Summary:

- Microsoft’s earnings performance disappointed the market, as the stock has given up all its July 2024 gains.

- However, investors have not fled for the exit, even though near-term volatility may persist.

- Microsoft investors are likely weighing the AI monetization opportunities against the potential of overinvesting in AI capacity.

- With MSFT still priced at a premium against its tech sector peers, robust execution is necessary.

- I explain why the market’s pessimism has been overplayed, providing investors with another fantastic opportunity to buy more aggressively. Read on.

FinkAvenue

Microsoft: Gave Up All Its July Gains

Microsoft Corporation (NASDAQ:MSFT) investors are likely befuddled with the market’s pessimism as the stock of the Redmond-based company continued its pullback following its initial post-earnings decline. Consequently, MSFT has surrendered all its July 2024 gains, as the stock revisited lows last observed in early June 2024.

In my previous bullish Microsoft update, I indicated that MSFT could be approaching a potentially decisive breakout. I demonstrated why the software leader’s full-stack approach in AI monetization aligns with its infrastructure opportunity through its Azure cloud computing business.

Despite that, MSFT has underperformed the S&P 500 (SPX) (SPY) since my previous update, as the market was disappointed with Microsoft’s softer-than-expected guidance. With MSFT down almost 12% from its July highs through this week’s lows, should investors reassess their optimism in the stock? Or should they ignore the pessimism even as the underlying media narrative suggests the market’s patience is being “tested?”

Microsoft’s AI Monetization Thesis Isn’t Broken

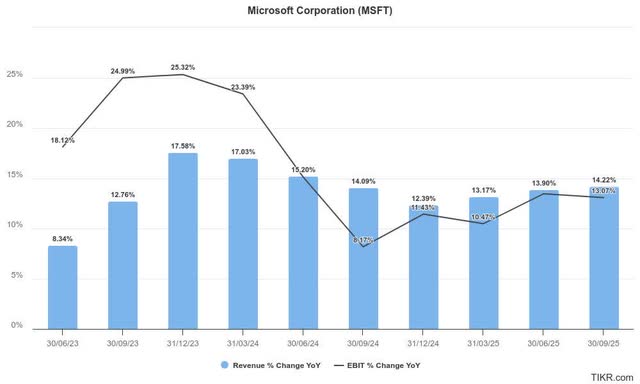

If you consider Microsoft’s normalizing revenue growth through FQ4 (June quarter), it seems justified that the company could face headwinds in proliferating AI across the stack. After all, management attempted to assure the market of Microsoft’s capabilities to monetize Generative AI.

Accordingly, the company emphasized the achievements of GitHub copilot. Management indicated that more than 77K organizations have adopted it, marking an increase of 180% YoY. In addition, Copilot also accounted for over 40% of GitHub’s revenue base. Consequently, it has bolstered GitHub’s annualized revenue run rate to $2B. The company also anticipates replicating the success of GitHub on other business and personal productivity tools across its software suites. In other words, we are likely still in the early innings of further productivity gains through Copilot.

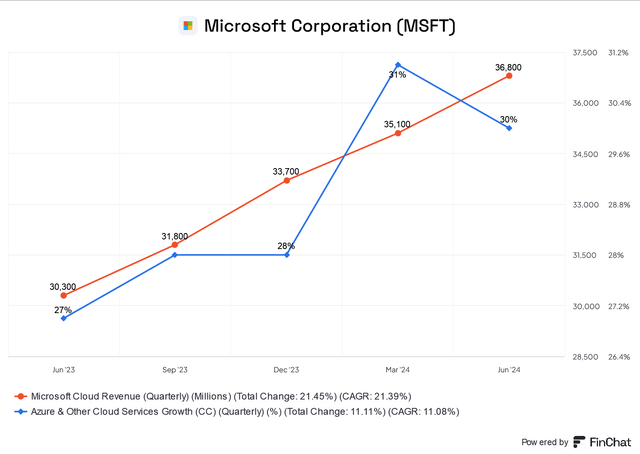

Microsoft Cloud revenue and Azure growth rates (CC) (FinChat)

In addition, Azure revenue increased by 30% YoY (on a constant currency basis), significantly boosting Microsoft Cloud revenue. Despite that, Wall Street was disappointed with the performance, as it fell within the lower end of Microsoft’s guidance range. Notwithstanding Wall Street’s caution, management provided crucial insights into the underlying health of the Azure cloud computing business.

Microsoft Must Invest To Stay Ahead

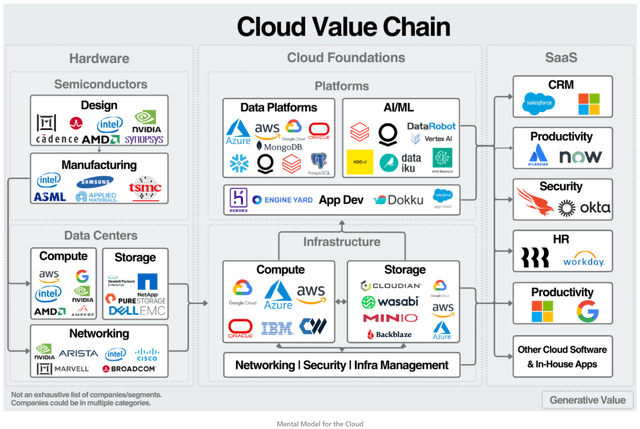

Cloud Value Chain (Public Comps)

As seen above, MSFT’s representation in the Cloud Value Chain is broad. Its exposure helps the company understand underlying demand signals well, allowing it to build technical infrastructure in anticipation of growth. As a result, I’m not surprised that the company has decided to invest more aggressively in its data center footprint to beef up its capacity.

Management highlighted capacity constraints that affected Azure’s growth momentum. Furthermore, Microsoft accentuated that AI services accounted for “8 points of growth,” corroborating the evolving opportunities in AI monetization.

As a result, Microsoft’s emphasis on being strategic in its investments should assure investors. In addition, management underscores its confidence in “balancing investments between infrastructure and the specific technology needs based on customer demand.” The company also reminded investors that AI monetization is possible without “necessarily needing to increase CapEx at the same elevated rates indefinitely.”

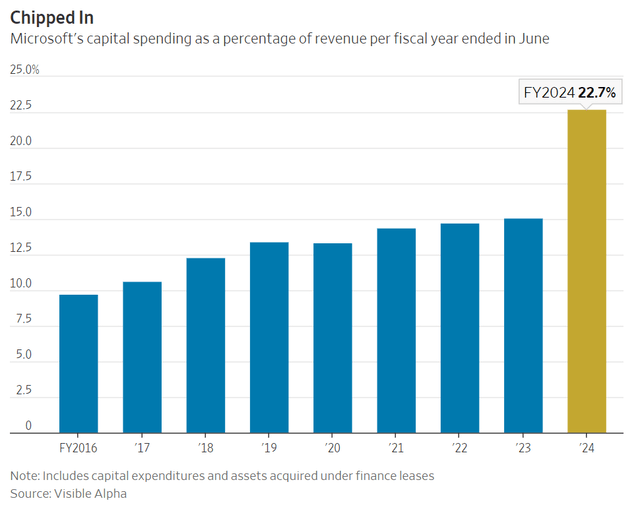

Microsoft CapEx margins % (WSJ, Visible Alpha)

Despite that, the market is likely concerned with the potential of overbuilding for growth. Accordingly, Microsoft’s CapEx margin surged to 22.7% for FY2024 (June quarter), highlighting the urgency to monetize AI robustly.

Moreover, potentially more aggressive CapEx spending from Alphabet Inc. (GOOGL) (GOOG) and Meta Platforms, Inc. (META) could worsen the market’s worries about overinvestment. A slower adoption of GenAI services by Azure’s customers could also hurt its AI monetization cadence. Despite that, Microsoft’s ability to utilize its capacity for internal use cases and less on third-party developers like Amazon.com, Inc.’s (AMZN) AWS could mitigate the downside risks attributed to overinvestment.

With that in mind, I still assess the market’s worries as justified. Investors must account for near-term execution risks, which could potentially hurt Microsoft’s robust margins.

Is MSFT Stock A Buy, Sell, Or Hold?

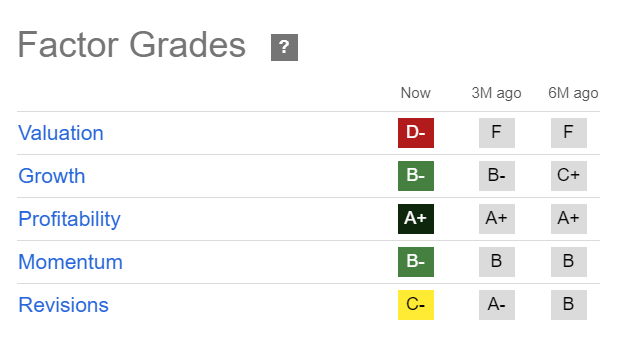

MSFT Quant Grades (Seeking Alpha)

As a result, I’m not surprised that Wall Street has mostly downgraded Microsoft’s estimates, reflecting caution into the second half of CY2024. Furthermore, MSFT’s valuation is still rated at a premium (“D-” valuation grade) relative to its tech sector peers.

Even when adjusted for growth, MSFT’s forward-adjusted PEG ratio of 2.3 is almost 20% above its sector median. However, it’s aligned with the stock’s 5Y average, suggesting a potential bottoming opportunity if more robust buying sentiments are observed.

In other words, I assess the correction in MSFT as justified, as analysts downgraded potential near-term earnings accretion from AI monetization. However, MSFT’s robust “B-” momentum grade suggests investors have not fled for the exit, telegraphing their confidence in MSFT’s long-term thesis.

Therefore, investors focusing on near-term AI monetization may feel disappointed with the lack of clear guidance on potential earnings boost. However, MSFT’s execution track record and massive scale should assure long-term investors of its ability to navigate these near-term headwinds.

As a result, I assess MSFT’s risk/reward profile as still attractive, although patience is needed for the company to justify a potentially more robust AI growth inflection.

Rating: Maintain Buy.

Important note: Investors are reminded to do their due diligence and not rely on the information provided as financial advice. Consider this article as supplementing your required research. Please always apply independent thinking. Note that the rating is not intended to time a specific entry/exit at the point of writing unless otherwise specified.

I Want To Hear From You

Have constructive commentary to improve our thesis? Spotted a critical gap in our view? Saw something important that we didn’t? Agree or disagree? Comment below with the aim of helping everyone in the community to learn better!

Analyst’s Disclosure: I/we have a beneficial long position in the shares of MSFT, META, GOOGL, AMZN either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

A Unique Price Action-based Growth Investing Service

- We believe price action is a leading indicator.

- We called the TSLA top in late 2021.

- We then picked TSLA’s bottom in December 2022.

- We updated members that the NASDAQ had long-term bearish price action signals in November 2021.

- We told members that the S&P 500 likely bottomed in October 2022.

- Members navigated the turning points of the market confidently in our service.

- Members tuned out the noise in the financial media and focused on what really matters: Price Action.

Sign up now for a Risk-Free 14-Day free trial!