Summary:

- Microsoft’s financial results show growth in revenue and EPS, driven by the More Personal Computing Segment and Productivity and Business Processes.

- Analysts predict strong growth for Microsoft Cloud and positive feedback on M365 Copilot, indicating potential widespread adoption.

- The valuation of Microsoft stock is a concern, with a high P/E ratio and low free cash flow yield suggesting limited future price growth.

- In the short term, I expect that the price will find it increasingly difficult to rise and that we’ll probably end up in a consolidation again at best.

- I reiterate my ‘Hold’ rating this time.

lcva2

Intro & Thesis

I have repeatedly written in my past articles about Microsoft (NASDAQ:MSFT) that it is one of my favorite FANGMAN companies. It owes this to its wide moat, its good business diversification with a leadership position in several industries, and its excellent management that has been able to make this happen and has the strength and savvy to maintain this state of affairs from year to year.

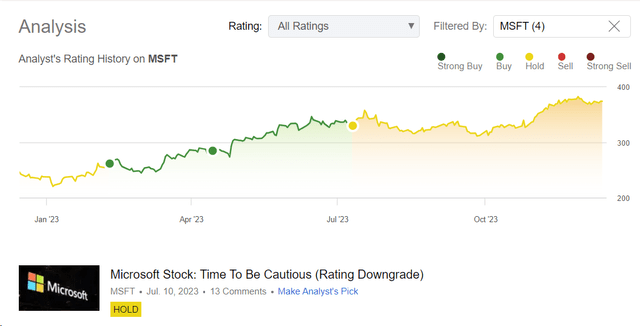

But everything has its price, and MSFT shares are no exception, despite their apparent long-term appeal. Five months ago, I adjusted my recommendation for MSFT shares from ‘Buy’ to ‘Hold.’ Over the subsequent four months, the stock underwent a period of consolidation, with a noticeable upward trend emerging only in the last few weeks:

Seeking Alpha, my coverage of MSFT stock

I think that MSFT shares are now approaching a similar consolidation phase again, which could last several months.

Why Do I Think So?

To begin with, I would like to discuss the company positively and focus on the things that make me optimistic in the longer term. Let’s start with the latest financial results.

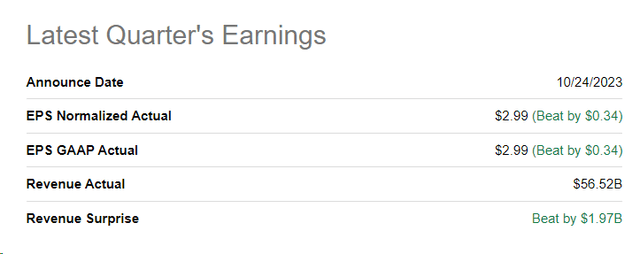

In Q1 FY2024, Microsoft’s revenue reached $56.5 billion, up 13% in USD and 12% in constant currency (CC). EPS stood at $2.99, growing 27% in USD and 26% in CC. The results beat the consensus by 4% for revenue and 12.8% for EPS.

The More Personal Computing Segment led the positive outcome, driven by better-than-expected OEM revenue and a 4% YoY growth in PC market unit volumes, returning to pre-pandemic levels.

Productivity and Business Processes also did well, with a 2% increase. Key contributors were 17% CC growth in Office 365 Commercial, strong performance in E5, LinkedIn, and successful execution on contracts exceeding $10 million. Dynamics 365 and Azure both showed strength, with Dynamics 365 growing 26% in CC, and Azure posting a robust 28% growth in CC.

[Source]

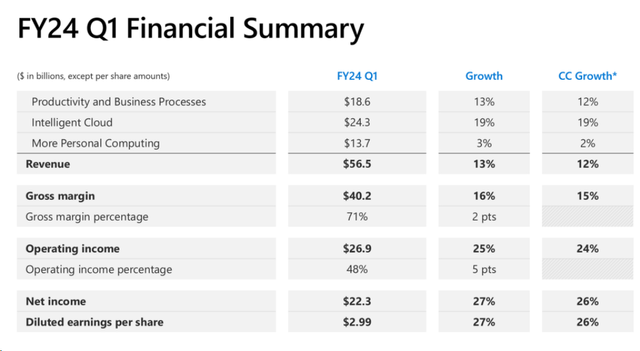

Microsoft’s Commercial RPO of $212 billion reflected an 18% YoY increase. Commercial Bookings rebounded with a +17% CC growth after facing challenging comparisons in the previous quarter.

As Goldman Sachs analysts wrote in their earnings review note [proprietary source, October 25, 20023], the optimistic view is that Microsoft Cloud can end the year with a +20% increase, considering this metric accounts for ~70% of the next twelve months (NTM) revenue. The strong demand for Gen-AI/Copilot across Microsoft’s portfolio is expected to drive further growth.

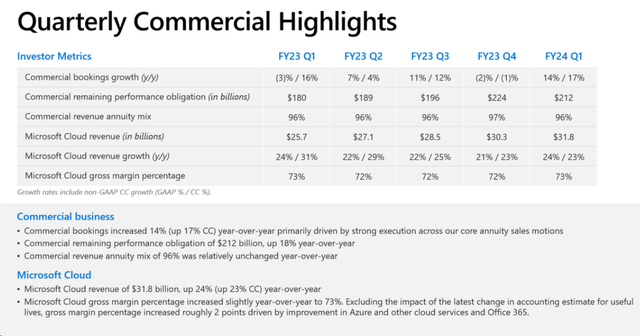

According to an October survey by JPMorgan analysts [proprietary source], the feedback on Microsoft’s M365 Copilot is overwhelmingly positive, with 42% of partners expressing enthusiasm, citing increased productivity and potential widespread adoption. Partners anticipate 60%+ Copilot adoption within 2.5 years, contradicting bearish views.

JP Morgan [proprietary source, October 19, 2023]![JP Morgan [proprietary source, October 19, 2023]](https://static.seekingalpha.com/uploads/2023/12/15/49513514-17026282556274047.png)

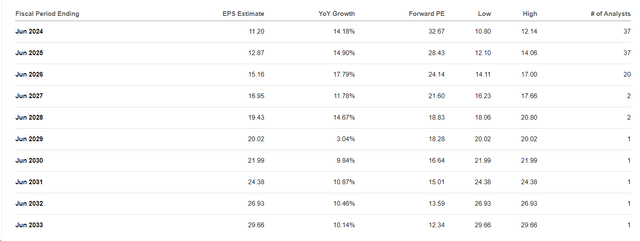

Positioned to capitalize on long-term trends such as public cloud and SaaS adoption, digital transformation, generative AI, BI/analytics, and DevOps, Microsoft is going to leverage its cloud business, reaching a ~$100 billion run-rate, to drive sustainable EPS growth, potentially doubling earnings per share from FY2024 to FY2030 (that’s what the consensus data tells us).

Seeking Alpha, MSFT’s earnings estimates

As technology’s share of global GDP rises, Microsoft’s longer-term target appears reasonable, supported by intact secular drivers for Azure and Office. The company’s efficient capital allocation, and successful track record in acquisitions, dividends, and share purchases, add to its compelling total return story.

But there are also many risks with Microsoft stock, especially in terms of its valuation.

Valuation is a fairly subjective thing that leads each investor to their own unique conclusions. I am aware of the company’s strength and potential for operational growth – the YTD performance of almost 53% didn’t just happen.

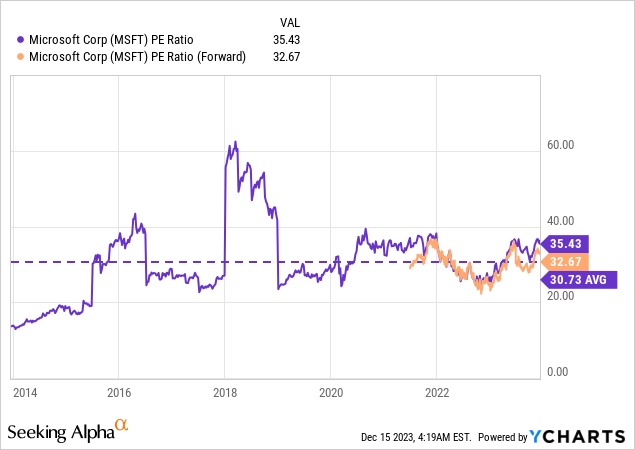

The debate over whether MSFT’s high P/E ratio can be explained by future growth in earnings per share (whose estimates, by the way, has risen sharply in recent months) will never really end. The fact is that if we only look at the P/E ratio, MSFT is only 10% overvalued at the moment (based on forward P/E) compared to its historical norms:

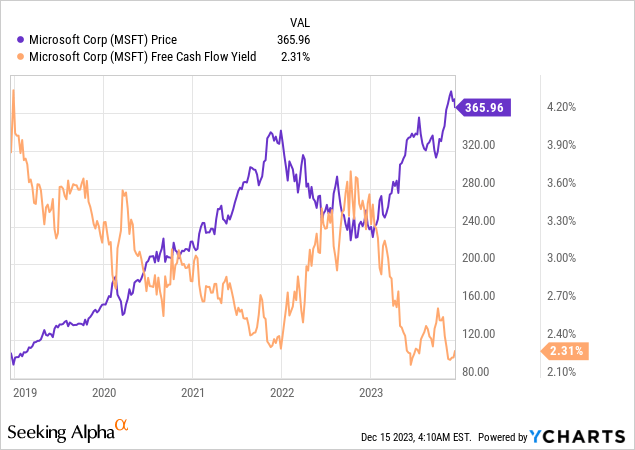

It’s not too much. But I don’t like to focus only on the P/E ratio, as it’s an overused metric. Financial theory tells us to focus on free cash flow. Therefore, free cash flow yield – FCF divided by market capitalization – is a very useful metric in my opinion. It’s this metric that is screaming the loudest today that MSFT is actually rapidly losing its chances of continued ‘nominal price growth’ in the foreseeable future.

In the last quarter, the company spent around 8.54% of its revenues on buying back common shares and another 8.91% on paying out dividends. At the same time, the annual dividend yield looks meager at 0.75% (TTM). If we combine those pieces, we’re not even getting half of what you can get in the bond market today. In the context of the existing risk, I think MSFT shares should provide a much higher total shareholder return yield than today. This is only possible with very rapid operational growth or a decline in market capitalization. The second option seems to me to be the most likely, as the latter seems to be already largely priced in.

The Bottom Line

I would not recommend selling MSFT stock after its phenomenal YTD rally. However, I don’t see the point of buying these shares at current prices either. In the long term, the price should, of course, go higher, but if you think in the context of overweight/underweight positioning, then MSFT stock looks too expensive at current prices due to its low FCF yield. In my opinion, we need a 15-20% drop in the share price to finally consider the stock undervalued and attractive to buy. In the short term, I expect that the price will find it increasingly difficult to rise and that we’ll probably end up in a consolidation again at best. So active investors can sell options and collect premiums while waiting for better entry points.

I reiterate my ‘Hold’ rating this time.

Thanks for reading!

Analyst’s Disclosure: I/we have a beneficial long position in the shares of MSFT either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Hold On! Can’t find the equity research you’ve been looking for?

Now you can get access to the latest and highest-quality analysis of recent Wall Street buying and selling ideas with just one subscription to Beyond the Wall Investing! There is a free trial and a special discount of 10% for you. Join us today!