Summary:

- Microsoft is expected to report strong Q4 FY2024 results. I believe it should beat again, as the short-term consensus expectations seem to be too low.

- The fear surrounding CRWD’s system breach is unlikely to significantly impact Microsoft, from what we see.

- Microsoft’s plans to heavily invest in AI may be already priced in, so the management’s new comments about it shouldn’t significantly impact the stock during post-earnings comments.

- Despite strong fundamentals and high odds of beating Q4 consensus, Microsoft stock is currently overvalued, with a limited margin of safety.

- I maintain my “Hold” rating on the stock, waiting to see what’s in Q4 report.

lcva2

Intro & Thesis

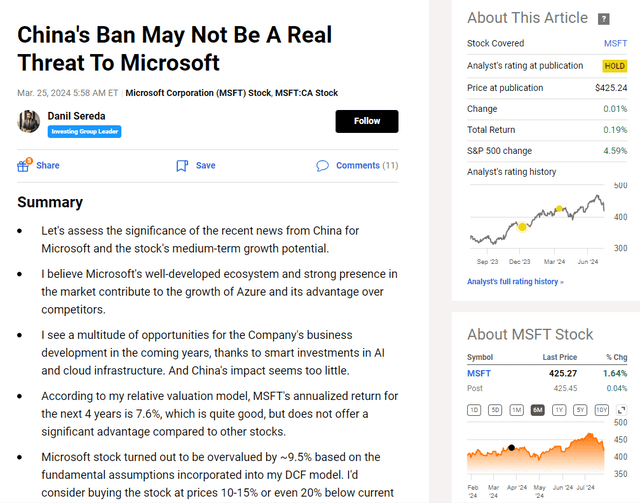

There will be a number of very important Q2 reports this week – the market is mainly waiting for the big tech companies, including Microsoft Corporation (NASDAQ:MSFT), which I have been writing about regularly on Seeking Alpha since December 2022. My last 3 ratings on MSFT were neutral – I urged caution as the stock seemed overvalued to me based on DCF. The last time I updated my thesis was in March, and since then, the stock has been virtually unchanged, and due to its recent price dip it has underperformed the broad market.

Seeking Alpha, my latest article on MSFT

Tomorrow, July 30, Microsoft will present its Q4 FY2024 report (the fiscal year is not synonymous with the calendar year in this case), and based on a number of indirect signs, I think MSFT’s chances of beating current forecasts are quite high. I think most market participants will likely use the recent drop in MSFT’s stock price as an opportunity to add to their long positions, so I’d expect a positive reaction post-earnings release.

Why Do I Think So?

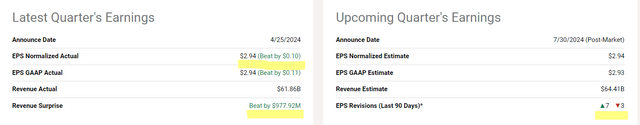

First off, let’s take a quick look at how the company reported for its fiscal Q3 FY2024. On a consolidated basis, MSFT reported $61.86 billion in revenue, which is a 17% increase year-over-year; on the bottom line, the company recorded an EPS of $2.94 – that’s a surge of 20% YoY. So Microsoft beat the consensus expectations for Q3 on both sides:

Microsoft’s Cloud segment in particular had a great quarter, bringing in $35.1 billion in sales (+23% YoY). Azure and other cloud services, including significant contributions from AI services, saw a 31% YoY growth. While this segment’s gross margin percentage dipped slightly to 72% because of ” the change in accounting estimate for useful lives”, it still outperformed the management’s internal expectations thanks to “the shift to higher-margin businesses and effective cost management”. So the cloud’s EBIT grew by 23% YoY, with operating margins improving to 45%, which I consider a fantastic result.

In the Productivity and Business Processes segment, revenue rose by 12% to $19.6 billion. Office 365 commercial revenue increased by 15%, supported by “strong renewal rates and higher average revenue per user.” On the other hand, LinkedIn and Dynamics revenues went up by 10% and 19% YoY, respectively. The More Personal Computing segment also reported a 17% YoY revenue increase (to $15.6 billion), largely thanks to the Activision acquisition, which boosted gaming revenue by 51%. Windows OEM revenue grew by 11%, “benefiting from a better-than-expected PC market”. However, devices revenue declined by 17% YoY as the company focused on higher-margin premium products.

According to the Q3 results, Microsoft reported cash flow from operations of $31.9 billion, a 31% increase, driven by “strong cloud billings and collections.” So as far as I can see, the growth in revenue and margins in specific segments is confirmed by enhanced cash generation, indicating that those are not just inflated income statement lines. Moreover, even with increased capital expenditures recently, the results of Q3 showed free cash flow amounting to $21 billion, which is 18% more than a year earlier, so again – this indicates that from a cash generation perspective, Microsoft is growing quite qualitatively.

And now, regarding the 4th quarter results, which will be published literally tomorrow.

According to statements made by management during the last earnings call, they expected the top-line growth to continue, albeit with some impact from the stronger U.S. dollar against the currencies important to the company. Management anticipated that exchange rate changes and the stronger dollar would impact sales by approximately 1%, which equates to approximately $700 million in sales. They expected strong commercial bookings and an increase in the number of Azure contracts. In the Intelligent Cloud segment in particular, they expected to see an increase of sales by 19-20% year-on-year due to the stronger performance of Azure. The Productivity and Business Processes segment was expected to grow 9-11% to $20.2 billion, driven primarily by continued growth in average check size and Office 365 subscriptions. The More Personal Computing segment was projected to grow 10-13% YoY, with Windows OEM and gaming playing a key role. Management highlighted that following the acquisition of Activision, gaming revenue is expected to increase by more than 40% year-on-year, which is a lot (almost like in Q3 FY2024). In addition, the company issued a forecast indicating that COGS and OPEX would be slightly higher due to accounting changes. Nevertheless, the combination of all the above projections is likely to result in an operating margin rise:

we now expect full year FY2024 operating margins to be up over 2 points year-over-year, even with our cloud and AI investments, the impact from the Activision acquisition and the headwind from the change in useful lives last year.

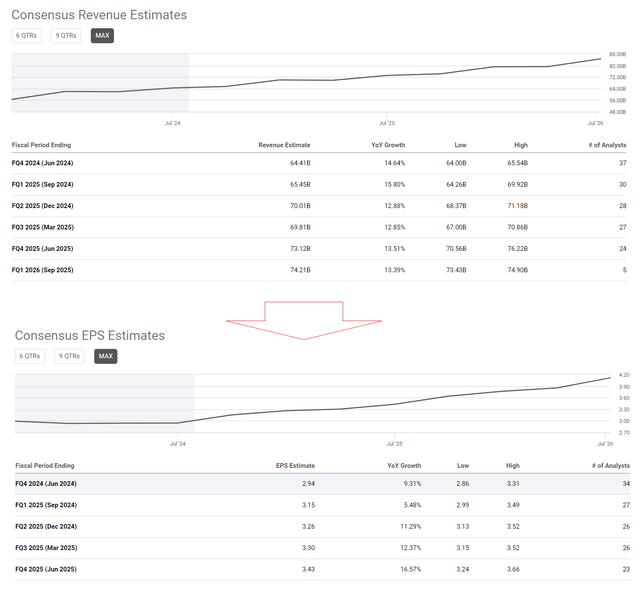

I may be mistaken in my conclusions, but it seems to me that the market is not fully accounting for the management’s forecast of a higher operating margin. In terms of revenue, the Q4 sales growth rate is predicted to exceed the growth rate of EPS by ~530 basis points – this suggests a margin contraction, contrary to the management’s expectation of higher marginality on a YoY basis. So the market appears to be underestimating the strength of the company’s financials for Q4.

One of the reasons for the recent decline in Microsoft’s stock has been news about issues with CrowdStrike (CRWD). However, Barclays analysts suggest that this is more of a problem for CrowdStrike itself rather than for Microsoft. So the fear surrounding this breach is unlikely to significantly impact Microsoft.

Barclays’ research note [July 2024], proprietary source![Barclays' research note [July 2024], proprietary source](https://static.seekingalpha.com/uploads/2024/7/29/49513514-17222429523816116.png)

I anticipate that management will naturally state that they plan to invest heavily in the development of their AI products during the upcoming Q4 earnings call. However, this is already old information. In past calls, we’ve already heard similar statements, and I believe this is already factored into Microsoft’s stock price and shouldn’t materially harm it if the management announces another round of heavy investments.

However, from the latest news, we see that one of the key companies for the development of Microsoft’s AI sphere, OpenAI, has released a new service for its search engine based on its LLM model – SearchGPT. I think this is very positive news, as Microsoft’s Bing search engine has been gradually increasing its market share in recent months, even if it remains a minority player. If this new technology proves to be very effective in terms of information sourcing, I believe Google (GOOG) will finally have a very strong competitor, and Microsoft will have a new revenue stream. So I’m looking forward to more detailed comments from Microsoft management at the upcoming conference call, and believe that expanded commentary will allow the market to understand the company’s strategy better and could lead to revised EPS forecasts for the next few years. This, in turn, could provide a boost to the stock in the medium term.

Unfortunately, Microsoft can’t be considered an undervalued company to date.

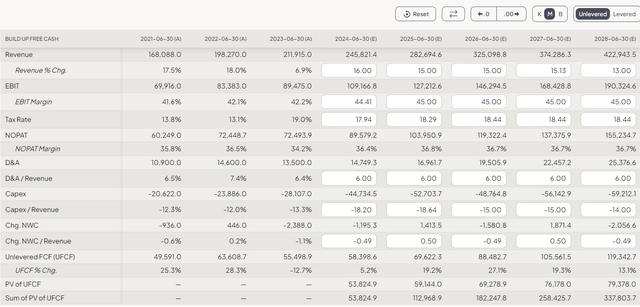

Based on the foregoing, let’s update its DCF valuation model in a somewhat simplified form. I’ll add a small premium to current revenue forecasts, ranging from 50 to 80 basis points annually. I’ll also assume that Microsoft will achieve a 45% operating margin, and other operating metrics will stabilize at their average historical values. Additionally, I expect capital expenditures in relation to revenue to reach 18.6% by FY2025 and then decline to 14% by FY2028. Here’s what I have at this stage:

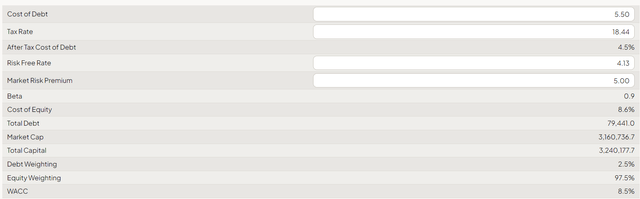

I suggested that the cost of debt for my calculations is approximately 5.5%, considering that the risk-free rate is still relatively high at around 4.13%. So this results in a weighted average cost of capital for the company at 8.5%, which seems to be a reasonable assumption.

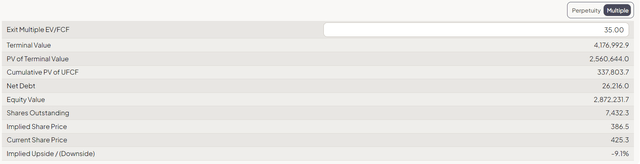

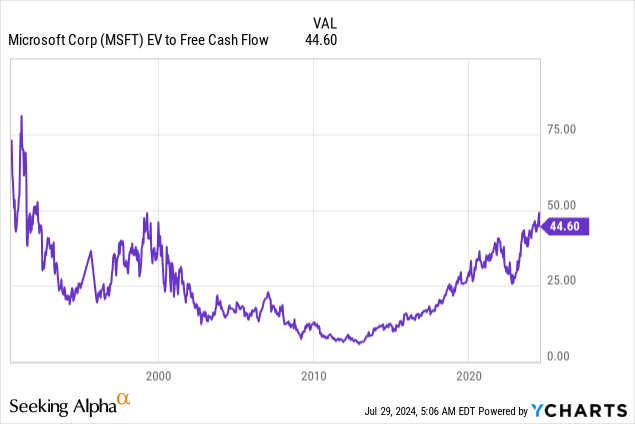

Microsoft’s current EV/FCF ratio is ~44x, almost double the multi-year average. As the last time, I expect the exit EV/FCF multiple to be ~35x, which is still above average, but lower than the current figure.

So based on all my assumptions, Microsoft stock turned out to be overvalued by ~9.1%, but the “fair” price went up from $413/sh. last time to $425.3 today:

The Bottom Line

In my opinion, Microsoft is still a strong company with significant growth prospects. The company is very large and well-positioned for future growth. However, many of these growth prospects seem to be already priced for the long term.

On the other hand, Microsoft has the potential to increase in value due to its strong fundamentals in the short term. There are some discrepancies in the market’s assessment for Q4 FY2024 and even Q1 FY2025 compared to what the company can actually deliver in these periods. The current forecasts for Q4 may be underestimated, and based on the options pricing available to us, if MSFT beats again, the stock could see an increase of around $19. In other words: If Microsoft can beat the current consensus Q4 consensus, its stock could rise by 4.5%. However, there’s not enough margin of safety in the stock’s valuation, which is why I maintain my “Hold” rating on the stock.

Thank you for reading!

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Hold On! Can’t find the equity research you’ve been looking for?

Now you can get access to the latest and highest-quality analysis of recent Wall Street buying and selling ideas with just one subscription to Beyond the Wall Investing! There is a free trial and a special discount of 10% for you. Join us today!