Summary:

- MSFT’s quarterly performance continues to exceed expectations, with expanded margins and backlog, thanks to the raised prices and cost optimization efforts.

- Despite the peak recessionary fears, it appears that tech/capex spending is starting to return, with the Commercial segments exceeding expectations by QoQ/ YoY.

- Thanks to the generative AI boom, MSFT’s Cloud segment recorded expanding top-line, margins, and backlog as well, potentially eroding AMZN’s market share.

- However, its performance in Search/ Advertising proved to be disappointing, with the management alleging a lower ad spending environment, against GOOG & META’s optimistic outlook through H2’23.

- Therefore, while MSFT has performed brilliantly, we believe that its current execution has not kept pace with its elevated valuations/stock prices, suggesting more volatilities ahead.

vchal/iStock via Getty Images

The MSFT Investment Thesis Remains Somewhat Lofty Now

We previously covered Microsoft (NASDAQ:MSFT) in May 2023, discussing its successful transition toward the next generational platform, Artificial Intelligence, thanks to the early investments in OpenAI. This cadence had naturally led to the stock’s extreme rally thus far, significantly aided by the excellent quarterly results.

For now, MSFT has exceeded expectations again, with double beat FQ4’23 revenues of $56.18B (+6.3% QoQ/ +8.3% YoY) and operating incomes of $24.25B (+8.5% QoQ/ +18.1% YoY), compared to its previous guidance of $55.85B and $23.65B in the FQ3’23 earnings call.

Most importantly, the management’s raised prices and optimization efforts have paid off extremely well, flowing into its expanded gross margins of 70.1% (+0.6 points QoQ/ +1.8 YoY) and operating margins of 43.2% (+0.9 points QoQ/ +3.6 YoY) in the latest quarter.

Combined with its sustained share repurchases thus far, retiring -39M of shares over the last twelve months, it is unsurprising that MSFT’s FQ4’23 EPS has also expanded to $2.69 (+9.7% QoQ/ +20.6% YoY).

Despite the peak recessionary fears, it appears that tech/ capex spending is starting to return, with the company’s Productivity and Business Processes segment recording improved revenues of $18.3B (+4.5% QoQ/ +10.2% YoY), with Windows commercial revenues also increasing by +2% YoY.

This cadence easily negates MSFT’s underperforming More Personal Computing revenues of $13.9B (+4.5% QoQ/ -3.4% YoY), with the PC demand destruction still lingering, as similarly highlighted by Intel (INTC) and Hewlett Packard Enterprise (HPE).

Then again, with things likely to normalize by H2’24, investors need not worry yet, especially given the exemplary results reported in the Intelligent Cloud segment at $24B (+8.5% QoQ/ +14.8% YoY), with more corporations migrating to Azure, potentially eroding Amazon’s (AMZN) leadership in Q2’23.

On the one hand, MSFT’s Cloud segment has “surpassed $110B in annual revenues (+27% YoY),” with expanding gross margins of 72% (inline QoQ/ +3 points YoY) and commercial remaining performance obligation of $224B (+14.2% QoQ/ +18.5% YoY).

On the other hand, despite its aggressive push into the AI scene, it is apparent that the search and advertising revenues are disappointing, with only +8% YoY increase in the segment, supposedly due to the lower ad spending environment.

However, it is apparent that Alphabet (GOOG) (GOOGL) and Meta (META) have not reported similar macro headwinds, with both advertising giants guiding optimistic advertising outlook in H2’23. This is especially due to Google Search’s accelerating revenues of $42.62B (+5.6% QoQ/ +4.7% YoY) as the market incumbent.

Despite ChatGPT’s initial popularity, Google Search’s market share has also grown to 92.64% by June 2023 (+0.78 points YoY), compared to Bing’s decline to 2.77% (-0.43 points YoY) at the same time. Perhaps this is why the MSFT stock has pulled back from recent heights, due to the slower monetization cadence from its heavy AI investments thus far.

Then again, MSFT has already guided FQ1’24 revenues of $54.3B (-3.3% QoQ/ +8.3% YoY) and operating income of $24.05B (inline QoQ/ +11.8% YoY) at the mid point, suggesting a sustained bottom line expansion ahead.

In addition, the management has guided improved top-line contribution from its AI initiatives by H2’24, with most consumers likely still optimizing their cloud spending due to the elevated interest rate environment.

While MSFT has performed brilliantly, we believe that its current execution has not kept pace with its elevated valuations/ stock prices. This alone suggests more volatilities ahead, depending on its performance over the next few quarters.

Furthermore, thanks to the boom in Azure and AI workloads as similarly reported by GOOG, we have seen a drastic increase in MSFT’s capex to $8.94B (+35.4% QoQ/ +30.1% YoY) in FQ4’23. With the management emphasizing expanded data center and networking equipment in FY2024, we may see its Free Cash Flow generation temporarily impacted as well.

Only time may tell.

So, Is MSFT Stock A Buy, Sell, or Hold?

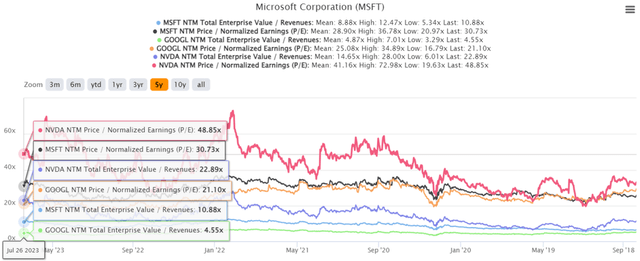

MSFT 5Y EV/Revenue and P/E Valuations

For now, MSFT’s valuations are also nearing its hyper-pandemic peak, at NTM EV/ Revenues of 10.88x and NTM P/E of 30.73x, naturally elevated against its 1Y mean of 9.06x/ 26.94x and 3Y pre-pandemic mean of 6.04x/ 24.43x.

This cadence is unsurprising indeed, due to the massive optimism embedded in generative AI and ChatGPT, similarly propelling Alphabet’s and Nvidia’s (NVDA) stock valuations and prices.

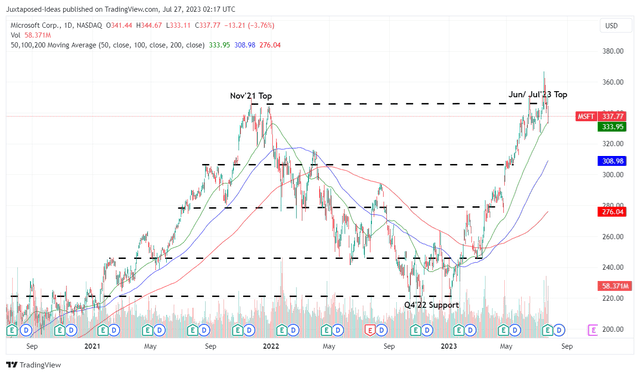

MSFT 3Y Stock Price

Then again, here is where we prefer to proceed with caution, since MSFT is already retesting its previous November 2021 top, implying further volatility in the near term.

Despite the lifted headwinds from Activision Blizzard acquisition (ATVI), stellar FQ4’23 performance, and optimistic forward guidance, we believe much of the premium is already priced in, suggesting a reduced margin of safety at these inflated levels.

Investors may want to monitor the situation a little longer and only add MSFT if these levels hold over the next few weeks.

Otherwise, we prefer iterating a lower entry point of $300s for an improved upside potential of +30% to our long-term price target of $390, based on its normalized P/E valuation and the market analysts’ FY2026 EPS projection of $14.54.

Combined with our full position, with the stock already rallying by +45.28% since our previous buy-in point at the October/ December 2022 bottom, we prefer to rate MSFT as a Hold here. Chasing the rally here naturally results in elevated dollar cost averages. Investors beware.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of MSFT, AMZN, NVDA, GOOG, INTC either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

The analysis is provided exclusively for informational purposes and should not be considered professional investment advice. Before investing, please conduct personal in-depth research and utmost due diligence, as there are many risks associated with the trade, including capital loss.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.