Summary:

- Microsoft is showing bearish technical signals, while sitting at its highest valuation since the 2000 Dotcom bubble peak.

- The Ease-of-Movement indicator is highlighting a substantial drop in buying volumes during July, with share selling steadily increasing.

- I rate shares a Sell with a 12-month target price of $300, given an overvaluation extreme and potential economic challenges.

RyanJLane/E+ via Getty Images

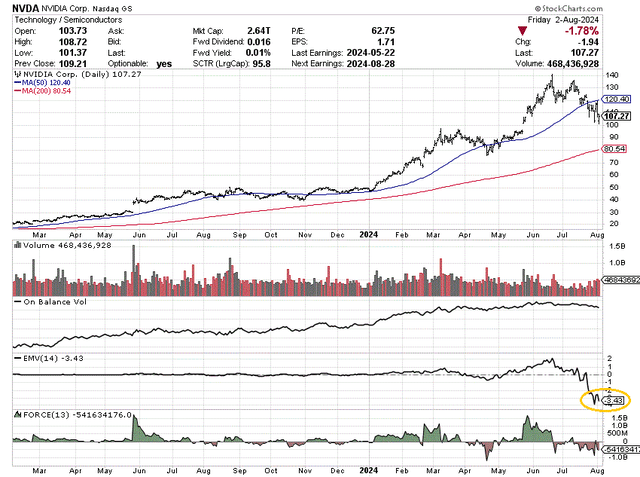

I became the fan favorite of NVIDIA (NVDA) perma-bulls last week here (punching bag actually), when I mentioned the stock had succumbed to a vacuum of buying interest. The logical explanation is net accumulation volumes in the AI mania have been exhausted, while long-time shareholders (including the CEO and management) have decided to liquidate their shares.

The ability of Nvidia to implode -25% in price the last few weeks, on incredibly light trading volume is very typical of past Big Tech peaks for pricing. I have explained the trouble-making repercussions of the bottom falling out of the 14-day Ease of Movement indicator in past articles for the leading AI-chip name plus other technology giants since the spring, including Advanced Micro Devices (AMD) here and Meta Platforms (META) here.

Well, you can add trading action in Microsoft (NASDAQ:MSFT), the top software company on the planet, to the bear list. During late July and early August, an expanding subset of Big Tech stocks are screaming investors should consider selling out, lightening up, hedging, or just plain avoiding in portfolio construction. When part of an already bearish investment setup including an extreme equity overvaluation as recession approaches, I have nicknamed wickedly bad EMV action off a price top as akin to the godfather “kiss of death!”

Is the world ending for Microsoft’s business? Heck No! However, trading at 35x trailing EPS with sales and income growth perhaps unexpectedly slowing to 5% to 10% YoY in a mild recession (starting late summer), plenty of downside risk does exist. Don’t kid yourself.

Adding insult to injury, if crude oil prices spike on new Middle East trouble (think Iran and Israel actually bombing each other, and Iran attacking oil shipments in the Persian Gulf), the Fed may be stuck keeping interest rates around 5% the remainder of 2024 (whiffs of 1990, 2008 for a model).

Under this realistic bearish scenario, I peg Microsoft downside of another -20% to -50% as probable in a true credit crunch and recession, no matter the long-term outlook for AI or gaming or cloud or PC or business software services growth. Such would pull the share valuation back to 10-year averages, or even below them.

My previous article on MSFT in April here was actually a warning shot on stretched valuations, explaining nothing could go wrong in the world or with expected operating business growth. Given future business expansion for one of the largest organizations in America weakens from currently high expectations, a rapid stock drop is not out of the question. (Note: Fiscal year for financial reporting ends in June.)

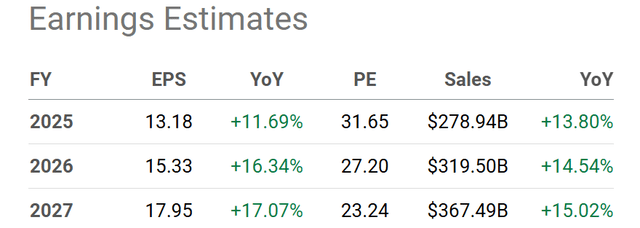

Seeking Alpha Table – Analyst Estimates for FY 2025-27, Made August 1st, 2024

Let me go through the technical trading deterioration logic, and my continuing outlook for a dip in Microsoft’s share price. My thinking is the odds of a large price drawdown over the next 3-12 months have gone up dramatically.

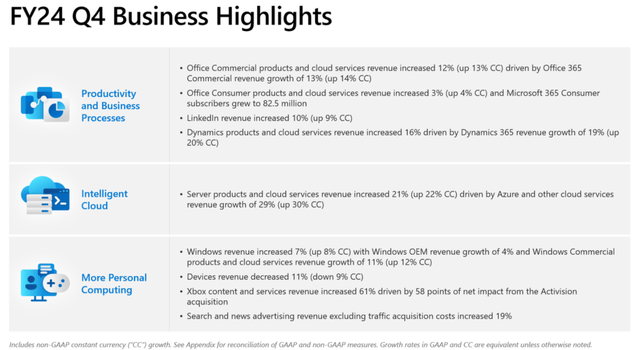

Microsoft – Q4 2024 Highlights, Earnings Presentation

Bearish Technical Signals

What has me specifically worried Microsoft is stuck in a downdraft or new bear market revolves around the 14-day EMV reading. When buyers disappear, quote declines become easier with just average selling volumes. The balance in share dynamics has changed vs. the regular shortage of sellers that supports a sizable bull move.

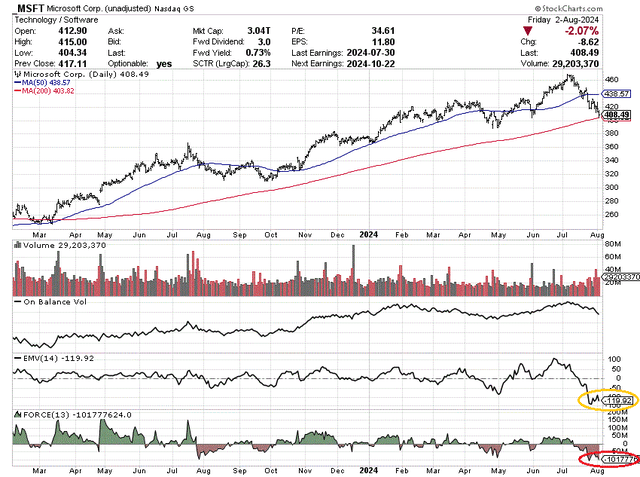

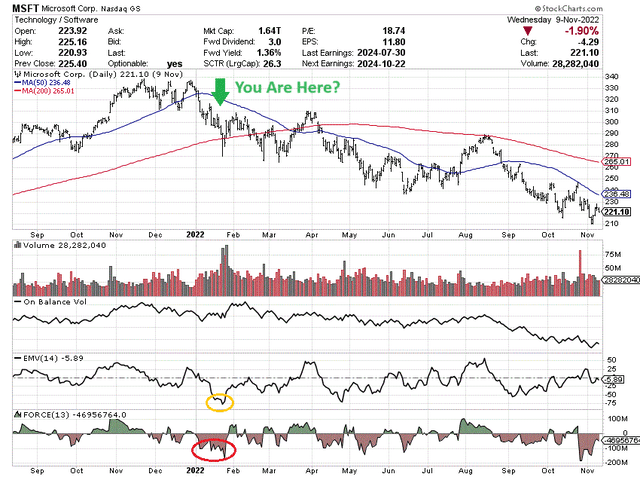

I have circled in gold below MSFT’s record-low reading for the EMV creation over the last week and a half. Supporting and confirming something is amiss, the 13-day Force Index (circled in red) is expressing overwhelming sell volumes vs. buying.

The interesting part of the EMV story is extraordinary buy volumes are usually necessary to reverse a sell signal. In today’s case, we may need a major change in Fed policy to monetary easing during August (perhaps aggressively to prevent a recession) which might theoretically bring in new buyers at the current AI-craze overvaluation point in time.

StockCharts.com – Microsoft, Daily Price & Volume Changes, Since Feb 2023, Author Reference Points

I will also say a monster drop in the EMV indicator is not a foolproof signal of doom by itself. You can see late April witnessed a sizable drop, but Microsoft’s price was able to recover to new all-time highs this summer. Nevertheless, the share quote is back to April levels, where you could argue further price erosion makes the EMV signal months ago potentially a long-term success (albeit early).

While the EMV swing to negative territory is the main reason for me writing this article, the EMV has not completely imploded like Nvidia’s. Below is a graph of the odd and scary movements for the world’s AI-chip leader in July. In all honesty, the Nvidia EMV decline is one of the most pivotal I can remember in a top blue-chip name. In essence, very few sellers have had an easy time sending price into a tailspin. What happens if heavy selling is next?

StockCharts.com – NVIDIA, Daily Price & Volume Changes, Since Feb 2023, Author Reference Point

For Microsoft, the last time EMV reached a record low (circled in gold) at the same moment as the Force Index screamed sell (circled in red) was January 2022. I have marked with a green arrow the parallels to the current situation. After this “kiss of death” formation, shares would steadily retreat another -30% into early November 2022.

StockCharts.com – Microsoft, Daily Price & Volume Changes, Aug 2021 to Nov 2022, Author Reference Points

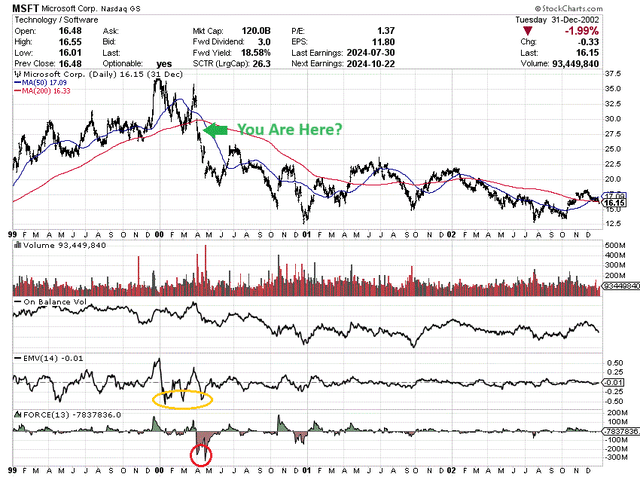

The MSFT Dotcom bubble peak in 1999-2000 is drawn below. While the EMV pattern was not as horrifically bad as today, a combination selloff in the EMV and Force Index, with a drop below the 200-day moving average marked the beginning of the mania bust during April 2000.

StockCharts.com – Microsoft, Daily Price & Volume Changes, 1999-2002, Author Reference Points

Clear Overvaluation

The opposite of a low-valuation idea ready to ride higher for years on renewed investor confidence, Microsoft is sitting in the unenviable position as one of the most over-loved, overvalued, and over-owned on Wall Street. What this means is enormous downside exists if the investment picture gets cloudy, after years of sunshine and happy days.

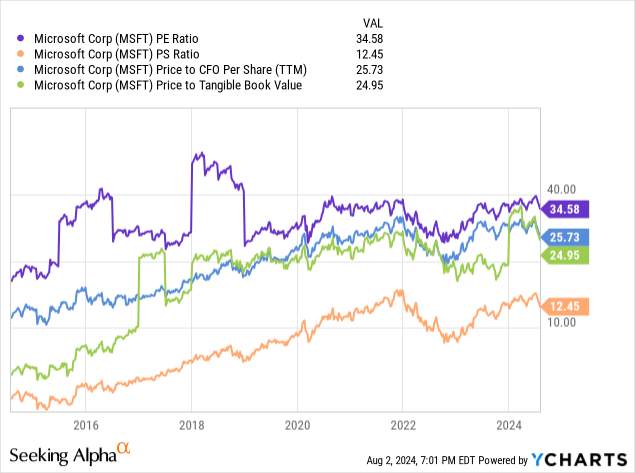

The 10-year valuation picture below shows that Microsoft’s current multiples on trailing earnings (34.6x), sales (12.4x), cash flow (25.7x), and tangible book value (25x) are more than DOUBLE the level of a decade ago.

YCharts – Microsoft, Basic Fundamental Ratio Valuations, 10 Years

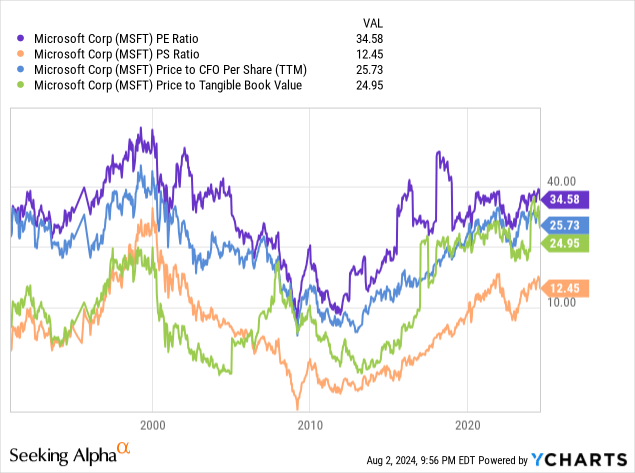

Honestly, on a combination of these four valuation multiples, Microsoft is the most overvalued since 1999-2000, the original Dotcom bubble peak.

YCharts – Microsoft, Basic Fundamental Ratio Valuations, Since 1991

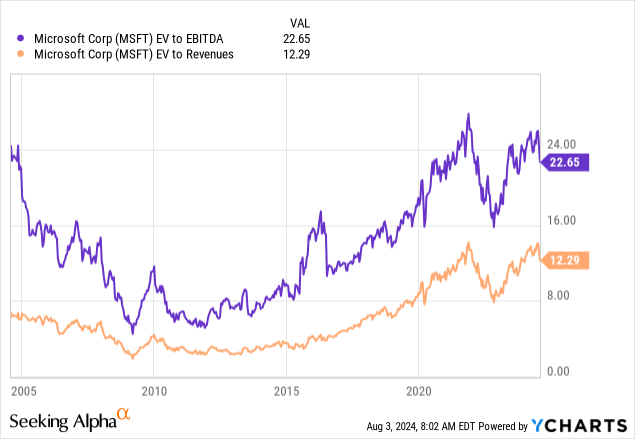

Even worse, when we include net debt to fashion enterprise valuations, MSFT shares appear to be extremely stretched, just off the 20-year highs of late 2021. EV ratios on trailing EBITDA (23.1x) and sales (12.5x) are more like 4x the equivalent number lows of 2012!

YCharts – Microsoft, Basic Enterprise Valuations, 20 Years

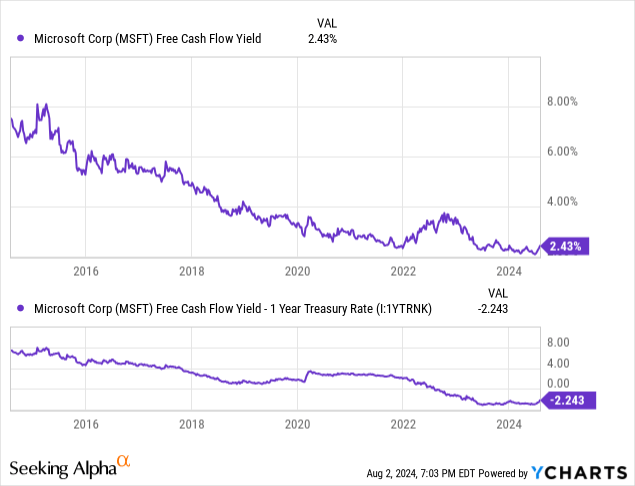

Yet, my main valuation worry for Microsoft is the free cash flow yield of 2.4% is a complete failure vs. the 1-year “risk-free” Treasury rate near 4.9% today. Why do I want to take on sizable equity risk (even from an AI leader like Microsoft), if I can capture TWICE the return on my investment from cash (using operating business cash generation beyond CAPEX divided by share price)?

YCharts – Microsoft, Free Cash Flow Yield vs. 1-Year Treasury Rate, 10 Years

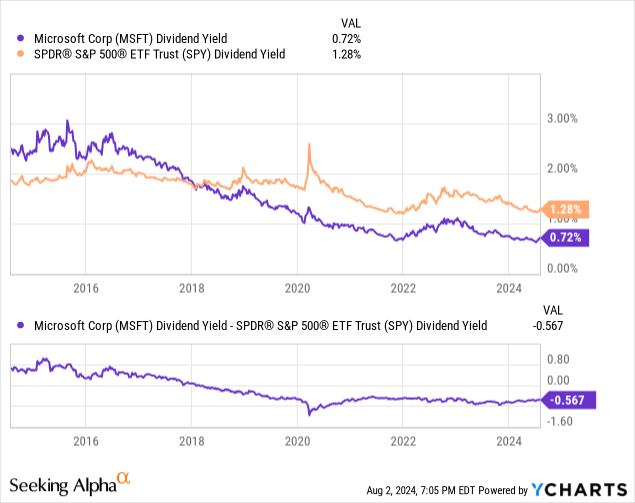

Another knock on the Microsoft argument for ownership is the paltry 0.72% dividend yield. Not only does it provide a truly inferior cash distribution vs. cash rates around 5%, but it is a major distance from the S&P 500 index equivalent of 1.28%. Not much incentive to buy a stake if you ask me.

YCharts – Microsoft vs. S&P 500 ETF, Dividend Yield, 10 Years

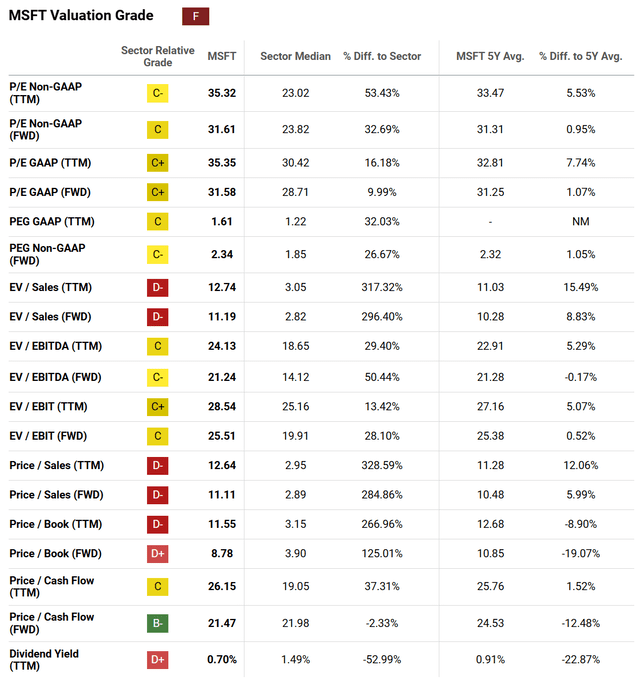

The bottom line is Seeking Alpha puts an “F” Quant Valuation Grade on shares, sorting the company vs. software peers and Microsoft’s 5-year history, using a variety of financial analysis ratios.

Seeking Alpha Table – Microsoft, Quant Valuation Grade, August 2nd, 2024

Final Thoughts

Putting all the investment ingredients together, what concerns me is the combination of an unsustainable investment craze in Microsoft, its radical overvaluation, a slowing economy, and now the rolling over of technical action. This is exactly the recipe for a major stock market top in the past.

If we repeat the early 2022 pattern, Microsoft could stick around the present share price level over the next month or two, trying to hold its 200-day moving average. But, there are no guarantees from this point. Another trading possibility is even larger selling and weaker EMV readings could play out the next couple of weeks. Of course, this scenario includes a far lower stock quote.

To me, the risk of a material price decline remains too high for my tastes. The valuation story argues a -20% to -50% Microsoft dump could be our future into 2025, to again trade at an average to below average valuation setting. Remember, equities can also be priced at the low-end of historical ranges, when investors pull the plug as deep recession hits.

Consequently, you have to believe the Fed can successfully lower rates soon without spiking inflation or pushing off Wall Street’s expectation of a soft-landing economy, as likely the only way to keep MSFT’s quote above $400.

Absent a “goldilocks” outcome over the next 6-12 months, sales and EPS may begin to miss rosy analyst forecasts. At the same time, any recession could remove significant liquidity from the financial markets and wealth to spend from consumers and businesses. So, plenty could go wrong for shareholders in Bill Gates diversified software brainchild, especially as recession fears exploded this past week in the mainstream press.

I rate Microsoft shares a Sell, with a 12-month target price of $300. Such a number would better represent its long-term valuation average, with a P/E closer to 20x and free cash flow yield approaching 5%. My assumption is short-term interest rates will remain in the 4% to 5% range well into 2025, continuing to provide real competition for overvalued Big Tech names. My modeling includes materially higher commodity prices and a weaker U.S. dollar exchange rate, partly a function of Wall Street factoring in a Democratic electoral win in November.

Thanks for reading. Please consider this article a first step in your due diligence process. Consulting with a registered and experienced investment advisor is recommended before making any trade.

Analyst’s Disclosure: I/we have a beneficial short position in the shares of NVDA either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

I am effectively short Microsoft and other Big Tech names through bearish positioning in NASDAQ 100 and S&P 500 derivatives. This writing is for educational and informational purposes only. All opinions expressed herein are not investment recommendations and are not meant to be relied upon in investment decisions. The author is not acting in an investment advisor capacity and is not a registered investment advisor. The author recommends investors consult a qualified investment advisor before making any trade. Any projections, market outlooks, or estimates herein are forward-looking statements based upon certain assumptions that should not be construed as indicative of actual events that will occur. This article is not an investment research report, but an opinion written at a point in time. The author's opinions expressed herein address only a small cross-section of data related to an investment in securities mentioned. Any analysis presented is based on incomplete information and is limited in scope and accuracy. The information and data in this article are obtained from sources believed to be reliable, but their accuracy and completeness are not guaranteed. The author expressly disclaims all liability for errors and omissions in the service and for the use or interpretation by others of information contained herein. Any and all opinions, estimates, and conclusions are based on the author's best judgment at the time of publication and are subject to change without notice. The author undertakes no obligation to correct, update or revise the information in this document or to otherwise provide any additional materials. Past performance is no guarantee of future returns.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.