, meaning Q2-23 is Microsoft’s fiscal Q4-23.

As we predicted in our May article, Azure has laid a smackdown on its competitors during the last quarter. We don’t have AWS numbers yet, as Amazon is set to announce its results only next week, but if we take their 11% guidance which was provided in their last call, we can understand that Azure has potentially outpaced AWS by 2.5x and nearly 2x in terms of absolute dollars.

Furthermore, we can see that Microsoft is not only taking share from the industry leader, but it is also protecting its share against the much smaller Google Cloud, which grew by a similar 27%.

Search – Putting Pressure On Google

Let me begin with an important disclaimer – I have no doubt Google will remain the significant leader in search in terms of market share for the foreseeable future. However, this doesn’t mean Microsoft doesn’t have significant upside with its search business, as the company estimates that every 1 point of search advertising market share gained equals an incremental $2B in revenue. And so far, the company is on a great pace.

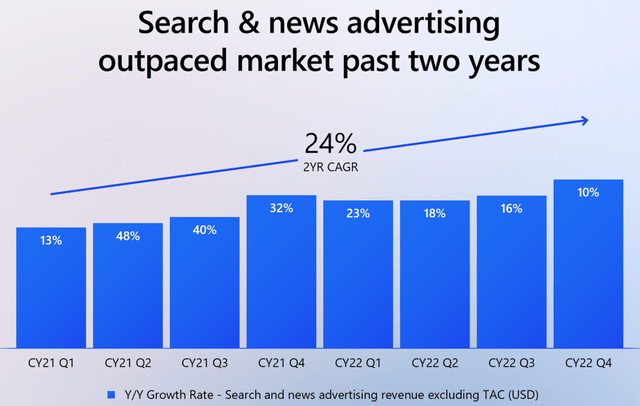

Microsoft New AI-powered Bing and Edge Conference Presentation

The trend continued last quarter, as Microsoft’s search and news advertising grew by 8%, whereas Google Search has grown by 4.8%, although it’s important to note that the latter is still significantly larger.

Activision Blizzard Acquisition

After a rigorous and extensive process, the Activision Blizzard (ATVI) acquisition is now on the cusp of completion, with reports suggesting a significantly high probability of over 90%. The latest development reveals that a Federal Trade Commission official has withdrawn its internal suit against the deal, and the preliminary injunction that posed a potential obstacle has been denied.

In a recent update, the involved companies have decided to extend the deal deadline, making some minor adjustments to their termination terms. One significant change worth noting is the increase in the termination fee in the event that the deal falls through.

Under the revised terms, should the termination happen after August 29, 2023, Microsoft will be liable to pay Activision $3.5 billion, surpassing the initial termination fee of $3 billion. Furthermore, if the termination occurs after September 15, 2023, the compensation will amount to $4.5 billion, reflecting a further increase from the previous $3.5 billion.

The increased termination fee suggests that Activision has made internal preparations for the deal, making the potential impact of its failure more significant.

Microsoft’s acquisition of Activision, a prominent game maker, at a reasonable $69B enterprise value appears promising. With a 3% FCF yield on a trailing twelve-months basis, the valuation is cheaper than Microsoft’s own. This acquisition brings potential cost savings by leveraging Microsoft’s cloud infrastructure and opens doors for cross-selling opportunities with the game pass and Xbox hardware.

While the gaming industry can be cyclical and less resilient compared to Microsoft’s core businesses, this move complements the company’s existing operations in hardware and gaming. Despite some concerns about ‘diworsification,’ I view the acquisition as a net positive for both Microsoft and its investors.

Dividends & Buybacks

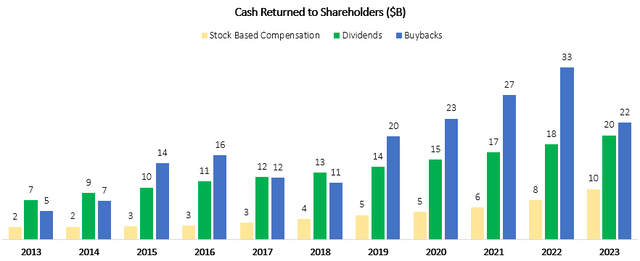

Microsoft is a natural constituent in dividend growth portfolios. The company has raised its dividend for 18 consecutive years and has bought back over 11% of its shares outstanding since June 2013.

Created by the author using data from Microsoft’s financial reports (10-K)

Between 2013-2023, the company increased its dividend at an 11.4% CAGR and returned a cumulative $285.1B to shareholders, net of stock-based compensation. At the beginning of 2013, Microsoft’s market cap amounted to approximately $225B. So in essence, if you bought the stock around January 1st, 2013, you would have gotten a 127% ROI via cash returns from the company alone.

In FY23, the company once again increased its dividend by 9.7% and bought back an additional 0.8% of its shares, a trend that should continue for the foreseeable future.

MSFT Stock Valuation

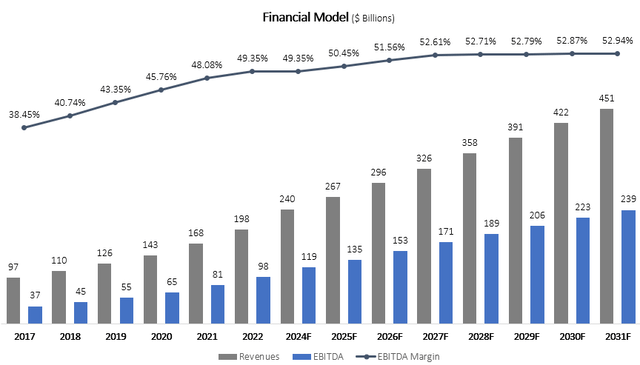

I used a discounted cash flow methodology to evaluate Microsoft’s fair value. I forecast the company will grow revenues at a 9.4% CAGR between 2024-2031, based on growth in the company’s core operations, continued market share gains in the cloud, and growth acceleration in search, news, advertising, gaming, and devices. My projections are pretty much in line with the consensus but are significantly below Microsoft’s past 7-year CAGR of 14.0%.

I project EBITDA margins will increase incrementally up to 53.6% in 2030, as margins in Intelligent Cloud and More Personal Computing recover to their historical averages.

Overall, my assumptions result in EBITDA growth slightly above revenue growth, reflecting operational leverage and recovery in segments that are experiencing temporary headwinds like ads and gaming.

Created and calculated by the author based on data from Microsoft’s financial reports and the author’s projections

Taking a WACC of 7.6%, I estimate Microsoft’s fair value at $389 per share. This valuation reflects a forward blended P/E multiple of 32.4 based on my EPS projection for FY24 and FY25, which is slightly above its 5-year average.

It’s clear that the market is now pricing in significant contributions from the company’s AI endeavors, specifically its $30-priced Copilot. Moreover, I believe the market is expecting growth acceleration in lagging segments, and a successful integration of Activision. All of these, in my view, are highly likely.

Conclusion

In my perspective, Microsoft stands as a must-have in any long-term portfolio. The company’s solutions are unparalleled, exhibiting both strong demand and remarkable growth. Under the leadership of Satya Nadella, Microsoft continues to conquer market share across various business segments while maintaining a profitable outlook and efficient innovation, despite its size.

Although the current valuation might not be as enticing as it was a few months ago, and there exists the inherent risk of falling short of expectations, I firmly believe that Microsoft possesses a higher likelihood of exceeding expectations rather than failing to meet them. Therefore, I confidently reiterate my Buy rating.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of MSFT either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.