Summary:

- Microsoft, with a $3.04 trillion market cap, is a robust firm that is growing at a rapid pace for its size.

- Q1 2025 results show a 16% revenue increase to $65.59 billion, with significant growth across all segments, especially in Intelligent Cloud.

- Microsoft’s profitability and cash flow are robust, with net income at $24.67 billion and significant share buybacks and dividends.

- Despite a high valuation, Microsoft’s quality and growth trajectory justify a bullish outlook as a GARP candidate.

HJBC

With a market capitalization as of this writing of $3.04 trillion, software behemoth Microsoft (NASDAQ:MSFT) is one of the largest publicly traded companies on the planet. In the past, I have been somewhat bullish about the company. Back in July, I chronicled how shares of the company experienced a dip after reporting financial results for the final quarter of its 2024 fiscal year. Even though revenue and earnings exceeded analysts’ expectations, the company was experiencing slower growth in from Azure. Margins were also showing some signs of weakness.

At the time, however, I viewed this as a buying opportunity for investors. My rationale was that the company was still growing at a rather rapid pace. It continued to be a cash cow and I argued that while shares were not cheap, I didn’t consider them expensive for such a high quality business on the trajectory that it was on. Since then, the market has disagreed with me to some extent. Shares are up 1.3% while the S&P 500 is up 7.9%. But with management recently having posted results for the first quarter of the 2025 fiscal year and those results showing continued strength, I believe that this downside is an overreaction. Ultimately, I believe that Microsoft will continue to achieve enough growth to justify a bullish outlook from an investment return perspective.

A great start to a new fiscal year

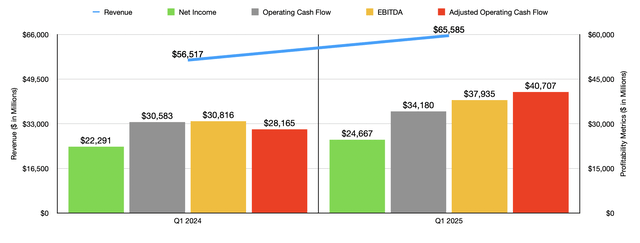

Fundamentally speaking, it’s difficult to be upset with Microsoft. Take results for the first quarter of the 2025 fiscal year compared to the first quarter of 2024. These came out last week. During the quarter, revenue for the company came in at $65.59 billion. That’s an increase of 16% compared to the $56.52 billion the company reported just one year earlier. This was driven by growth across all three of the company’s operating segments. But before we get into those, I do think a discussion of bottom line performance is also in order.

Author – SEC EDGAR Data

With revenue rising, it would be shocking to see any scenario other than an improvement in profits and cash flows. Net income for the most recent quarter was $24.67 billion. That’s 10.7% above the $22.29 billion the company reported one year earlier. But that wasn’t the only improvement. Operating cash flow jumped from $30.58 billion to $34.18 billion. If we adjust for changes in working capital, the increase is even more impressive from $28.17 billion to $40.71 billion. And finally, EBITDA for the company managed to expand from $30.82 billion to $37.94 billion.

Management has created such a cash cow that, even after subtracting $45.12 billion worth of debt, the company has excess cash of $33.31 billion. But it would be a mistake to assume that the company is just sitting on this cash. In fact, this excess cash comes after significant share buybacks and dividends. In the first quarter of the year, Microsoft repurchased $3.40 billion worth of stock. This was net of $706 million of common stock that was issued. Admittedly, this is lower than the $4.15 billion repurchased one year earlier. However, the company has done well to grow its dividend. Last year during the first quarter, the software giant paid out $5.05 billion to shareholders. This year, that number was $5.57 billion. The company has achieved all of this while also repaying $6.71 billion worth of debt and allocating $14.92 billion toward capital expenditures and $1.85 billion toward various acquisitions.

Breaking it down

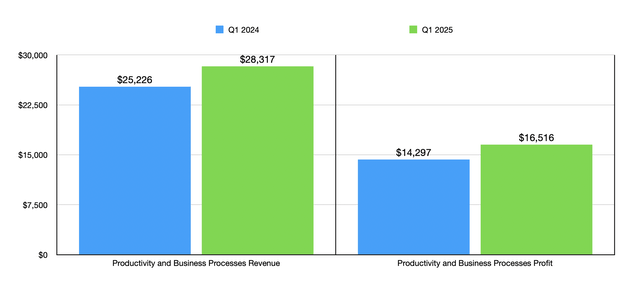

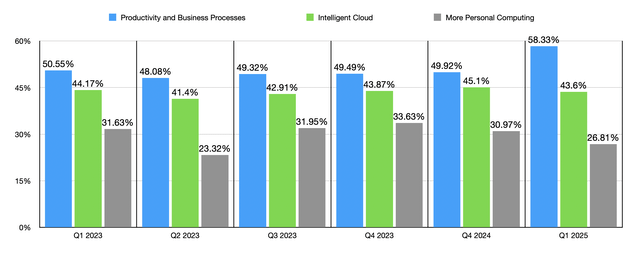

Over the past ear, management has done well to continue growing the different operating segments of the business. Take the Productivity and Business Processes segment as an example. This is the part of the company that includes things such as Microsoft Office subscriptions, LinkedIn, and more. During the first quarter, revenue for this segment was $28.32 billion. This happens to be 12.3% above the $25.23 billion reported one year earlier. This increase in sales was driven by growth across the board. For instance, LinkedIn revenue grew by roughly 10%, or $379 million. The commercial side of Microsoft 365 reported a $2.4 billion increase in revenue, with commercial cloud revenue growing 15% because of higher average revenue per user and because of an 8% increase in user count. Microsoft 365 Consumer products and cloud services revenue popped by 5%, or $84 million, with cloud revenue under that category expanding 6% because of a 10% rise in subscriber growth.

Author – SEC EDGAR Data

Profitability for the segment has also increased. Segment income grew from $14.30 billion to $16.52 billion. This represents a change in profit margin from 56.68% to 58.33%. This is because Microsoft 365 Commercial cloud apparently has higher margins than the other parts of the business do. The picture would have been even better, ever so slightly, had it not been for a $101 million increase in operating costs because of increased investments in commercial sales and cloud engineering activities.

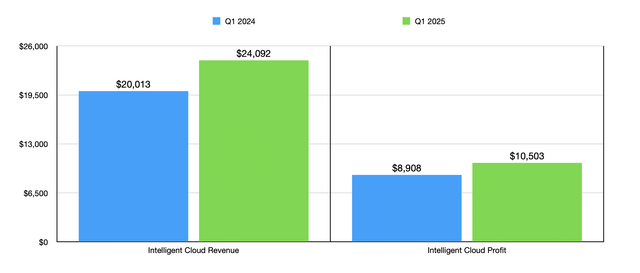

Author – SEC EDGAR Data

Next in line, we have the segment that I find most interesting. This is the Intelligent Cloud unit, which includes the company’s cloud computing business, including Azure and other cloud services. Revenue here jumped from $20.01 billion to $24.09 billion. This was largely because of a 23% increase in sales associated with server products and cloud services that management attributed to Azure growth. Specifically, Azure and other cloud services revenue jumped a whopping 33% year over year, with some of that because of higher demand for AI services. Profitability for this unit grew from $8.91 billion to $10.50 billion. That’s a change in profit margin from 44.51% to 43.60% that management said was driven by higher costs as the company grows its AI infrastructure and because of higher investments in Azure.

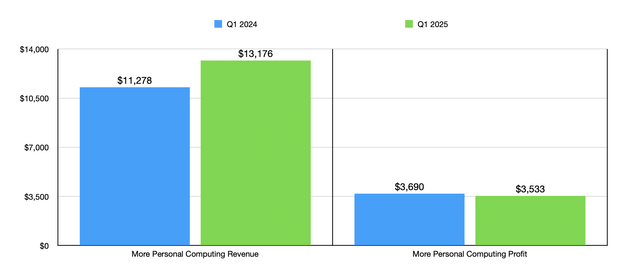

Author – SEC EDGAR Data

And lastly, we have the More Personal Computing segment. This is really a catch all of other businesses, such as Xbox, revenue associated with various devices, Windows Pro, Bing Ads, and more. Sales here jumped from $11.28 billion to $13.18 billion. This was mostly because of a $1.7 billion increase in gaming revenue courtesy of Xbox content and services. Those sales jumped an astounding 61%, with most of that attributable to the firm’s acquisition of Activision Blizzard. Unfortunately, Xbox hardware revenue dropped 29% year over year because of a decline in the volume of consoles sold. This was the only weak spot for the company, with profits declining from $3.69 billion to $3.53 billion. Despite this increase in revenue, the firm suffered from margin contraction because of its acquisition of Activision Blizzard.

Author – SEC EDGAR Data

Shares aren’t cheap, but they are appealing

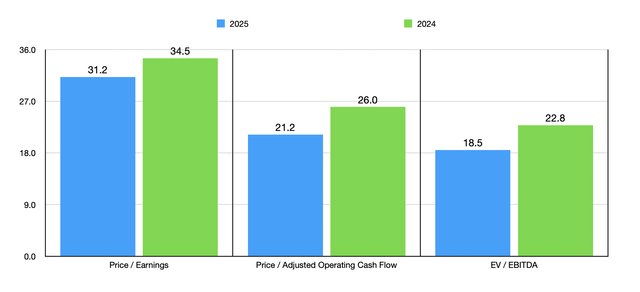

So far, the 2025 fiscal year is off to a great start for the company. Revenue, profits, and cash flows, are all rising nicely. Of course, such a high quality business does not come cheap. If we project out financial results based on first quarter results this year, we would expect net income for 2025 of $97.53 billion. Adjusted operating cash flow would be $143.69 billion, while EBITDA would come in at $162.15 billion. These would mark meaningful increases over what the business achieved last year.

Author – SEC EDGAR Data

In the chart above, you can see what this means for the company from a valuation perspective. To be perfectly clear, I think it would be a mistake to rely on projections this early in the fiscal year. Because of that, I also included valuation data based on historical results from the 2024 fiscal year. In this case, the company is far from being a cheap candidate. But it is trading at levels that I would consider to be fundamentally attractive. While that might seem odd coming from a value investor, since these units are objectively not cheap, they are attractive enough once you apply the premium for the quality of the business and the rate at which growth is continuing.

It would be helpful, I believe, to put in perspective how shares of Microsoft are priced compared to similar enterprises. This could help us understand the extent to which the stock might be undervalued relative to comparable firms. In the table below, you can see this example laid out. I compared the company to five other major software businesses. And what I found was that, using each of the three valuation metrics, our candidate ended up being the cheapest of the group. This is even if we rely on the 2024 figures instead of the projected figures for 2025.

| Company | Price / Earnings | Price / Operating Cash Flow | EV / EBITDA |

| Microsoft | 34.5 | 26.0 | 22.8 |

| Oracle (ORCL) | 48.7 | 28.0 | 26.7 |

| ServiceNow (NOW) | 157.3 | 49.6 | 93.1 |

| Palo Alto Networks (PANW) | 53.9 | 42.5 | 97.6 |

| CrowdStrike (CRWD) | 474.2 | 61.1 | 183.4 |

| Fortinet (FTNT) | 53.7 | 36.8 | 36.4 |

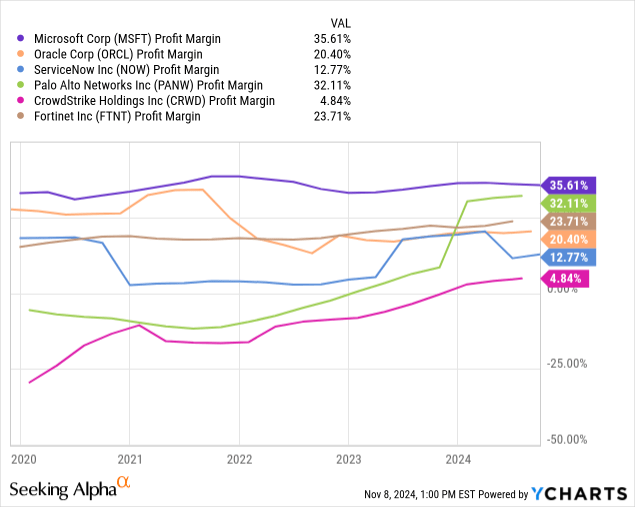

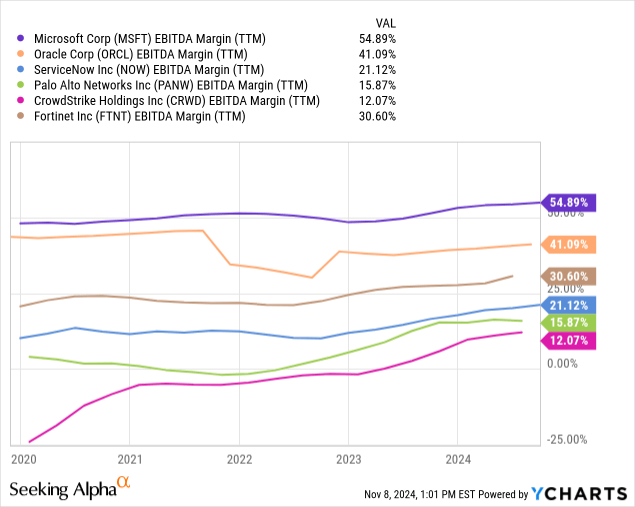

Now, to be fair, there is some justification to this return disparity. Over the last five years, for instance, Microsoft’s growth rate, whether it be from a revenue perspective, and earnings perspective, or a cash flow perspective, has been near the low end of these five businesses. On the other hand, there are other factors that, in my mind, offset this. As you can see from the first chart below, the business has consistently achieved a higher net profit margin in each of the last five years than any of these companies. And in the second chart below, you can see that its EBITDA margin is also greater than any of these businesses. So at the end of the day, while revenue growth might be slower, and the same might apply for profits and cash flows, each dollar of revenue being brought in is having a greater impact than an identical dollar being generated by these other firms.

There are other ways to evaluate the candidate as well. One method that is suggested is the PEG ratio, which looks at the current price to earnings multiple relative to the projected growth rate of the business over the next few years. In instances where profitability increases consistently, this can be a fantastic metric to utilize. But there are some problems in our case. Chiefly, this stems from the fact that earnings growth has been lumpy over the past five years and there is no reason to believe this won’t be the case moving forward. In one of the five years, earnings even decreased compared to what they were in the previous year. And in the best instance, earnings jumped 38.4%.

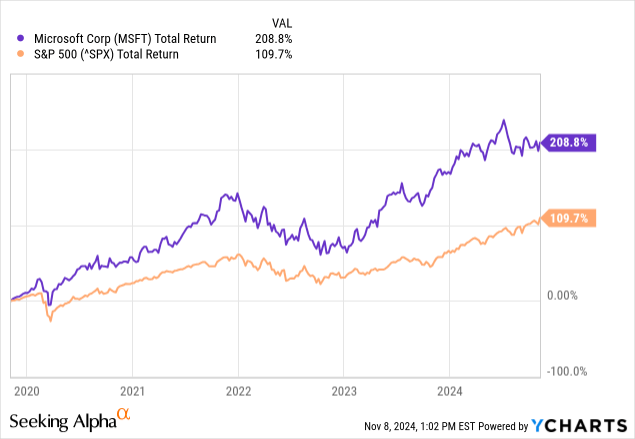

Over the last five years, however, earnings growth has been about 17.6% per annum on average. Even if we use a 15% figure to be safe, we do end up with a PEG ratio of 2.30. Normally, an undervalued business would have a PEG ratio of 1 or lower. But it is not my assertion that Microsoft is a value play. Rather, I consider it to be a GARP (growth-at-a-reasonable-price) candidate because of its rapid growth, and its valuation relative to comparable firms. Also, when I rate a company a ‘buy’, it is my belief that the stock will likely outperform the market for the foreseeable future. And as you can see from the chart below, Microsoft has seen upside over the last five years that has been significantly greater than the S&P 500.

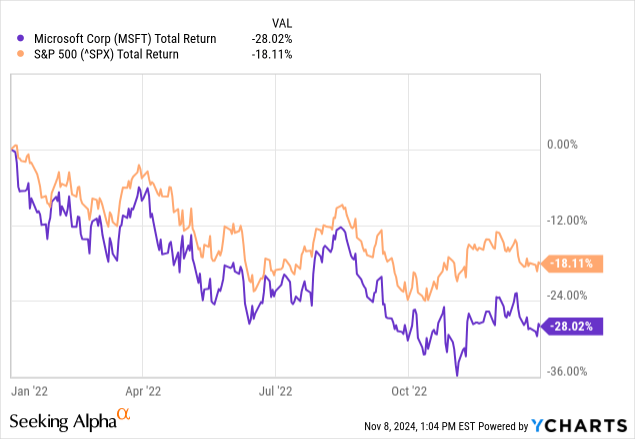

Of course, this does not mean that the company is without risks. Buying into companies that trade at lofty multiples, even though it’s likely that growth will continue for the foreseeable future, can still result in some volatility. As an example of this, we need only look at the period of time between the end of 2021 and the end of 2022. As you can see in the chart above, Microsoft did experience quite a bit of underperformance during this window of time. When times get tough in the market, even the best of companies can see major swings lower, including swings that are worse than with the broader market experiences. Obviously, there’s also competitive risk. As I have mentioned before, Microsoft is one of the two big players in the cloud computing market. But as I have detailed in a prior article, the third place business, Google parent Alphabet (GOOG) (GOOGL), has been doing better in that industry. It is still far behind the two largest, which would be Microsoft and Amazon (AMZN). But then add on top of this a risk that, at some point, investment into the cloud market could become overextended, and we are not talking about a scenario where no risk exists.

Takeaway

Based on the data currently available, I believe that Microsoft still makes for a sensible ‘buy’ at this time. I don’t think it’s the kind of opportunity that will make you rich. But if things continue as they have been, I have no reason to believe that the stock won’t outperform the broader market for the foreseeable future. Because of this, I have no problem keeping it rated a soft ‘buy’ at this time.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Crude Value Insights offers you an investing service and community focused on oil and natural gas. We focus on cash flow and the companies that generate it, leading to value and growth prospects with real potential.

Subscribers get to use a 50+ stock model account, in-depth cash flow analyses of E&P firms, and live chat discussion of the sector.

Sign up today for your two-week free trial and get a new lease on oil & gas!