Summary:

- Microsoft is set to report fiscal fourth-quarter results amid a selloff in big-tech and AI stocks.

- Satya Nadella has an opportunity to reignite AI enthusiasm as concerns about monetization rise.

- The report will provide insight into the next fiscal year and key business lines like Office, LinkedIn, Gaming, and Hardware.

FinkAvenue

Microsoft (NASDAQ:MSFT) is set to report its fiscal fourth-quarter results, amid an ongoing big-tech and AI selloff.

This Tuesday, Satya Nadella will have a chance to reignite AI enthusiasm, as concerns about near-term monetization continue to rise.

In an all-important report, Microsoft will provide an initial glance into its next fiscal year, as well as shed light on other key business lines like Office, LinkedIn, Gaming, and Hardware.

Let’s dive in.

Cautious Setup Into The Print

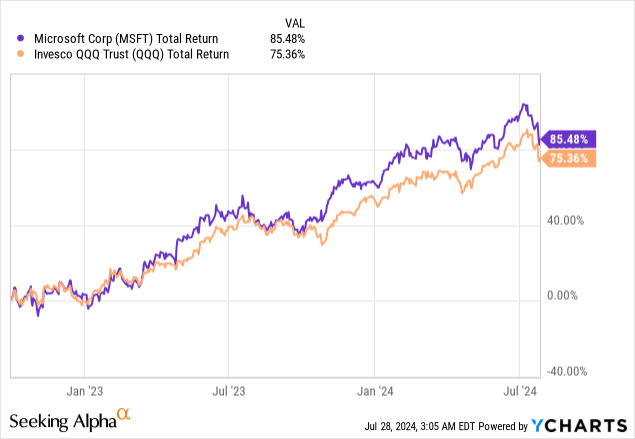

I’ve been covering Microsoft on Seeking Alpha since May of last year, several months into the great rebound of 2023.

Since the bottom of October 2022, Microsoft, and the rest of big tech, have all seen their shares go up and to the right, pretty smoothly.

There were really only three hiccups along the way. In October 2023 and April 2024, the downturns were primarily a result of a changing macro outlook, as rate expectations responded to inflation concerns.

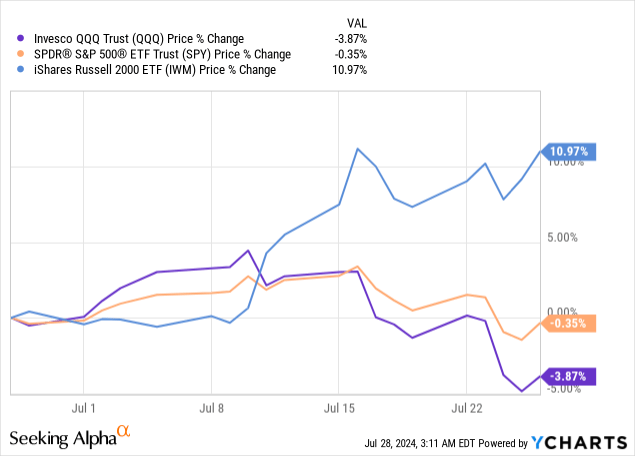

However, this time, the opposite is true. As rate cuts become increasingly certain, the market seems eager to reallocate funds to riskier, more interest-sensitive companies (i.e. small caps).

In addition, and perhaps more relevant to the purpose of this article, AI enthusiasm is fading. While there seems to be a consensus of optimism regarding AI’s potential to become a major paradigm shift, there’s growing suspicion about the astounding amounts of capital investments by big tech.

As a result, Microsoft is once again coming into a report with a somewhat convenient setup, as it gets the chance to reignite investor confidence.

Let’s dive into the key factors to monitor which will drive the shares in the near-to-mid-term.

Azure, AI Contribution, And The 31% Threshold

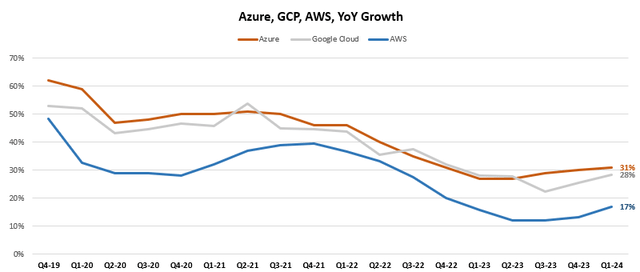

Since calendar Q3’23, Azure has taken back the lead in cloud growth in the three-horse race with Amazon’s (AMZN) AWS and Alphabet’s (GOOG) GCP.

Created and calculated by the author using data from the companies’ financial reports; Microsoft’s fiscal quarter is two periods ahead of the calendar year, meaning Q1-24 is Microsoft’s fiscal Q3-24.

Not coincidentally, this was right around when AI became a big decision factor, and Open AI, which is available exclusively through Azure, took the world by storm.

Notably, among the three hyper scalers, Microsoft is the only one who quantified AI’s contribution to its growth, coming in at 7 points last quarter.

Azure maintained a ~30% growth rate for three consecutive quarters, and it’s expected to come above that, at 31%, in this upcoming quarter. Channel checks are aligned on a beat, and there’s no reason to expect less than 31% growth.

On the last earnings call, Microsoft said that even though growth is accelerating, it was still supply-constrained, and I’m sure it’ll be asked to provide an update on that front. If Azure comes at 31% and management reiterates a shortage of supply, this will be a very good sign.

It’s also worth noting that the non-AI growth opportunity remains huge, as a little over 50% of workloads are still done on-prem.

So, What Are Investors So Concerned About?

First, open source. Meta (META) is making waves across the industry with its open Llama model, which seems to be on par with the leading closed models. This raises big questions about the validity of closed LLMs as a business. Although Microsoft itself offers Llama through Azure, the company’s huge investments in OpenAI might not be as lucrative as initially thought.

Second, customers’ ROI. Unlike most of its customers, Microsoft is already monetizing AI, primarily through Azure and Copilots. Almost every tech company is doing something in AI, but not many of them have come out with true AI-based products.

I think there’s much more innovation and success on that front than what AI bears claim. However, it’s still very early.

Office, Copilots

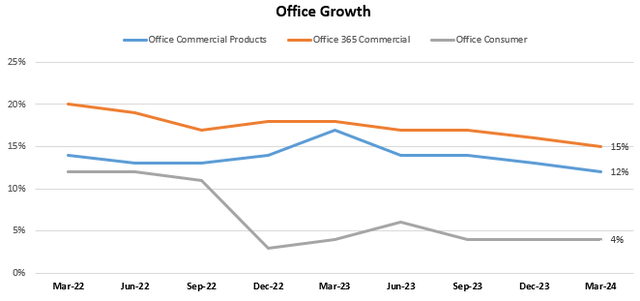

Office remains arguably the strongest software business in the world, and despite several decades of leadership, Microsoft is still innovating and gaining market share, maintaining double-digit growth in the enterprise segments.

Created by the author based on data from Microsoft financial reports.

Microsoft’s own end-point AI product is its copilots. So far, the primary use case is GitHub copilot, with 1.8 million paid subscribers, growing 35% QoQ. At a price level of $21 per user per month, that’s a direct $500 million run rate. Not too significant for a company as big as Microsoft, but still impressive.

In addition, Microsoft is seeing continued adoption of its Office Copilots, as well as its Copilot Studio. They still expect this to become their fastest product to reach $10 billion.

Office 365 Commercial is expected to grow 14%, Office Consumer low-to-mid-single-digits, and Office on-prem, is expected to decline, as migrations to the cloud continue.

Devices, Windows & Security

I decided to pile these three together because I think they are commonly underappreciated by the market, for various reasons, and I expect all three of them to become a meaningful growth driver in the near term.

Security

First, security. Microsoft has a $20 billion security business across multiple segments. Security is one of the fastest-growing categories in tech, and it’s only accelerating. With rising geopolitical tension, it seems like every day there’s a new cyberattack, and it’s affecting key mission-critical sectors of the economy including healthcare and telecom.

I’m not sure why Microsoft doesn’t break out more details about its security products, but it is perfectly positioned to become the world’s largest cybersecurity company in the cloud, with its unparalleled penetration in enterprise customers.

Windows

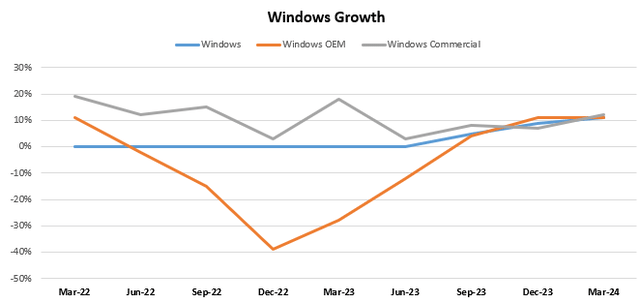

Second, Windows. Windows has been a drag on Microsoft’s results all throughout fiscal 2023, but it turned positive starting Q1’24, which ended in September 2023.

Created by the author based on data from Microsoft financial reports.

Windows growth accelerated for three consecutive quarters and is expected to decelerate in the upcoming quarter. However, it should be noted that this quarter’s comps are easier, and I expect a beat.

Devices

Devices revenue growth has been negative for six consecutive quarters, driven by the Covid pull-forward effect. We’re seeing the same trend across other major device providers, including the leader Apple (AAPL).

Despite AI capabilities potentially driving an upgrade cycle, Devices are still expected to decline in the mid-teens this quarter.

However, this quarter isn’t as important as the guide for the next quarter, which will include the Copilot+ PCs. With the help of convenient comps, I’m expecting a much better guide for next quarter.

Gaming

Microsoft’s gaming division has now become the Activision segment in essence, as it’s the biggest component of the business. Somewhat under the radar and overlooked by investors, I think that Microsoft is failing in gaming, and the Activision acquisition would have been much more scrutinized if gaming wasn’t a not-so-important segment in Microsoft.

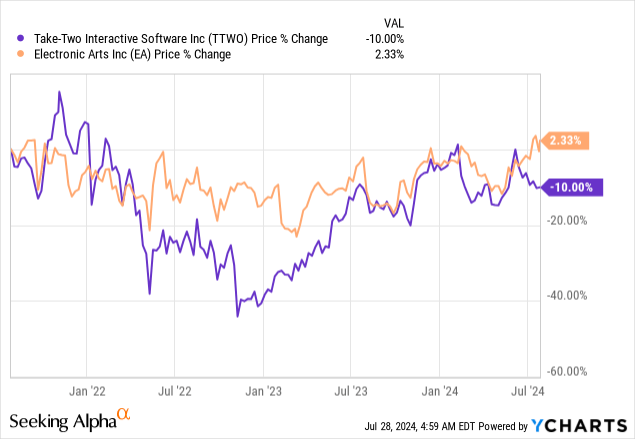

The entire gaming industry is struggling right now, as reflected by the 3-year performance of Take-Two (TTWO) and Electronic Arts (EA).

Hardware sales are plunging, and triple-A games are becoming increasingly expensive to develop. This is another industry that’s struggling to recover from the pull-forward effect of COVID-19, in addition to the fact that mobile games are taking share and community-based games like Fortnite and Roblox are taking much of the engagement.

Still, gaming is a huge industry, and any sign of improvement on that front would be great for the stock.

Advertising, LinkedIn & Bing

At last, we get to Microsoft’s internet businesses, in LinkedIn and Bing. Both are primarily advertising platforms, although LinkedIn has a very strong subscription business in LinkedIn Premium.

These are two highly profitable businesses, which have been accelerating over the past several quarters.

For Search, it was primarily market share gains driven by AI innovation in Bing.

For LinkedIn, it’s been a product innovation story, as the company is capturing more business and adding value to customers amid a tougher job market.

Search is expected to accelerate from 12% to mid-teens growth, while LinkedIn is expected to decelerate from 9% to mid-to-high-single digits.

Valuation & Guidance

I think it’s fair to say we established Microsoft as an extremely diversified business, with extraordinary growth prospects in every single one of them, and clear industry leadership in most.

Three factors will drive share performance following this report. One, beating this quarter’s expectations as we discussed. Two, providing positive guidance for the next quarter, as well as positive commentary for next year, which they already said should be another year of double-digit revenue and operating income growth.

Three, valuation.

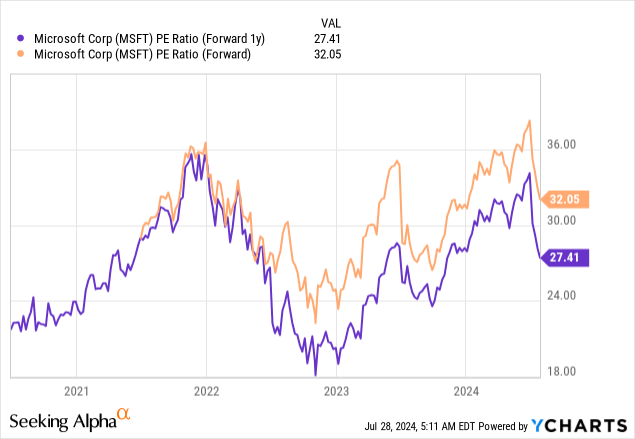

It’s funny how these things work, but in three days, Microsoft will no longer be trading at 36 times forward earnings, but rather at a 32x multiple, as shares will start trading based on the company’s FY25 numbers.

That puts Microsoft in line with its historical average. Frankly, not screaming attractive.

However, I still believe this is an attractive entry point. Microsoft is expected to grow EPS at a mid-teens pace for the foreseeable future and buying shares at a fair valuation is enough to generate market-beating returns.

In addition, Microsoft always beats expectations and FY25 should be no exception, meaning it’s actually slightly undervalued.

Lastly, Microsoft is arguably best positioned to capitalize on AI, with the lowest risk of overspending thanks to its unparalleled demand signals and best-of-breed management. With that in mind, I think a premium over historical valuation would be reasonable.

Conclusion

Microsoft is set to report its results for the last quarter of its fiscal year this Tuesday.

Once again, it’s coming into the print with a somewhat favorable setup, as shares have been underperforming for several months.

Satya Nadella will take center stage, and I expect he will succeed in doing what Sundar Pichai failed to do, which is to provide assurance for the market about AI in both the near and long term.

All of the company’s key businesses are expected to maintain or accelerate already elevated growth.

Therefore, I reiterate Microsoft as a Buy ahead of earnings.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of MSFT, GOOG, AMZN either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.