Summary:

- Microsoft’s essential products and consistent revenue growth justify its premium valuation, making it a cautious buy despite a slim margin of safety.

- Sustained growth driven by strong management and capital allocation, with a 10-year revenue CAGR of 10.9% and significant expansion in all business lines.

- Current valuation reflects expected growth, but potential positive surprises in cloud revenue and AI integration could enhance returns.

- Despite competition and regulatory risks, Microsoft’s robust business model and diversified growth make it a reliable and a cautious buy.

D. Anschutz/DigitalVision via Getty Images

Microsoft (NASDAQ:MSFT) (NEOE:MSFT:CA) undoubtedly has one of the best business models in the world. The company is so essential to world capitalism that if one day its products stopped working, it would be a huge global problem since its products such as Microsoft Office, Azure, Windows, and the like are essential to hundreds of large corporations.

With this essentiality and recurrence in revenue, predictability also becomes a crucial factor for the thesis. These, among other factors (such as Microsoft being one of the main AI players), mean that Microsoft deserves a premium valuation and often plays a structural role in several portfolios, either via direct exposure or index.

However, for the current valuation to make sense, it needs to be a little optimistic, which reduces the margin of safety, making Microsoft stocks only a cautious buy.

Sustained Growth Drives Microsoft’s Success

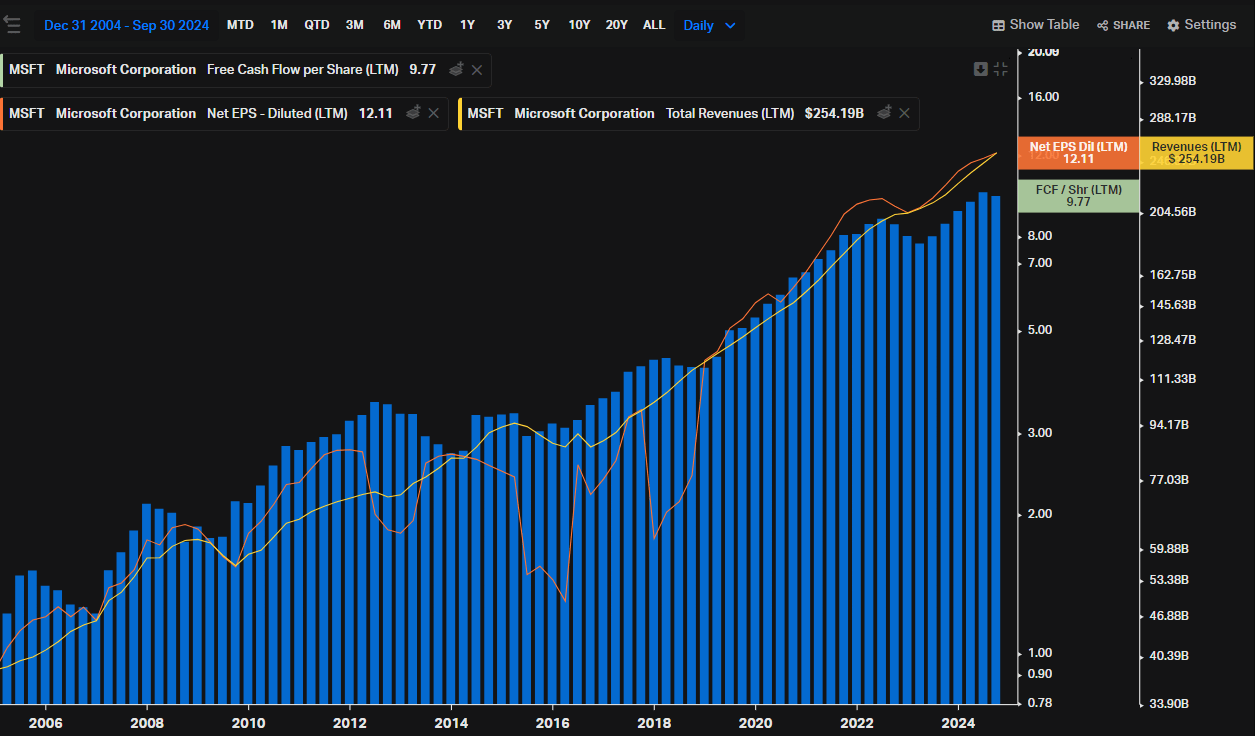

Microsoft’s business model has become something really off the charts. In the last 10 years, the CAGR of its revenue has been 10.9%, and even if you consider the last 3 years when the company was already this consolidated behemoth, the CAGR was 13.4%. In the same periods, the Free Cash Flow CAGR was 10.47% and 9.69%, illustrating an enormous generation of shareholder value. Another reflection of this profitable business model is the ROE, which has averaged 34.6% over the last few decades, and the ROIC, which has averaged 24.7% over the same period.

Koyfin

This has been enabled by excellent management, great capital allocation discipline (organic and inorganic growth), and secular trends in its core services. All of Microsoft’s business lines have shown exceptional expansion over the years. In FY25 Q1 this continued, with productivity and business processes advancing by 12%, Intelligent Cloud advancing by 20%, and More Personal Computing advancing by 17% (with a relevant increase in Search and news advertising and also the Activision acquisition). Meanwhile, operating income rose by 14%, with a margin of 47%.

Despite this, there was a higher CapEx in the period to sustain growth, especially in the Cloud segment. Despite this, the trend remains positive. In addition to the very high CAGR estimates for the Cloud market, around ~20% per year until 2030, the management mentioned in the earnings call that “growth in CapEx will slow, and the revenue growth will increase” when answering a question about CapEx spend in relation to cloud revenue.

It is interesting to note that in the Productivity and Business Processes segment, the cloud areas also accelerated growth, such as Microsoft 365 Commercial Cloud, Microsoft 365 Consumer Cloud, and cloud services. In other words, although Microsoft’s revenue is well diversified, the current growth is closely linked to the cloud market, but other lines are still making reasonable progress, such as LinkedIn with a 10% increase in revenue and Windows OEM and devices with +2%.

If we combine this good track record, the wide moats, and Microsoft’s strategies, it’s easy to envision sustainable growth. The moats help directly with the recurrence of revenue, and gradual price increases without generating a drop in demand. In addition, we have strategies that help expand revenue organically, inorganically, and with optionalities that are difficult to model. An example of this is AI, not only with the traditional Copilot as LLM, but also with new proposals such as Microsoft Security Copilot, and the Copilot+ PCs. And even though it’s hard to see all the products and services that can increase growth, Microsoft certainly is and will be one of the main players in AI, providing services such as the integration of its products and also benefiting from the efficiency that AI brings.

And there are other ventures that also have good prospects, such as the gaming ecosystem and LinkedIn.

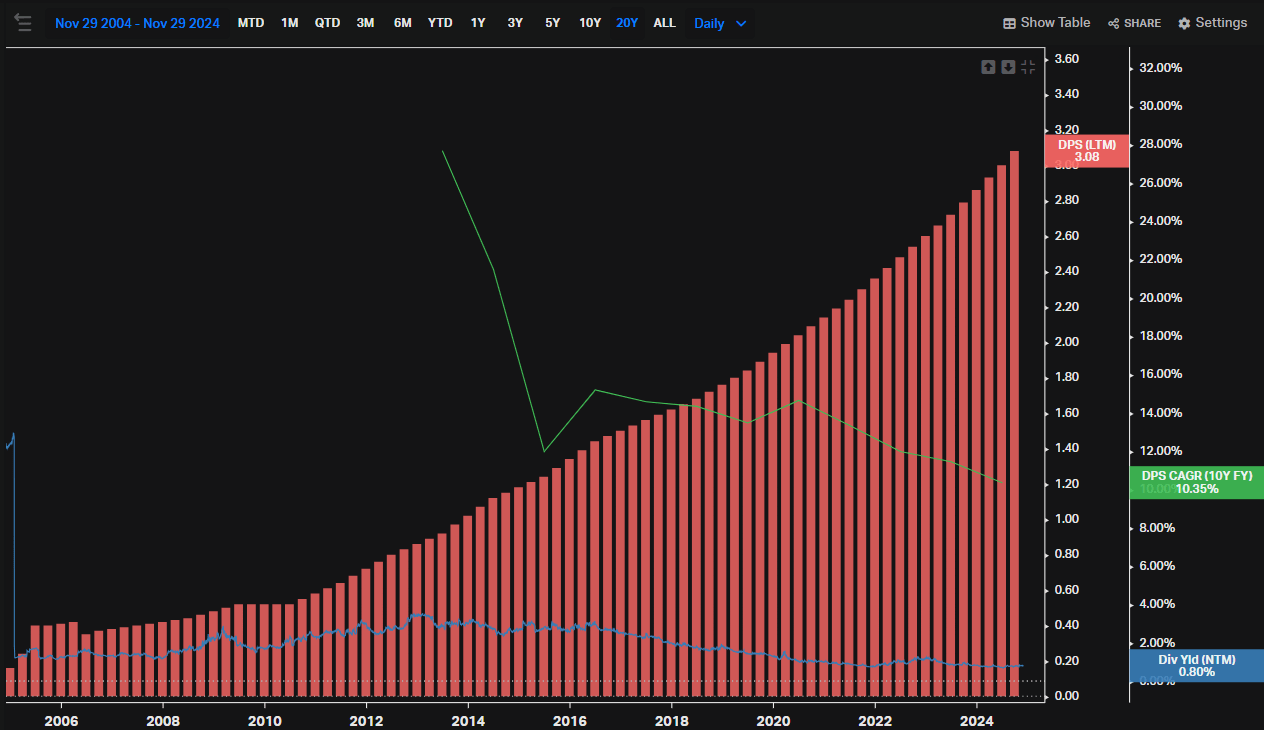

It’s worth mentioning that in addition to the financials and huge cash generation, this is ultimately converted into shareholder returns. In various periods analyzed (the last 10 years, 7 years, 5 years, and 3 years) the CAGR of Microsoft’s dividend per share is approximately 10%, so with the outlook pointing to a continuation of this growth, it is also possible to expect continued increases in dividends and possible buybacks.

Microsoft’s Growth Is Already Priced In

In view of the section above, the Microsoft thesis seems perfect. But there is a little problem: the valuation. The DPS has shown an impressive trajectory, but if analyzed together with the dividend yield of 0.8% over the next 12 months, this 10% growth becomes less attractive, although it is still interesting due to the payout, which is not high.

Koyfin

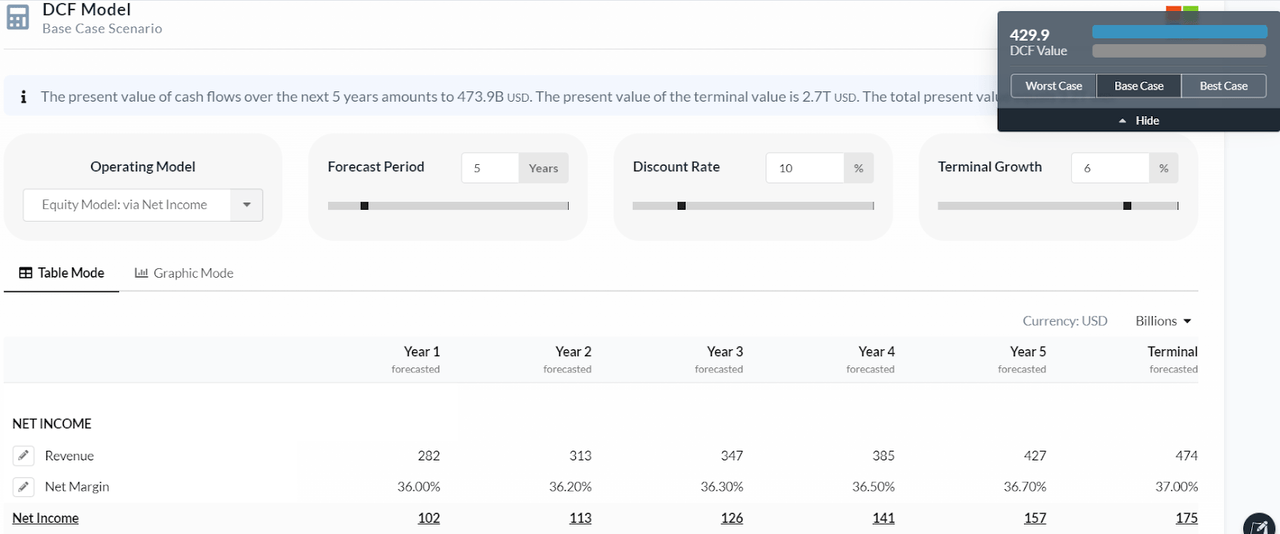

As mentioned earlier, the margin of safety of Microsoft stocks is small. An Equity Model finds a fair price of $429 (slightly above the current price) for MSFT using the following assumptions:

-

CAGR for revenue of ~11% over the next few years.

-

Net income margin gradually expanding to 37%.

-

10% Discount Rate

-

6% Terminal Growth

AlphaSpread

This means that the market is already pricing this growth in Microsoft’s revenue, as well as a net income margin at an acceptable level. In this base scenario (which has optimistic assumptions, but is reasonable given that we are dealing with Microsoft), the investor would still get ~10% per year.

What makes me think that the current valuation is still reasonable is that the company has a lot of room to surprise positively under these assumptions. The revenue estimate could be exceeded in several scenarios since the cloud market itself is expected to grow by ~20% a year; the net margin could also possibly exceed 37%, as has already been seen in some quarters; and the discount rate itself of 10% could be lowered to 8% or 9% to reward the quality of the company.

Potential Hurdles for Microsoft’s Thesis

The “Cautious buy” mentioned at the beginning also concerns the risks added to this low margin of safety. Growth seems secular and well diversified, but there is a dependence on the cloud for this to happen, and there are very competitive players such as Amazon (AMZN) and Alphabet (GOOGL) in this market. The increase in CapEx can also momentarily put pressure on free cash flow and consequently on the distribution of shareholder value.

As Google’s case has shown, antitrust regulatory risks are also relevant and must be monitored, and could eventually cloud Microsoft’s prospects, as in the case of major acquisitions or monopoly treatment.

Finally, it is necessary to mention the risk of execution, as with the AI tools mentioned, since these also see relevant competition from other important names, such as Apple (AAPL) with Apple Intelligence strengthening its devices, Google with Gemini, and so on.

These risks are not enough to make Microsoft unattractive, but they do serve to illustrate that there are uncertainties (as in any other thesis), which is why it is necessary to have a relevant equity risk premium even with a high-quality company (which is why I prefer to use higher discount rates in the modeling).

Balancing Microsoft’s Potential and Opportunity Cost

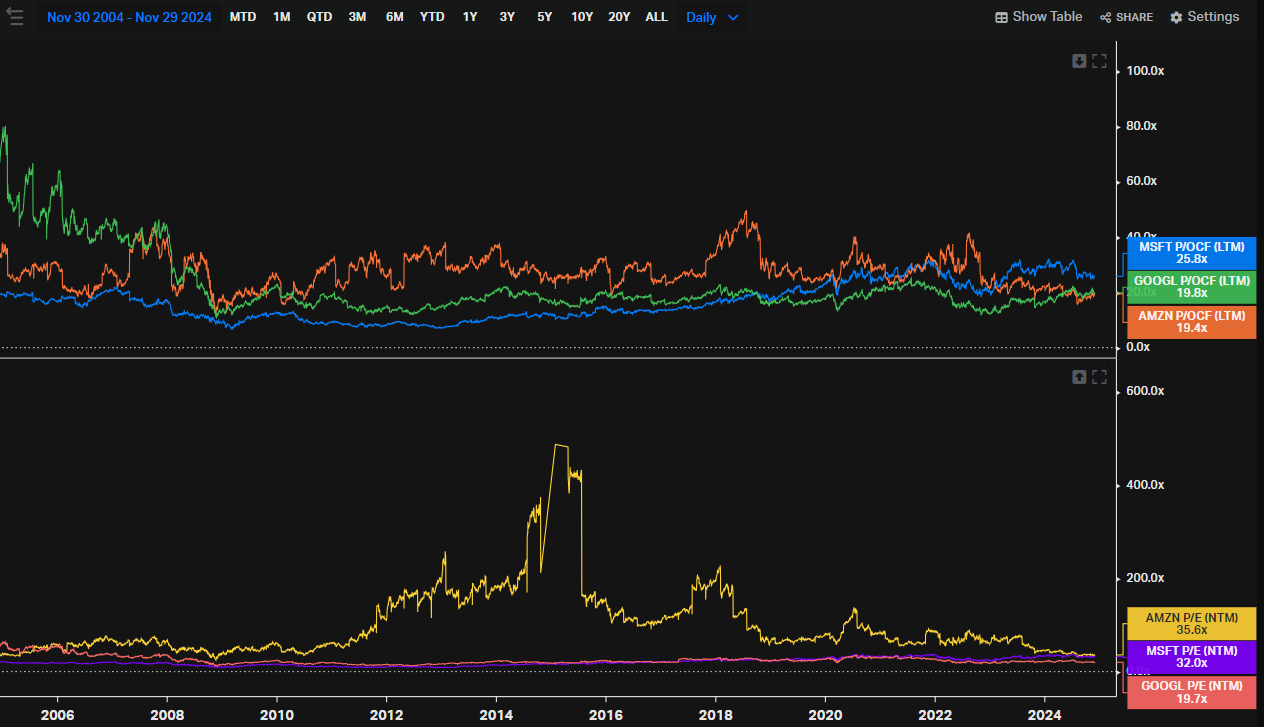

In addition to the aforementioned risks, the opportunity cost must be mentioned. Among the big techs, Microsoft is one of the names that stands out today. In my view, it is the most reliable thesis among the magnificent seven, whose growth is clearer and more diversified.

Despite this, I don’t believe it’s the most asymmetrical name and that should generate the most value. Theses such as Google and Amazon present a greater degree of uncertainty, but they also appear to be more asymmetrical and consequently should present a better return if everything goes according to plan.

In addition to the cloud, Amazon also has tons of optionalities with robotics, AI, international expansion, and the like, and with a P/OCF of 19.4x, substantially lower than Microsoft’s (despite the higher P/E due to high depreciation and SBC).

As for Google, it also has the growth prospects of the Cloud, but it has growth in YouTube, AI and even search, which has a certain cloudiness but continues to show strong momentum, and this for a P/E NTM of 19.7x, while Microsoft’s is 32x.

Therefore, it is essential to weigh up these factors as well, since all three are good companies and should present good returns, but with different risks and consequently, be able to compose different portfolios and suit different investor profiles.

Koyfin

The Bottom Line

Even with the factors mentioned, Microsoft’s robustness outweighs the current slim margin of safety. Factors such as practically contracted growth and its wide moats make it possible to accept a slightly lower return for having it in the portfolio (pleasing mainly investors looking for a safer thesis), since not only the ‘optimistic’ scenario is likely to happen, but also with possible positive surprises could make it better.

In any case, there is a need to be a little more cautious and bear in mind that the margin of safety reduces the upside, and neither is Microsoft an asymmetric thesis that has the prospect of high returns. It’s the kind of stock that serves to balance the portfolio towards something safer, exposing itself to secular growth, dividends, and the like at a reasonable price, while some peers like Google and Amazon can present greater returns (and with their respective risks).

Analyst’s Disclosure: I/we have a beneficial long position in the shares of AMZN, GOOGL either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.