Summary:

- Microsoft’s business is expected to continue exceeding expectations and retain its momentum, thanks to growth catalysts such as its AI product Copilot and the integration of GPT-4o into Bing search engine.

- The generative AI market and worldwide IT spending are expected to provide ample opportunities for Microsoft’s growth in the foreseeable future.

- However, despite its strong performance, Microsoft’s shares are currently overvalued, offering little margin of safety for investors, and better alternatives may be available in the market.

Robert Way

Ever since jumping on the AI bandwagon thanks to its partnership with OpenAI, Microsoft (NASDAQ:MSFT) (NEOE:MSFT:CA) has been aggressively expanding its customer base and greatly improving its overall performance. Its shares have rallied in recent quarters as the business was able to exceed expectations and generate significant returns. However, while Microsoft’s business is likely to continue to beat expectations, questions are arising about whether it makes sense to acquire the company’s shares at the current price given their relatively excessive valuation.

Microsoft Retains The AI Momentum

In late February, I wrote an article on Microsoft in which I stated that thanks to the expanding number of new AI-related opportunities, the company is likely to continue to exceed expectations over the coming quarters. However, while I noted that the business itself will likely retain its momentum, I also stated that Microsoft’s stock offers a little margin of safety to new investors. Since that time, Microsoft’s shares have appreciated by ~5%, and while they managed to perform in line with the broader market since late February, there’s still a possibility that aggressive growth of the company’s business won’t be able to fully translate into the aggressive appreciation of its shares.

At the time of this writing in late May, there are once again reasons to believe that Microsoft’s business will likely continue to exceed expectations as it still has several growth catalysts going for it. In the latest earnings report for Q3, which was released last month, the company announced that it managed to increase its revenues by an impressive 17.1% Y/Y to $61.9 billion, while its GAAP EPS was $2.94. The top-line and bottom-line results both were above the street expectations.

In Q4 and beyond, Microsoft will likely be able to exceed expectations again, as its flagship AI product Copilot has been helping the company to aggressively scale the number of subscriptions and generate greater sales. As Copilot continues to gain traction, the company has recently announced that it is adding new functions to its AI assistant, which could make it indispensable to various organizations and create new streams of recurring revenue for Microsoft. On top of that, thanks to Microsoft’s partnership with OpenAI, Copilot will start using the GPT-4o model, which can handle more data and better execute the given tasks.

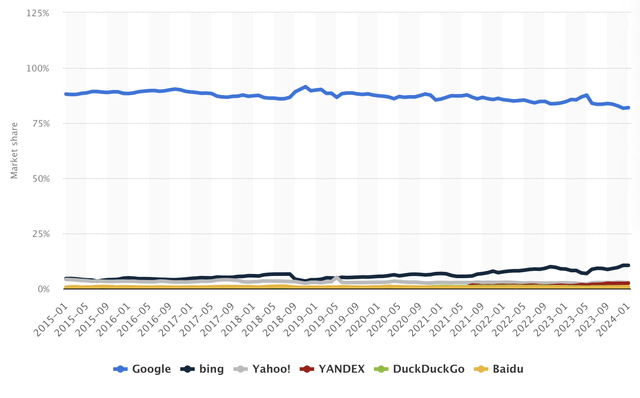

In addition to the Copilot, Microsoft is also integrating GPT-4o into its Bing search engine to attract new users and expand its share in the search market. In Q3, the search and news advertising revenues were already able to increase by 12% and the direct partnership with OpenAI could help the company scale that business even more in the following quarters. Just recently, Bing was able to reach a new record by capturing over 10% of the search market, which suggests that Google’s (GOOG)(GOOGL) monopoly over the market is slowly being undermined.

Search Market Share (Statista)

As the generative AI market is expected to be worth over $1 trillion in less than a decade, while worldwide IT spending is forecasted to set a new record and grow at 8% this year, it’s safe to assume that Microsoft has more than enough catalysts to scale its business in the foreseeable future. Add to all of this the fact that its cloud computing platform Azure was able to capture 25% of the cloud market at a time when Amazon’s (AMZN) AWS has experienced a decline in market share, and it becomes obvious that Microsoft could continue to exceed expectations in the following quarters.

The company has already received dozens of upward revisions for its revenue and earnings expectations in recent months. Given its impressive growth and prospects, there is every reason to believe that Microsoft will be able to retain its momentum in the foreseeable future, as its growth story appears to be far from over.

Microsoft’s Revisions (Seeking Alpha)

The Price Is Too High

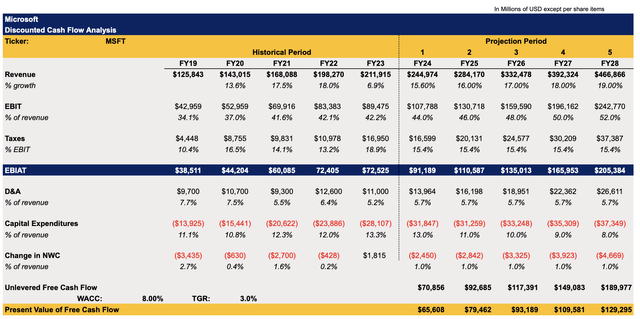

Despite all the growth catalysts that Microsoft has going for it, its shares at the current price offer little margin of safety to justify a bullish rating at this stage. While the company’s business has certainly performed well and will likely continue to perform great in the following years, questions are arising about whether it makes sense to purchase Microsoft’s shares at the current levels. To answer that question, I decided to create a DCF model that can be seen below.

My model assumes a stable double-digit growth of revenues in the following years, which closely correlates with the overall expectations, as Microsoft has more than enough growth catalysts to deliver a stellar performance in the foreseeable future. The earnings as a percentage of revenue in the model are also expected to increase, as the monetization of various AI-related services could help the company significantly improve its margins and result in a better bottom-line performance. The assumptions for all the other metrics in the model are mostly in-line with Microsoft’s historical performance. The terminal growth rate in the model is 3%, while the weighted average cost of capital is 8%.

Microsoft’s DCF Model (Historical Data: Seeking Alpha, Assumptions: Author)

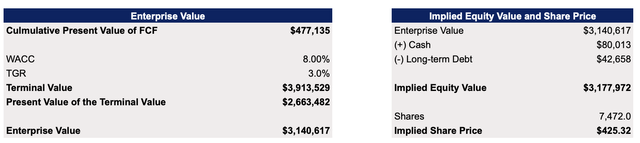

My model shows that Microsoft’s fair value is $425.32 per share, which represents a downside of ~1% from the current market price.

Microsoft’s DCF Model (Historical Data: Seeking Alpha, Assumptions: Author)

While markets are forward looking as there’s always a possibility that the underlying assumptions could be too conservative, I would argue that the assumptions in my model are rather optimistic. As such, I would say that with such assumptions, it’s hard to justify a long position in Microsoft at the current price solely based on the fundamentals.

There’s no denying that the company’s business is doing great and could retain its momentum in the foreseeable future. But at a forward P/E of ~36x, Microsoft’s shares trade above the market’s average P/E of ~28x, and in case of a potential market downturn they are likely to suffer more than the rest. There’s already a risk that the weak retail and investment data from China could have a greater negative effect on the global economy, which could result in a lower growth rate for Microsoft and its peers. At the same time, the potential announcement of additional oil production cuts by OPEC+ could revive inflation fears and prompt the central banks across the globe to keep higher rates for longer. Microsoft’s growth rates could also be negatively affected in such a scenario.

That’s why I’m not giving Microsoft’s shares a BUY rating at the current price, as the market currently offers better alternatives with more significant upside potential and greater margins of safety at the same time.

The Bottom Line

In the current situation, I believe that giving Microsoft a rating of HOLD is the best course of action. While the company’s business is likely to continue to grow at an aggressive rate thanks to the AI momentum that it has going for it, its shares offer little margin of safety even in the optimistic scenario. There’s a risk that in the case of the overall market selloff, Microsoft’s shares will experience a greater impact due to their relatively aggressive valuation. As such, I believe that it is best to look for other opportunities on the market and reconsider opening a long position in Microsoft after the potential pullback that could lead to the company’s shares offering a better margin of safety.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of GOOG either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Bohdan Kucheriavyi is not a financial/investment advisor, broker, or dealer. He's solely sharing personal experience and opinion; therefore, all strategies, tips, suggestions, and recommendations shared are solely for informational purposes. There are risks associated with investing in securities. Investing in stocks, bonds, options, exchange-traded funds, mutual funds, and money market funds involves the risk of loss. Loss of principal is possible. Some high-risk investments may use leverage, which will accentuate gains & losses. Foreign investing involves special risks, including greater volatility and political, economic, and currency risks and differences in accounting methods. A security’s or a firm’s past investment performance is not a guarantee or predictor of future investment performance.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.