Summary:

- Microsoft’s Intelligent Cloud segment is experiencing significant growth, driven by Azure AI adoption as customers turn to leveraging agents and copilots in the workplace.

- Despite capacity constraints, MSFT is leveraging third-party cloud hosting and investing heavily in data centers to catch up to AI demand.

- Power sourcing remains a limiting factor for growth as new baseload capacity needs to be built out to support additional data center capacity.

helen89

Microsoft (NASDAQ:MSFT) (NEOE:MSFT:CA) continues to realize significant growth in its Intelligent Cloud segment, driven by growth in Azure AI adoption. The hyperscaler laid out a sequential increase in capital investments going into eq2’25, which will primarily be allocated to expanding its CPU and GPU footprint to cater to the strong demand for AI training and inferencing. Microsoft reiterated on the q1’25 earnings call that compute demand continues to outstrip supply, resulting in Microsoft leveraging 3rd party cloud hosting services to cater to these needs. Given the strong growth trajectory, I am reiterating my BUY rating for MSFT shares with a price target of $577/share at 23x eFY26 EV/EBITDA.

Microsoft Operations

Microsoft experienced sustained growth across its cloud offering driven by AI workloads and cloud migrations. Accordingly, Microsoft now has data center coverage in over 60 regions globally with new investments in Brazil, Italy, Mexico, and Sweden.

Mr. Satya Nadella, Chairman and CEO of Microsoft, believes that Microsoft’s AI business will surpass an annual run rate of $10b by eq2’25. Microsoft experienced a 2x uptick in customer usage of its Azure OpenAI Service, driven by customers moving applications from testing to production. Azure AI will likely continue to expand as Microsoft brings together more industry-specific models to help customers facilitate their own AI development needs. Microsoft Fabric currently commands over 16,000 paid customers and has captured over 70% of the Fortune 500 companies. Management is forecasting the strongest level of sequential nominal growth to Azure in eq2’25.

According to its q1’25 earnings report, Microsoft is the first cloud platform to spin up NVIDIA’s (NVDA) Grace Blackwell GB200-powered AI servers. In addition to this, Microsoft is developing an end-to-end application platform to facilitate the development of custom copilots and agents by its customers. Taking into consideration Microsoft’s drive to expand its leadership in GenAI applications, the firm has significantly expanded its copilot features across its platforms, including Copilot Auto Fix to help correct vulnerabilities and improve the coding experience, and its Power Platform to facilitate low-code/no-code development.

Despite the strong, $49b capital investments in the last twelve months, Microsoft is still experiencing capacity constraints and has shifted some capacity out of eq2’25. Accordingly, it has been suggested that Microsoft may spend upwards of $10b between 2023-2030 renting servers from CoreWeave to help alleviate its constrained server capacity. CoreWeave is directly backed by Nvidia, acting as a cloud infrastructure competitor for leasing access to Nvidia’s GPUs across its 14 data centers.

One major factor that must be considered for the future growth of Microsoft’s data center footprint is its ability to secure baseload capacity. Microsoft announced in September that it has signed an agreement with Constellation Energy (CEG) to restart and supply power from the remaining reactor at the Three Mile Island nuclear plant. Microsoft has also partnered with Helion Energy to provide nuclear fusion-generated electricity near the end of the decade. Microsoft had previously reported that it was developing a small team to develop an integration plan for small modular reactor [SMR] technology to power its data centers.

Other hyperscalers are doing much of the same in terms of developing partnerships to source baseload power capacity. In October 2024, Amazon (AMZN) announced its partnership with Energy Northwest to develop 4 SMRs to generate upwards of 960MW. Google (Alphabet (GOOG)) also announced a partnership with Kairos Power to develop SMRs with upwards of 500MW of total capacity. NextEra Energy (NEE) is also in the process of bringing back online one of its nuclear facilities that can potentially help alleviate the high-power demand for the growing data center footprint.

On the productivity side, Microsoft has made significant improvements to its Microsoft 365 Copilot, resulting in 2x improvements in speed and 3x improvements in quality responses. Accordingly, Mr. Nadella mentioned on the call that users at Vodafone have saved an average of 3hrs per week when using Microsoft 365 Copilot. In addition to this, customers can also leverage Microsoft’s autonomous agents to facilitate the AI transformation with minimal human intervention.

Looking at custom silicon, Microsoft continues to see adoption of its general compute Cobalt 100-based VMs, offering 50% improved price-to-performance when compared to the previous generation. Similar to other hyperscalers, Microsoft’s custom silicon is purpose-built for its data centers, allowing for better performance with less power demand.

Microsoft Financial Position

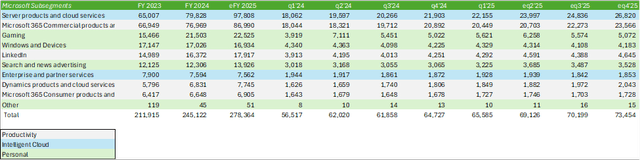

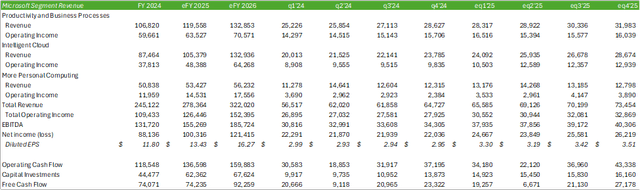

Microsoft experienced continued growth across all segments as the firm continues to heavily invest in its data center footprint. Management is forecasting continued strength in productivity and intelligent cloud. For these two segments, I’m forecasting growth of 12% and 20.5%, respectively. This will place Microsoft’s total revenue at $69b for eq2’25. For all of eFY25, I’m forecasting total revenue to come in at $278b with a diluted EPS of $13.43/share.

Management is forecasting operating expenses to increase by ~8% in eq2’25 as the firm continues to heavily invest in cloud-based computing. Despite the increase in opex, I’m forecasting Microsoft to generate a stronger operating margin at 45% for eq2’25 driven by margin expansion in its Intelligent Cloud segment.

For q1’25, Microsoft’s capital outlay was $14.9b, or $20b when including finance leases related to data center buildouts. ~50% of the cloud- and AI-related investments were tied to long-lived assets with a 15+ year monetization period. The rest of the related capital investments were distributed towards CPUs and GPUs, as driven by customer demand. Despite operating cash flow increasing by 11% in q1’25 from the previous year, free cash flow declined by -6% as a result of the 50% increase in capital investments. Looking out to eq2’25, management is forecasting a sequential increase in capital investments to support cloud and AI demand. I’m forecasting Microsoft to generate $22b in operating cash flow and invest over $15b of capital in eq2’25, resulting in free cash flow of $6.66b.

As for operations, I’m forecasting Microsoft to generate $69b in total revenue and a diluted EPS of $3.16/share. I’m expecting Microsoft’s operating margin to improve on a year-over-year basis by nearly 1% driven by margin improvement in its Intelligent Cloud segment. Looking through the remainder of eFY25, I’m forecasting that the Intelligent Cloud segment will remain strong and reaccelerate growth towards the back-half of the year as more AI-related infrastructure comes online.

Risks Related To Microsoft

Bull Case

Microsoft remains one of the leading hyperscalers for productivity services in the cloud. The firm is hard at work developing and enhancing its internally developed copilots and agents to both expand across its internal- and external-facing applications, as well as be utilized across its customers’ application development process. Despite the scaling constraints for AI compute, Microsoft is partnering with other cloud service companies to offload some of the demand while keeping the customers within its ecosystem.

Bear Case

Compute demand continues to outstrip supply, creating the need for Microsoft to invest significant sums to expanding its data center footprint. This has led to an increase in power demand, which may result in higher costs for electricity before additional capacity is built out. Microsoft’s partnership with Helios isn’t expecting its first facility until 2028 and is based on an unproven technology that may not materialize by that time. If Microsoft cannot source an adequate baseload capacity to power its AI factories, the firm may become more dependent on 3rd party hosting sites and may potentially result in profitability constraints.

Valuation & Shareholder Value

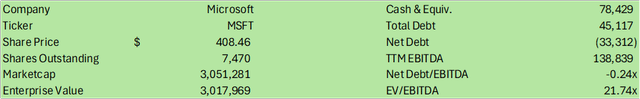

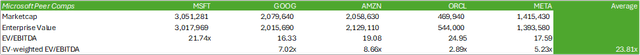

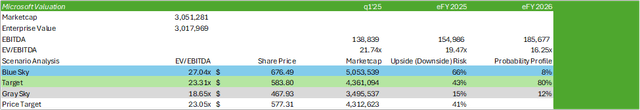

MSFT shares currently trade at a discount to its peer hyperscalers’ enterprise value-weighted EV/EBITDA of 23.81x at 21.74x EV/EBITDA. To come up with this average, each of the firms’ multiples are weighted to its respective enterprise value to normalize the average multiple by size. I believe that this provides us with a more accurate target valuation when compared to measuring by just the average.

This puts MSFT shares in a prime position for shareholders to rebalance their positions or acquire additional shares with the expectation for continued growth going forward.

MSFT shares sold off post-q1’25 earnings release, putting the stock in a position for a strong rebound. Charting the stock, I believe shares may continue their decline to ~$401/share before returning to growth.

Using an internal model based on my EBITDA forecast through eFY26 and MSFT’s historical valuation range, I remain bullish on the name and reiterate my BUY rating. My price target for MSFT shares is $577/share at 23x eFY26 EV/EBITDA.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.