Summary:

- Investing is not just about fundamentals and technicals. Psychology matters, too.

- Stock splits are in Microsoft’s DNA, although not recently.

- Microsoft is a strong company fundamentally, but its stock can use the jolt from a stock split.

- Microsoft continues playing Chess in a field dominated by Checkers.

David Ramos

Microsoft Corporation (NASDAQ:MSFT) is all over the news for both good and not-so-good reasons. The ChatGPT news is making waves to the extent of being called an “iPhone moment” while the company has also announced a plan to layoff 10,000 employees. After a horror 2022, the stock has not gotten off to the best of starts in the new year either, as it is down a hair more than 3% YTD. This has prompted SA Authors and analysts alike to wonder what factors may turn the ship around and when.

The SA article referenced above is suggesting a base case price of $220, while SA commenters in the same article call for an entry at $210. But what if the stock never reaches any of those specific targets? And what could turn around the stock? Those two questions made me look up Microsoft’s stock split history. Why? Because, as someone that loves selling puts on stocks I like instead of waiting for specific price targets, the $230 is a punch to the gut. Plus, to see what history says about the impact of stock splits on a stock’s performance.

Cut my Pizza into 4 Slices, 6 is too much to eat

Unlike stock buybacks and dividends, stock splits don’t change anything fundamentally about a stock or the underlying company. An often used joke about stock splits refers to a quote from the legendary Yogi Berra, “You better cut my pizza into four slices because I’m not hungry enough to eat six.”

But is it as perfunctory? I am not so sure.

Psychology – The forgotten third wheel

Let’s not forget the often unsung third wheel of investing. I believe investing is mostly about the fundamentals of a company. Despite short-term noise (which can last for years), in the long-run, fundamentals dictate investor returns. I also pay attention to short-term technical indicators to determine the best entry points. But an often-overlooked aspect is psychology. When retail investors look at a stock trading at $230, they don’t fundamentally think “Oh, that’s the same as me buying 10 shares at $23.” It just doesn’t work that way. The thinking rather goes like “Why would I spend $230 to buy one share of Microsoft when I can buy, say, 8 shares of Intel Corporation (INTC) for the same $230?”

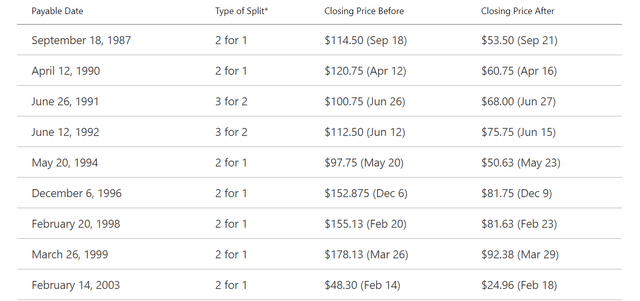

It is hard to blame the retail investor here, despite the recent advent of partial shares. And Microsoft is no stranger to stock splits, as shown by its history below. Although the last split was two decades ago, stock splits are in the company’s DNA. What’s not to like about stock splits in this scenario?

MSFT Stock Split (Microsoft.com)

The other forgotten world – options

Beyond the psychological aspect, stock splits (and resulting lower price per share) have a very real impact on options traders. Most fundamental investors stay away from options due to a misunderstanding of the risk factors, but it is undeniable that options trading has generally been on the rise, powered by meme stock chasers. Readers of my articles may recall that I am huge fan of selling puts to be able to buy stocks I like at price points I like. This ensures that I don’t completely miss out on a stock by waiting for a precise buying point like the $220.17 and $210 mentioned at the beginning of the article.

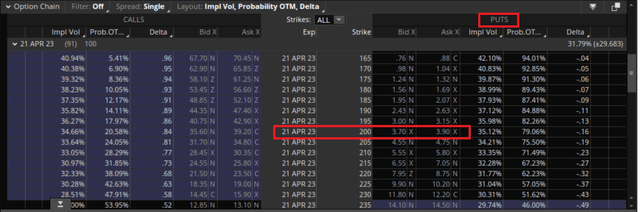

In the options chain I am considering below, the put seller gets a premium of $370, or about 2% in 3 months for agreeing to buy Microsoft 13% lower from the current trading price. Not a bad deal, one might say. But the capital needed for a cash secured put here is $20,000. Not many retail investors have that much capital waiting to be deployed for a single trade. Now, if Microsoft were to announce a 10:1 stock split, the same options chain will be adjusted for a strike price of $20 and a premium of $37. In other words, same returns in terms of percentage but tying up a much lesser amount. What’s not to like about a stock split in this scenario, too?

MSFT Option Chain (Think or Swim)

History suggests negative sentiments before a split helps

Lastly, let’s look at history. How have stocks performed after stock splits when compared to the general market? One may recall the heady days of the 1990s, when stock splits on high flying names were seen as bullish signs until they didn’t work anymore. If you are expecting a twist to that story, you are right.

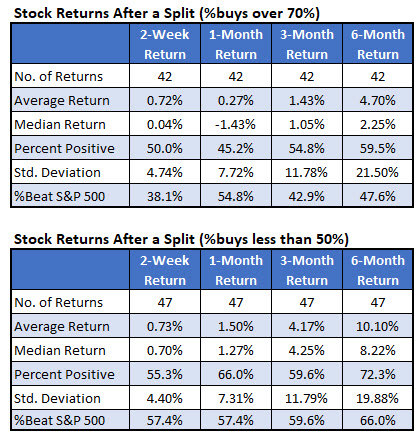

The table below shows that the returns are generally not exaggerated after stock split but the key thing to know is the more the bearish sentiment before a stock split, the better the returns have been. For example, using the 6 month return columns in the tables below, 66% of stocks with <50% bullish ratings outperformed the S&P 500 (SP500), while only 47.6% of the stocks with >70% bullish ratings did so. I don’t believe Microsoft is as negatively viewed at this point, but as noted in the article, bearish sentiment ahead of a stock split has historically helped those stocks outperform the market.

“Perhaps the stock split was the catalyst needed to spur buying in these stocks that are looked at unfavorably.”

If you are interested in going a bit further back into history, this may be of interest to you. In short, there is reasonable evidence to suggest that stock splits tend to help, especially when market sentiments are low as they are right now. I believe Microsoft investors will welcome a split here.

Stock Split Returns (schaeffersresearch.com)

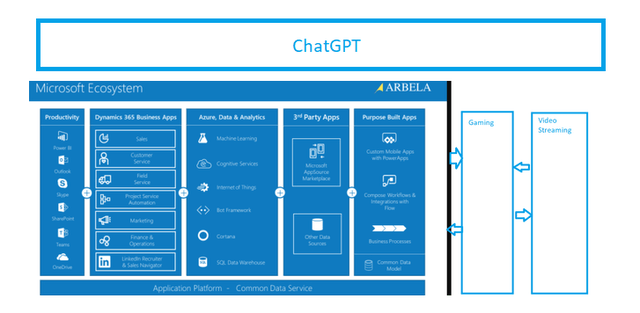

Fundamentally Sound

None of these theories about stock split will sustain investor confidence the way fundamental business strength can. Microsoft, despite the troublesome 2022 for its stock and the rocky start to 2023, remains a fundamentally strong company. The move to invest billions into ChatGPT fits right into the carefully expanding Microsoft ecosystem that I’ve referenced a few times in my articles. This ecosystem is expanding at such a rapid space that I’ve had to edit the image below thrice in the last couple of months to depict what the expanding ecosystem looks like. Rapid does not mean careless, as Microsoft is clearly adding components that leverage and expand its existing businesses. For example, ChatGPT is expected to help the company fight back against Google Docs’ (GOOG) domination and strengthen its own position in the Cloud segment against Amazon Web Services (AMZN) and Google Cloud.

MSFT Ecosystem (Arebelatech.com)

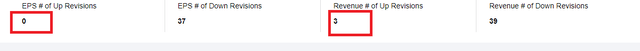

Microsoft Corporation stock may still be a tad overvalued at 24 times forward earnings, but it is safe to say that expectations are more leveled now than anytime in recent history, as evidenced by the EPS and revenue revisions shown below. Furthermore, the balance sheet strength is so enormous that Microsoft can afford to double its dividend payments and still not be at the risk of a dividend cut.

MSFT Revisions (Seekingalpha.com)

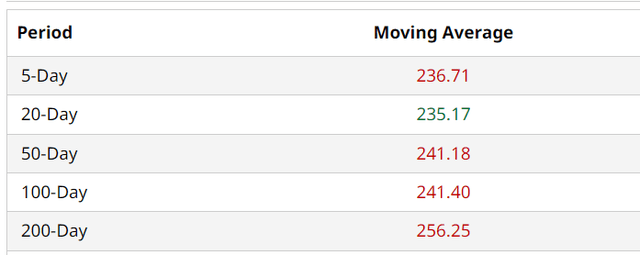

Despite all the negative headlines and weak price action, Microsoft stock is not doing too shabbily on the technical front, either. The stock is about to move past its 5- and 20-Day moving averages while the 50- and 100-Day averages are less than 3% away. If the stock continues to trade around the $230 range for the next few days, a new 200-Day moving average base will be established around the $240 area. A newer base is likely to serve as the foundation to build the next leg up, backed up by the fundamental factors discussed above.

MSFT Moving Avg (Barchart.com)

Conclusion

As someone who is constantly looking for opportunities to sell puts on stocks I like, I will certainly welcome a Microsoft Corporation stock split. Besides the jolt it may give the stock in the short term, stock splits remove the psychological barriers associated with large price tags. And remember, none of this matters if the underlying company and its balance sheet are not strong enough to last tough times.

Microsoft Corporation is one of the best-equipped companies to handle most of the challenges thrown by the macro environment. The rapid expansion (or at least efforts towards) of its ecosystem reiterates my earlier comment that CEO Satya Nadella and team are masterfully playing the game of Chess when the field is busy playing Checkers.

Do you believe Microsoft Corporation should split its stock here? And more importantly, do you believe they will? Please leave your comments below.

Disclosure: I/we have a beneficial long position in the shares of MSFT, AMZN, GOOG either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.