Summary:

- Microsoft’s Q4 performance exceeded analyst estimates with strong revenue and EPS growth, projecting double-digit growth for FY25.

- AI spending is necessary for Microsoft as it drives revenue growth across various segments, with a steady uptrend in AI contribution.

- Google’s regulatory challenges in the search business create an opening for Microsoft’s Bing, with potential for market share gains and revenue growth.

Pla2na/iStock via Getty Images

Investment Thesis

Microsoft (NASDAQ:MSFT) released its fourth-quarter results last week. In this article, I am initiating coverage of the company by analyzing its latest earnings report and investigating the setback seen in Azure’s growth along with the growth prospects for its search business.

Q4 Highlights

Microsoft delivered a solid fourth-quarter performance, in my opinion. Q4 Revenues came in at $64.7 billion, up 16% y/y in constant currency, beating analyst estimates by $287.8 million. Diluted EPS came in at $2.95, up 11% y/y in constant currency and beating analyst estimates by $0.01. Operating margins came in at 43%, relatively unchanged y/y, and free cash flows came in at $23.3 billion, up 18% y/y.

For the full year, revenues totaled $245.1 billion, representing a y/y growth of 15% in constant currency, and diluted EPS came in at $11.8, representing a y/y growth of 22%. For FY24, operating margins came in at 44.6%, which represents a y/y expansion of 280 bps. The company ended the year with $75.5 billion in cash and short-term investments.

The tech giant now expects both FY25 revenues and operating income to grow at double-digits y/y. FY25 Operating expenses are projected to grow in the single-digits and operating margins are expected to be down by about 1% y/y. FY25’s effective tax rate is expected to be around 19%, and capital expenditures are expected to be higher than the FY24 number, which was $44.5 billion.

For Q1 of FY25, the company now expects revenues to come in the range between $63.8 and $64.8 billion, falling short of analyst estimates of $65.1 billion. Growth in Azure is expected to be in the range between 28% and 29% in constant currency. COGS for Q1 is expected to be between $19.95 and $20.15 billion, operating expenses are projected to come in between $15.2 and $15.3 billion, and other income and expenses are expected to be approximately negative $650 million. The effective tax rate for Q1 is also expected to be about 19%.

AI Spend is Necessary as Capacity Constraints Are the Challenge, Not Demand

One of the main issues that investors appear to have with the major AI players recently has been the so-called “excessive” spending on AI. Big Tech’s capex spending has significantly increased, as evidenced by their latest earnings reports. More specifically, Alphabet spent $13.2 billion (y/y growth of 91%), Meta Platforms spent $8.5 billion (y/y growth of 33%), and Amazon spent $17.6 billion (y/y growth of 54%). Microsoft, who is considered to be the first-mover in AI among Big Tech, given that the AI revolution began when it invested in OpenAI in my opinion, was no different, as it spent $19 billion in the latest quarter, which represents a y/y growth of 77%. Moreover, these four companies have now spent $106 billion combined for the first six months of 2024. And the spending is only set to increase in the coming years. As mentioned in my last article on Alphabet, analysts project the total capex spend by Big Tech, primarily driven by AI, to exceed $1 trillion within the next five years.

The issue that investors have with this scenario, and we saw this with Alphabet as well after its earnings release, is that they are unsure about the timeline of the ROI on these investments. Now, while the majority of software companies have not offered any concrete evidence of how much AI is driving their growth, Microsoft was different in that respect. Management clearly stated that AI contributed 8% to the overall growth of Azure, which was up from 7% in the previous quarter and 6% from two quarters ago. This suggests that the spending is translating to growth, and while the growth may not be explosive, it does signal a steady uptrend.

There was more evidence of how AI is driving growth in the company’s other segments. For instance, during the earnings call, CEO Satya Nadella mentioned that the growth in the number of Azure AI customers jumped to 60% y/y. The company’s Models as a Service segment, where the company provides API access to third-party AI models saw the number of paid customers more than double sequentially. The company’s data and analytics tools also got a boost from Azure AI customers, as the number of these customers who were also using the tools jumped nearly 50% y/y. And finally, Copilot, Microsoft’s AI assistant accounted for over 40% of GitHub’s revenue growth in FY24. GitHub’s annual revenue run rate stands at $2 billion, which translates to an additional $800 million from AI. While this might seem a small number for a company that just generated $245 billion in revenues in FY24, it is not just the revenues that one needs to look at, but also how Copilot is driving growth in terms of other metrics such as customer acquisition.

Finally, one of the main reasons why investors were disappointed by Microsoft’s quarter, was the slowdown in growth seen in Azure. More specifically, revenues from Azure generated a growth of 29% y/y (30% in constant currency), missing both the company’s expectations of anywhere between 30% and 31% and the analysts’ estimates of more than 30% growth. During the earnings call, management attributed the slow growth to capacity constraints as well as a slowdown in Europe. Management now expects Azure growth to accelerate in the second half of FY25, as the company’s capital investments drive up the available AI capacity. In recent times, the success/failure of Microsoft’s quarter has been entirely dependent on how Azure performs. Q4 was no different, but it was clear that one of the main reasons behind the slowdown in Azure growth was the AI-related capacity constraints, which makes it a supply problem and not a demand problem, given that demand for Azure AI remains strong.

Therefore, taken together, it is clear that AI is generating revenues and profits for Microsoft, and while the growth may not be explosive, it is heading in the right direction. The company simply cannot keep up with the demand and as such, based on current evidence, it does suggest that Microsoft is right in continuing to invest in AI. It would be a different matter altogether if, in the second half of the year, the company increases its AI capacity, and yet this has no impact on Azure growth. Maybe then, investors could start questioning the company’s AI spend. Until that day comes, in my opinion, higher investments in AI are simply not a convincing excuse to dump the stock.

Google’s Regulatory Challenges Could be an Opening for Bing

One of the biggest news in the Tech space that occurred earlier this week was related to Google and its search business. More specifically, the company lost an antitrust case related to its Search business, as the US District Judge ruled that the company “exploited its market dominance to stomp out competitors.” Moreover, the judge also sided with the Justice Department that Google “suppressed competition” by paying operators of web browsers and phones billions of dollars to be the default search engine.

While the case could still take years to be fully resolved, especially since Google plans to appeal the ruling, the ruling does create an opening for MSFT and its Search business. One of the risk factors that I outlined in my thesis on Alphabet was the rising competition in the Search business, primarily due to AI-driven search. Microsoft, recently, announced that it has added gen-AI capabilities to Bing. Combine this with the new ruling, and it sets a base for Microsoft to gain market share in the Search business. The company, in the latest quarter, saw its Search and Advertising revenues jump 19% y/y, with both Bing and Edge registering strong volume growth.

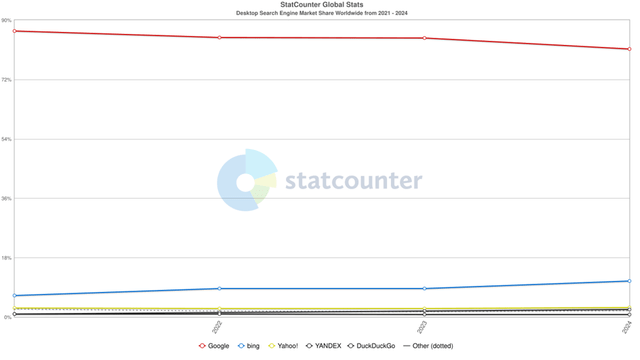

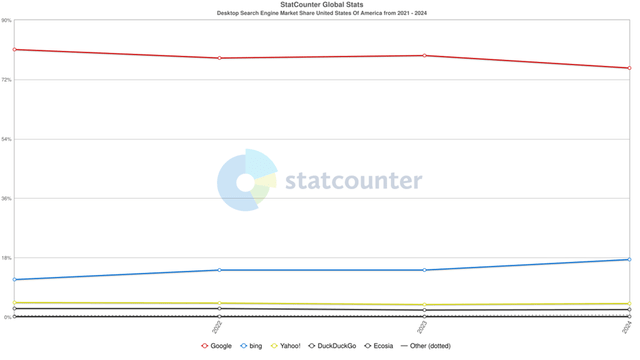

According to Statcounter, Bing’s market share worldwide, for Desktop Search, has gone from 6.44% in 2021 to 10.96% in 2024. Google, on the other hand, has seen its market share drop from 86.6% to 81.1%. In the US, Bing’s market share has gone from 11.4% in 2021 to 17.5% in 2024 whereas Google has seen its Market share drop from 81.1% to 75.5% during the same period.

While the stats clearly show that Google is miles ahead of MSFT when it comes to Search, the steady drop in market share for the former over the last three years is noteworthy, especially in the US. The latest ruling could also lead to Google losing its position as the default search engine on Safari, which could create a massive opening for MSFT, especially now that it has added gen-AI capabilities to Bing.

The search business of MSFT may still be very small compared to Google’s, but the progress made so far, since the AI revolution has started, along with the latest regulatory setback for Google could allow MSFT to make a substantial inroads into the Search & Advertising Business. This also becomes yet another reason why the company’s AI spend is justifiable.

Valuation

|

Forward P/E Multiple Approach |

|

|

Price Target |

$444 |

|

Projected Forward P/E Multiple |

30x |

|

Projected FY25 EPS |

$13.1 |

|

Projected Earnings Growth |

13.04% |

|

Projected FY25 EPS |

$14.81 |

Source: LSEG Data (formerly Refinitiv), Author’s Calculations, Seeking Alpha, and Microsoft Q4FY24 Earnings Transcript

As mentioned earlier, the company now expects FY25 revenues to grow double-digits y/y. The company’s trailing 5-year CAGR, according to LSEG Data, stands at 14.3%. For FY24, the y/y revenue growth came in close to this figure, at 13.83%. While the company is seeing strong demand for its AI services, it does remain capacity-constrained. As such, I don’t expect an explosive growth in FY25. Keeping this in mind, I have assumed revenue growth of 14.3%, its trailing 5-year CAGR, for my calculations. This results in FY25 revenues coming in at $280.1 billion.

The company expects operating margins to be down by 1% in FY25, which is reasonable in my opinion, given that they are expected to spend heavily on AI-related investments. I have factored this decline in my calculations, so my projected operating margins are 43.6%, which translates to an operating income of $122.1 billion. I am assuming the FY24 figure of negative $1.32 billion for my projections of FY25 other expenses. The company already expects a negative $650 million for the first quarter, so I do expect this figure to be in the red for the full year. This would result in net income (before taxes) of $120.8 billion. At an effective tax rate of 19%, which is what management’s projections for FY25 are, FY25 net income (after taxes) is projected to come in at $97.85 billion. According to LSEG Data, the diluted weighted average number of shares outstanding stands at 7.47 billion. This results in a projected FY25 EPS of $13.1, which shows a y/y growth of 11%, lower than its long-term earnings growth rate of 14.6%.

The company currently trades at 31.3x, according to LSEG Data (formerly Refinitiv) slightly more expensive than its historical forward median P/E of 30x. It is substantially more expensive than all of its peers, especially the rest of the Sensational Six, except Amazon and Nvidia. Given the earnings growth for the next twelve months is not that strong in my opinion, I have assumed its historical forward P/E of 30x for my calculations.

The company, according to Seeking Alpha, currently trades at a forward PEG ratio of 2.3, which is around its 5-year historical average. At a forward P/E of 30 and a forward PEG ratio of 2.3, the projected earnings growth comes in at 13.04%. At this growth rate, FY26 EPS is projected to be $14.81.

A forward P/E of 30x and a projected EPS of $14.81 result in a price target of $444, which represents an upside of about 12% from current levels. Given the limited upside from current levels, I wouldn’t recommend initiating a new position at these levels. Having said that, given the market meltdown that we are currently experiencing in the US on account of recession fears, the opportunity to get into this stock may not be far away.

Risk Factors

The main risk factor for the company is the one that I mentioned earlier whereby the increase in AI capacity still does not translate into meaningful growth of Azure. Of course, investors would then be perfectly valid to question whether the ROI on AI is meaningful enough.

The other risk factor is also related to spending. As mentioned earlier, it is not Microsoft alone who is spending. Everyone within Big Tech is spending on AI. And the race is heating up among competitors. AWS, for instance, had a better-than-expected growth in the recent quarter. Google Cloud also saw impressive growth, both in terms of revenues and operating profits. The competition is heating up, which could also have an adverse impact on the ROI from the capex spend.

Concluding Thoughts

Microsoft, in my opinion, had an impressive finish to the fiscal year. Both the revenues and EPS came in above expectations. While Azure’s growth narrowly missed analyst expectations, the decline in growth is more likely to be temporary, given that it was primarily due to capacity constraints rather than a lack of demand. AI’s contribution towards Azure has been steadily increasing, and together with the capacity constraints plaguing the company, MSFT is fully justified to spend on AI-related capital expenditures. The rest of Big Tech is doing it, and at this stage of AI adoption, the company simply cannot afford to be left behind, given that it still has the first-mover advantage.

Alphabet’s regulatory troubles for its Search business also opens the door for Microsoft’s Bing business. The company recently added gen-AI capabilities to its search engine, and this has seen substantial growth in the company’s search and news advertising business. While it would take years to resolve Alphabet’s case, there would still be opportunities for Microsoft to pounce.

From a valuation perspective, the stock has limited upside from current levels, based on my estimates. Having said that, the recent unwinding of the AI trade along with recession fears are likely to create an entry opportunity for new investors. In such a scenario, there is no reason not to get into this name. The spending on AI is not an option, it is a necessity. And for a transformative technology like AI, there is no such thing as “excessive spending” today.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of MSFT either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.