Summary:

- Microsoft’s Q1 results and long-term history both speak to its unflinching growth potential in every aspect of tech.

- Strong gross margins and a lean balance sheet make it less risky than what is average for the S&P 500.

- MSFT’s high growth is projected not merely from generative AI but other paradigm shifts that may yet materialize going forward.

- This is supported by its flexible approach to internal reinvestment and M&A in good times and bad.

- The one potential issue is the price one pays, and current valuations suggest that a Hold is a better rating.

jewhyte

Microsoft (NASDAQ:MSFT) is, to me, is the most magnificent of the Magnificent 7. It may not stand as much at the forefront of investors’ minds as the others. While all check the “tech” box, each has its own niche. Amazon (AMZN) represents retail, while Tesla (TSLA) represents automobiles.

Of the 7, Microsoft is the omnibus, the business that transcends basic stereotypes and has room to expand into anything. That is why, even after it became a large cap, it has continued to grow as if it were a much smaller company.

The question then is the price we get for it. MSFT’s current price represents a fair value and warrants a Hold rating, but I have to agree that it wouldn’t take much of a price dip for it to enter Buy territory.

Financial History

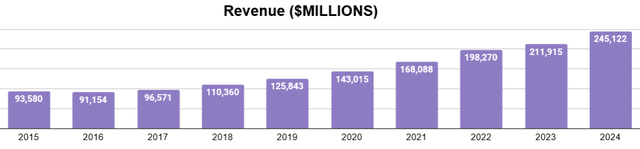

With fiscal years ending each June, we see Microsoft did very well over the past decade.

Revenues more than doubled in ten years, and the company was seemingly unfazed by disruptions, whether it was COVID, supply chain issues, inflation, interest rate hikes, the War in Ukraine, anything. It continued to grow its sales.

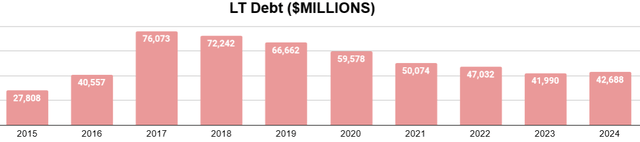

Another sign of their steadiness is how they paid down a significant portion of their long-term debt during this period, which I find impressive. Many companies took on significant debt to get through COVID, but not Microsoft.

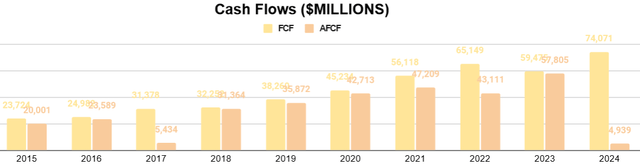

Seen above, this unsurprisingly results in consistently positive free cash flow. I’ve also provided an Adjusted FCF, to account for the outflows from M&A activity. Microsoft is always acquiring something, and occasionally this outstrips most of the cash flow. I think this reveals what kind of company Microsoft fundamentally is.

Because M&A is a consistent alternative to additions to property, plant, and equipment-essentially, nabbing someone else’s PP&E- I’ve decided to count it in this analysis. More importantly, it speaks to just how flexible Microsoft is in its capital allocation.

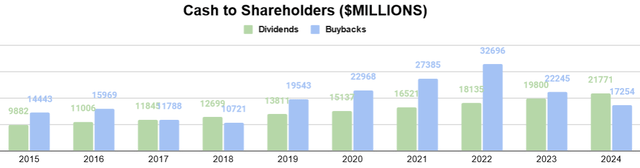

On that note, the company regularly returns most of his cash to shareholders, either through buybacks or dividends. The dividends have regularly increased each year, and buybacks tend to fluctuate, depending on other capital needs.

Looking at the last decade, it’s even easy to make sense of the general history of Microsoft. It started with Windows. Then came Office, the Xbox, OneDrive and other cloud services. Microsoft organically formed a universal reach into work and play. It uniquely benefits from M&A in that it can acquire smaller companies that have had time to prove themselves. It always has the cash to do so, and its operational breadth frequently unlocks value from these acquisitions.

Current Snapshot

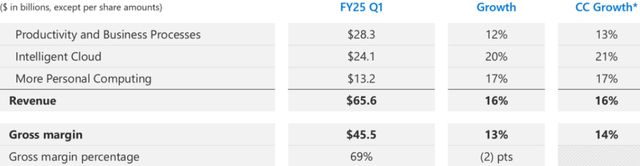

If we look to the current day, based on their Q1 FY 2025 results, which just released October 30th, we can see what kind of business this flexible capital approach has created.

Q1 FY 2025 Company Presentation

Microsoft has three basic segments:

- Productivity and Business Processes: Microsoft Office, related products

- Intelligent Cloud: Server and cloud products

- More Personal Computing: Windows OS, Gaming, other devices

All of these contribute significant portions to revenues, and all of them have double-digit growth, with incredibly strong gross margins. Intelligent Cloud enjoys the faster pace of growth, currently.

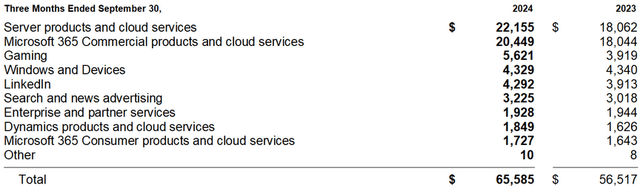

Q1 FY 2025 Company Presentation

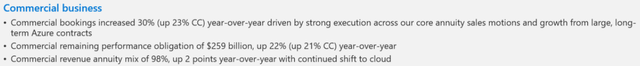

This is largely driven by their sale progress in Azure, their commercial AI product and currently a central focus for the company.

Yet, breaking down their different products and lines further, we see revenues growing in most places year-over-year or otherwise holding steady, no signs of going backward.

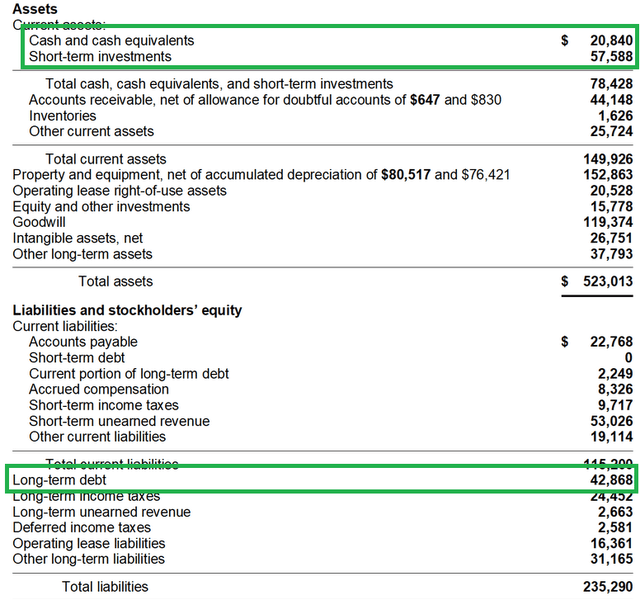

The balance sheet, meanwhile, is a fortress, with $78B in liquidity against $42.6B in long-term debt.

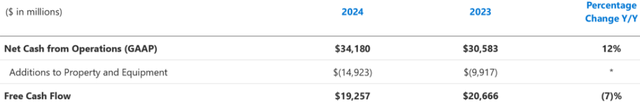

All of this translates to healthy growth of operating cash flows, with has been offset by higher year-over-year capex, in order support the growth of their AI capabilities.

Future Outlook

Realistically, there is little reason for me to think that Microsoft cannot continue to grow cash flows in a range of 20% to 25% for the long run. Very few companies can continually add to themselves and expand, having their pick of the best M&A opportunities.

This is true of markets where it already thrives, such as in the US, but this also makes Microsoft among the best-positioned to ride the benefits of globalization. The beauty of Microsoft isn’t simply that it’s well-positioned to benefit from the explosion of generative AI; it has the moat to benefit from any paradigm shift in tech.

That gets us to the question of the valuation, as even amazing companies (and their stocks) have finite values. I’m going to use a Discounted Cash Flow model and elaborate my thoughts behind it.

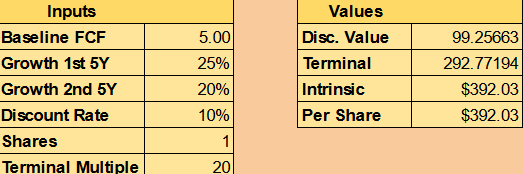

Above, I’ve shown the annual adjusted FCF per share, which shows the cumulative effects of business growth and buybacks, as well as what happens during especially large moments of M&A. If we average the last three years of AFCF per share, that would give us $4.74. For my calculation, I’ll round up to an even $5.00, as Q1’s results show continued growth.

Overall, my DCF assumptions are:

- $5 as baseline FCF per share

- 25% CAGR first 5 years

- 20% second 5

- Terminal multiple of 20

I think Microsoft will continue to deliver double-digit revenue growth to support a FCF CAGR in the range of 25% to 20%, enhanced further by buybacks. I’ve reduced the last five years to 20% and the terminal multiple accordingly to reflect potential deceleration, as AI demand may begin to saturate.

Author’s calculation

Priced for a 10% discount rate (typical return of the market), that gets us to $392 per share. The current market price is a slight premium to this, indicating that long-term returns may still be positive but more in the territory of what I consider a fair value, prompting my Hold rating.

I will say, however, that if given the choice between buying the S&P 500 and MSFT at a price that matches my 10% discount rate, I would choose MSFT. Compared to most S&P 500 companies, it has much better growth prospects and a better balance sheet. Valuation being equal, Microsoft actually seems less risky than a diverse index.

Conclusion

MSFT it slightly above what I would want to pay for it, but the company’s continued growth, fat gross margins, lean balance sheet, and unlimited potential in all that is tech means it’s better to own than the index it’s hiked up with the rest of the Mag 7. I rate it a Hold for now, but even a modest drop would be worth reconsideration.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.