Summary:

- Microsoft remains one of the most expensive mega-cap technology stocks, despite its initial AI edge subduing.

- Previously we discussed the rising threat from open-source AI, namely Meta’s Llama models, to Microsoft-OpenAI’s proprietary models.

- Though, there are more risks beyond this threat that put into question Microsoft’s ability to continue commanding such a high valuation.

FinkAvenue

Microsoft’s (NASDAQ:MSFT) AI growth story so far has centered around Azure, with the cloud service providers being seen as the ‘picks and shovels’ of this AI revolution during these early stages. Although simultaneously, the software giant has also been embedding AI into its other products and services. There has been ample discussion around the addition of the Copilot assistant to its popular Office 365 productivity suites. More recently, Microsoft has also been promoting the coming wave of AI PCs as a promising growth avenue, having completely re-architected the Windows 11 operating system to make it fit for running complex AI workloads.

Locking enterprise customers into its Windows ecosystem during the early stages of this AI revolution, through AI PCs and servers, is of paramount importance to win over the long term, beyond just the personal computing segment. In fact, in this new age of generative AI-powered assistants, Copilot can serve a vital role in upselling organizations from on-premises computing solutions towards Azure cloud services, which remains Microsoft’s key growth driver.

However, the hype around AI PCs is likely to be quelled by the various risks ahead for Microsoft, in part due to its own setbacks. MSFT currently maintains a ‘sell’ rating.

Microsoft’s bearish developments

In the previous article, we discussed how Microsoft Azure’s initial edge in the AI race through its exclusive access to OpenAI’s models is fading away amid the rise of open-source. We covered how Meta’s (META) Llama models are gaining prevalence among enterprise customers, and paving the path towards commoditization of Large Language Models (LLMs), posing a threat to closed-source, proprietary model providers, and putting into question Microsoft’s lofty valuation multiple.

Additionally, Microsoft has also been facing hurdles on the ‘Productivity and Business Processes’ side of the business, a segment that made up nearly a third of the company’s total revenue last quarter. Moreover, there have been reports of enterprise customers pulling back on Office 365 Copilot deployments, as the bugs and flaws of this new automated assistant invalidate its expensive price tag.

Microsoft has also been reluctant to share how many enterprises have decided to adopt Copilot, though estimates by market participants suggest that the penetration rate is still quite low relative to the total Office 365 installed base.

I think it’s about 5 million. There’s about 450 million office users. And so, this is still just scratching the surface

– Gene Munster, Managing Partner at Deepwater Asset Management

When such new, transformational technology arises, many customers can often be wary of being “Beta testers” and would rather wait for feedback and reviews from other adopters before deciding to invest in it themselves, hoping that any major flaws and bugs would be resolved by then.

Hence, the revenue growth story from this new technology is likely to play out slowly over a span of multiple years.

Furthermore, the publicized issues around Copilot are also likely to have spillover effects into the adoption rate of Microsoft’s AI PCs.

AI PC wave likely to be underwhelming

The tech giant’s next big AI endeavor is desktop/laptop computing solutions. This is primarily through the Windows operating system licensed to Original Equipment Manufacturers (OEMs) like Dell Technologies, Hewlett Packard, Lenovo and Acer. Additionally, Microsoft also has its own line of Surface devices. Both of these business lines fall under the ‘More Personal Computing’ segment, which constituted 25% of Microsoft’s top-line last quarter. Note that the segment also includes other business lines like Gaming and Bing Search.

On the Q4 2024 Microsoft earnings call, CFO Amy Hood offered underwhelming guidance for both Windows OEM and devices revenue.

In More Personal Computing, we expect revenue to grow between 9% and 12% in constant currency, or US$14.9 billion to US$15.3 billion. Windows OEM revenue growth should be relatively flat, roughly in line with the PC market.

…

In Devices, revenue growth should be in the low to mid-single digits.

This soft guidance comes despite the launch of AI PCs, including a rehabilitated Windows 11 that is more capable of running complex generative AI workloads.

The June launch of Microsoft’s AI PCs excluded its key “Recall” feature that the company’s leaders boasted about during the introduction event back in May 2024. The release of this feature has been delayed amid the security and data privacy concerns highlighted by critics.

Security researchers initially found that the Recall database — that stores snapshots taken every few seconds of your computer — wasn’t encrypted, and malware could have potentially accessed the Recall feature.

Although whether the eventual release of this feature into Windows 11 will make AI PCs more appealing to buyers is up for debate. It is certainly a setback that throws cold water on Microsoft’s efforts to outshine Apple’s (AAPL) macOS in the era of AI, a brand that prides itself on industry-leading data privacy and security standards.

Now one might think that such setbacks and the underwhelming outlook for AI PCs is not such a big deal given that the Windows and Surface business lines make up a much smaller proportion of Microsoft’s total revenue base relative to the other larger segments. However, these missteps around data security and privacy can have much wider repercussions across Microsoft’s entire business, including Azure cloud.

Moreover, in a previous article discussing Nvidia’s (NVDA) massive software revenue opportunities through its own AI operating system “Nvidia AI Enterprise”, we discussed how the Jensen Huang-led company is offering on-premises AI solutions to enterprise customers, mitigating the need to migrate to the cloud to run generative AI workloads. We covered research revealing how many enterprises are experimenting with Gen AI in the cloud, and then shifting back to on-premises computing servers, due to being reluctant to shift their data to the cloud amid security, privacy and trust concerns.

Now of course this does not mean that no enterprises are migrating to the cloud at all, but Nvidia’s on-premises endeavors taking advantage of these data security concerns do throw spanners into the works of Microsoft encouraging businesses to shift from on-premises to Azure. Therefore, MSFT certainly could not afford this data privacy slip-up around Windows 11’s “Recall” feature, given that IT departments, C-suite executives, and management teams across the corporate world are closely observing the data security attributes of Microsoft’s entire technology stack when making decisions about whether to migrate to Azure Cloud, or even adopt Office 365 Copilot for that matter.

Beyond attracting enterprises into Azure, it is vitally important for MSFT to also keep enterprises with on-premises workloads tightly knotted into the Windows ecosystem through both AI PCs and servers, as this will ultimately pave the path for easier migration onto its own cloud platform going forward.

That being said, while the introduction of AI PCs was anticipated to spur an upgrade cycle across the market, such expectations have subdued lately.

The worldwide traditional PC market is expected to remain flat in 2024, with shipments reaching 260.2 million units, despite economic improvements and a new category of PCs with onboard neural processing units (NPU) colloquially dubbed AI PCs

– International Data Corporation (IDC)

Separately at the introduction event of Microsoft’s Copilot+ PCs in May 2024, Yusuf Mehdi (Microsoft’s Executive Vice President & Consumer Chief Marketing Officer) shared that the company estimates over 50 million AI PCs to ship over the next year across the industry encompassing competitors’ products as well.

This reflects the fact that AI PCs are expected to make up only a small fraction of computers sold this year and going into next year.

Perhaps the biggest hindrance to AI PC adoption at the moment is the lack of “killer software applications” that can only be run on AI PCs, and entice customers to upgrade their devices to take advantage of new generative AI apps.

Applications ultimately drive the success of tech cycles, and we have yet to identify AI’s “killer application”, akin to the Enterprise Resource Planning (ERP) software that was the killer application of the late 1990s compute cycle, the search and e-commerce applications of the 2000-10 tech cycle…The AI cycle is still very much in the infrastructure buildout phase, so finding the killer application will take more time

– Kash Rangan, Senior Equity Research Analyst at Goldman Sachs

Moreover, generative AI has yet to prove that it is a significant productivity booster over traditional AI technologies and IT processes, commensurately justifying the heavy investment it requires.

Generative AI is great for generating content, but of less compelling value for things like demand forecasting, anomaly detection, predictive maintenance and churn prediction, according to Sameer Maskey, founder and chief executive of enterprise AI company Fusemachines.

Until generative AI can prove cost-effective and adequately superior to traditional technologies, with worthwhile software applications arising that truly transform the way we work, the impetus for enterprises to purchase AI PCs will remain underwhelming.

Upside considerations for Microsoft stock

Now even though the AI PC wave is likely to play out slowly, the adoption rate is indeed expected to pick up over the coming years, with IDC expecting over 60% of desktops and notebooks sold in 2028 to be AI PCs.

We’re projecting AI-enabled PC shipments to grow with a CAGR of 42.1% from 2023 to 2028. – IDC

In fact, while the adoption rate of Windows 11 across enterprises had been quite soft over the past few years since it was released in October 2021, Microsoft CEO Satya Nadella proclaimed on the last earnings call how adoption has been accelerating lately, particularly as the software giant re-architected Windows 11 for generative AI workload processing:

Windows 11 active devices increased 50% year-over-year. And we are seeing accelerated adoption of Windows 11 by companies like Carlsberg, E.ON, National Australia Bank.

Furthermore, Microsoft’s key AI partner OpenAI continues to innovate increasingly powerful models. Back in May 2024, OpenAI wowed the world by introducing the multimodal “GPT 4-Omni” model, capable of facilitating incredible human-like conversations. Then just a few months later in September 2024, OpenAI previewed the “o1” model that demonstrated progression on multistep reasoning and task completion, moving a step closer towards facilitating agentic capabilities.

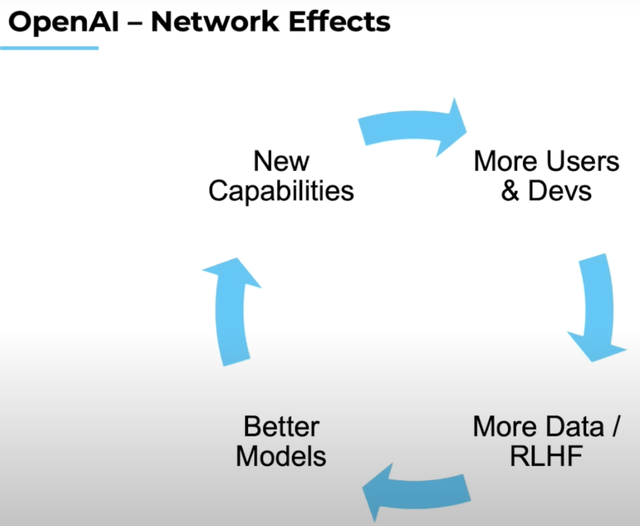

ChatGPT remains the most popular chatbot interface despite the entrance of rival apps into the market, conducive to a data advantage that drives a virtuous network effect, enabling it to build increasingly advanced AI models over competitors.

As a result, Microsoft continues to benefit through embedding OpenAI’s powerful AI models into their own products like Office 365 Copilot and Copilot+ PCs, granting it a first-mover advantage.

That being said, this competitive advantage will inevitably fade as open-source models, such as Meta’s Llama series, catch up in performance and capabilities.

Another important factor to consider is that while OpenAI’s latest models are impressive, they are also very costly to run, which is why the company has been limiting the release of these models in preview mode. Moreover, the high inferencing costs incurred could also hinder the development of new generative AI software applications based on these latest models, or at least undermine the prospects of successful business models being built around such AI solutions.

Enterprise customers are already finding Microsoft’s Copilot price tag too expensive at $30/per month/per user. So if Microsoft and other software companies need to charge premium prices for new generative AI services to compensate for the high costs incurred, it may undermine the adoption rates of such new software applications.

As discussed earlier, the absence of “killer software applications” is what is slowing down the adoption of AI PCs. And until the cost equation improves for serving such software services, the adoption rate could continue to remain slow both on the software and hardware side.

Microsoft stock’s investment case

Now, a lot of readers were alarmed by my downgrade of MSFT to a ‘sell’ rating in the previous article, and my sale of Microsoft shares. The key thesis of that article was the rise of open-source models subduing Microsoft’s initial competitive advantage through OpenAI, raising questions over the stock’s premium valuation relative to peers.

Additionally, I had also briefly touched upon another reason I had personally sold the stock, which I want to clarify more clearly in this article.

Microsoft’s key advantage in the AI race has relied heavily on the success of AI start-up OpenAI. While both companies have found great success with the GPT series, the truth is these models were trained on texts from numerous books, academic papers, as well as websites on the internet.

Consequently, the rising popularity of OpenAI’s models and ChatGPT app has also been met with a growing number of lawsuits from authors that claim that their work had been used to train these LLMs, without any authorization or compensation. Meanwhile, OpenAI CEO Sam Altman has repeatedly cited “fair use” to justify the utilization of unauthorized material to train AI models.

As an author myself for the Seeking Alpha platform, I can easily empathize with these authors who are losing out on compensation for their work that Microsoft-OpenAI is allegedly generating revenue from. Putting myself into their shoes, if I found out that all SA articles had been used by a third party to train an AI model without any compensation for authors, I would be very upset. Hence, my decision to sell MSFT shares was also driven by the reluctance to profit off of what, I believe, are OpenAI’s unethical business practices.

Even though the companies are likely to resolve these copyright issues over time, I would be more comfortable buying the stock when there is more clarity around appropriate author compensation, even if that means having to buy the stock at a higher price in the future.

I understand that people may have opposing viewpoints regarding this issue, but just wanted to candidly share my own perspective on this matter, and I will continue sharing my research on Microsoft’s AI growth story in an objective manner to help readers make well-informed investment decisions.

I would also like to disclose the fact that I had bought the stock in 2023 when this AI revolution was in its early innings. So my positioning would differ greatly from long-term shareholders that have been holding the stock for many years before ChatGPT had even launched. These investors benefit from a much lower price-entry point, which they would understandably not want to give up easily.

Therefore, while I have a ‘sell’ rating on the stock, I would certainly not advise these long-term investors to sell out of the stock simply based on the copyright issues, or the rising challenge from open-source models, as these concerns are likely to be resolved over time, and people can have different ways of making peace with companies’ questionable business practices, which I respect. Despite the hurdles, Microsoft still stands to competently benefit from the AI revolution over the longer-term.

However, for those on the sidelines considering whether to invest in MSFT, the shares still remain very expensive. As per Seeking Alpha data, MSFT currently trades at over 31x forward earnings. Although the Forward P/E multiple on its own offers a limited picture. A more comprehensive valuation metric is the Forward Price-Earnings-Growth (Forward PEG) ratio, which essentially adjusts the Forward P/E multiplied by the anticipated earnings growth rate.

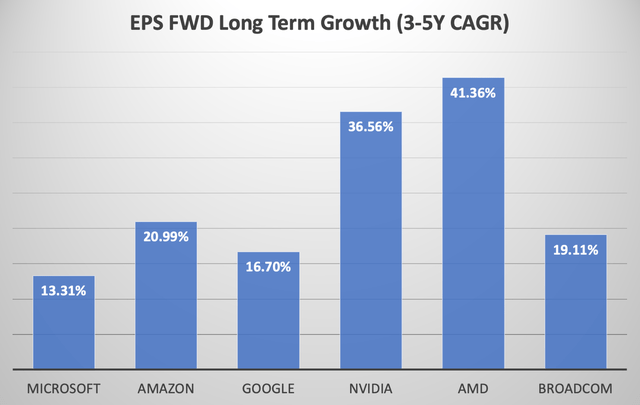

Microsoft currently has an expected EPS FWD Long-Term Growth (3-5Y CAGR) of 13.31%, which is the lowest projected growth rate among the biggest AI winners that are perceived as the ‘pick and shovels’ of this revolution.

Nexus Research, data compiled from Seeking Alpha

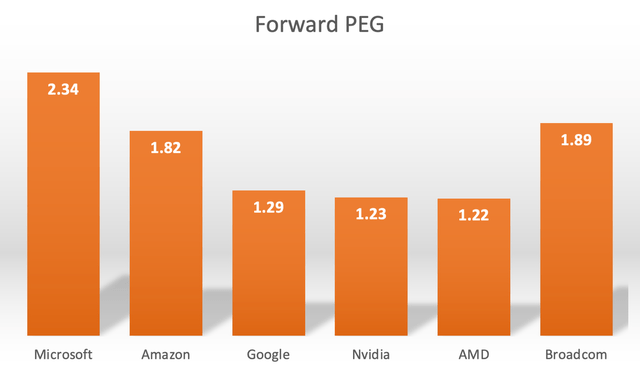

Adjusting each stock’s Forward P/E multiple by their anticipated EPS growth rates to derive the Forward PEG ratios, reveals just how expensive MSFT is relative to other AI stocks.

Nexus Research, data compiled from Seeking Alpha

For context, a Forward PEG multiple of 1x would imply that a stock is trading roughly around fair value. Keeping this in mind, every other major AI winner is trading closer to fair value than MSFT, which trades at a lofty premium of 2.34x. In fact, Nvidia, which is considered the king of AI, is trading at a more appealing valuation than the major cloud service providers, at 1.23x.

The bottom line is, MSFT is simply way too expensive given the risks around open-source alleviating its initial advantage, data security and cost considerations undermining adoption rates, and the AI PC wave likely to be underwhelming until “killer software applications” arise that make the hardware investments more worthwhile. Investors looking for AI growth exposure should consider the cheaper alternative stocks that also stand to win big from this revolution.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of NVDA either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.