Summary:

- Microsoft’s stock outperformance is attributed to its Generative AI leadership, however may face near-term challenges.

- The incorporation of niche data is crucial for the development of Large Language Models (LLMs) and commercializing Generative AI.

- New York Time’s recent lawsuit against OpenAI and Microsoft highlights the potential roadblocks LLM developers will face.

- We expect near-term risk for Microsoft meeting its growth expectations, which can create an opportunity for long term investors to take a position on any repricing of the stock.

Editor’s note: Seeking Alpha is proud to welcome Fundamental Insights as a new contributor. It’s easy to become a Seeking Alpha contributor and earn money for your best investment ideas. Active contributors also get free access to SA Premium. Click here to find out more »

pcess609

Investment Thesis

Microsoft (NASDAQ:MSFT) is one of the most impactful global businesses of our time. While the company has solid fundamentals backed by a large runway for growth in its area of focus, namely Cloud and Commercial Software, we believe the market is pricing in an unreasonable amount of near-term growth from the recently announced GenAI initiatives. We believe there are several challenges to GenAI initiatives coming to the forefront and moving the needle for large tech players such as Microsoft. This can lead to a near-term price deterioration from any performance miss compared to market expectations which long term investors can benefit from to take a position in the stock. We see potentially 15-20% downside from today’s valuation with limited margin for safety.

Perceived GenAI Impact on MSFT’s Growth

It should now be obvious to everyone that Generative AI (GenAI) is a significant contributor to Microsoft stock’s recent outperformance compared to its peers. While the first mover advantage created by Microsoft through its partnership with OpenAI and other GenAI based initiatives it has undertaken (and announced) is impressive, it is not immune to the complex challenges accompanying the deployment of its AI strategy. Recent developments have shed light on some of these challenges, most notably the recent news around New York Times (NYT) suing OpenAI and Microsoft for use of copyrighted work. This event highlights two important themes:

- The importance of incorporating niche data in the development of Large Language Models (LLM) in order to bring GenAI closer to commercialization

- Potential access to data challenges LLM developers (who are basically all backed by the large tech companies) will face going forward

In this article, we will discuss these themes and the overall impact these will likely have on the GenAI world where Microsoft is currently the leader. We believe this impact will have implications on how the market is currently valuing Microsoft’s stock and its growth trajectory and we will provide our perspective on the company’s valuation.

MSFT Recent Stock Performance (Seeking Alpha)

The Importance of Data in LLM Development and the Quest for Niche Data

The development of LLMs such as OpenAI’s GPT models and Google’s (GOOG) Bard (among others) depends heavily on vast amounts of data. This data is generally sourced from various sources such as scraping the internet, public data sets, crowdsourcing and even synthetically generated data. The more extensive the dataset, the more comprehensive the language model’s understanding of human language becomes. At the same time, the variety in the data set ensures a broader grasp of different contexts, styles and use cases. Currently, all LLM developers are focused on incorporating various data sets into their models and we are seeing the concept of model convergence emerge. This essentially means that the various models will eventually perform at a similar level simply because they have been trained on the same data. Therefore, the key differentiator in the future will be the availability of niche data on which each LLM is trained.

| Feature/ModelParameters | GPT-41.5 Trillion | Bard1.6 Trillion | LLaMA1.2 Trillion | Flan-UL220 Billion | BLOOM176 Billion |

|---|---|---|---|---|---|

| Training Data | WebText-like corpus | WebText-like corpus | WebText-like corpus | Publicly available data | Multilingual web corpus |

| Training Objectives | Language modeling | Language modeling | Language modeling | Mixture-of-Denoisers (MOD) | Not specified |

| Special Features | Improved prompt design | Improved prompt design | Improved prompt design | Universally effective across NLP tasks | Open-access, multilingual |

| How to Access | Via OpenAI API | Via Google Workspace | Application required | Not specified | Open-source |

| Released By | OpenAI | Meta AI | Google Research | BigScience Workshop | |

| Dataset Used for Training | WebText-like corpus | WebText-like corpus | WebText-like corpus | Publicly available dat | Multilingual web corpus |

| Multimodal Capabilities | No | No | No | No | Yes |

| Multilingual Support | Yes | Limited | Yes | Yes | Yes |

Comparison of various LLMs (source)

LLM developers, including OpenAI (backed by Microsoft), are encountering hurdles in accessing niche data crucial for training their models. The most high profile example of this is NYT’s claim of copyright infringement by OpenAI/Microsoft. While NYT’s move to sue is likely a negotiating tactic in getting OpenAI/Microsoft to agree to a higher licensing fee and more favorable terms (based on news reports, negotiations have been ongoing for quite some time), it highlights the challenge which all LLM developers will face in the near term in getting access to niche data. The landscape is likely to shift as data owners, such as journalism organizations and artists, recognize the financial potential behind GenAI and the fact that big tech’s deep pockets are up for grabs. Note that OpenAI and other developers have already struck deals with several data owners as evidenced by OpenAI’s deal with Axel Springer and Apple’s licensing deals with various organizations.

Financial Implications for Microsoft and other Tech Companies Counting on GenAI Monetization

General Impact on LLMs

The financial implications of this issues should be fairly clear. LLM developers will have to pay a substantial amount of fees to content owners in order to further develop their models. It is important to understand that these are not expected to be one-time expenses. AI models require refreshing on a regular basis; according to McKinsey, one-third of AI models needs to be refreshed at least monthly, and one in four require a daily refresh. The cost of data will vary depending on the uniqueness associated with it. For example, in the case of New York Times, OpenAi will likely be looking at other sources who produce similar type of content (e.g. Washington Post and other publications) however more niche data (such as customer information and spending habits) will come at a much greater cost.

Furthermore, we are likely to see an increase in legal costs, not just in fighting off copyright claims, but also indemnifying customers who are subject to copyright claims due to their use of output from LLMs. Anthropic recently updated their service terms to include:

Our Commercial Terms of Service (previously our services agreement) will enable our customers to retain ownership rights over any outputs they generate through their use of our services and protect them from copyright infringement claims.

Ultimately, this will elongate the LLM development cycle and likely slow down the monetization benefits expected from this new technology and developers strike deals with individual data owners. Additionally, margins will be suppressed for an extended period which will impact the bottom lines of large tech players.

Microsoft Specific Impact

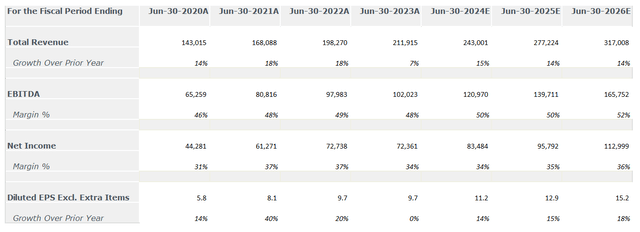

While Microsoft’s efforts to date in progressing its GenAI strategy are commendable (certainly industry leading), it should be noted that we are in the very early innings of this long game. The future growth which has been underwritten by the market in determining Microsoft’s current valuation will require substantial enhancements to GenAI’s capabilities. While the current capabilities are great at generating text and image based content, it is currently limited to a few use cases which present limited opportunities for monetization for Microsoft’s customers. Microsoft has announced its intention to incorporate GenAI into its Copilot offerings however given the limited use cases to date, the uplift which Microsoft will receive from these offerings will be nowhere near sufficient in meeting its underwritten growth targets. Consider the fact that OpenAI, which we believe is currently generating the bulk of global GenAi based revenue, is expected to hit ~$1.3b in revenue this year. While this is impressive growth given the hype around GenAI was only created roughly 1 year ago, this barely moves the needle for a company such as Microsoft which needs to grow its revenue in its next fiscal (FY25) year by ~$34b to meet analyst consensus forecast while its most recent fiscal year (FY23) saw revenue growth of ~$13b. The expectations for FY24 growth is ~$32b which is expected to primarily be driven by Microsoft’s cloud division however we believe there is a fair bit of risk in at least a slight miss in this year’s expectations which could cause a meaningful decline in share price (further discussed in section below). It is clear that future growth expectations for the company is building in a substantial amount of revenue from GenAI based initiatives which may not arrive as quickly as the market expects due to themes such as access to niche data and regulatory scrutiny.

Additionally, consensus targets expect margin uplift at Microsoft which as we explained previously will be challenged as GenAI developers will need to share a portion of their revenue with data owners.

MSFT Financial Performance (Capital IQ)

Valuation

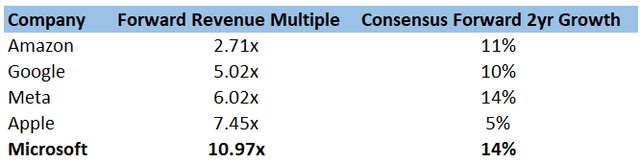

Microsoft currently trades well above its large tech peers. While a premium is justified given higher margins, lead in GenAI and a capex light model; the difference in forward growth rates (which we believe have the highest correlation with valuations) don’t warrant today’s extended lead. Consider the fact that Meta is expected to grow at the same rate but is trading at half the revenue multiple. Furthermore, all the other tech peers have their own GenAI initiatives and while we believe there will be a lot to go around for everyone to share, the timing and magnitude of the GenAI prize is still uncertain

Based on the table above, the average peer comp is ~5.3x forward revenue. Keep in mind that estimates of forward revenue (which are essentially from analyst consensus forecasts) can be overstated as we believe most analysts react to update their estimates on good/bad news vs. proactively scrutinizing management provided estimates. Nonetheless, we will take Microsoft’s consensus forward TTM revenue of $251.3b in arriving at our valuation. We will attribute Microsoft a generous 70% premium on average peer comps and use a 9x multiple. This implies a potential 15-20% downside on today’s valuation.

We believe there is elevated risk for near-term price deterioration on a slight miss to consensus financial metrics or growth expectations for the remainder of FY24. Microsoft’s CFO noted on the last earnings call that the impact of GenAI and Copilots will be weighted towards the second half of the year, implying that there is revenue built in from this source for the remainder of the year’s projections. Keeping in mind the themes we have noted to GenAI development, we believe this revenue could be at risk or at least may spill into the next fiscal year.

Investor Takeaways

To be clear, we believe Microsoft is a fantastic business which should be in everyone’s portfolio for the long run. This article is by no means meant to persuade existing investors to sell however we do caution anyone looking to take a long position at today’s prices to take into account the risks we have laid out above with regards to GenAI benefits accruing in Microsoft’s growth trajectory.

A near-term re-pricing can create an opportune time for long term investors to take a position in the stock or for existing investors to average down. There could of course be a materialization of upside risks (i.e. faster growth on the cloud unit) which could mitigate any revenue miss from GenAI however on an overall basis, we believe the margin for safety is currently limited.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of MSFT either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.