Summary:

- Microsoft Corporation was not ready for the AI revolution the way Nvidia Corporation was, and, therefore, has been unable to provide the jaw-dropping earnings guidance numbers the way Nvidia has.

- Microsoft Azure has been making some impressive moves to win over customers from competitors and drive robust recurring revenue growth over the long-term.

- Microsoft Fabric is a masterstroke that strongly positions the company to win in the era of AI.

jewhyte

Microsoft Corporation (NASDAQ:MSFT) reported its highly-anticipated quarterly earnings last week as it has become a high-flying AI stock this year. Though the forward-looking earnings guidance turned out to be underwhelming as executives emphasized that AI-driven growth would be gradual, while capex growth would pick up. This has induced selling pressure on the stock, which is down around 8% from its peak. Nonetheless, Microsoft’s AI-powered growth potential remains promising over the long term, and Nexus Research recommends using the stock price dip as a buying opportunity.

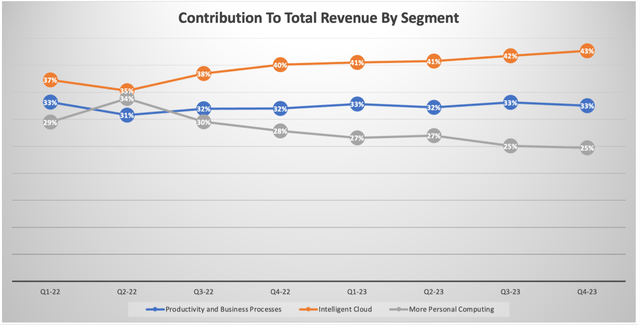

While AI will transform every product and service offered by Microsoft, the Intelligent Cloud segment is a key focus, given that it remains the largest contributor to revenue, constituting 43% of total revenue in Q4 FY23.

A key driver of the Intelligent Cloud segment is Azure cloud services, which is expected to win big from the AI revolution as businesses across industries require more cloud-based computing power to build and run their own AI applications. However, on the Q4 FY23 earnings call, Microsoft CFO Amy Hood tempered investors’ growth expectations:

“Even with strong demand and a leadership position, growth from our AI services will be gradual as Azure AI scales and our copilots reach general availability dates. So for FY ’24, the impact will be weighted towards H2.

To support our Microsoft Cloud growth and demand for our AI platform, we will accelerate investment in our cloud infrastructure. We expect capital expenditures to increase sequentially each quarter through the year as we scale to meet demand signals.”

For Q1 FY24, Microsoft forecasted:

“In Azure, we expect revenue growth to be 25% to 26% in constant currency, including roughly 2 points from all Azure AI Services.”

Microsoft will need to spend heavily on building and scaling AI infrastructure. Now, this presents a double-edged sword. On the one hand, it is disappointing that Microsoft was not ready for the AI revolution the way Nvidia Corporation (NVDA) was.

While the tech giant was wise enough to invest in the revolutionary AI start-up, OpenAI, it seems like even Microsoft underestimated how rapidly ChatGPT would gain worldwide popularity, and its prospect of triggering a new industrial revolution. As a result, it does not have the highly-scaled Azure infrastructure in place to support the AI revolution across industries. Microsoft was just not ready for the ChatGPT moment the way Nvidia was, and therefore has been unable to provide the jaw-dropping earnings guidance numbers the way Nvidia was able to last quarter.

On the other hand, Microsoft has been emphasizing that demand for its AI platform and offerings is strong, hence investors can already be confident that Microsoft’s heavy capex will certainly pay off given the pent-up demand. In fact, Microsoft is already making meaningful progress in serving cloud customers’ AI needs, given that its Azure OpenAI Service now has over 11,000 customers, that’s more than four times the 2,500 customers revealed last quarter.

Furthermore, on the earnings call, the CEO also shared that:

“the average annualized value for our large, long-term Azure contracts was the highest it’s ever been, driven by customer demand for our innovative cloud solutions today as well as interest in AI opportunities ahead.”

The fact that Microsoft Azure has been able to secure high-value, long-term contracts with the promise of AI innovations reflects Microsoft’s brand power and trust from customers that the tech giant will sustain its leadership position in the AI race going forward. This is what allows investors to be confident to buy the dip in Microsoft stock, as one can be sure of the fact that the software giant will be able to capitalize on the high demand for AI solutions once it has effectively scaled its AI infrastructure. So, while earnings growth may seem underwhelming over the near term, one can be certain that earnings growth will pick up steam in 2024 and beyond.

In fact, Microsoft is not only winning high-value, long-term contracts, but is also making great strides in acquiring new customers and gaining market share, as CEO Satya Nadella proclaimed:

“We also have even customers who’ve used multiple clouds who use that for a class of sort of workloads also start new projects when it’s transferred in data and AI, which they were using other clouds. So what I think you will see us is more share gains, more logo gains, reducing our CAC [Customer Acquisition Costs] even.”

This not only signals strong revenue growth prospects, but also better profitability prospects given the reduction in Customer Acquisition Costs, as Microsoft’s AI leadership is enabling it to attract cloud customers more easily.

Microsoft Fabric

While Microsoft scales its AI infrastructure over the next several quarters, the software giant is actually already finding ways to capitalize on cloud customers’ AI ambitions with its Microsoft Fabric solution.

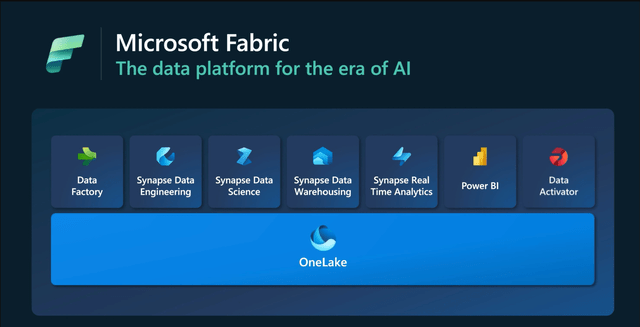

Launched in May 2023, Microsoft Fabric is a data and analytics platform that combines key data management and analytics workloads into one service. The service essentially strives to solve the problem of a fragmented data stack, whereby enterprises have to integrate numerous data analytics solutions together from various providers.

Now going back to how Microsoft Fabric helps the tech giant capitalize on enterprises’ AI ambitions, on the earnings call CEO Satya Nadella iterated the importance of optimal data management and structure in order to be able to take full advantage of Azure’s AI models and services:

“I think having your data, in particular, in the cloud is sort of key to how you can take advantage of essentially these new AI reasoning engines to complement, I’ll call it, your databases because these AI engines are not databases, but they can reason over your data and to help you then get more insights, more completions, more predictions, more summaries, and what have you.

… The thing that perhaps even in the last quarter, and I had that in my remarks, that’s most exciting is how with Microsoft Fabric, especially for the analytics workloads, we brought together compute, storage, governance with a very disruptive business model.

I mean to give you a flavor for it, right, so you have your data in an Azure data lake. You can bring SQL Compute to it. You can bring Spark to it. You can bring Azure AI or Azure OpenAI to it, right? So the fact is you have storage separated from all these compute meters, and they’re all interchangeable, right? So you don’t have to buy each of these separately. That’s the disruptive business model. So I feel that we are well — Microsoft is very well positioned with the way our data architecture lays out our business model around data and how people will plan to use data with AI services. So that’s kind of what I mean by getting your data estate in order. And it’s just not getting data estate in order but you have to have it structured such that you can have the flexibility that allows you to exercise the data and compute in combinations that makes sense for this new age.”

Microsoft is striving to play the lead role in helping businesses optimally structure their data for the AI revolution. Not only does this service wisely capitalize on enterprises’ data platform needs for the era of AI, but it also enables customers to get more value out of Azure AI services over time. Microsoft indeed has a vested interest in ensuring its cloud customers gain optimal value from its Azure AI services as they build their own AI applications, and the quality of the outputs will highly depend on the quality of inputs (data).

Hence, the effective deployment of Microsoft Fabric should allow customers to more optimally feed their corporate data into training/ inferencing their own AI applications using Azure AI services. This should lead to greater customer satisfaction in the form of higher ROI and should therefore help the tech giant retain and attract more cloud customers. This can drive recurring revenue for Azure over the long-term, benefitting Microsoft shareholders.

On the earnings call, CEO Satya Nadella proclaimed how Microsoft Fabric is already attracting cloud customers to the service:

“One month in, we are encouraged by early interest in usage. Over 8,000 customers have signed up to trial the service and are actively using it, and over 50% are using 4 or more workloads. All-up, we once again took share with our analytics solutions with customers like Bridgestone, Chevron and Equinor turning to our stack.”

In fact, Microsoft is leveraging the power and value proposition of Microsoft Fabric to acquire customers from competitors. Microsoft Fabric has been designed with a multi-cloud approach, which means the use of the service does not lock customers into Azure, as they will also be able pull in data from Amazon S3 and Google Storage. Hence, Microsoft is indeed striving to lure in customers from its key competitors, and will indeed seek to upsell and cross-sell more Azure solutions to these customers to encourage them to increasingly migrate their workloads to Microsoft Azure. Again, this should translate to higher Azure revenue for investors.

Key risks to consider

Competitors will fight back: Microsoft is indeed going all in to build upon its AI leadership and take market share from rivals. But competitors like Amazon AWS and Google Cloud are certainly going to fight back with their own AI-focused initiatives to retain customers. In fact, on Google’s last earnings call, CEO Sundar Pichaishared:

“Our AI capabilities are also expanding our partner ecosystem with hundreds of ISVs and SaaS providers, such as Box, Salesforce and Snorkel and the world’s largest consulting firms like Accenture and Deloitte. They’ve collectively committed to train more than 150,000 people on Google Cloud generative AI.”

Such training initiatives fortify Google Cloud’s ecosystem and discourage customers from migrating to another cloud provider like Microsoft Azure. The point is, counteractive moves by competitors may subdue Microsoft Azure’s customer acquisition endeavors and pricing power to drive revenue and profitability growth.

Valuation: Despite around an 8% correction, Microsoft stock remains expensive, with a forward P/E multiple of almost 31x, according to Seeking Alpha data. Investors were underwhelmed by Microsoft’s earnings guidance amid a slower than anticipated AI-driven growth ramp, while also acknowledging the heavy capex that the tech giant will need to embark upon in order to serve Azure AI services.

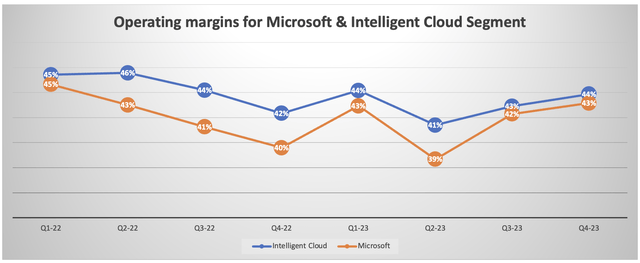

On the last earnings call, Microsoft executives did acknowledge that expense growth will pick up this financial year, but that operating margins should remain stable, as CEO Satya Nadella shared:

“We are committed to driving operating leverage, and therefore, we will manage our total cost growth across COGS and operating expense in line with the demand signals we see as well as revenue growth. Increased capital spend will drive higher COGS growth than in FY ’23, and FY ’24 operating expense growth will remain low as we prioritize our spend. Therefore, we expect full year operating margins to remain flat year-over-year.”

Despite Microsoft’s ability to sustain its profitability, certain short-term investors may feel inclined to sell given that the stock price still reflects elevated AI-related expectations while the tech giant tries to tame AI-driven growth expectations over the near-term. This could indeed induce further downward pressure on the stock.

That being said, Nexus Research takes a longer-term approach, and considers such dips in the stock price appealing buying opportunities. Despite the fact that Microsoft Azure was not ready for the AI revolution in terms of infrastructure scale, the software giant has been competently securing long-term, higher-value Azure contracts, and is making the right moves to continue attracting customers away from competitors with new services like Microsoft Fabric. The tech giant is indeed well-positioned to drive long-term recurring revenue growth through Azure.

So, investors that have been sitting on the side-line should definitely use this stock price dip as a buying opportunity, and should stay ready to buy more in case the stock continues to dip. But investors should definitely be building a long-term position here in Microsoft Corporation stock.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of MSFT either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.