Summary:

- In my view, Microsoft may exceed its Q3 FY2023 EPS consensus forecasts or provide optimistic guidance, giving an additional catalyst for its stock.

- Despite the slowdown in the overall growth of the Cloud market, MSFT should continue to expand its share at the expense of competitors.

- Credit Suisse estimates could drive around $40 billion of potential revenue and $2 of potential EPS uplift over the next 5 years.

- Goldman Sachs believes that MSFT stock is one of the most out-of-consensus opportunities on the US stock market to date.

- I expect earnings estimates turn from red to green after the Q3 rellease. MSFT is still a Buy despite its recent run-up.

David Becker

Thesis

Some factors suggest Microsoft Corp. (NASDAQ:MSFT) may, if not beat consensus forecasts for EPS and revenue numbers for Q3 of fiscal 2023 [releases on April 25, 2023, post-market], at least provide encouraging guidance for the near future, thereby providing an additional catalyst for its stock.

Why Do I Think So?

Few people realize it, but the technology sector has its own business cyclicality – earnings revolve around and are positively correlated with global economic growth/slowdown.

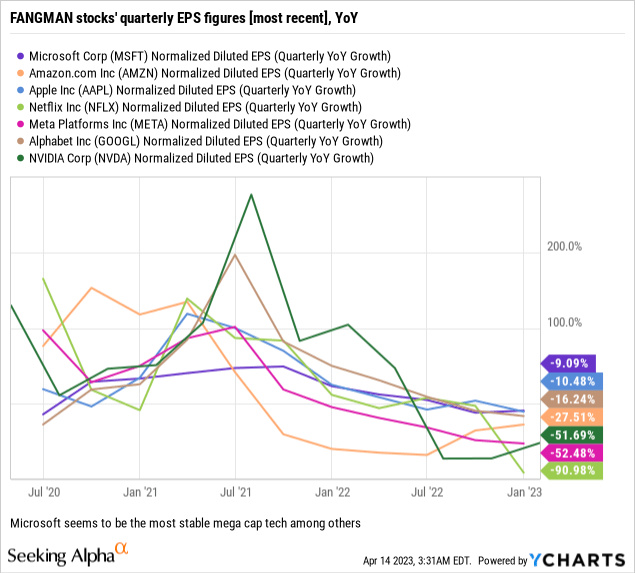

Currently, even large technology companies are having a very hard time – their profit margins are falling as costs rise, which, against a backdrop of a decline in the volume of products or services sold, inevitably leads to a fall in EPS and therefore share prices.

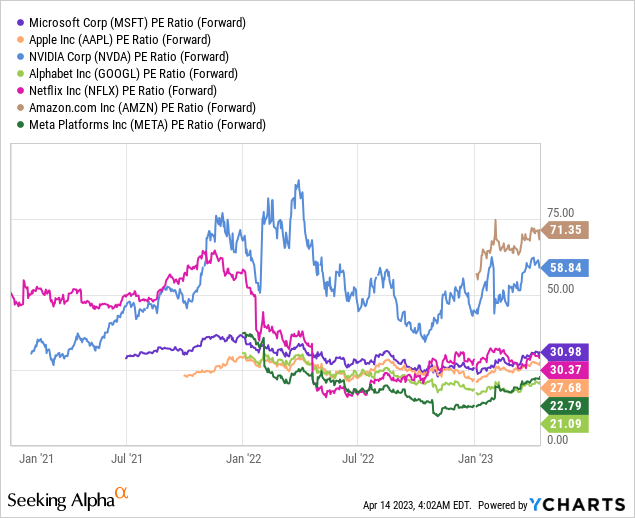

Right now, Microsoft looks like the most stable of the FANGMAN stocks – its EPS proved to be more stable and fell the least in the sample analyzed. Investors are paying their premium for this sustainability. If we exclude Amazon (AMZN) and NVIDIA (NVDA) from the sample – each of these companies has too high multiples for their own and conflicting reasons – MSFT’s forwarding price-to-earnings ratio is slightly higher than Apple’s (AAPL) and even higher than Netflix’s (NFLX), which had serious business model issues at the beginning of the current slowdown.

Although I am skeptical that the S&P 500 Index (SPX) can meet the bullish expectations placed upon it, it’s evident that the optimism of buyers can persist for some time. As I’ve previously mentioned in my articles, I regard Microsoft as one of the top performers among the mega techs, and now this conviction has only been reinforced before its Q3 report release.

If we exclude the Xbox gaming console and the Surface line of tablets and laptops [Gaming + Devices revenue segments, 12% in total sales], Microsoft is primarily a software company that develops, licenses, and sells computer software – Windows operating system, Microsoft Office, and the Microsoft Teams collaboration platform, among others. These are unusually “sticky” software products that, against the backdrop of MSFT’s dominant position in these markets, allow the company to continue to grow revenues even in the most difficult times (like now) thanks to its pricing power and moat.

However, a crucial area that modern investors need to focus on is the role of Microsoft’s Cloud business. Over the past year, this segment has experienced impressive annual growth of 17.8% and significantly expanded its share of the company’s revenue mix by 547 basis points, according to Q2 FY2023 data. With such a substantial contribution to Microsoft’s quarterly revenue of $52.7 billion, the Cloud business has become an essential component of the company’s success.

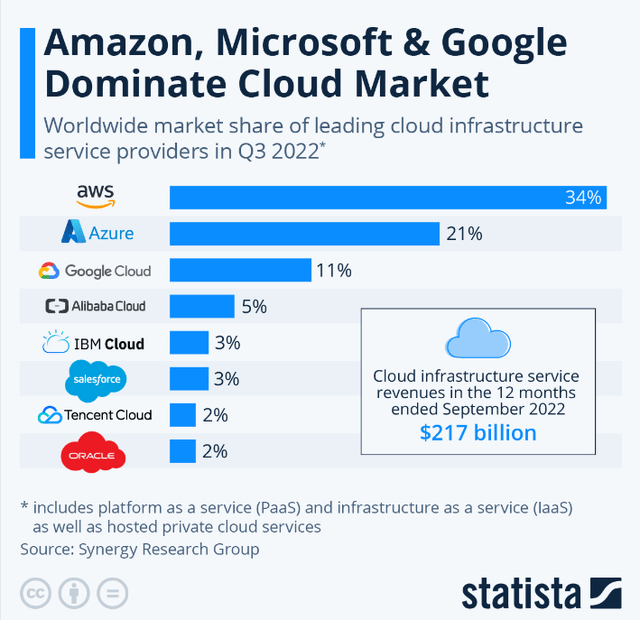

The global cloud market is a market with oligopolistic competition, where only a few dominant firms produce a nearly homogeneous product and try to compete with each other by absorbing more flexible and innovative players [in a certain way], thus expanding their offerings and creating barriers to entry.

Statista

Amazon’s AWS, Google’s (GOOGL) GCP, and Microsoft’s Azure collectively dominate 66% of the cloud computing market. In contrast, Alibaba’s (BABA) cloud services are primarily focused on specific geographical regions and have less impact on the developed markets of the Western world.

I recently came across a study by UBS analysts [10 April 2023, proprietary source] who shared their projections for the sales volumes of these 3 companies for the coming year [2023]:

![UBS [10 April 2023], proprietary source](https://static.seekingalpha.com/uploads/2023/4/13/49513514-16813841179352624.png)

UBS [10 April 2023], proprietary source

Let’s imagine that we live in the world of these 3 companies in the Cloud market and all the competition is only between them. As of December 2021, Azure held a 30.98% share of the market, a figure that had grown to 32.42% by December 2022. Looking ahead, UBS analysts have forecasted that Azure’s market share will continue to climb and reach 34.16% by December 2023.

The analysts are not simply extrapolating MSFT’s market share growth rates from last year into the near future – they spoke with ~20 large enterprise customers and partners to support their findings.

I read the 42 pages of the UBS report and can agree with the conclusion that Azure is not just predicting market share growth. A comment from one of the customers interviewed confirmed my suspicion that MSFT already has some pricing power and a fairly comfortable ecosystem that will allow it to attract even more new users going forward.

![UBS [10 April 2023], proprietary source](https://static.seekingalpha.com/uploads/2023/4/14/49513514-1681465485602137.png)

UBS [10 April 2023], proprietary source

However, it should also be noted that the analysts at UBS see significantly lower growth rates for Azure’s cloud segment compared with the consensus – in their opinion, this is not due to the special nature of MSFT’s product, but to the saturation of the entire market in general. The deviation is going to start in June 2023:

![UBS [10 April 2023], proprietary source](https://static.seekingalpha.com/uploads/2023/4/14/49513514-16814658654205873.png)

UBS [10 April 2023], proprietary source

But UBS is not the only firm that has recently published analytics about MSFT. Let’s turn from the Cloud to ChatGPT now.

On 6 April 2023 [proprietary source], Credit Suisse analysts published a note on what they learned from the company’s “Business Applications” launch event. The bank sees significant potential for monetization of AI/GPT capabilities through the existing installed base and additional market share gains. However, the core of their Microsoft thesis is Microsoft’s ability to monetize OpenAI technology within the O365 suite, which Credit Suisse estimates could drive around $40 billion of potential revenue and $2 of potential EPS uplift over the next 5 years.

![CS [6 April 2023], proprietary source](https://static.seekingalpha.com/uploads/2023/4/14/49513514-16814667995694425.png)

CS [6 April 2023], proprietary source

While Credit Suisse sees potential for Dynamics 365 Copilot, they believe Microsoft’s announcement of M365 Copilot will be a more significant needle mover. The ultimate pricing and packaging of this additional functionality remain unclear, but Credit Suisse believes Microsoft will likely move to monetize this functionality via a broad price increase to reflect basic M365 Copilot functionality and the introduction of a new E7 SKU embedding the full scope of M365 Copilot plus other advanced GPT-enabled functionality for “power users” of Office applications. Overall, CS analysts see significant potential for Microsoft’s AI/GPT-enabled products and features to drive revenue growth and EPS uplift in the coming years.

Therefore, I expect MSFT management to be relatively optimistic during the Q3 FY2023 earnings call – this will likely have a positive impact on MSFT stock.

The options market is already starting to confirm my findings. Recently I shared with my premium subscribers at Beyond the Wall Investing 25 trade ideas for the upcoming earnings season from the Goldman Sachs Derivatives Research team [12 April 2023, proprietary source], including MSFT. They believe that MSFT stock is one of the most out-of-consensus opportunities on the US stock market to date, as its EPS and revenue estimates are too low.

Goldman Sachs software analyst Kash Rangan believes that Microsoft has a 15% upside potential over the next 12 months, as the company announced the integration of generative AI into its commercial and consumer products, including Microsoft 365, GitHub Copilot, Power Apps, and Azure OpenAI Services, among others. This integration could drive market share gains in Microsoft’s search engine business, with a 100 basis point share gain amounting to $2 billion in ad revenues. Rangan believes that concerns related to limited scope for advertising revenues are overstated and that Microsoft has demonstrated its ability to display relevant links alongside user queries. He expects Microsoft to prioritize value over volume and believes that integration of generative AI into its offerings may have tailwinds across its many other businesses. He predicts that cloud revenue could double to $200 billion by FY27 as AI workloads gain traction. Overall, Rangan believes that Microsoft is well-positioned to capitalize on several long-term secular trends and that its EPS estimate is 3% above consensus for the current and 4% above for the next four quarters.

Source: GS [04/12/2023], author’s summarization

Concluding Thoughts

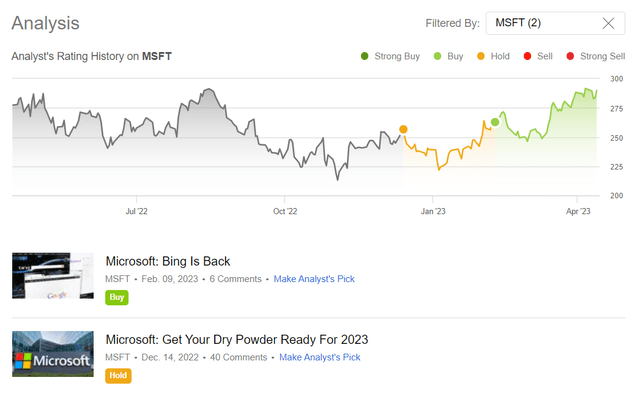

I am well aware that my earlier bearish assessments of the major technology companies are not consistent with my positive view of Microsoft. Perhaps it is because the picture for the company has changed dramatically in recent weeks. In mid-December 2022, I was Neutral, recommending that investors keep their powder dry and prepare for a recession; and by early February 2023, I was already bullish, and my call outperformed the SPX index by a factor of 10.

Seeking Alpha, the author’s MSFT coverage

Things are changing fast in the tech industry – whoever is first on the frontier has a chance to be a leader in the years to come. Microsoft stock began absorbing a new wave of expectations that the company is now at that very frontier – it’s possible the crowd is wrong and the stock has become very expensive at current levels. This opinion is also shared by analysts from UBS, whose above-mentioned calculations in the cloud segments of the three major companies seemed to suggest the opposite.

![UBS [10 April 2023], proprietary source, author's notes](https://static.seekingalpha.com/uploads/2023/4/14/49513514-16814681084760923.png)

UBS [10 April 2023], proprietary source, author’s notes

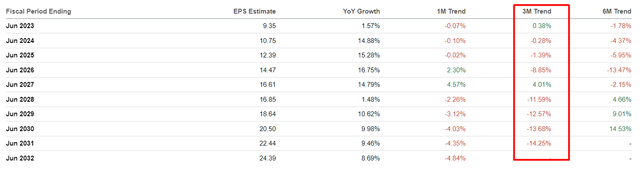

Microsoft has significantly outperformed Amazon and Google stocks in the last 3 months in the process of pricing-in new growth drivers. However, the reason for my today’s bullishness is that there could be another important catalyst driving the share price higher once earnings estimates turn from red to green:

Seeking Alpha, MSFT’s EPS estimates, author’s notes

This will be possible after the actual EPS numbers for Q3 FY2023 and the CEO’s comments come out. The management should mention everything I wrote about above and hint at brighter-than-expected prospects. I certainly hope so.

Thank you for reading!

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, but may initiate a beneficial Long position through a purchase of the stock, or the purchase of call options or similar derivatives in MSFT over the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Struggle to navigate the stock market environment?

Keep your finger on the pulse and have access to the latest and highest-quality analysis of what Wall Street is buying/selling with just one subscription to Beyond the Wall Investing! Now there is a free trial and a special discount of 10% – hurry up!