Summary:

- Everyone considers Microsoft as one of the AI winners.

- Investors also appreciate the growing cloud business.

- However, while these two segments represent two cornerstones of MSFT, a third segment is often overlooked, though growing.

- In this article, I try to explain what I am considering and why I think Microsoft’s “More Personal Computing” segment presents some hidden gems.

Chris Cook

Microsoft (NASDAQ:MSFT) (NEOE:MSFT:CA) has surely been one of the first go-to stocks as the AI trend started in 2023, igniting a bull market that keeps reaching new highs. This year, the stock has lagged the market, taking a breather. But the company has not been idle, and a major event has just taken place, although I found very little coverage of its implications in financial news and analyses.

One of the best-selling video game franchises just released a much-awaited update. Call of Duty Black Ops 6 was released on Friday, October 25th, on the Microsoft Store and other platforms for $79.99, with the BlackCell Season 1 battle pass edition costing $109.99.

Well, the news is that the standard edition can be played by subscribing to the Xbox Game Pass for just $19.99/month.

We are talking about the third most popular video game with 425M units sold, beyond Tetris and the role-playing series Pokémon. Call of Duty has a dedicated following, with tens of millions of monthly players across different platforms. Some estimates recorded a total of 126M players in January 2024, with 65M playing the mobile version.

This means that many of these fans could choose to subscribe to Game Pass instead of buying upfront the new edition. Moreover, these players will likely renew their subscriptions to keep playing their beloved game.

This brings us to make some estimates on the third business segment Microsoft has after Productivity and Business Processes and Intelligent Cloud: More Personal Computing. Under this category, we find three main units: windows and devices, search and news advertising, and gaming. As the company explains, gaming includes Xbox hardware and Xbox content and services, “comprising first-party content (such as Activision Blizzard) and third-party content, including games and in-game content; Xbox Game Pass and other subscriptions; Xbox Cloud Gaming; advertising; third-party disc royalties; and other cloud services”.

The FY25 outlook expects the gaming revenue to grow in the mid-30s including 40 points of net impact from Activision Blizzard. The Xbox content and services revenue should grow in the low- to mid-50s.

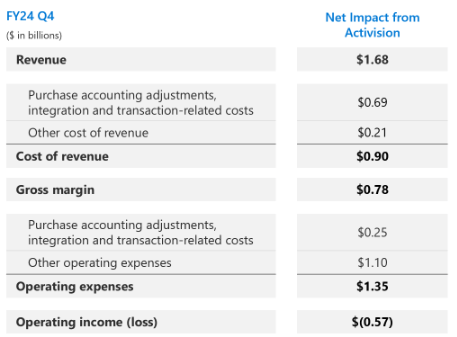

This was the net impact of FY24 Q4 of the Activision acquisition. We see it brought an additional $1.68B in revenue that cost $900M. Considering operating expenses we have a loss of $570M for the quarter. However, there are big one-offs as Microsoft moves the Activision content from third-party to first-party.

MSFT FY24 Q4 Earnings Presentation

However, we should be aware that while Xbox hardware revenue declined 42% YoY, the gaming revenue saw a 44% boost thanks to 48 points coming from Activision. Moreover, Xbox content services revenue grew by 61%, with 58 points coming from the Activision acquisition. So the net is about 3 points of growth. This shows once again how big of a deal this integration was for Microsoft’s gaming business.

During the Q4 earnings call, we also learned that Microsoft has

Over 500 million monthly active users across platforms and devices. And our content pipeline has never been stronger. We previewed a record 30 new titles at our showcase this quarter. 18 of them such as Call of Duty: Black Ops 6 will be available on Game Pass. Game Pass Ultimate subscribers can now stream games directly on the devices they already have, including as of last month, Amazon Fire TVs.

So let’s put the pieces together and make some rough estimates of what the new release could mean for Microsoft’s finances.

We talked about 120+M monthly players. Let’s assume that each player logs in 4 times a week. I think it is a fair estimate balancing out those who play daily and those who play once or twice a week. This means we have around 30M individual players per month. Many of these will be interested in Call of Duty Black Ops 6. So we could forecast around 25M players willing to buy the release or, even better, subscribe to Game Pass.

From this total addressable market, let’s say around 50% will subscribe to Game Pass. We have an extra $250M of monthly revenue which means we could project $3B of subscription revenue for the year.

Of course, $3B seems like peanuts for Microsoft: just 1.2% of last year’s total revenues. But the gaming business made $21.5B in revenue last year and this would be a 14% increase for this product line. Moreover, an increase in the number of subscribers to Game Pass leads to further monetization thanks to ads and other services. It is also a way for Microsoft to gain more data that can be used for its other products such as search, ads, and gaming services.

Activision Blizzard had an operating margin of around 45%. So we could also believe that this additional revenue could generate $1.2B in operating income assuming a 40% margin (lower than Activision’s due to integration costs).

Let’s also consider that these estimates may be a bit too bold and let’s take 20% off. We could have $2.4B in additional subscription revenue and $960M in operating income. We are in any case before a 1% increase in Microsoft’s total revenues. Once again, peanuts. But I would not overlook this minuscule additional revenue for two reasons:

- it shows how Microsoft can focus on several revenue streams working to make each one of them a better and more profitable business

- Microsoft has all it takes to become the leader in gaming. With a gaming business of $21B, it is just behind Tencent ($25.5B) and Sony ($29.8B). It might look smaller than Microsoft’s other segments. But having a larger subscriber base will also provide Microsoft with new data for its AI business that I expect to be soon integrated into video gaming as well. It is also plain and simple that video gaming is currently a business that runs on the cloud, which is something that benefits Microsoft as well.

So, I would not be surprised to see Microsoft report in a couple of years a gaming business earning $30B in revenue.

Two years ago, Microsoft was a screaming buy and when it touched $220 I poured in the stock all the money I had at that time. Since then, we have seen nice returns. But currently, the valuation is a bit high, with a fwd PE of 32.4, a fwd EV/EBITDA of 21.7, and a fwd P/FCF of 22. The fwd FCF yield is 2.4%. Yet, this year the stock has mainly traded in the range between $400 and $425 and has allowed the company’s fundamentals to catch up a bit with the multiples, bringing them down. I think Microsoft is a top-tier company and in a highly priced market, its multiples make more sense than many others. Considering the company keeps growing in the mid-teens even though it is considered a mature and well-established business, we are before acceptable multiples. After all, current EPS estimates think that today’s price is a fwd 2029 PE below 19. If one buys Microsoft, the timeframe should be very long-term, since this is a true compounder. As a result, I rate the stock once again as a buy, believing it is one of the safest stocks I currently hold.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of MSFT either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.