Summary:

- Microsoft’s AI Co-Pilot initiatives could potentially add 23% to run-rate EBITDA.

- The adoption of Co-Pilot in Microsoft Office products could result in an additional $31 billion in run-rate revenue.

- Azure is well positioned to capture share in the enterprise software, IT services, and communication services markets.

gorodenkoff

Microsoft (NASDAQ:MSFT) is poised to benefit materially as company IT spend shifts to AI-enabled software. Its strong balance sheet supports the elevated investment cost necessary to underpin the development of AI-embedded applications. Whilst AI Co-Pilot initiatives are only just starting to be rolled out and the ultimate adoption rate among clients is unknown, these new products could add potentially 22.5% to run-rate EBITDA. The cloud hyperscalers have grown in disciplined fashion and companies globally are still in the early phases of migrating on-premise workloads into the public cloud. With the AI theme in its infancy, we are in a period of extraordinary innovation driven by both enterprise and consumer interest. With the potential to be a key beneficiary, MSFT is attractively valued on a 29.7x forward P/E ratio.

One of Microsoft’s principal yet most understated competitive advantages is its distribution across its enterprise business and the ability to up-sell into its existing client base. Knowledge workers and developers are key beneficiaries of Microsoft’s generative AI based toolkit, primarily the Co-Pilot suite of solutions which can be adopted and integrated into customer’s existing work-flows to augment functionality across the application layer.

Office 365 Co-Pilot has been priced at $30 per user per month on top of a standard E3 / E5 office license. Consider that the average MSFT Windows user pays only $180 per annum and a Teams premium account costs $10 per month.

Given the infusion of AI into the Microsoft Office suite of products offers significant productivity benefits, the potential revenue enhancement is vast. It will be interesting to see what take-up will be across the current 345 million Office 365 user base but a 25% penetration rate by 2026 would result in an additional $31 billion in run-rate revenue.

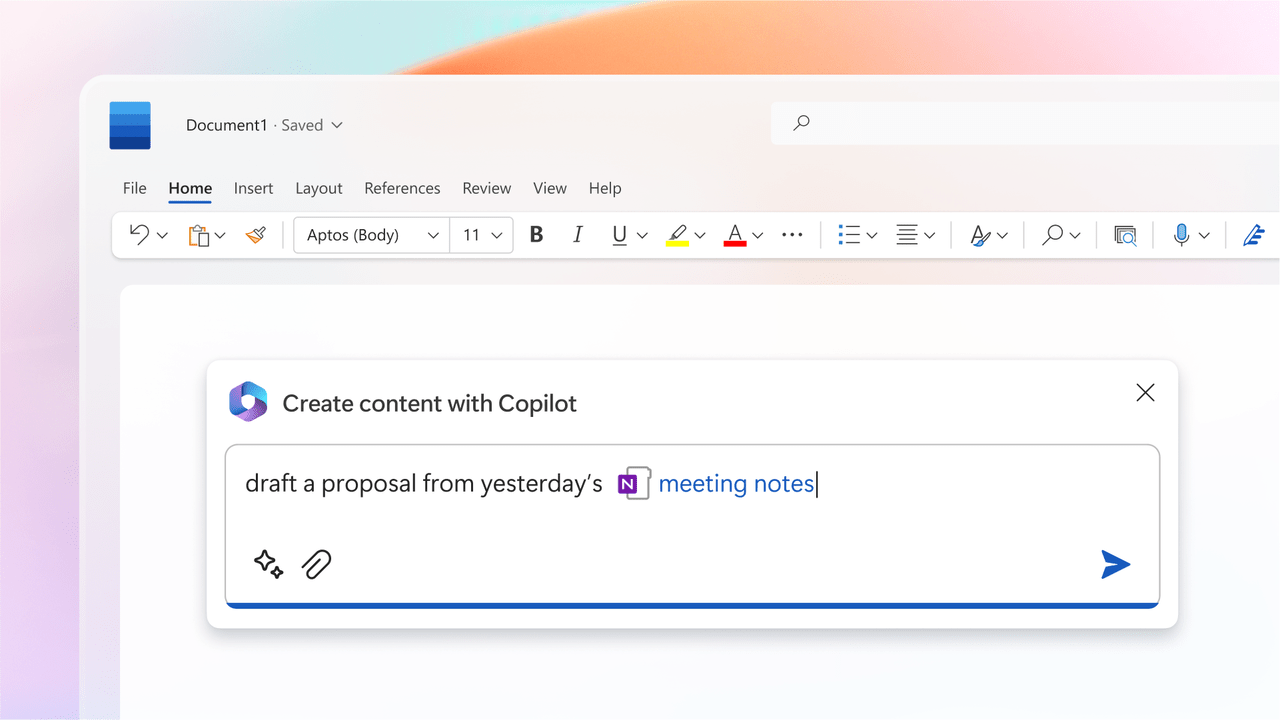

Microsoft 365 Co-Pilot

Microsoft Co-Pilot (Microsoft)

Considering the migration of Office On-Premise to Office 365 reached 20% penetration within two years, the potential for a similar adoption pattern with Co-Pilot is not unrealistic. The next question is what kind of margin can we expect Co-Pilot to deliver? Generative AI Solutions ought to have similar margins as to the cloud business or around 70% gross margin. Whilst AI is a computationally intensive solution, the costs should come down in the future and the margin should not be overly dilutive. Github’s AI Co-Pilot writes programming code to assist developers. This is a high value solution which will generate significant benefits for users and commands a price point of $10 per month or $100 per annum per user. There are 100m Github users and assuming 20% adopt Co-Pilot yields an additional $2bn in run-rate revenue.

The next opportunity to consider is within Azure. Most start-ups and many established companies rent their computational power from a handful of cloud vendors who effectively sell workload capacity or infrastructure for other businesses to utilise. The main hyperscalers – Google Cloud Platform, Microsoft Azure and Amazon AWS – enjoy around 66% global market share and have exercised discipline in adding capacity.

Yet, around 90-95% of global IT spend still remains on-premise which indicates we are still in the early innings of cloud adoption.

Global IT expenditure totaled $4.43tri in 2021 and whilst the three main cloud providers are set to generate around $185 billion in revenues in 2023, this still equates to only around 4% of the total. Microsoft Azure is well positioned to capture share in enterprise software ($1.2tri market in 2021); IT services, a $1trillion market; and communication services, a $1.3trillion market.

AI offers a new layer of growth due to the substantial computational power required and the inability of organisations to develop their own large language models. Given advancements in machine learning and large language models, large enterprises are likely to want to leverage their internal data to drive differentiation and build their own solutions rather than adopt packaged software applications. Whilst companies are announcing AI initiatives, it will take time for pilot projects to move into production and for cloud AI expenditure to inflect.

Within the cloud eco-system, Amazon developed an early lead by leveraging first mover advantages which enabled AWS to attract SMEs and digital natives through a strong value proposition and broad solution portfolio stressing their value proposition. MSFT entered later based on their strength of existing customer relationships and existing infrastructure within on-premise systems. MSFT has more customers using their Platform as a Service (for PaaS) infrastructure and are larger across the database layer. For instance, Amazon’s mix is 70% Infrastructure as a Service (IaaS) and 30% PaaS whilst MSFT is 65% PaaS and 35% IaaS. Once the cloud build-out matures, the hyperscalers will reap annuity / utility-like benefits for many years to come.

We don’t know how much an AI Generative workload will consume which makes forecasting margins challenging. We can expect the volume of workloads utilized to accelerate driven by expanded functionality enabled by Generative AI. Microsoft should be able to monetize these workloads and it is possible Azure could capture up to 50% of these workloads. Security Co-Pilots could be an additional growth vector. Microsoft’s security business currently generates around $20bn of revenue. Their Sentinel solution has ramped quicker than consensus expectations and there is a significant opportunity to leverage its position in security analytics.

The capital expenditure associated with building out these AI capabilities will be substantive – perhaps in the order of $40-50bn per annum. This represents a 50-75% increase in cap ex and is indicative of the potential uplift in cloud revenue where MSFT is leading the market.

Risks

The IT spend environment is presently constrained and the ability to move the needle on a large installed base requires patience. There is uncertainty around the near-term revenue like and the AI ramp will take time as the technology is still very new. It will take enterprises a while to push applications into production.

Valuation

MSFT trades on a 29.7x forward P/E ratio. The company is in a net cash position and is set to acquire Activision Blizzard subject to UK CMA approval. Based on the aforementioned Co-Pilot and security AI initiatives, the company could generate c. $33bn incremental revenue from AI initiatives over the next 2-3 years. Applying a 70% margin would add $23bn to EBITDA or an extra 22.5%.

Conclusion

Microsoft is a world leading provider of human productivity software set to reap the benefits of integrating Generative AI into its platform. Developers will access open AI services through the Azure platform to build applications and implement Gen AI solutions, while enterprise and individual customers will benefit from a suite of Co-Pilot products across Office365, Github (the biggest utiliser of large language models), Bing and Teams Premium. In essence, Microsoft builds AI technologies for users to leverage or implement, but also infuses AI into its own products which enhance customers’ productivity. The core business model is very sticky and the use case of AI in areas such as coding have already been clearly demonstrated by Microsoft’s Github Co-Pilot initiatives. As these productivity enhancements become more demonstrable and uptake inflects, the stock may see further multiple expansion than the 10% already evident this year driven by the prospect of structurally higher profitability.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of MSFT either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.