Summary:

- Microsoft stock price has doubled, but earnings only increased by 20%, leading to a record forward P/E of 38x.

- Growth is expected to remain at 15% driven by Cloud, but that is simply not enough to justify the price tag.

- Moreover, the stock is unlikely to benefit from interest rate cuts as much as most believe.

FinkAvenue

Dear readers,

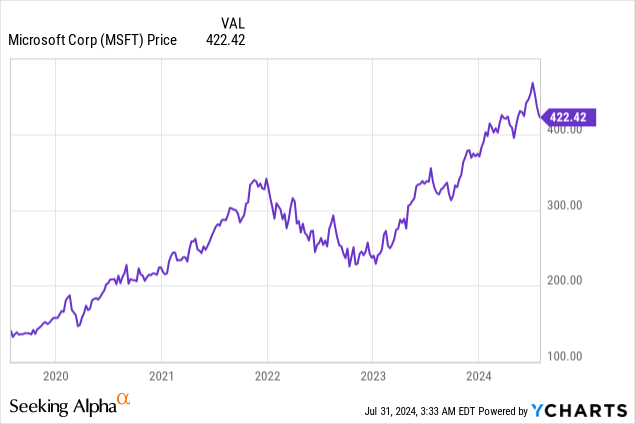

Microsoft (NASDAQ:MSFT) has been a major beneficiary of the recent AI-fueled rally and has seen its price rise from a low of $230 per share in late 2023 to over $450 per share recently. Yesterday, the company announced their latest earnings results and the price has slumped to $422 per share.

But while the price has nearly doubled over the past year, earnings (fiscal 2023 vs. fiscal 2024) have only increased by about 20%. The stock now trades at a record P/E of 36x and an earnings yield deeply below long-term treasury yields of only 2.8%. That is hardly a sustainable valuation, even for an AAA rated company, which is why I have been fairly bearish on the stock.

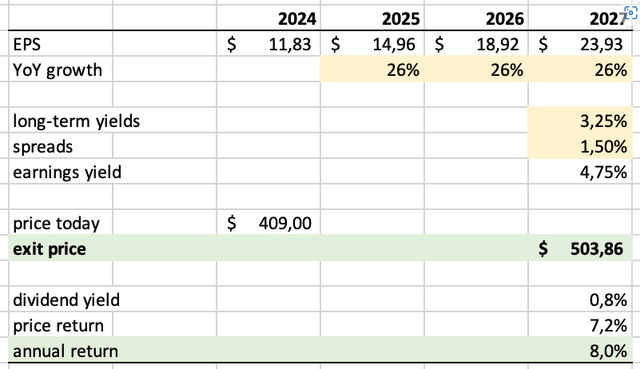

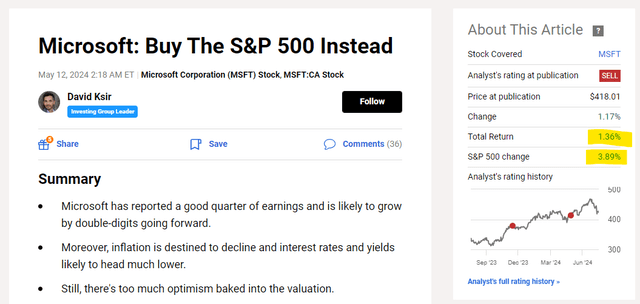

Most recently, I published an article called Buy The S&P 500 Instead, where I argued that even under the assumption that long-term yields would decline to 3.25% (a somewhat stretched assumption), earnings per share would still have to grow by at least 26% per year for the stock to deliver at least a market level return of 8% from current valuation levels. With average consensus EPS growth for the next three years of just 15%, I did not see the valuation as justified and issued a SELL rating at $409 per share.

Now, to clarify, I wasn’t calling for a major crash in the price of Microsoft. Rather, my findings led me to believe that even in a very bullish scenario the stock would likely not be able to deliver market beating returns, which is why I recommended investing in the S&P 500 (or other more favorably valued stocks) instead. Admittedly, the stock price has not moved much since my last article. Microsoft returned an RoR of 1.4% and the S&P 500 increased by 3.9%.

But there are two factors that, I believe, justify taking a closer look at Microsoft stock again:

- The recently announced results beat expectations, but showed a slowdown in Azure, and failed to show signs of growth accelerating above 15%, which would further support the initial SELL thesis,

- but at the same time, the macroeconomic environment has improved and points to interest rate cuts sooner, rather than later, which could be a positive catalyst for the stock.

Latest results hit expectations

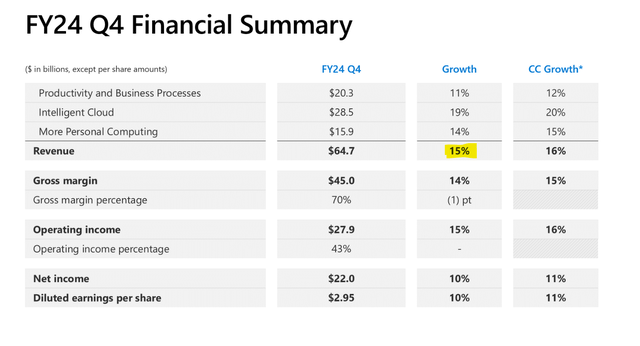

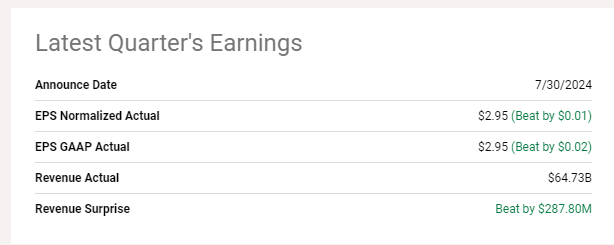

Microsoft reported their fiscal Q4 2024 with EPS of $2.95 and revenue of $64.7 Billion. Although technically both metrics beat expectations, the beat was insignificant.

SA

These results were driven by 15% YoY revenue growth, in line with expectations, but were down from 17% YoY in Q3 as a result of lower growth in all three major segments – Productivity and Business, Cloud, and Personal Computing. This is important for my thesis because for the stock to be a BUY, I would need to see an indication of growth accelerating towards the 26% threshold described earlier. Unfortunately, we did not see anything pointing in the direction.

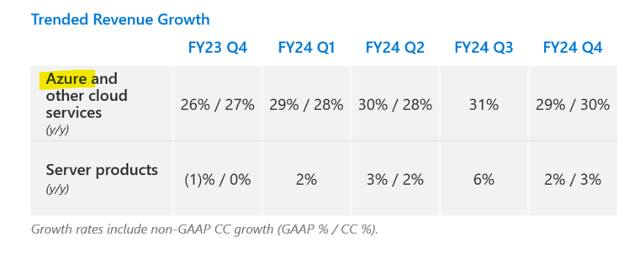

Notably, Intelligent Cloud, and especially Azure, which has been the biggest beneficiary of growth in AI, has seen its growth slow from 31% YoY in Q3 to 29% YoY in Q4. This may be the reason why the price dropped 6% intra-day on the earnings announcement. After-all, everyone has been buying the stock for its AI prospects, so a slowdown in this category is a big deal. But if we zoom out, it is quite clear that Azure remains on a steep growth trajectory with 25%+ growth and one small 2% drop in YoY growth does not change that. At least not for now.

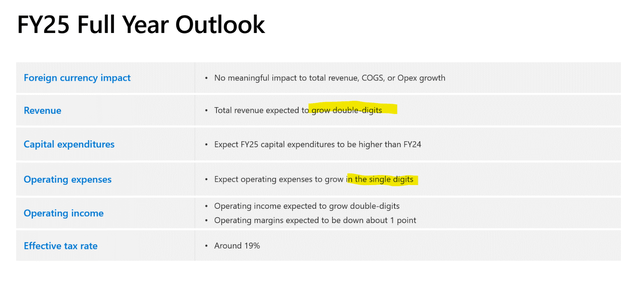

The latest results have also revealed that the gap between revenue and operating expense growth rates has been narrowing, which could eventually prove problematic for margin expansion. For reference, during the quarter, revenue grew by 15% YoY, while operating expenses grew by 13% YoY. For next year, however, management guides towards double-digit revenue growth only single-digit operating expense growth, which should drive margins higher.

All in all, the latest results confirmed that (1) AI is to be taken seriously as Azure remained the fastest growing segment, (2) Microsoft is likely to continue to grow its revenue by around 15% per year, and (3) operating leverage should improve in fiscal 2025 and result in margin expansion.

In line with this, the general consensus is for EPS growth of 12.5-18% over the next three years, which well below the level of growth that I estimated would be needed for Microsoft to return any sort of alpha.

Macro improves the picture, slightly

The macro picture has been improving by the day as inflation has cooled for 12 consecutive months and reached a low of 3% in June. Moreover, I believe that a further decline in inflation is only a question of time, as the headline numbers continues to be overstated due to a significant lag in shelter and auto insurance inflation. As addressed in my recent article called A Bet On Rates I Am Willing To Make, real-time data for these components of CPI are already showing price declines (i.e. negative inflation). Therefore, I expect that headline CPI will very likely fall below the Fed’s 2% target by the end of the year.

The market has priced in a first rate cut in September, but if I’m right and inflation does fall faster than expected, then there could be many more interest rate cuts coming.

The question then becomes whether these rate cuts are likely to benefit Microsoft in a positive way. Looking at the Excel screenshot above, it is obvious that a decline in long-term yields should translate into a higher valuation multiple / a lower fair earnings yield. But this effect may be partially offset by the fact that Microsoft will earn less on their enormous cash pile. Currently, the company has $75 Billion in cash and equivalents which accrued interest at high rates. This, alongside the fact that debt is lower than cash, is one of the main reasons why the stock has done well in a high interest rate environment, despite a long duration of its cash flows. More importantly, it is also the reason why it may not benefit from a drop in rates as much as everyone expects.

Bottom Line

Microsoft is a classic example of a wonderful business with an expensive price tag. The company has delivered very good results with strong double-digit earnings growth and expects to continue to grow earnings by as much as 15% per year for the foreseeable future. Unfortunately, the valuation has got very expensive and has effectively priced in growth much higher than 15%. Some might argue that a premium valuation is (somewhat) justified by an improving macro environment, but I expect that a decline in interest rates will not benefit Microsoft enough to justify the premium. If anything, given Microsoft’s large cash position and lack of debt, I don’t expect it to be very interest rate sensitive. For these reasons, I rate the stock a SELL due to overvaluation.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

If you want to access my entire Portfolio and all my current Top Picks, feel free to join ‘High Yield Landlord’ for a 2-week free trial.

We are the largest and best-rated community of real estate investors on Seeking Alpha with 2,500+ members on board and a 4.9/5 rating from 500+ reviews:

![]()

You won’t be charged a penny during the free trial, so you have nothing to lose and everything to gain.