Summary:

- AI isn’t just another buzzword; it’s a technological revolution set to boost productivity, potentially adding 10% to the global GDP in the next decade.

- Thanks to its extensive user base, Microsoft is primed to lead the AI revolution across various sectors, ranging from individuals to businesses and even governments.

- Microsoft eyes extra $193 billion revenue by 2032 driven by AI, with analysts projecting 14.4% annual top-line growth.

- Yet, even in the bull case scenario, Microsoft is currently overvalued, lacking a margin of safety if expectations fall short.

- I recommend caution at current prices, but consider aggressive buying if it drops below $280, given its potential to lead in the AI market.

lcva2

Investment Thesis

The fluctuations of the stock market are inherently influenced by investor sentiment and the underlying economic conditions.

There are moments of deep pessimism when stellar companies trade at bargain prices, and then there are those euphoric times when even profitless companies are touted as the next big thing, driving market levels to dizzying heights.

Artificial Intelligence “AI” often gets brushed off as a mere buzzword—a flashy tool in the hands of corporations and executives, designed to lure investors and showcase an alignment with the latest trends.

These trends, AI included, can be treacherous. They fuel the “FOMO”, leading to inflated valuations that pose substantial risks to investors.

Yet, I view the AI revolution through a different lens. It’s not just a passing fad; it marks the dawn of something profound. A transformative force that promises unparalleled productivity gains over the next decade.

Microsoft’s CEO, Nadella, reinforces this belief, stating that AI could contribute a significant 10% to the Global GDP. In a global economy hovering around $100 trillion, that could mean an astounding growth of $7 to $10 trillion, all catalyzed by the next wave of AI technology.

Consider, for a moment, the transformative impact of computers in our lives—how they’ve redefined productivity and, in the same breath, reshaped the job landscape.

In this context, I view Microsoft (NASDAQ:MSFT) as a juggernaut in the competitive AI arena. What sets Microsoft apart is its vast reach in today’s digital landscape. For example, Microsoft 365 has an impressive user base of approximately 345 million individuals, accounting for nearly 5% of the world’s population.

This colossal existing customer base presents an unprecedented opportunity. Infusing AI into Microsoft 365’s multifaceted applications isn’t just a seamless transition; it’s a revolution. This integration won’t merely drive user growth for Microsoft; it’ll catapult businesses around the world into an era of unprecedented productivity.

Thus, I foresee Microsoft not merely leading the AI market but also outpacing industry giants like Apple (AAPL), emerging as the cornerstone of the S&P 500 (SPY), and cementing its status as the most valuable company for the next 5-10 years.

The rationale is crystal clear: in our increasingly digital world, Microsoft’s expansive user base serves as the ideal launchpad for the widespread adoption of AI. You might not be aware, but starting tomorrow, you could already be using AI without even realizing it.

Microsoft 365 Users (Sign House)

Of course, Microsoft’s potential isn’t limited to just to Office 365 —it extends far beyond.

That’s one of the key reasons why I’ve personally invested significantly in Microsoft, currently constituting over 4% of my portfolio.

Let me show you other opportunities at hand and explain why I believe Microsoft will become the most valuable company in the coming decade.

Microsoft’s AI Opportunity

Before we dive into the AI opportunities, let’s take a moment to admire Microsoft’s incredible journey of growth.

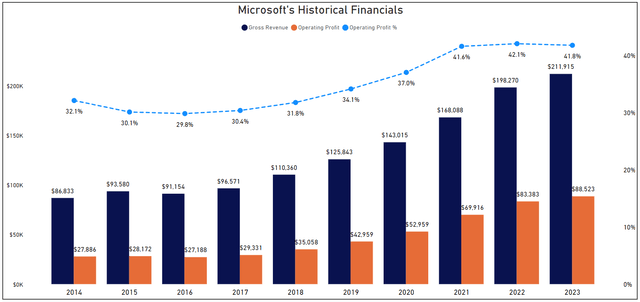

Over the past ten years, Microsoft didn’t just grow its revenue; it skyrocketed. In 2014, they were bringing in about $87 billion, and fast forward to June 2023, that number had ballooned to a whopping $212 billion.

This translates to a yearly growth rate of about 14.4% – that’s a serious growth for back then already one of the largest companies.

But here’s the really cool part: it’s not just about growing top-line; it’s about doing it smarter. Microsoft’s Operating Income, surged ahead at an even faster rate – around 21.7% annually.

This means they didn’t just grow, they grew efficiently. Their Operating Margin today is nearly at its all-time high, standing at 41.8%.

Now, consider this against the sentiment of the early 2010s when investors weren’t so sure about Microsoft’s future. There was doubt in the air, and the company’s stock was trading on average at a modest 12x earnings.

Fast forward to today, and Microsoft has not just proven the naysayers wrong; they’ve done so with style and financial finesse. It’s a story of resilience, strategic brilliance, and a lot of hard work paying off.

Historical Financials (Author’s Graph (Data SA))

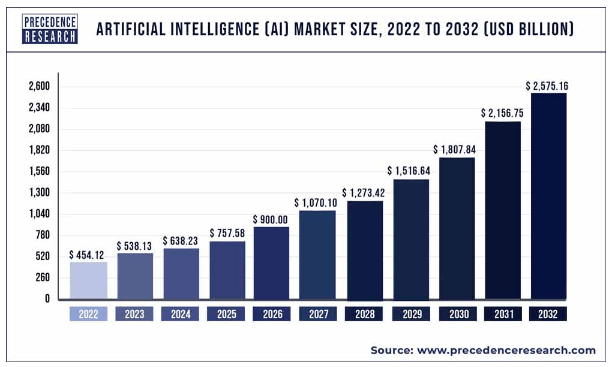

Now, let’s get back to AI. It’s pretty mind-boggling when you realize that the global AI market in 2023 is valued at around $538 billion. And get this, analysts are predicting it will grow by a whopping 42% each year until 2032, reaching $2.6 trillion.

But here’s the interesting bit: Microsoft, in June, announced their expectation to rake in about $10 billion in AI-related revenue for 2023 with Azure Cloud and OpenAI’s models. It might sound like a drop in the ocean compared to the total market, accounting for just 2%, but hold on.

Microsoft’s AI ventures are incredibly diverse. They’re not just stopping at one thing; they’re working on generative AI for government applications, partnering up with Edge/Telecom companies, and even gearing up to challenge Google with their own Search Engine Bing.

Now, imagine if Microsoft manages to grab 7.5% of the total AI market share. That’s an extra $193 billion in revenue by 2032 only through AI. It’s not just a testament to their ambition but also a smart move considering the vast potential in the AI sphere.

AI Market Forecast (Precedence Research)

In my opinion, Microsoft is poised to dominate the AI landscape in several key applications, making it a top choice for investors to play the AI revolution.

So in what specific areas will Microsoft leverage AI for its applications?

One of Microsoft’s strengths lies in its AI platform, which faces limited competition primarily from Google Cloud and Amazon’s AWS. The company’s software assets, especially Office 365, are well-suited for AI advancements.

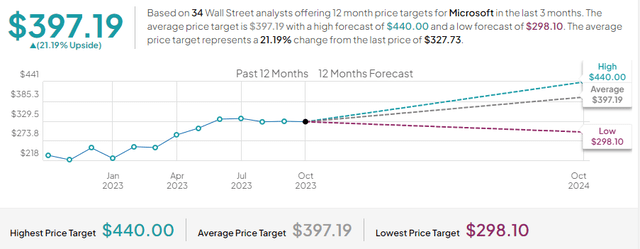

Analysts are also bullish on Microsoft, with most raising price targets to the high $300s and the highest being $440, citing the potential for a significant revenue boost, possibly reaching $100 billion in 2027, driven by AI integration across Microsoft’s products, which is well above my more conservative estimate of around $83 billion by 2027.

MSFT Stock Price Targets (Tip Ranks)

Azure and Office 365 have already contributed significantly to Microsoft’s revenue, increasing from $110 billion to $198 billion over the past four years, with a stock appreciation of 180%.

The market previously underestimated the revenue potential of these businesses, and history might repeat itself with AI’s impact on Microsoft’s future sales growth.

Microsoft’s investment in OpenAI has undeniably been a successful venture, evident from the recent milestone of monthly revenue hitting $100 million, marking a remarkable 30% increase since this year’s summer.

This achievement not only underscores the strength of the partnership but also significantly boosts Microsoft’s market standing. The seamless integration of OpenAI APIs with Azure is a key factor.

This integration not only retains Microsoft’s existing customer base but also acts as a magnet for new customers and workloads, effectively broadening Microsoft’s reach in the market.

The federal government sector, often overlooked in terms of AI impact, is undergoing a cloud transition, and Microsoft’s generative AI capabilities cater to its specific security and compliance needs, making it an attractive choice for government agencies.

Microsoft has launched earlier in June, OpenAI Service which allows government departments to adapt generative AI models for tasks including content generation and semantic search while adhering to stringent security and compliance standards.

Microsoft’s innovative products, such as Microsoft 365 Copilot, leverage AI-related R&D to enhance productivity. Copilot uses large language models to generate drafts, create presentations, and analyze data trends, offering immediate benefits and contributing to Microsoft’s potential of reaching $193 billion revenue increase by 2032.

Moreover, Microsoft’s strategic partnerships with global telecom and data center companies strengthen its position in edge computing, a vital area in the AI landscape. By tailoring AI-powered services for telecom networks, Microsoft continues to innovate and establish a strong foothold in this space.

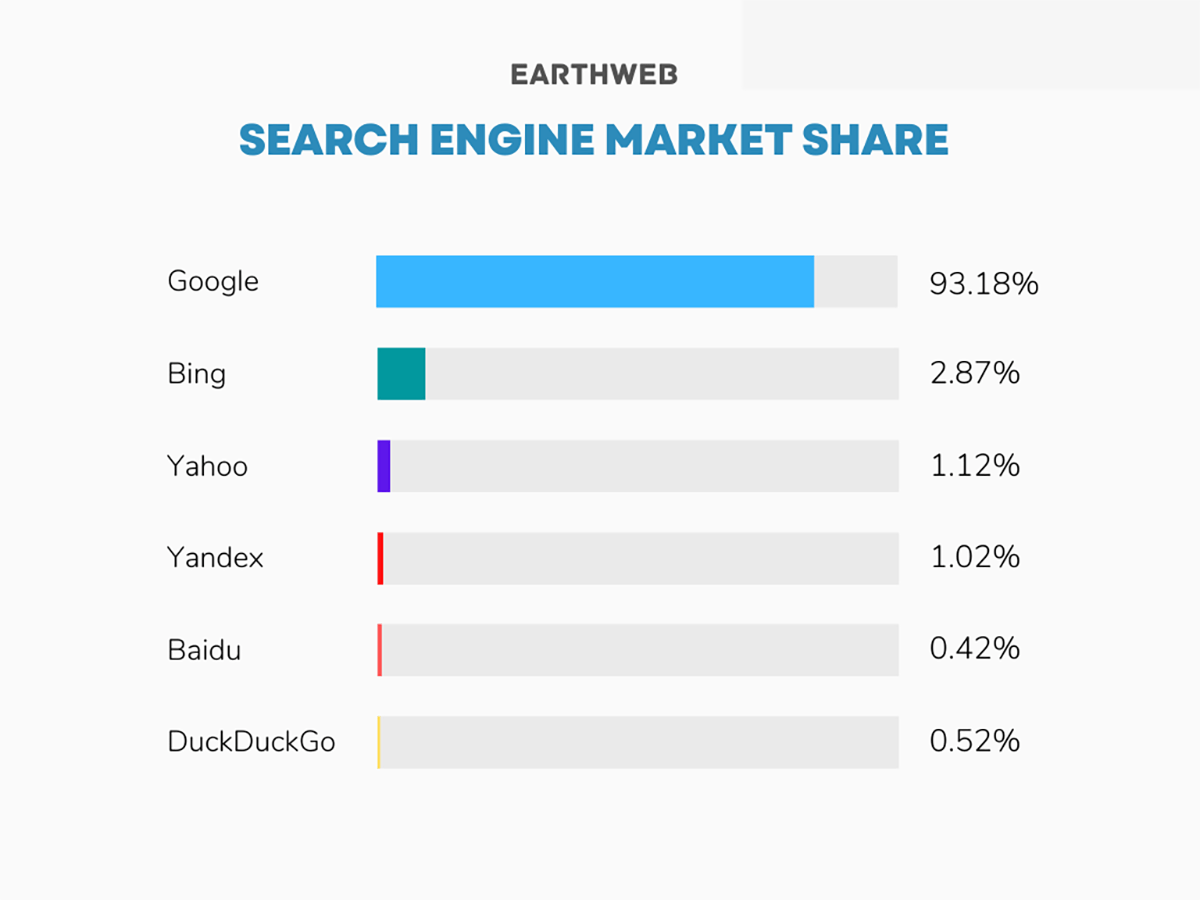

In addition to these developments, Microsoft’s AI-powered Bing and Edge have garnered positive responses, with over 100 million daily active users. The unique combination of search, answers, chat, and creation in one experience sets Microsoft Bing apart, at least for now.

While this market is heavily dominated by Google, the potential is massive, if executed well. With every 1% increase in market share, Microsoft stands to gain an additional $2 billion.

Search Engine Market Share (Earthweb)

The Main Risk is the Valuation

Despite Microsoft’s a strong business foundation, excellent management, and promising prospects in the AI sector, the major concern at the moment revolves around its valuation.

I found the ideal window to invest in Microsoft during the fall of 2022 when I was aggressively purchasing the stock below $230 per share. This price sharply contrasts with its current value of $327, a surge driven by the AI hype, coinciding with the release of Chat-GPT in November 2022.

While Microsoft isn’t the priciest option among its peers, which, in my opinion, are the top players in the AI industry, its current valuation aligns closely with the elevated levels of the past five years.

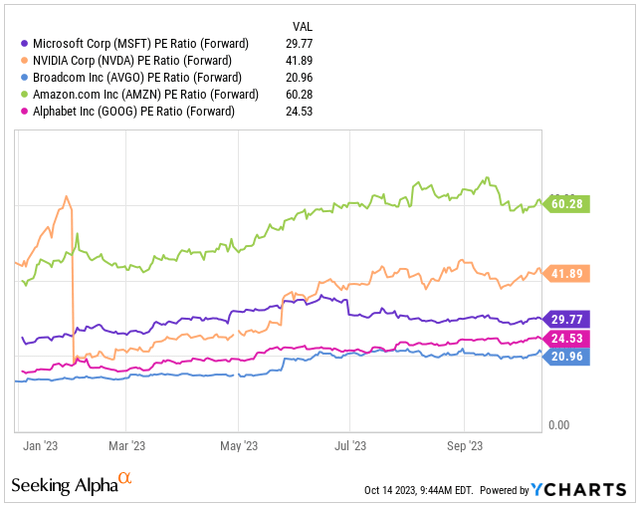

The Forward PE ratio presently stands at 29.77x its FY24 earnings, a figure that closely mirrors the 5-year average of 29.84x. To put it in perspective, other companies like Alphabet (GOOGL) are trading at 24.53x, and Broadcom (AVGO) at 20.96x its FY24 earnings, making them comparatively more affordable choices.

On the flip side, Amazon (AMZN) is significantly pricier at 60.28x, and NVIDIA (NVDA) stands at 41.89x its FY24 earnings.

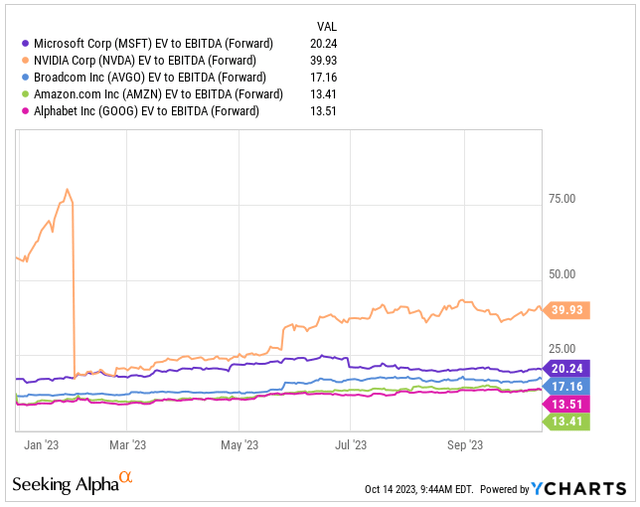

When we consider the Forward EV/EBITDA, the picture is very similar. Microsoft is currently trading at 20.24x, which is quite close to the 5-year average of 19.98x.

But what if we take into account the growth projections made by analysts?

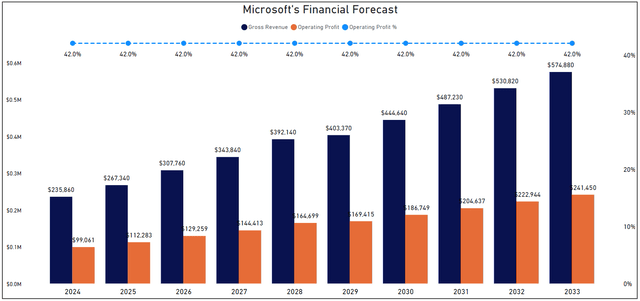

Analysts are foreseeing Microsoft’s earnings to grow at an annual rate of about 14.4% between FY24 and FY33. What’s astonishing is that this growth rate mirrors what the company has achieved over the past decade. This is quite impressive given the substantial size Microsoft has already reached.

This growth isn’t solely dependent on AI; it will also come from Microsoft’s existing segments. Personally, I hold a similar expectation about Microsoft’s growth potential, but keep in mind this is bull case, not a bear case scenario.

Under this scenario, Microsoft could potentially reach a staggering revenue of around $575 billion by the end of FY33. Assuming no significant changes in the already strong operating margin, which currently stands at 42%, Microsoft could achieve an operating income of $241 billion.

MSFT Financial Forecast (Author’s Graph (Data SA))

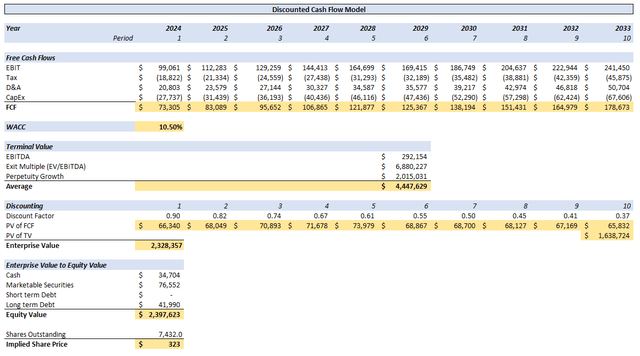

To calculate Microsoft’s Fair Value, I am using the DCF model and the growth rates from the bull case scenario above.

Additional assumptions for the DCF analysis are:

-

A tax rate of 19%.

-

D&A and CAPEX amounting to 21% and 28% of EBIT, respectively.

-

WACC of 10.5%.

-

EV/EBITDA multiple of 23.55.

-

A Terminal Growth Rate set at 1.5%.

Looking at the anticipated strong annualized growth rate of 14.4% driven by promising AI opportunities, Microsoft seems poised for an impressive future.

However, at its current price of $327, it appears slightly overvalued, with a fair value estimate pegged at $323, indicating a 1% overvaluation.

Although this overvaluation isn’t high, it gains significance when we compare the projected growth rate with what the company achieved in a favorable tech environment of low interest rates in the last decade.

Considering the lack of a safety margin at the current price point, I would advise waiting for a more favorable entry opportunity before considering an investment in this promising AI stock.

Game Plan & Conclusion

In this analysis, I’ve pointed out how Microsoft stands to benefit from the AI revolution, thanks to its vast tech customer base.

Microsoft’s stellar growth in the past decade is noteworthy, and with the AI market poised to grow at a rate of 42% annually, I firmly believe Microsoft can secure a significant 7.5% share, potentially bringing in over $192 billion from AI alone by 2032.

What sets Microsoft apart is its strategic approach in the AI landscape. They’re reaching out to everyone, from individuals to businesses and governments, positioning themselves as leaders in the market. With the 2020s being defined by the AI revolution, Microsoft could very well become the most valuable company.

However, it’s important to be cautious, especially given the current slight overvaluation of the stock, even in what I would call the best-case scenario. Without a margin of safety, it’s wise to be careful, especially if things don’t unfold as expected.

As someone who has a significant stake in Microsoft, my advice for others in a similar position is to HOLD.

But if the stock price drops, I plan to accumulate more shares at $280, increasing my position by 10%. At $260, I’ll add another 10%, and if it goes below $240 (my current cost basis), I’m prepared to increase my position by another 20%.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of AVGO either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.