Summary:

- With the projected growth of AI, Microsoft Corporation continues to invest in infrastructure to benefit.

- The dividend has been increased for 19 consecutive years and cash flow remains strong to support future dividend raises past the dividend aristocrat milestone.

- Their increased exposure to the gaming industry after the Activision Blizzard acquisition will boost this segment’s profitability.

- The acceptance of remote work is likely to continue growing. Microsoft Corporation’s tools and services will greatly benefit from this.

Gary Hershorn/Corbis News via Getty Images

Thesis

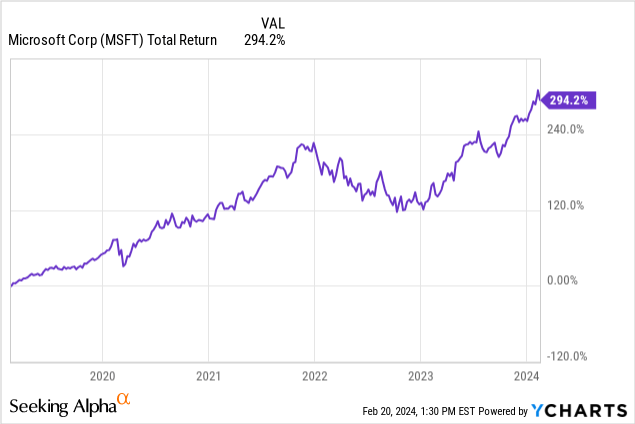

Microsoft Corporation (NASDAQ:MSFT) is my largest individual holding that I continue to buy on every dip opportunity. Microsoft has done extremely well over the last decade, and I believe that next decade is likely to yield similar results. There are several catalysts to support this thesis, including the projected artificial intelligence (“AI”) boom, strides in the gaming segment, great management, healthy financials, and constant investments in different growth initiatives.

Of these, I will cover three main catalysts that I believe will drive the most growth going forward. The performance so far has been stellar, reaching almost a 300% total return over the last 5-year period. Microsoft’s stock price has nearly quadrupled over the same time period. So, will MSFT stock keep rising?

As a bonus, management has been able to increase the dividend for 19 consecutive years. While MSFT isn’t typically known for its dividend, I think the dividend growth that’s been delivered should be mentioned, as it adds to the bull case over the next decade. If you are an investor that values dividend growth stocks, MSFT is a must own in my opinion.

Following the acquisition of Activision Blizzard, MSFT has huge potential in the gaming space. The growth of the gaming industry has always been strong, but this growth really exploded since 2020 when everyone was forced to stay home. According to Mordor Intelligence, the gaming market is estimated to grow at a CAGR of 9.32% throughout 2029. In addition, the AI industry is expected to grow at a CAGR of 15.83% through 2030, surpassing $730B. Lastly, the growth and acceptance of remote work positions MSFT to greatly benefit from the shifting work norm through their office products / services as well as their server and cloud services.

Financials & Outlook

It’s no surprise that MSFT has solid financials and a healthy balance sheet. Over the last 5-year period, revenue has grown at a CAGR (compound annual growth rate) of 14% in comparison to the sector median growth of only 4.8%. EBITDA (earnings before interest, taxes, depreciation, and amortization) has increased at a CAGR of 18% over the same period. Microsoft can be broken into several main segments that you can see here to learn more details on what is included in each segment. These are shared below, and I have compiled management’s expectations for each:

- Productivity & Business Processes: ranging from growth of mid-single digits to mid-teens.

- Intelligent Cloud: average growth of mid-single digits.

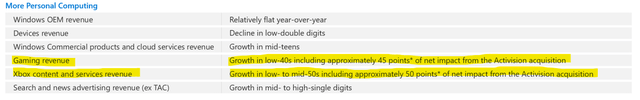

- Personal Computing: average mid-single digit to high single digit growth but growth as high as low 40s – high 50s in the gaming segment after ATVI acquisition.

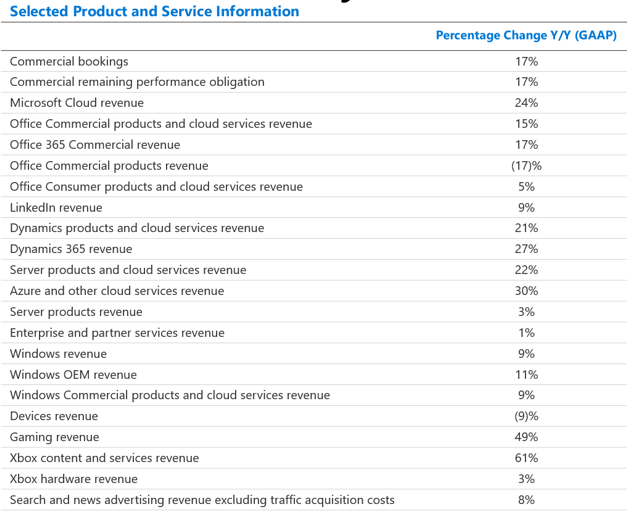

Over the last earnings reported in January, MSFT reported decent growth across these mentioned segments. Total revenue for the period reached $62B which represents an 18% increase from the prior year. Operating cash flow growth sits at 21.64% year-over-year, and I expect this to increase over the course of 2024 due to the catalysts I will describe later in this article. We can see some high double-digit growth in several components of their business below.

MSFT Investor Presentation

Within the Productivity & process segment, revenue increased by 13% YoY as well. The Cloud segment continues to be the source of major growth as revenue reached approximately $26B. This represents a 20% increase from the year prior, which also reinforces that there is ongoing demand for MSFT’s cloud infrastructure products and services.

As interest rates are expected to come down by the mid-point of this year, I believe this will help propel the price upwards. The Fed estimates a three quarter point cut, which will greatly benefit the tech sector as a whole. The main contributors with lower rates would likely be increased investment in MSFT due to economic expansion. Second, it would lower borrowing costs and help enable further operational growth or expansion.

According to my own calculations, which I will share further on, I think there is an additional upside of 20% in price by the end of 2025. This growth is supported by great management, strong financials, and a few strong catalysts. Let’s cover some of the catalysts that I believe will influence positive price growth.

Catalyst #1: AI

The hottest topic for the last year has been AI. So is Microsoft stock a good AI buy? Most people want to know how they can invest to profit from the progression made in the AI space. The first company that comes to mind is probably NVIDIA (NVDA) due to the huge price movement and strong financial earnings that’s surpassed expectations time and time again. However, while MSFT has not seen the same upside as NVDA, I believe that MSFT is uniquely positioned to benefit from the AI boom.

To start, let us look no further than OpenAI’s ChatGPT which is backed by MSFT. Speaking from personal experience, I find myself using generative AI bots like this more frequently than traditional search engines such as Google (GOOG) (GOOGL). It has proved much more convenient in terms of getting a quicker and more specific result compared to having to shuffle through many unrelated results that Google may show.

It hasn’t even occurred to me that this was my natural choice of search until seeing the prediction by Gartner that search engine volume will drop by 25% due to AI Chatbots. This generative AI is only one layer, however, and MSFT is investing cash to grow in this space.

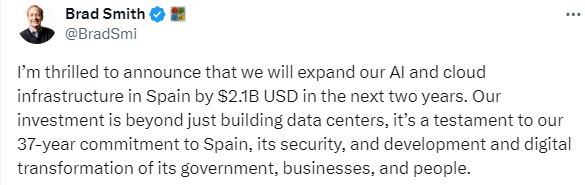

X – Brad Smith

For example, MSFT just announced that they plan to invest over $2B in Spain to boost AI infrastructure. They also pledged to invest over $3B, mostly in AI, in Germany as well. While Google’s search engine controls the market share at 91%, this merely means that MSFT has more market share to gain in my opinion.

Catalyst #2: Microsoft Store – Xbox & Subscription Based Gaming

Microsoft helped launch the Xbox over two decades ago in 2001. Since then, the gaming industry has exploded and surpassed the value of the sports industry. I previously published an article titled: “Microsoft: Xbox Game Pass Potential” where I specifically dove deep into the growth prospects of the subscription based gaming model. However, I would like to discuss the direction MSFT is going since this initial publication and how else they plan to capitalize on the growing video game market.

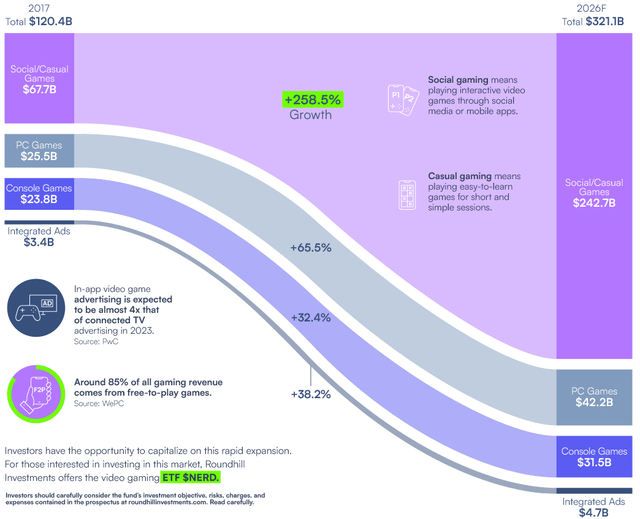

For some context, the gaming market is projected to grow to $321B by the end of 2026. Of this growth, 85% of all gaming revenue is said to come from free-to-play games. This data makes one thing clear: the money is not made from the games sales themselves, but rather from the additional content you make users subscribe to.

Back in October of 2023, MSFT completed the acquisition of Activision Blizzard, which has increased the growth projections on a massive scale. Xbox’s Game Pass service is the perfect middle ground to capitalize on this subscription model. For a flat monthly fee, users get access to a library of constantly updated games. Over time, the cost of this service is likely to increase as MSFT acquires more developers and studios that can expand their portfolio offering. For example, popular gaming titles like Call of Duty are now part of Xbox and has the potential to bring in several billions in additional revenue. For example, Call of Duty mobile, free to play game, has brought in over $3B in revenue over its lifetime.

The previous 2022 release of Modern Warfare II brought in over $1B in only 10 days! Internal projections estimate growth in gaming revenue in the low 40s from this acquisition, and Xbox services revenue to be in the mid to high 50s of net impact.

While gaming currently represents only 10% of Microsoft’s revenue, I believe these catalysts will contribute a much larger percentage of the revenue going forward. I think management also agrees with this judging from their investments in growing this segment of business.

Catalyst #3: Remote Work

The data clearly tells us that people prefer to have some access to work remotely. My thoughts are that companies will have to adjust and accommodate this in order to retain some of the best talent out there. Here are some survey results, compiled by Forbes:

- By 2025, 32 million Americans will work remotely. This represents 22% of the workforce.

- 98% of workers want to work remote at least some of the time.

- 93% of employers plan to conduct job interviews remotely.

- 57% of workers would look for a new job if their current company didn’t allow remote work.

- 65% of people want to work 100% remote.

- Employers can save $11,000 per employee by embracing remote work.

As remote work continues to be embraced, MSFT has the perfect set of products and services to benefit. The most popular being Microsoft Teams. In short, this platform helps cater to workplace video meetings and file storage. Next, they also have Microsoft 365, which provides the ever-so famous Excel and Outlook. In addition, MSFT’s SharePoint is perfect, too, for remote work, as it can enable team management of documents.

Lastly and most importantly, Azure helps support the needed infrastructure to support organizations to deploy and manage virtualized desktops and apps in the cloud. Azure enables remote access to desktops and applications from any device. As previously mentioned, Server & Cloud services revenue increased 22%, and this was primarily driven by Azure. In fact, 85% of Fortune 500 companies use Azure, with 722 million active users. It seems like leadership is focused on propelling AI into all areas of this growth as well.

“We’ve moved from talking about AI to applying AI at scale. By infusing AI across every layer of our tech stack, we’re winning new customers and helping drive new benefits and productivity gains across every sector.” – Satya Nadella, CEO.

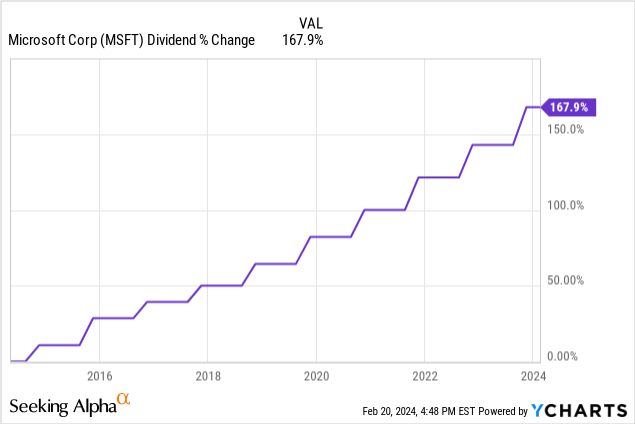

Dividend

While MSFT’s dividend isn’t the main appeal of investing in the company, it’s definitely worth mentioning. This is because of their excellent dividend growth over the years as well as the very conservative payout ratio of 26%. As of the latest declared quarterly dividend, the current dividend yield is 0.74%. While the dividend yield is low, the growth is where I want to focus. In total, the dividend payout per share has grown by 167% over the last decade.

Over the last 5-year period, the dividend has grown at a CAGR of 10.2%. Zooming out to a longer time horizon of 10 years, the dividend still managed to grow at a CAGR of 10.8%. This consistency is highly appreciated and with such a low payout ratio and growing revenue, I believe this kind of growth can be sustained over the next decade.

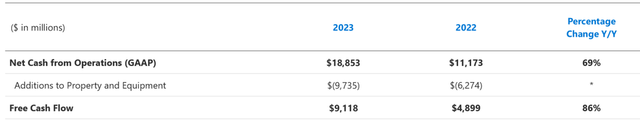

In addition, MSFT has over $100B in cash from operations, which is plenty to ride out any potential headwinds while simultaneously providing a steady dividend as well as investing in future growth initiatives. Free cash flow has also increased a whopping 86% YoY as of the last earnings report.

Is MSFT A Buy, Sell, Or Hold?

While MSFT is already my largest position in my dividend portfolio, I have a strong conviction to buy more when looking ahead to their future growth potential. MSFT has always been a company with a wide moat so as a result, you can rarely get in at a discount. MSFT has the potential to generate billions in additional income through the growth of their AI infrastructure as well as their gaming segment.

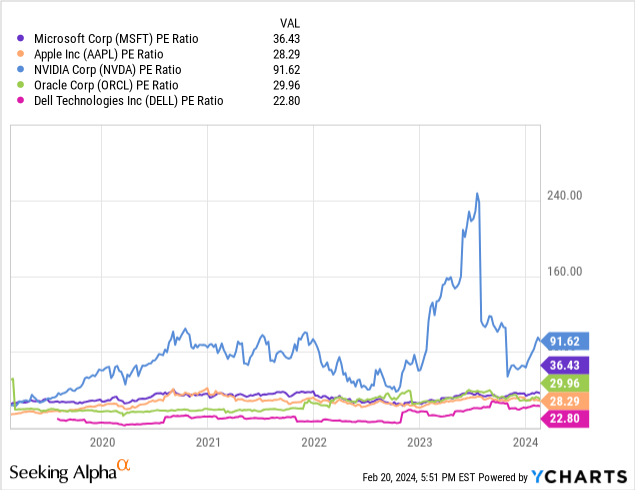

In terms of valuation, MSFT has an average price target of $465/share, which represents a potential 15% upside. From traditional valuation metrics, MSFT will seem like it’s overvalued, as do many tech companies at the moment. For example, the current P/E is 36.5x which is above the 5-year average P/E of 31.9x. Looking at some of the peers in the industry leaves us with nothing special here, as most of them trade at higher P/E than usual.

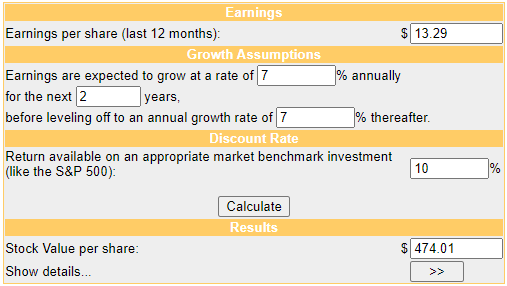

If we were to run a quick DCF (discounted cash flow) calculation on MSFT using the current EPS (earnings per share) and growth estimates, we can determine an approximate fair stock value. For our inputs, we will use the estimated EPS of 13.29 for 2025 as well as a conservative 7% estimated earnings growth. So what will Microsoft stock be worth in 2025? We estimate a fair value of $474/share. From the current price level, this equals a potential upside of about 18%.

Money Chimp

This estimated fair value closely aligns with the average Wall Street target of $465/share. With these factors in mind, I rate MSFT as a Strong Buy. I will continue adding to my existing position here as these catalysts continue to play out over the course of 2024.

Risk Profile

If I am wrong about the AI growth and the industry does not take off the way I anticipate, MSFT will likely decline in price, as they are actively investing in many different regions to increase their infrastructure in this space. This means that all of the invested cash in AI-related endeavors could have been better allocated to other aspects of the business.

Also, MSFT can be vulnerable to interest rate sensitivity. Interest rates are expected to be cut later on this year, but that can change. We saw this previously happen over the last Fed meeting when they decided to leave rates unchanged for now.

Lastly, following the acquisition of Activision Blizzard, there is a lawsuit that popped up alleging a monopoly over Call of Duty tournaments and leagues. Although it’s too soon to know how far this will go, it’s worth mentioning as a potential headwind for MSFT. A big focus on the acquisition was the profitability of the Call of Duty series. If sales slump for future releases, it will affect profitability in the gaming segment.

Takeaway

In conclusion, MSFT has a promising outlook for 2024 and beyond. Microsoft continues to demonstrate resilience and growth prospects in any market cycle. I believe that the future growth catalysts are too large to ignore. These catalysts such as the growth of AI, gaming industry growth, and the adoption of remote work all align with MSFT’s portfolio. They are likely to continue capitalizing in each of these segments for the next decade. With several average price targets indicating an upside of about 20%, there is lots of opportunity here at this price level.

Microsoft’s diversified and growing revenue streams leaves me with lots of optimism around their ongoing success. Despite potential risks such as interest rate sensitivity and legal challenges post-acquisitions, the company’s strategic investments and commitment to dividend growth signal a Strong Buy rating. The dividend growth has been stellar in comparison to some of their peers, and I think we are likely to cross the dividend aristocrat milestone.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of MSFT either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.