Summary:

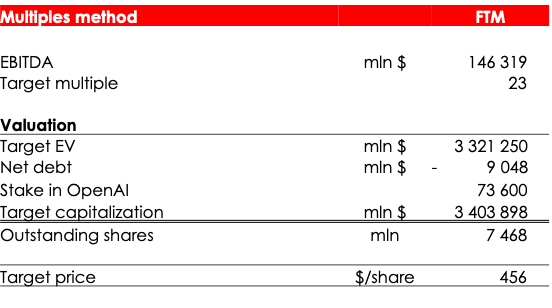

- Microsoft’s FCF Yield method underestimated the real price of shares, so it has been removed from valuation.

- Worldwide PC shipments rose by 3% in 4Q 2023, ending a streak of declines.

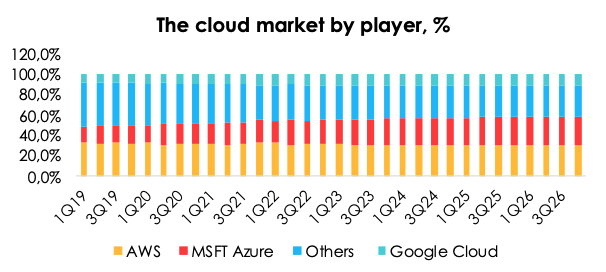

- MSFT’s Intelligent Cloud segment is rapidly gaining market share and is expected to reach 27% by 2026.

GIUSEPPE CACACE/AFP via Getty Images

Investment thesis

We have removed the FCF Yield method from the valuation, as the approach underestimated the real price of the shares as we did in previous article. Usually, technology companies have a low FCF Yield due to constant investments in their own product. To be competitive among fast growing environment IT companies have to constantly increase their budgets for research and developments which makes a pressure for net income and for FCF. Microsoft (NASDAQ:MSFT) is no exception. The company is investing heavily in new hyperscale data centers and AI products to meet the rising demand for computing systems. Also, as volatility in the bond market has increased, we have not seen a subsequent decline in tech stocks, suggesting that investors are looking at business growth in the here and now, ignoring the high required return on equity.

PC market

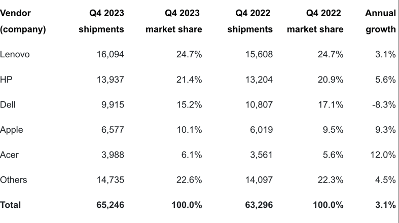

According to Canalys, worldwide PC shipments rose by 3% y/y to 65.3 mln units in 4Q 2023, ending a streak of declines. Even as the shipments fell from a year-earlier period, they rose by 8% q/q, extending growth for a second straight quarter.

Desktop PC shipments went down by 1% y/y to 13.7 mln units in 4Q 2023. Notebook shipments expanded by 4% y/y to 51.6 mln units. The recovery was driven by corporations updating their IT infrastructure and schools purchasing equipment. The efforts of vendors to reduce excess inventory also played a significant role in the acceleration of shipments in 4Q 2023.

Canalys

From the perspective of vendors, Dell suffered the biggest decline in sales, with sales falling by 8.3% y/y to 10.8 mln units and market share shrinking from 17.1% to 15.2%. Lenovo and HP continued to lead shipments, with sales of 16.1 mln units (+3.1% y/y) and 13.9 mln units (+5.6% y/y), respectively.

Canalys

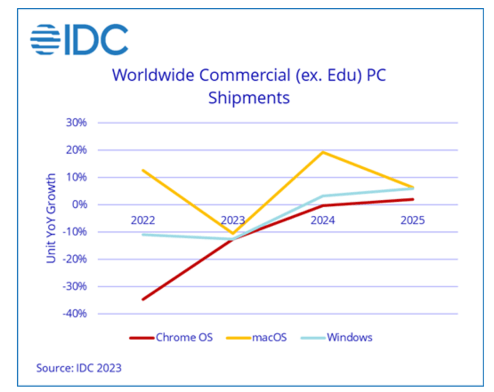

We base our forecasts on the IDC outlook for worldwide PC shipments. According to the latest data from the research company, worldwide PC shipments slowed by 13.8% y/y in 2023. IDC expects the PC market to recover as soon as 2024, with the growth rate averaging 3.1% y/y until 2027.

IDC

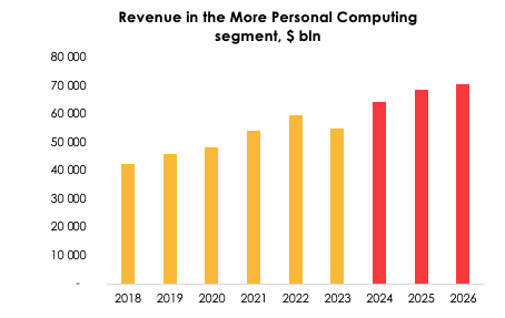

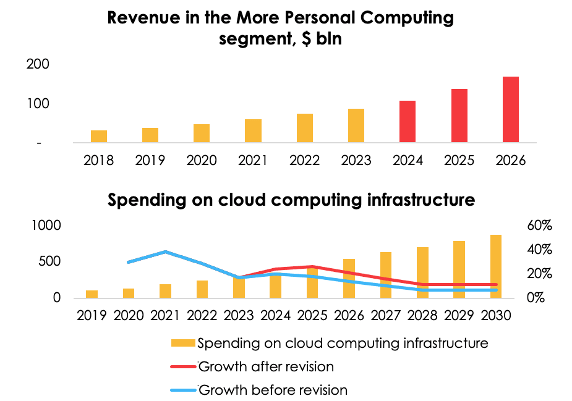

The PC market is developing in line with our expectations, so we maintain our assumption for the growth of revenue in the More Personal Computing segment by 17.7% y/y (including revenue in Activision Blizzard) and forecast the revenue to reach $64.4 bln in 2024, and $68.5 bln (+6.4% y/y) in 2025.

Invest Heroes

Cloud

The Intelligent Cloud segment jumped by 20.3% y/y to $25.9 bln in 2Q 2024, up from our estimate of $25.1 bln. The segment’s growth accelerated to the fastest pace in the last 4 quarters as the company was introducing AI solutions in its Azure and Office 365 cloud products. The company is rapidly taking away market share from its competition. According to Canalys, the company has been able to expand its market share from 23% to 26% since the start of 2024. We expect the trend to continue and Azure will take up to 27% of the market in 2026.

Invest Heroes

Given the greater success in capturing market share through the adoption of AI, and as corporate spending on cloud computing infrastructure is expected to rise in the second half of 2024, we are raising the revenue forecast from 99.5 bln (+13% y/y) to $107.9 bln (+23% y/y) for 2024, and from $106.5 bln (-1.3% y/y) to $137.8 bln (+27.7% y/y) for 2025.

Invest Heroes

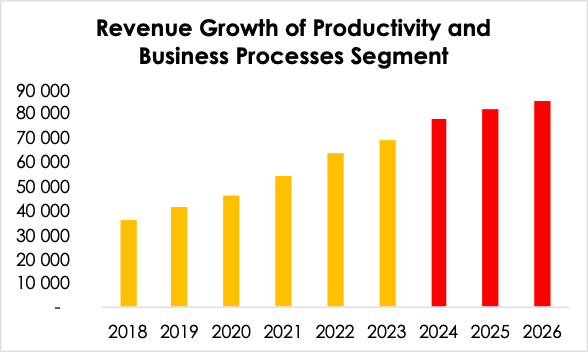

Productivity and Business Processes

The Productivity and Business Processes segment also showed an acceleration of financial results due to the introduction of AI assistants in Office products. Segment revenue increased by 13% YoY to $19.25 billion against our forecast of $19 billion, which was at the level of our forecast. We maintain our expectations for segment revenue growth at $77.7 billion (+12% YoY) in 2024, and at $82 billion (+5% YoY) in 2025 due to the acceleration of cloud services.

Invest Heroes

Valuation

We are raising the target price of the shares $456 due to:

- the increased EBITDA forecasts for 2024 and 2025

- the shift of the FTM valuation period, along with the discontinuation of the valuation based on the FCF Yield method, as it underestimates the fair price of the company’s stock

We are changing the rating for the shares to HOLD.

Invest Heroes

Conclusion

Microsoft is a company that continues to develop and remain a promising business. It is actively working on the development of artificial intelligence technologies, which is one of the main trends in the modern world. Thanks to this, Microsoft can offer its customers new innovative solutions that will help them improve their work and increase efficiency. In addition, the recovery of the global PC market also plays an important role for Microsoft, as they are one of the largest suppliers of PC software.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.