Summary:

- Microsoft appears set to make a strange deal to invest aggressively in OpenAI.

- The AI chatbot technology of ChatGPT has caught the market attention, but the service has no functional business model yet.

- The stock remains the most expensive of the tech giants, and a wild $10 billion investment is a negative signal.

WANAN YOSSINGKUM/iStock via Getty Images

According to media outlets, Microsoft (NASDAQ:MSFT) is working on a large shark tank type deal to invest in OpenAI, the firm behind ChatGPT. The AI chatbot has garnered a lot of attention, but the leaked deal leaves a lot of questions regarding the viability of the business, with the company needing such a massive investment. My investment thesis is Bearish on the tech giant continuing to make large investments and acquisitions to cover up lagging demand for PC software.

Shark Tank Type Deal

Microsoft is reportedly investing a whopping $10 billion in an AI chatbot only released into the wild back in November 2022. The large investment does come with a huge caveat in Microsoft controlling 75% of the profits until the investment is recouped. After reaching this threshold, Microsoft would only control 49% of OpenAI with other investors owning 49% and the non-profit parent controlling the other 2%. The tech giant would be left without control of the business going forward.

The deal is reportedly at a $29 billion valuation for a chatbot with no business model yet. Also, employees and early investors appear set to cash out shares at this relatively high valuation in a negative sign.

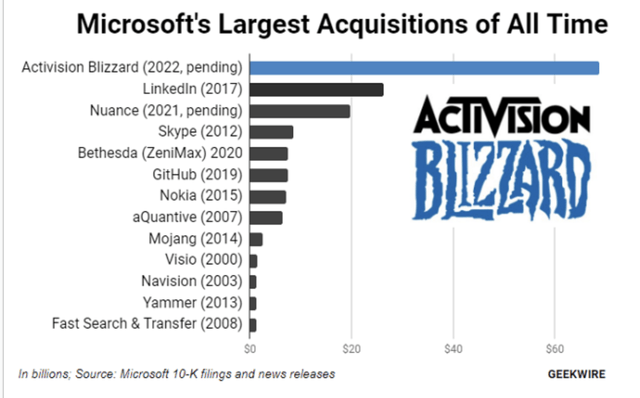

The valuation price would top all of the other deals done by Microsoft, other than the pending deal for Activision Blizzard (ATVI). All of the prior deals generally included well established business models.

The prime benefit to Microsoft is that OpenAI will be trapped into utilizing Microsoft’s cloud business. If the AI chatbot product turns into the entryway onto the internet, the tech giant could end up with a huge winner. If not, the Microsoft has wasted $10 billion on OpenAI after originally investing $1 billion in the business back in 2019.

The shark tank type deal where Microsoft collects the initial profits to cover the investment very much suggests the tech giant thinks the deal could be a home run, but the opportunity to be a major dud exists. The tech giant clearly envisions a path to where OpenAI fails to deliver meaningful profits.

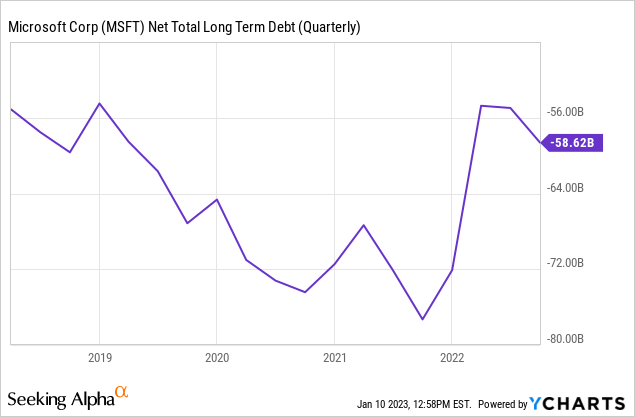

The size of the cash investment isn’t troubling to Microsoft, with a $59 billion net cash position. The company even returned $9.7 billion to shareholders in the last quarter alone. Regardless, the tech giant is still spending a large amount of funds on the unproven AI chatbot service when the money could be used to invest in the business or repurchase more shares.

While Microsoft is making an investment in AI chat technology, the $10 billion spent here is hardly any different than Meta Platforms (META) investing aggressively in the Metaverse. At least Meta actually has a business model with working VR devices and a Metaverse platform generating around $2 billion in annual revenues already.

In a lot of ways, the deal reminds us of the Intel (INTC) purchase of Mobileye (MBLY) back in 2017 for $15.3 billion. Some 5 years later and after substantial growth for the auto tech firm, Intel took the company public again with an IPO price approaching the purchase price, at one point.

In a lot of ways, Intel so overpaid for the business that all of the success didn’t provide much in the way of benefits for the chip giant. Microsoft appears to be making the same investment move here, with the over valuation of a venture startup firm buying into the hype.

Bad Signal

The biggest issue is that these aggressive investments suggest Microsoft faces a tough PC software environment. BoA analyst Vivek Arya just came out downgrading chip stocks due to expectations PC demand could dip to only 250 million units in 2023.

Just last week, CEO Satya Nadella discussed a difficult environment for the tech sector through 2025. Most notable, the market is still waiting for potentially disappointing Q4 numbers from the tech sector, and Satya just discussed over 2 years of additional weakness ahead.

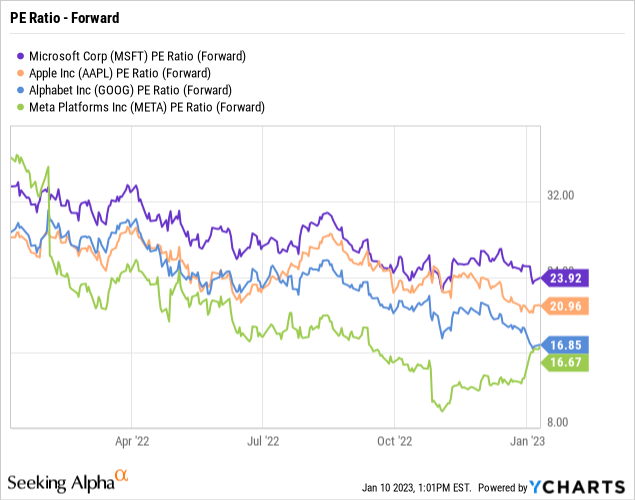

The OpenAI deal appears a move to re-accelerate growth or distract investors from the weak sector results ahead. The stock is already the most expensive in the big tech sector at 24x forward EPS estimates.

The group of Apple (AAPL), Alphabet (GOOG, GOOGL) and Meta all trade closer to 17x forward EPS targets. Right now, Microsoft is forecast to generate nearly 17% EPS growth for FY24 that appears out of touch with the tough PC market and the comments by the CEO.

In essence, the consensus analyst estimates very much disagree with the view of Satya. The current estimate now has FY24 revenues growing 13% to reach $241 billion.

Besides, Google already has its own AI chatbot in LaMDA (Language Model for Dialogue Applications). The chatbot technology appears as advanced as ChatGPT, though Google hasn’t released the technology to the public due to questions on commercial viability and the informative inaccuracies in the data provided by these AI chatbots.

Takeaway

The key investor takeaway is that Microsoft appears set to aggressively invest into a business with no proven business model. The market doesn’t like the wild investments by Meta into the Metaverse with an actual revenue stream, and this move into OpenAI could similarly hit the stock of Microsoft.

With the tech giant facing a further slowdown in PC demand, investors should avoid Microsoft and their aggressive investments.

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: The information contained herein is for informational purposes only. Nothing in this article should be taken as a solicitation to purchase or sell securities. Before buying or selling any stock, you should do your own research and reach your own conclusion or consult a financial advisor. Investing includes risks, including loss of principal.

If you’d like to learn more about how to best position yourself in undervalued stocks mispriced by the market heading into a 2023 Fed pause, consider joining Out Fox The Street.

The service offers model portfolios, daily updates, trade alerts, and real-time chat. Sign up now for a risk-free, 2-week trial to start finding the next stock with the potential to generate excessive returns in the next few years without taking on the outsized risk of high-flying stocks.