Summary:

- Microsoft’s $13 billion partnership with OpenAI underscores its ambitious AI strategy, despite lagging behind the broader market and AI-focused peers.

- Strong Q1 2025 earnings with a 16% revenue increase to $65.6 billion, driven by cloud growth, but challenges remain in the search market.

- Heavy CAPEX investment in AI infrastructure positioning MSFT for future leadership in the AI market.

- Target price of $650 per share, a 54% premium, reflects my confidence in Microsoft’s long-term AI growth prospects despite near-term challenges.

hapabapa

Overview

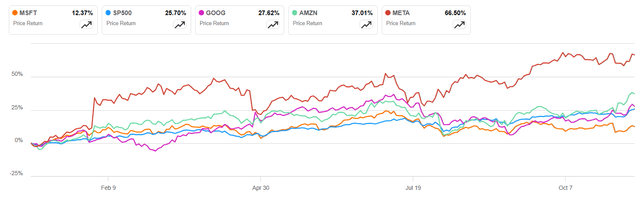

Microsoft (NASDAQ:MSFT) (NEOE:MSFT:CA) is one of the first companies going after the AI market with its partnership and aggressive investment in OpenAI. Year to date, the company has lagged behind the whole market (S&P500) and its principal peers seeking the AI market (Figure 1).

Figure 1: Seeking Alpha

Microsoft is delivering strong financial results; it is investing, in my opinion, accordingly in AI, and prospects for monetization are good. However, after two years of generative AI, it hasn’t gained any traction in the lucrative search market, and the core of its AI services is dependent on OpenAI in a complex and uncertain relationship. In any case, I estimate that Microsoft will be one of the leaders in the AI market, and my target price is $650 per share, with a substantial 54% premium over its current stock price. So, I recommend buying it.

Solid earnings results with cautious outlook

Microsoft reported a strong Q1 2025, with revenue reaching $65.6 billion, a 16% increase year-over-year, a 14% not considering Activision Blizzard. Operating income also saw a 14% increase to $30.6 billion. The company’s cloud business continued to be a significant growth driver, with Microsoft Cloud revenue reaching $31.8 billion, up 24% year-over-year. Azure and other cloud services revenue grew 33%, and Microsoft 365 commercial cloud revenue increased 15%. However, the company’s More Personal Computing segment experienced a decline in revenue, primarily due to weaker performance in the Devices business.

While Microsoft’s Q1 results were strong, my outlook for Microsoft for the second quarter is more cautious. I expect revenue to be around $70.7 billion, up 14%, with solid growth in Azure but with supply constraints. Windows OEM and Devices revenue will decline in the low to mid-single digits. I also expect capital expenditures to maintain a level of 23% of revenue, keeping pressure on AI business. I estimate the company’s operating expenses to be around 21% of revenue by improving efficiencies in general and administrative costs.

Despite the more cautious outlook for the second quarter, I remain optimistic about the company’s long-term growth prospects, particularly in the cloud and AI space. The company is investing heavily in these areas, and its AI business is on track to surpass $10 billion in annual revenue run rate in Q2. However, near-term challenges, such as weaker PC demand and increased capital expenditures, may impact the company’s financial performance.

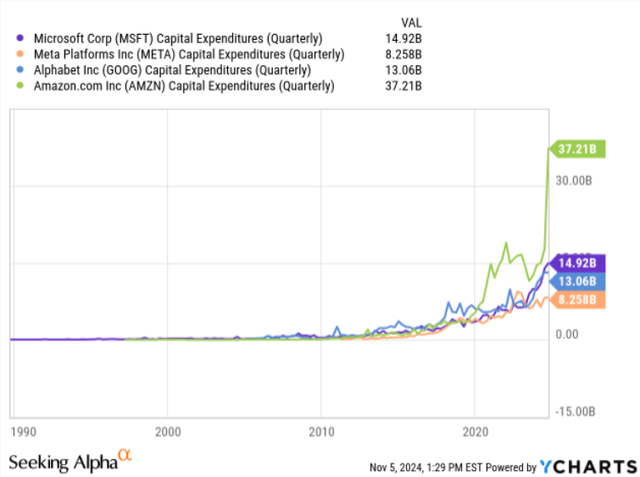

Adequate CAPEX investment

Microsoft’s CAPEX has been $15 billion in the last quarter, a considerable increase in the last quarters, as shown in Figure 2, which is a 50% growth rate year over year. And management has announced that this pace will continue in 2025. My estimation is that it will continue even until 2030. Microsoft will increase training model activity to acquire those capabilities so they don’t depend so much on OpenAI technology. Still, model inference is a broad activity that will keep growing as new applications appear and more users utilize AI services. Competition is keeping pace with CAPEX investment, and even though Microsoft is one of the companies that invests more in the industry, Amazon is the clear leader. Amazon’s CAPEX is not entirely comparable because it has been investing in its warehouses for its logistics business. However, those investments have been reduced lately, and the company’s main focus has been AI.

Figure 2

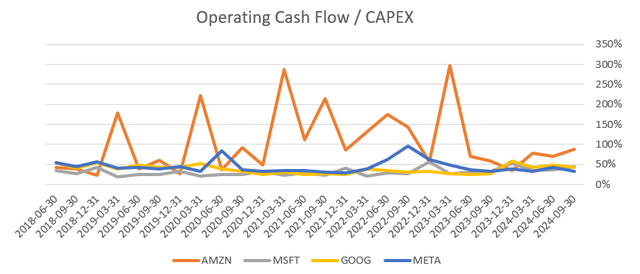

Relative to its operating cash flow (Figure 3), Amazon continues to be the company that invests most, while the rest of the players compete face-to-face. Meta has been reducing its investment in relative terms, which has rewarded the company in the stock market.

Figure 3: Author

In this scenario, you don’t know the best investment approach, in one side Amazon, with significant investments or in the other Meta. It all depends on AI’s expected cash flow generation. That is what we will talk about next, but given the uncertainty of the AI prospects, it is better to invest more than the competition. Microsoft is not badly positioned but lags behind Amazon.

AI business opportunity

I think there is a lot of confusion about CAPEX investments and AI monetization. It is believed that the CAPEX investment must be coupled with margins obtained from AI services like Office Copilot. However, they are two economic realities that impact different businesses. The CAPEX is employed for the Azure business. Its goal is to build the infrastructure enabling other companies (Azure’s clients) to develop its AI services. Specifically, the company has said that 12 percentage points from the 33% annual growth rate of revenue in Azure is due to AI. In other words, Azure earned $2.4 billion for AI services to Azure’s customers, mainly OpenAI.

When it comes to products like Office Copilot, where Microsoft offers AI services directly to clients, Microsoft contracts AI services. Microsoft does not own a large language model; instead, it utilizes models provided by OpenAI.

To explore the dimensions of AI monetization, I extrapolate how much revenue Microsoft will gain from Office 365 Enterprise licenses by acquiring a Copilot license. If there are 340 million licenses for $30 per month, it means $122 billion a year as a full potential, which is 48% of current revenue. If the market potential is 60% of all licenses, the margin is 47% as it pays OpenAI for using the model, the run rate free cash flow will be $34 billion. That means $63.8 per share of added value, a 13% increase from the current stock price. As a case to support the fact that the company is able to capture this value, Microsoft has signed a deal with Vodafone to provide Copilot for its 68,000 employees.

In the short term, Microsoft relies on OpenAI to provide AI models, so its margins are not as high as its own (47% vs. 70%). I estimate that the company will create its models and, in the near future, will compete directly with OpenAI. Microsoft recruited Mustafa Suleyman to lead AI efforts. He comes from the start-up Inflection AI and was co-founder of DeepMind, a reputable figure in the industry and a long-time rival of OpenAI.

This does not consider other AI-driven products across Microsoft’s portfolio, including GitHub Copilot and Dynamics 365, which have AI features. It also has the option to use AI services in Search, LinkedIn, or Gaming. What is clear to me is that demand is strong, with a 55% QoQ increase in GitHub Copilot enterprise customers or 60% QoQ growth in Dynamics 365 AI feature users with a broad-based adoption in multiple industries, 70% of Fortune 500 using Microsoft 365 Copilot.

Difficulties in the search market

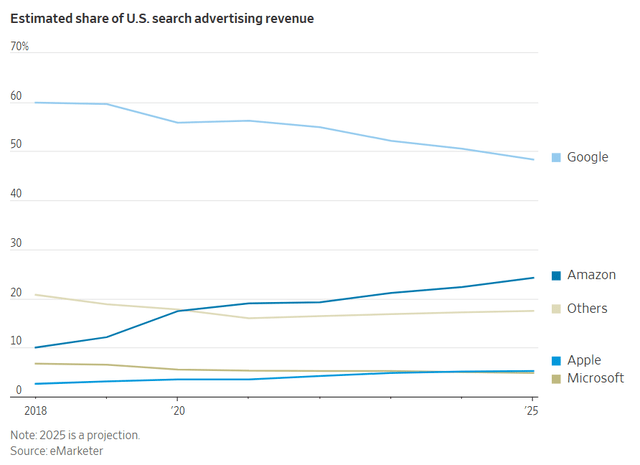

The search market is one of the biggest, with a clear dominant leader, Google (GOOG). Its size is $168 billion and is expected to grow 11%. Microsoft has been trying to capture some market share. Google has 98 billion visits to its site, and Microsoft’s Bing.com just 1.8 billion. With generative AI emerging in late 2022 and Microsoft’s partnership with OpenAI, I saw an opportunity to capture more market share in this sector. The reality is what you see in Figure 4. It is almost two years since the launch of ChatGPT, and the company that is capturing the search market is Amazon; Microsoft keeps under 5% market share.

Figure 4

The complex OpenAI relationship

Microsoft’s ambitions for AI are sustained on OpenAI, which is different from Google, whose AI capabilities are developed inside the company. For instance, former Google researcher Geoffrey Hinton was awarded a Nobel Prize in physics for discoveries in machine learning. However, the relationship with OpenAI is not straightforward.

Microsoft and OpenAI are tied financially and technologically. Azure is the exclusive cloud provider for OpenAI, and Microsoft uses OpenAI technology for Copilot. Microsoft has invested $13 billion in OpenAI, unlike a typical investment. First of all, OpenAI is a non-profit organization. Earnings are split 50% with a cap with no clear equity value.

OpenAI is working to become a for-profit organization, but it is challenging. There will be complex regulatory and legal hurdles. There is uncertainty about how to reward and split equity interests and how to distribute assets between for-profit and nonprofit organizations.

Microsoft faces a moderate-to-high (60-70%) probability of regulatory hurdles as OpenAI transitions from a non-profit, with potentially high impacts on Microsoft’s financial returns and agility in AI deployment. Additionally, the 50% profit cap poses an 80% likelihood of limiting Microsoft’s returns, with moderate impact, especially if OpenAI grows significantly. Finally, Microsoft’s dependency on OpenAI introduces a comparative disadvantage relative to Google’s in-house AI capabilities, with a moderate (50%) probability but a high potential impact on Microsoft’s competitive position.

Valuation

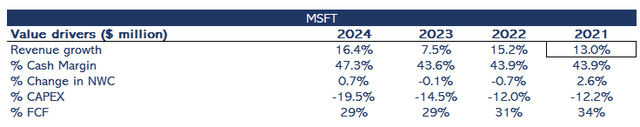

Figure 5 shows the company’s value drivers, considering a year as the last four quarters to capture the latest information. Regarding margins, I utilize a measure I call Cash Margin, which involves adjusting net income for non-cash items such as amortization and depreciation, stock-based compensation, and deferred income tax.

Figure 5: Author

I estimate revenue growth to be 14% in the next three years and to end with a 12% growth rate at the end of the ten years. My rationale is that AI services will monetize smoothly over the years, allowing Microsoft to maintain the growth rate with a slight reduction.

The cash margin will decrease from 47% to 43% in ten years. As the company develops AI model creation capabilities so they don’t depend on OpenAI, its operating expenses will increase relative to revenue. I am not impacting any effect of improvement in productivity in Microsoft’s developers due to AI.

CAPEX investments will remain at their current high levels of 20% until 2029 and then be reduced to 8%. Technology and scale will reduce pressure on investment. Energy sources and GPU prices will decrease over the years.

Cash flows will be discounted at an 7.3% WACC because the beta is 0.9. The risk-free rate is 3.8%. The company’s leverage is 14% of total capital. Perpetual growth rate is set at 3%.

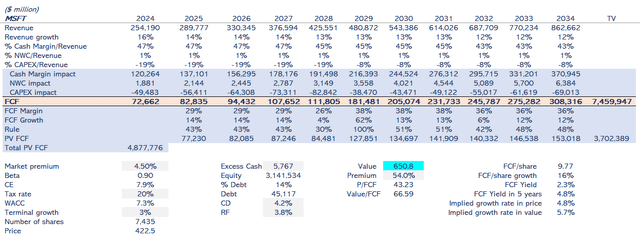

Figure 6: Author

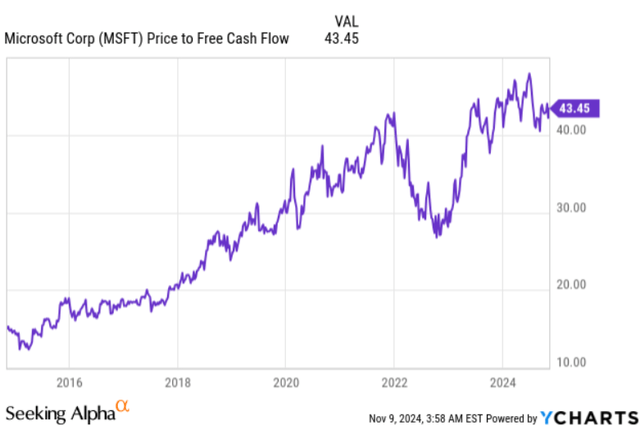

As shown in Figure 6, my value estimate is $651 per share, an 54% premium over its current stock price. My implied multiple Price to Free Cash Flow is 66, which means that I will keep growing the multiple to a level not seen in the last ten years (Figure 7). My valuation supports the core idea that Microsoft will be one of the leaders in the AI market and that this market will generate added value.

Figure 7

Conclusion

Microsoft’s $13 billion partnership with OpenAI highlights its ambitious AI strategy, yet the stock has underperformed the broader market and AI-focused peers. While recent earnings were strong—revenue grew 16% to $65.6 billion in Q1 2025—Microsoft remains dependent on OpenAI, limiting traction in key areas like search. Despite this, I believe Microsoft’s AI investments position it well for future leadership, supporting a target price of $650, a 54% premium over the current stock price.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of MSFT either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.