Summary:

- Microsoft’s current valuation is significantly above its fair price even under very aggressive assumptions.

- The market response to the OpenAI-Altman drama has priced in all potential positive outcomes while ignoring negative possibilities.

- As such, MSFT’s current price level is already a good exit point.

- Price volatility in the aftermath of the recent drama could push prices higher but with limited potential.

Justin Sullivan

Microsoft’s valuation implies AI potential can defy gravity

If you believe in the pursuit of growth at any cost, this article is not for you. The basic premise of this article’s thesis is that valuation ALWAYS matters. Under this premise, I will explain A) why Microsoft’s (NASDAQ:MSFT) valuation is far above its fair price even under the most aggressive assumptions, and B) subsequently, why the price volatility caused by the OpenAI-Altman drama offers an excellent exit point.

My rule #1 in investing is this: there is no sure thing. The closest “sure thing” we can get is treasury bonds, whose rates serve as the gravity for ALL asset valuation, meaning MSFT and its AI potential are no exceptions. In the remainder of this article, I will show that MSFT’s current prices are pushing its valuation to a level that seems to defy this simple notion.

The Altman-OpenAI Volatility

Let me start with a brief recap of the OpenAI-Altman drama – from my perspective. Plenty of other authors have already analyzed the causes and potential impacts of these developments. Thus, my goal here is not to repeat what they’ve covered before already. My goal is to argue that the market response has priced in all the potential positive outcomes of these developments while ignoring all the negative possibilities.

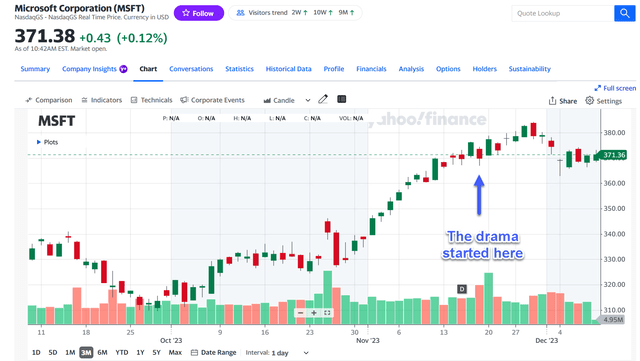

As such, I will only provide a very brief account of the event for readers new to it while mainly concentrating on interpreting the market responses. The drama started on Nov. 17, 2023, when OpenAI CEO Sam Altman was ousted by the board of directors unexpectedly (see the next chart below). MSFT quickly offered a new home for Altman, together with many other OpenAI executives and employees. Then only a few days later, OpenAI rehired Altman back to be the CEO.

The market response to these developments has been quite positive as seen in the chart below. MSFT stock prices rallied from around $370 on Nov. 17 to an all-time peak of around $384 per share in a few days. Such a rally added more than $100B of market cap to MSFT’s valuation, and the peak price level translated into a P/E of almost 37x on a TTM basis. There are of course good reasons for such optimism. For example, when these events WERE unfolding, it was certainly a possibility that MSFT could essentially acquire the OpenAI team (or at least the majority of it) without paying the market price. However, with Altman returning to OpenAI, the odds for this scenario have practically diminished to zero. Yet I won’t be surprised if other new developments trigger large price movements (say, push its price back to the $383 level) again in the near future. I don’t think the drama is over yet with so many key personnel changes and a new board.

And next, I will explain why such potential price volatility offers excellent exit opportunities for shareholders.

MSFT’s valuation

To illustrate how good these price levels are as exit points, here I analyze MSFT’s fair value under some of the most aggressive assumptions in my mind. I will apply a simple dividend discount model. Due to its long and stable dividend record, its dividends are the most reliable approximations for its true economic earnings in the long term.

As anyone who has used any discounted cash flow model knows, the key is all in the discount rates and the growth rates. By massaging these rates, you can pretty much justify any valuation between zero and infinity. So here I will pick these parameters with the least amount of massaging in the following way.

For the discount rates, I will just use the risk-free rates approximated by the current 10-year treasury rates (about 4.2% at the time of this writing). Rates with shorter durations are significantly higher. If you buy into Buffett’s thinking, the risk-free rates should only be used for businesses whose compounding power is close to certainty. I do not think MSFT’s AI future (or just AI future in general) is anywhere close to certainty at this point. So using the risk-free rates as the discount rates is a very aggressive assumption in my view.

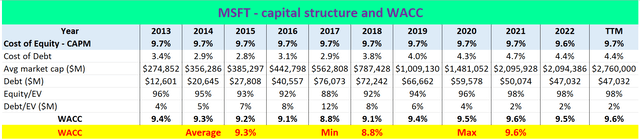

To further illustrate how aggressive the assumption is, I also estimated MSFT’s average cost of capital (the so-called WACC, weight average cost of capital) as shown below. My calculations were based on the capital asset pricing model (“CAPM”), a model most analysts used for an estimation of the discount rates. As seen, according to this model, MSFT’s WACC has been averaging around 9.3% in the past, and hence so should its discount rates. I am not saying that the CAPM model gives the “right” answer. That is a whole new discussion. I just want to contextualize how much optimism is baked in my following calculations by using 4.2% as the discount rate.

Author based on Seeking Alpha data

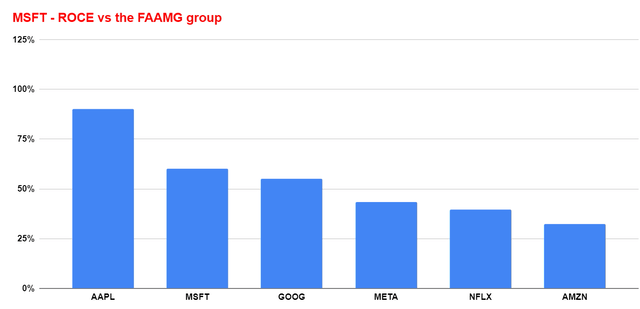

Now, for the terminal growth rates, my estimates were formed by its average return on capital employed (ROCE, as shown in the chart below) and also its average reinvestment rate. Its ROCE has been around 66% and it is indeed toward the higher end even among overachievers like the FAANG group. Its reinvestment rates have been around 5% on average in recent years and also happen to be the average for major tech firms. As such, the terminal growth rate is ~3.30% (66% ROCE x 5% reinvestment rate = 3.30%). Note since this is the terminal rate, I am by default assuming its current level of ROCE and reinvestment rate can be sustained indefinitely, which is also a very aggressive assumption given how quickly the tech landscape changes.

Author based on Seeking Alpha data

What is left now is to simply plug in the numbers to the discount model. With its TTM dividend of $2.8 per share, MSFT’s fair valuation turns out to be ~$311 based on the above discount rates and growth rates ($2.8/(4.2% – 3.3%)).

As I am typing these lines, its market price was $373, translating into a sizable premium of about 20% above the fair price even with all the aggressive assumptions baked in. If any price volatility pushes the price back to $383 (which is likely in my view), the premium would be more than 23%. Better than 20%, but not by that much.

Other risks and final thoughts

There are certainly upside risks. As one of the most debated stocks on the SA platform, most of the upside risks have been eloquently analyzed by the MSFT bulls (high ROCE, capital-light model, et al). I don’t think it is an exaggeration to say that MSFT is still an excellent business without any of the AI stuff.

Here I will entertain one upside risk that is less mentioned and more relevant to my particular approach used in this article. The risk-free rates, the gravity of all assets valuation, can change itself. My analysis above used 4.2%, the current 10-year treasury rate, as the discount rate. In case you are curious about what treasury rates would be able to justify MSFT’s current price, simple math would show the answer to be ~4.0% if you repeat the discount model with the other inputs I used above. It is certainly a possibility that risk-free rates can drop to the 4% level and thus is an upside risk.

All told, the current treasury rates are above 4% (and far above 4% if you choose to look at shorter-term rates instead of 10-year rates). Whether/when rates can return to 4% is uncertain, and whether it can stabilize at 4% is even more uncertain. As such, MSFT’s current price level is already a good exit point under current conditions in my view. If any new developments in the aftermath of the recent drama trigger more upside price volatility, I certainly won’t recommend potential investors to chase its shares out of fear of missing out.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

As you can tell, our core style is to provide actionable and unambiguous ideas from our independent research. If your share this investment style, check out Envision Early Retirement. It provides at least 1x in-depth articles per week on such ideas.

We have helped our members not only to beat S&P 500 but also avoid heavy drawdowns despite the extreme volatilities in BOTH the equity AND bond market.

Join for a 100% Risk-Free trial and see if our proven method can help you too.